Investing In Amundi MSCI All Country World UCITS ETF USD Acc: NAV Considerations

Table of Contents

Looking to diversify your investment portfolio globally? Exchange-Traded Funds (ETFs) offer a compelling solution, providing access to a wide range of assets with relative ease and low costs. The Amundi MSCI All Country World UCITS ETF USD Acc is a popular choice, offering broad exposure to global markets. However, making informed investment decisions requires a thorough understanding of its Net Asset Value (NAV). This article will guide you through the key aspects of Amundi MSCI All Country World UCITS ETF USD Acc NAV, helping you utilize this crucial metric for effective investment management. Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV is crucial for maximizing your investment potential.

H2: Understanding Net Asset Value (NAV) in ETFs

The Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV reflects the total value of all the global stocks held within the ETF, calculated daily in US Dollars. Understanding the NAV is crucial because it represents the intrinsic worth of your investment.

- Daily NAV Calculation Process: The Amundi MSCI All Country World UCITS ETF USD Acc NAV is calculated daily by taking the market value of all the underlying securities, subtracting any liabilities, and dividing by the total number of outstanding shares.

- Impact of Currency Fluctuations on NAV (USD Acc): As the ETF is denominated in USD (Acc), fluctuations in exchange rates against other currencies can impact the NAV. A strengthening dollar, for example, could lead to a higher NAV for investors holding other currencies.

- Difference between NAV and Market Price: While the NAV represents the theoretical value of the ETF, the market price can fluctuate based on supply and demand. Small differences are normal; however, significant deviations might indicate market inefficiencies.

- Resources to find daily NAV updates: You can usually find the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc on the official Amundi website, major financial news sources, and your brokerage account.

H2: Analyzing Amundi MSCI All Country World UCITS ETF USD Acc NAV Trends

Analyzing historical Amundi MSCI All Country World UCITS ETF USD Acc NAV data is essential for understanding its performance and identifying potential investment opportunities. Charting tools provide visual representations of NAV trends over time.

- Using online charting tools to visualize NAV performance: Numerous online platforms (e.g., tradingview.com, Google Finance) offer charting tools to visualize the Amundi MSCI All Country World UCITS ETF USD Acc NAV performance.

- Comparing NAV performance to relevant benchmarks: Comparing the ETF's NAV performance to other global ETFs or market indices (like the MSCI World Index) helps assess its relative strength and identify potential outperformance or underperformance.

- Identifying periods of high and low NAV and their potential causes: Analyzing periods of high and low NAV can provide insights into market conditions and their impact on the ETF. For example, a low NAV might present a potential buying opportunity.

- The relationship between NAV and ETF share price: While the NAV and share price should generally correlate closely, small discrepancies can exist due to market forces. Tracking both provides a holistic view.

H2: NAV and Investment Strategies for Amundi MSCI All Country World UCITS ETF USD Acc

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV informs investment decisions. It's a key component of several successful investment strategies.

- Using NAV to identify potential buy or sell opportunities: A significant dip in the NAV, compared to historical trends and benchmarks, might signal a potential buy opportunity, while a sustained high NAV might indicate a potential sell opportunity.

- Strategies for mitigating risk based on NAV fluctuations: Dollar-cost averaging, a strategy that involves investing a fixed amount at regular intervals regardless of the NAV, helps mitigate risk associated with market fluctuations.

- The importance of long-term investment perspective vs. short-term NAV changes: Focusing on long-term growth rather than short-term NAV fluctuations is crucial for success with this type of investment.

- Diversification strategies in conjunction with NAV analysis: NAV analysis can be a component of a broader diversification strategy. Understanding the NAV helps assess the overall risk and return profile of your portfolio.

H2: Factors Affecting the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Numerous macro and micro factors influence the Amundi MSCI All Country World UCITS ETF USD Acc NAV.

- Influence of global market indices on NAV: The ETF tracks the MSCI All Country World Index, so its performance is heavily influenced by the overall global market.

- Impact of individual company performance within the ETF: The performance of individual companies held within the ETF affects the overall NAV.

