Trump's Trade Policy And The Fed: How They Affect Bitcoin's Value

Table of Contents

Trump's Trade Wars and Their Impact on Bitcoin

Trump's protectionist trade policies, characterized by tariffs and escalating trade disputes, significantly impacted global economic stability and, consequently, Bitcoin's value.

Increased Market Uncertainty

Trump's trade wars created a climate of heightened market uncertainty. This uncertainty stems from the unpredictable nature of his policy decisions and their ripple effects across global markets.

- Increased market volatility: The imposition of tariffs and retaliatory measures led to significant price swings in various asset classes, including Bitcoin.

- Investor flight to safe havens: During periods of heightened uncertainty, investors often seek safe havens, potentially including Bitcoin, seen by some as a hedge against traditional market risks.

- Decreased investor confidence in traditional markets: The trade wars eroded confidence in traditional markets, driving some investors towards alternative assets like cryptocurrencies.

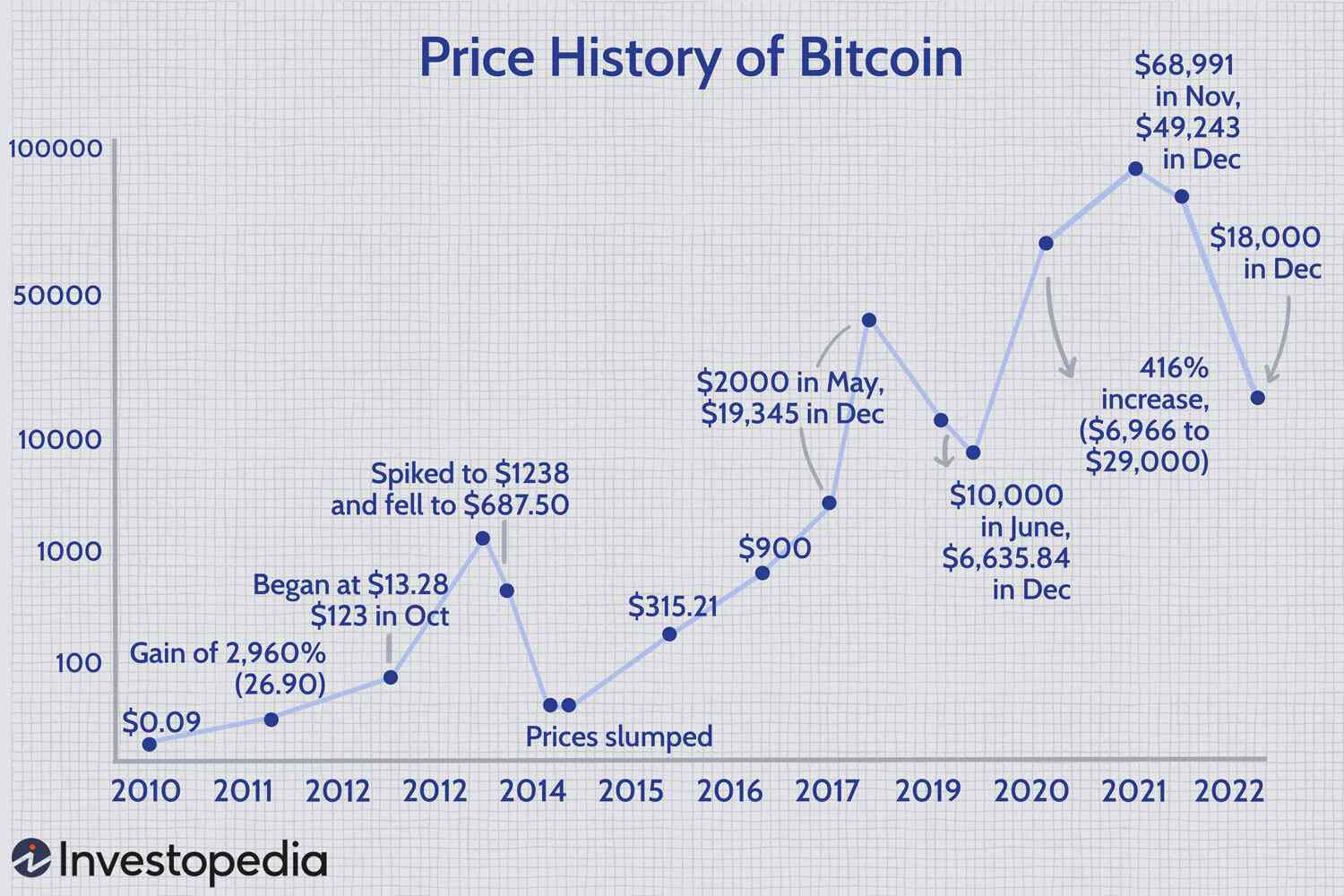

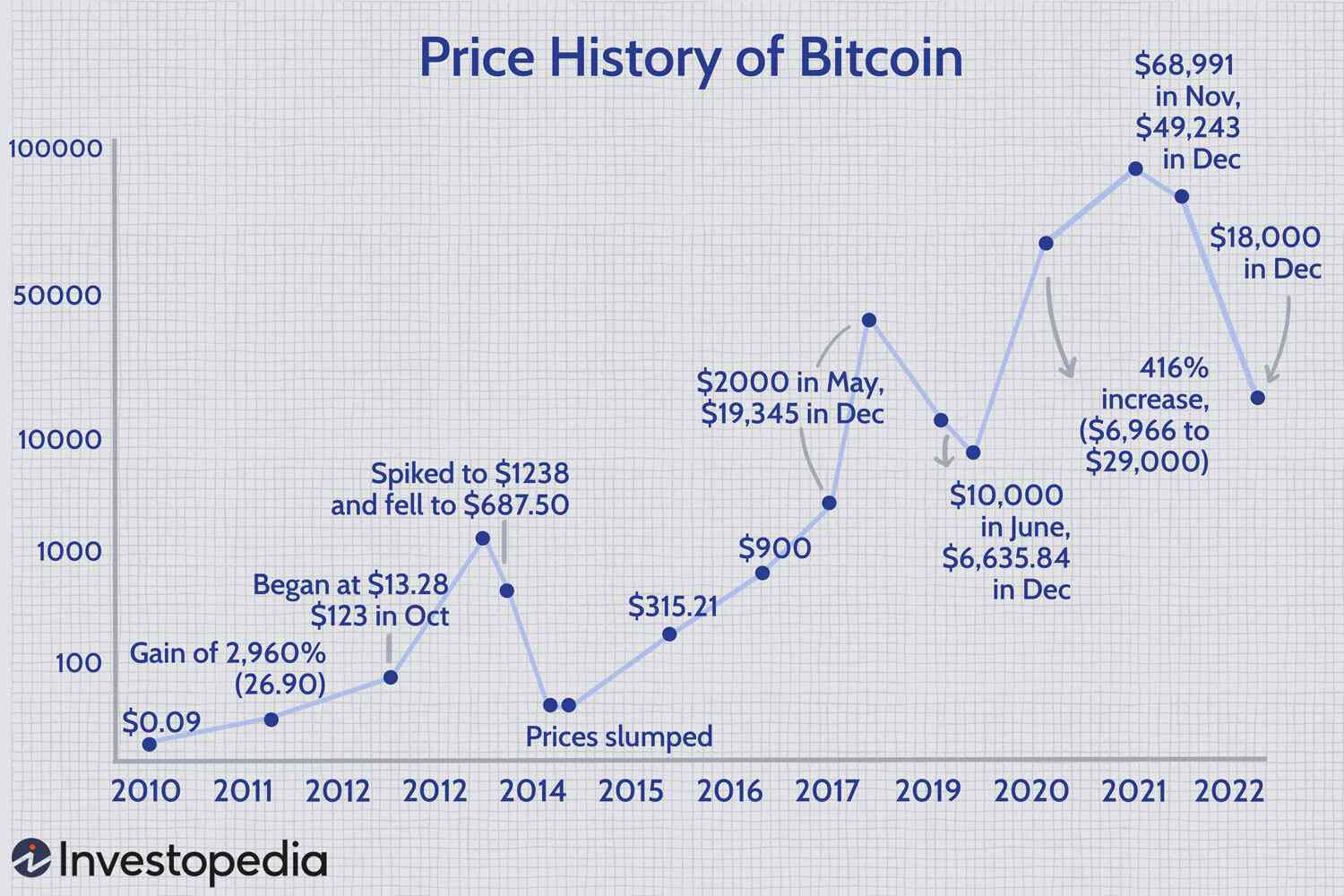

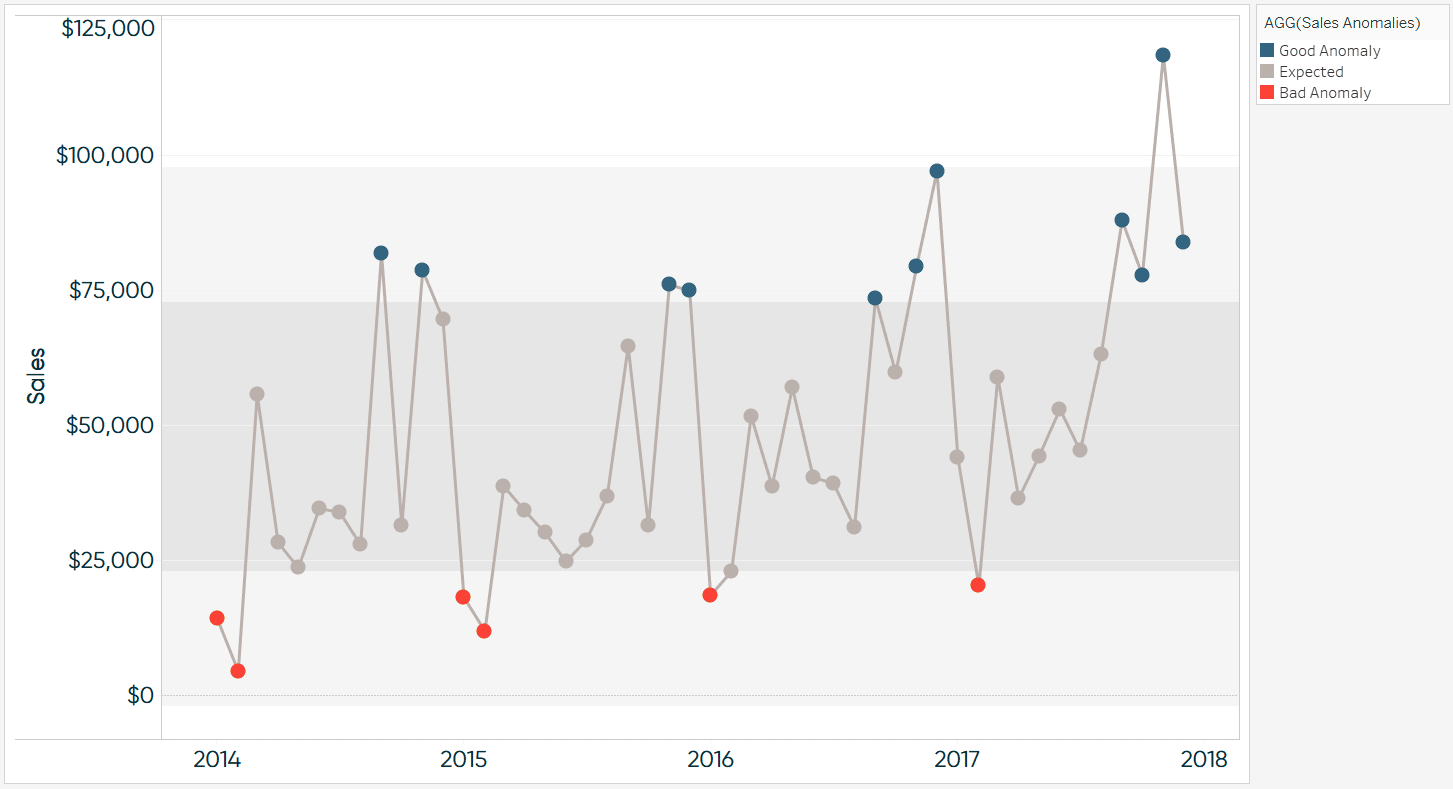

For example, the US-China trade war, marked by escalating tariffs and retaliatory measures, triggered substantial volatility in Bitcoin's price. Charts from this period clearly illustrate sharp price increases and decreases, reflecting the market's reaction to the unfolding trade tensions. (Insert chart/graph here illustrating Bitcoin price fluctuations during the US-China trade war).

The Dollar's Role

Fluctuations in the US dollar's value, often influenced by Trump's trade policies, have a demonstrable effect on Bitcoin's price. Generally, there's an inverse relationship:

- Strong dollar weakens Bitcoin: When the dollar strengthens, Bitcoin tends to weaken, as investors may shift their investments away from Bitcoin and towards dollar-denominated assets.

- Weak dollar strengthens Bitcoin: Conversely, a weakening dollar often correlates with Bitcoin price increases, as investors might seek alternative assets perceived as hedges against dollar devaluation.

- Correlation analysis between USD and BTC price: Statistical analysis reveals a correlation, though not always perfectly linear, between the USD index and Bitcoin's price.

This relationship is primarily due to Bitcoin's global nature. As a decentralized digital asset, its value is not tied to any single national currency. When the dollar weakens, the relative value of Bitcoin (priced in USD) can increase.

