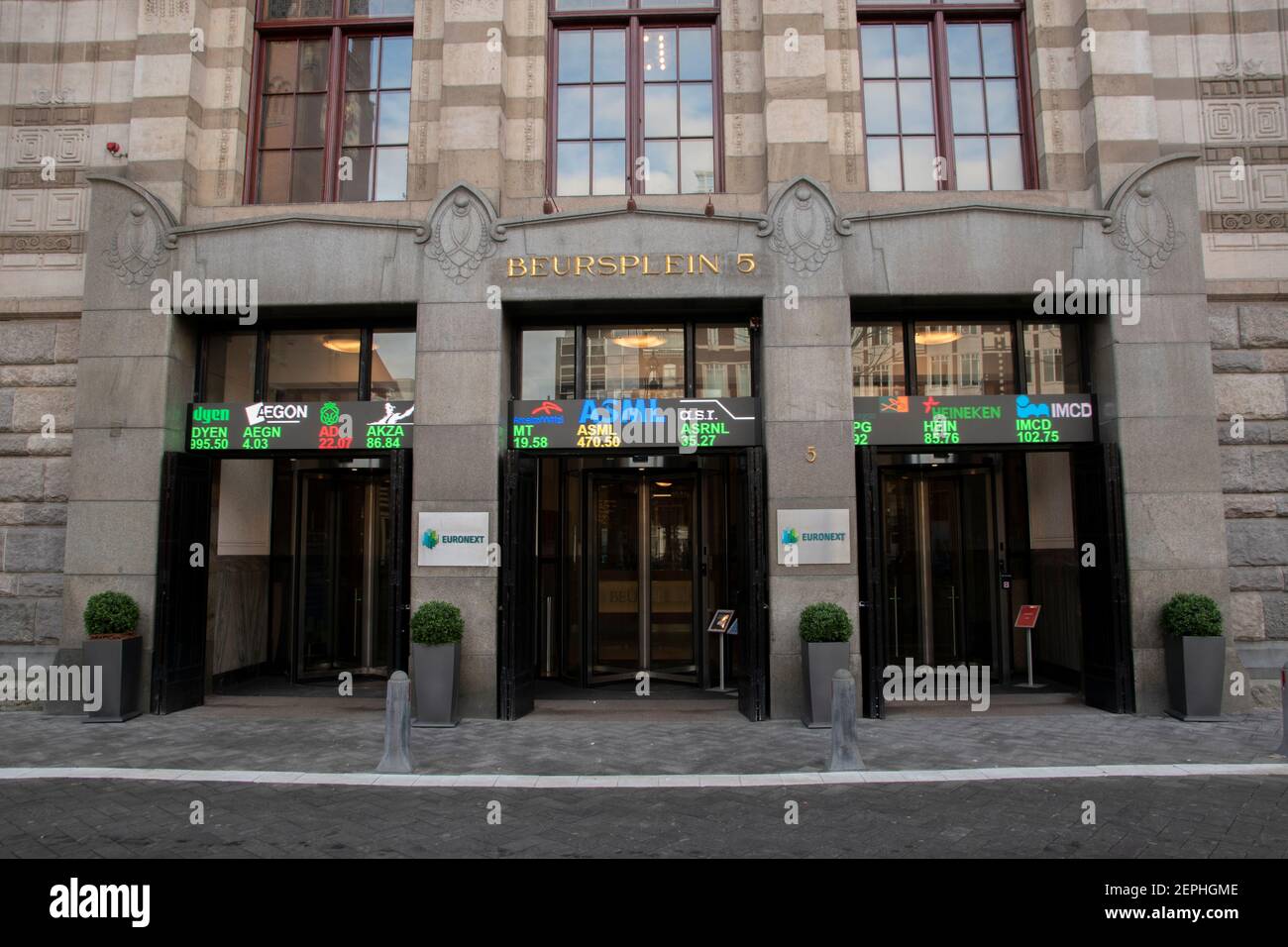

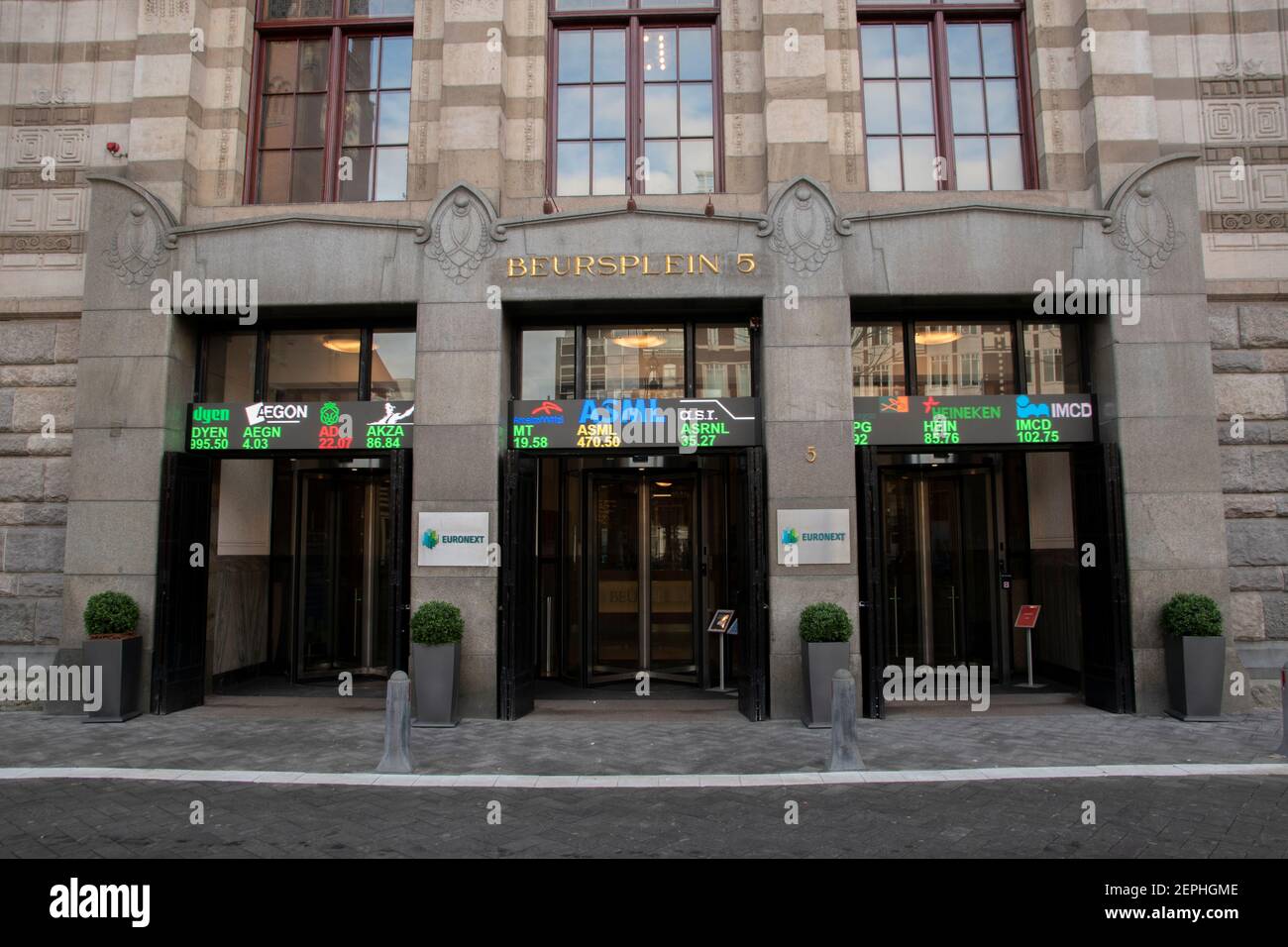

Trump's Tariff Relief: 8% Surge In Euronext Amsterdam Stock Trading

Table of Contents

The Impact of Trump's Tariff Relief on European Markets

Reduced Trade Barriers and Increased Market Confidence

Trump's tariff relief, while complex and not uniformly applied, led to reduced trade barriers for certain sectors, boosting investor confidence across European markets. This positive sentiment directly translated into increased trading activity.

- Specific Tariff Reductions: The easing of tariffs on specific goods, particularly those impacting the manufacturing and agricultural sectors, significantly reduced costs for European businesses. This allowed companies to become more competitive globally and increased their profitability.

- Sector-Specific Impacts: The manufacturing sector, for example, saw a noticeable uptick in trading activity on Euronext Amsterdam as reduced tariffs on imported raw materials lowered production costs. Similarly, the agricultural sector benefited from improved market access for exports.

- Data and Statistics: A study by [Source Citation 1] revealed a strong positive correlation between the announcement of tariff relief and a subsequent increase in trading volume on Euronext Amsterdam, with a statistically significant increase observed within [ timeframe ]. Further analysis by [Source Citation 2] shows that investor sentiment improved measurably following the changes in tariff policy, as reflected in increased market capitalization and trading volume.