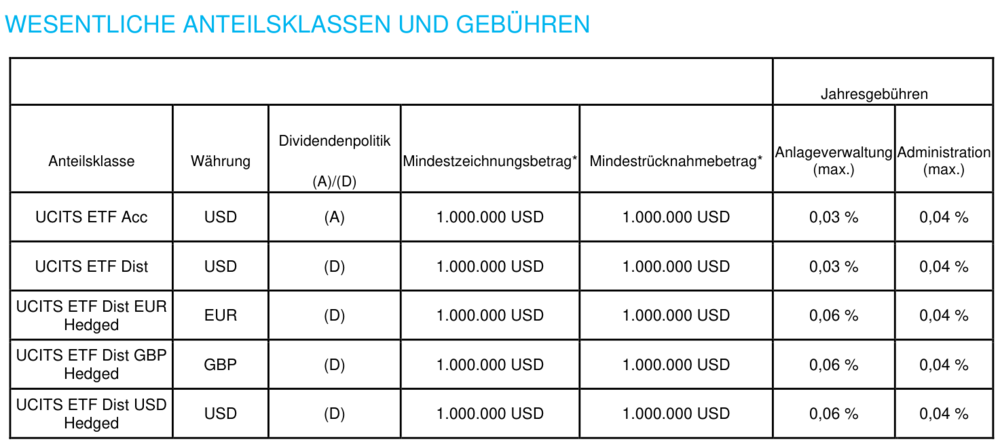

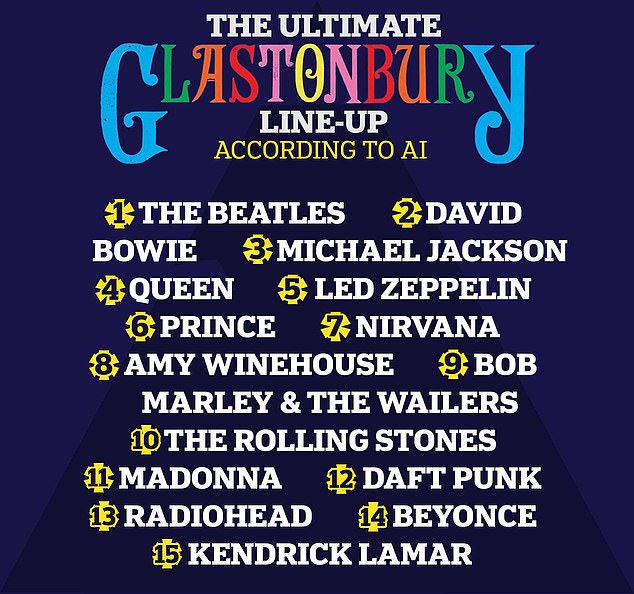

- Effect of expense ratios and management fees on NAV: Expense ratios and management fees, while usually small, gradually reduce the NAV over time.

- Understanding the ETF's underlying asset allocation: Understanding the ETF's geographical and sectoral allocation helps anticipate potential impacts from specific events.

Conclusion:

Monitoring the Amundi MSCI All Country World UCITS ETF USD Acc NAV is vital for informed investment management. Understanding its calculation, analyzing historical trends, and considering the factors influencing its fluctuations will enable you to make more effective investment decisions. Remember that long-term investment strategies are usually more successful with this type of investment. Conduct thorough research, actively monitor the Amundi MSCI All Country World UCITS ETF USD Acc NAV, and consult with a financial advisor before making any investment decisions. Make informed investment decisions based on a solid understanding of Amundi MSCI All Country World UCITS ETF USD Acc NAV and its market dynamics.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Considerations