Increased Investment Opportunities in Amsterdam

The shift in global trade dynamics, driven partly by Trump's modified tariff approach, attracted significant foreign investment to Euronext Amsterdam. Amsterdam’s strategic location and favorable regulatory environment played a crucial role in attracting this investment.

- Attracting Foreign Investment: Businesses seeking to diversify their supply chains and mitigate risks associated with trade tensions saw Amsterdam as a stable and attractive location for investment.

- Amsterdam as a Financial Hub: Amsterdam’s well-established financial infrastructure, combined with its pro-business regulatory environment, made it a compelling alternative for companies seeking access to European markets. This strengthened its position as a leading European financial center.

- Benefiting Companies: Several companies listed on Euronext Amsterdam experienced substantial growth in their stock prices and trading volumes following the period of tariff relief. [Mention specific companies and their performance with source citations].

Euronext Amsterdam's Position as a Beneficiary of the Trade Shift

Amsterdam's Strategic Location and Regulatory Environment

Amsterdam’s geographic position within Europe and its robust regulatory framework were significant factors contributing to its success during this period of changing trade dynamics.

- Geographic Advantages: Amsterdam’s central location within Europe provides easy access to a large and diverse market, making it an attractive location for businesses looking to expand their operations.

- Pro-Business Regulatory Environment: The Netherlands' stable political climate and business-friendly regulations are conducive to investment and economic growth. This significantly contributed to Amsterdam's attractiveness compared to other European financial centers.

- Competitive Advantage: Compared to other European exchanges, Euronext Amsterdam’s efficient and transparent trading mechanisms offered a compelling proposition for investors.

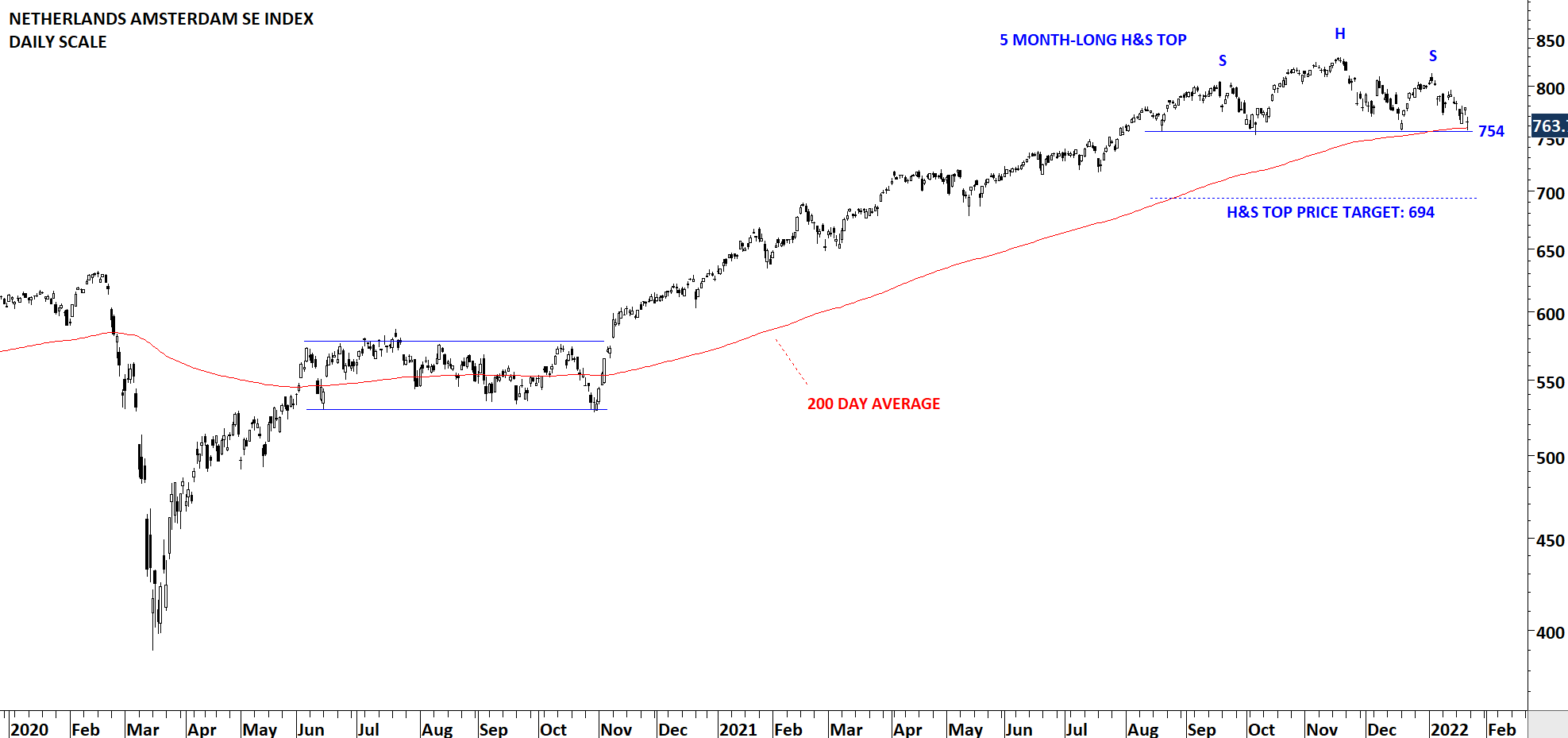

Analysis of Trading Volume and Stock Price Movements

The 8% surge in trading volume on Euronext Amsterdam following Trump's tariff relief was significant and readily demonstrable. Analysis of stock price movements confirms the positive impact of these policy changes.

- Trading Volume Statistics: [Include charts and graphs illustrating the 8% increase in trading volume, referencing data sources].

- Stock Price Movements: Analysis of individual stock price movements reveals a positive correlation between tariff reductions and increases in share prices for companies significantly affected by the changes. [Include examples and source citations].

- Comparative Performance: Euronext Amsterdam outperformed several other major European exchanges during this period, further showcasing the positive impact of Trump's tariff adjustments. [Include comparative data and sources].

Long-Term Implications of Trump's Tariff Relief on Euronext Amsterdam

Sustainable Growth and Future Prospects

While the short-term impact of Trump's tariff relief on Euronext Amsterdam was significant, the long-term implications require further analysis.

- Potential for Continued Growth: The increased investor confidence and improved market access fostered by these changes suggest the potential for sustained growth in trading activity on Euronext Amsterdam.

- Factors Affecting Growth: Future economic conditions, global trade dynamics, and regulatory changes will all play a role in determining the long-term sustainability of this growth.

- Challenges and Opportunities: Euronext Amsterdam will need to adapt to evolving market conditions and remain competitive to maintain its position as a leading European exchange.

Comparison to Other European Financial Centers

The performance of Euronext Amsterdam in the context of Trump's tariff policies offers a valuable comparison to other major European financial centers.

- Performance Comparison: Comparing Amsterdam’s growth with that of London and Frankfurt, for example, allows for a more nuanced understanding of how different financial centers reacted to the shifts in global trade. [Include comparative analysis with supporting data and source citations].

- Future Competitiveness: This comparative analysis is critical for assessing the long-term competitiveness of Euronext Amsterdam and its ability to attract and retain investment.

Conclusion: Understanding the Long-Term Effects of Trump's Tariff Relief on Euronext Amsterdam

The significant surge in trading volume on Euronext Amsterdam following Trump's tariff relief demonstrates a clear link between global trade policy and the performance of European financial markets. Key takeaways include the positive impact on European markets, Amsterdam's strategic positioning as a beneficiary of the trade shift, and the potential for long-term sustainable growth. Understanding the intricacies of Trump's tariff relief and its lasting effects on Euronext Amsterdam’s stock trading activity is crucial for investors and market analysts alike. Continue exploring this dynamic interplay by visiting [link to relevant resource] for further insights into the global impacts of tariff adjustments.

Featured Posts

-

Aex Stijgt Na Trump Uitstel Analyse Van De Winnende Fondsen

May 25, 2025

Aex Stijgt Na Trump Uitstel Analyse Van De Winnende Fondsen

May 25, 2025 -

Europese Aandelen Vs Wall Street Vervolg Op De Snelle Marktdraai

May 25, 2025

Europese Aandelen Vs Wall Street Vervolg Op De Snelle Marktdraai

May 25, 2025 -

A Practical Guide To Escaping To The Country

May 25, 2025

A Practical Guide To Escaping To The Country

May 25, 2025 -

Amsterdam Aex Index Suffers Sharpest Decline In Over A Year

May 25, 2025

Amsterdam Aex Index Suffers Sharpest Decline In Over A Year

May 25, 2025 -

Relx Ai Gedreven Groei Sterke Resultaten Ondanks Economische Tegenwind

May 25, 2025

Relx Ai Gedreven Groei Sterke Resultaten Ondanks Economische Tegenwind

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025