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Considerations

May 24, 2025 -

Kyle Walker Partied In Milan With Serbian Models Following Wifes Uk Trip

May 24, 2025

Kyle Walker Partied In Milan With Serbian Models Following Wifes Uk Trip

May 24, 2025 -

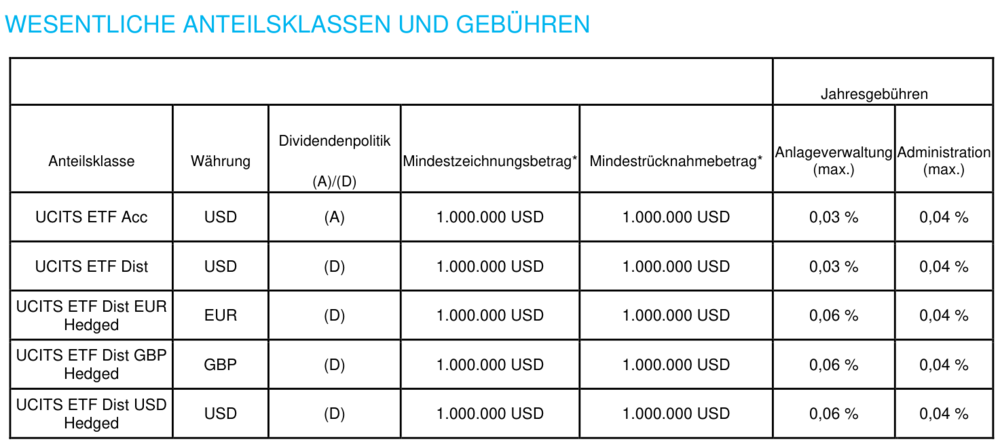

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025 -

New Ferrari Service Centre In Bengaluru High Performance Care

May 24, 2025

New Ferrari Service Centre In Bengaluru High Performance Care

May 24, 2025 -

13 Vuotias F1 Lupaus Ferrarin Uusi Taehti

May 24, 2025

13 Vuotias F1 Lupaus Ferrarin Uusi Taehti

May 24, 2025

Latest Posts

-

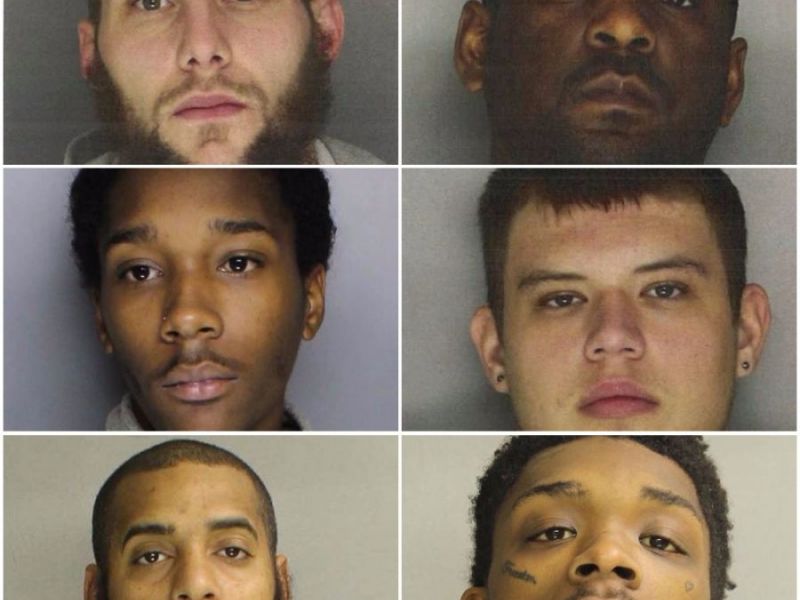

Major Gun Trafficking Bust In Massachusetts 18 Brazilians Charged Hundreds Of Firearms Seized

May 24, 2025

Major Gun Trafficking Bust In Massachusetts 18 Brazilians Charged Hundreds Of Firearms Seized

May 24, 2025 -

Dow Jones Index Cautious Optimism Following Strong Pmi Report

May 24, 2025

Dow Jones Index Cautious Optimism Following Strong Pmi Report

May 24, 2025 -

Dow Jones Steady Rise Positive Pmi Data Provides Support

May 24, 2025

Dow Jones Steady Rise Positive Pmi Data Provides Support

May 24, 2025 -

Pmi Beat Propels Dow Jones To Steady Gains

May 24, 2025

Pmi Beat Propels Dow Jones To Steady Gains

May 24, 2025 -

The Case For News Corp Undervalued And Ready For Growth

May 24, 2025

The Case For News Corp Undervalued And Ready For Growth

May 24, 2025