The Federal Reserve's Monetary Policy and Bitcoin

The Federal Reserve's monetary policy decisions, particularly regarding interest rates and quantitative easing (QE), also influence Bitcoin's price.

Interest Rate Hikes and Bitcoin

The Fed's decisions on interest rates impact investor behavior and, consequently, Bitcoin's appeal:

- Higher interest rates can draw investors away from riskier assets like Bitcoin: Increased interest rates make bonds and other fixed-income securities more attractive, potentially reducing the demand for riskier assets such as Bitcoin.

- Potential impact on inflation and its effect on Bitcoin's purchasing power: Interest rate hikes are often used to combat inflation. The effect on Bitcoin's purchasing power is complex and depends on the success of the Fed's actions in controlling inflation.

Examples of specific Fed rate hikes and their subsequent impact on Bitcoin's price can be found by analyzing market data from those periods (cite relevant data and market analysis here).

Quantitative Easing and Bitcoin

The Fed's quantitative easing (QE) programs, aimed at injecting liquidity into the economy, have indirect but significant effects on Bitcoin:

- Increased money supply can lead to inflation, potentially driving investors towards Bitcoin as a hedge against inflation: QE can lead to currency devaluation and inflation, potentially increasing Bitcoin's appeal as a store of value.

- Impact of QE on the dollar and its subsequent effects on Bitcoin: QE programs can influence the dollar's value, triggering the inverse relationship described above, impacting Bitcoin's price.

Analyzing past QE programs and their correlation with Bitcoin price movements reveals a complex dynamic, not always resulting in a direct positive correlation, but highlighting the potential influence of the increased money supply on investor behavior.

The Interplay Between Trump's Trade Policy, the Fed, and Bitcoin

The combined effects of Trump's trade policies and the Fed's responses create a complex and unpredictable environment for Bitcoin.

A Complex Relationship

The relationship is far from straightforward, with synergistic and conflicting effects often occurring simultaneously.

- Synergistic effects: A trade war leading to a weaker dollar, coupled with QE, might create a perfect storm for Bitcoin price increases.

- Conflicting effects: A trade war causing uncertainty, coupled with a rate hike to combat inflation, could lead to a decrease in Bitcoin's price.

- Difficulty in isolating the impact of each factor: It’s extremely challenging to precisely isolate the impact of each factor, as they interact and influence each other in a complex web of economic cause and effect.

Using case studies (cite specific examples) that illustrate the combined effects of simultaneous events (e.g., a trade war and a rate hike) would provide further insights into this intricate dynamic.

Predicting Future Trends

Predicting Bitcoin's price based solely on these macroeconomic factors remains incredibly challenging.

- Unpredictability of both Trump's policy decisions and the Fed's responses: The inherent unpredictability of both political and monetary policy decisions complicates any attempt at forecasting.

- Emergence of other economic and geopolitical factors influencing Bitcoin's price: Numerous other factors, including regulatory changes, technological advancements, and overall market sentiment, influence Bitcoin's price.

- Limitations of current predictive models: Existing models struggle to accurately capture the complexities and non-linear relationships involved.

Therefore, while understanding the influence of Trump's trade policy and the Fed's actions is crucial, it's essential to acknowledge the limitations of relying solely on these factors for predicting future Bitcoin price movements.

Conclusion

Trump's trade policies and the Federal Reserve's actions significantly influenced Bitcoin's value through various interconnected channels: market uncertainty, dollar fluctuations, and investor sentiment. The relationship between these three entities is complex and often unpredictable. Understanding how trade wars, interest rate hikes, quantitative easing, and the consequent shifts in investor sentiment affect the value of the dollar all contribute to the volatility of Bitcoin. While these macroeconomic factors offer valuable insights, they are only part of a larger puzzle. Other crucial elements, such as regulatory shifts and technological developments, must also be considered. Understanding the relationship between Trump's trade policy, the Fed, and Bitcoin is crucial for navigating the volatile cryptocurrency market.

Featured Posts

-

The Growing Trend Of Betting On Wildfires The Los Angeles Case Study

Apr 24, 2025

The Growing Trend Of Betting On Wildfires The Los Angeles Case Study

Apr 24, 2025 -

Positive Market Sentiment Fueling The Niftys Bullish Charge In India

Apr 24, 2025

Positive Market Sentiment Fueling The Niftys Bullish Charge In India

Apr 24, 2025 -

Office365 Breach Nets Millions For Hacker According To Federal Authorities

Apr 24, 2025

Office365 Breach Nets Millions For Hacker According To Federal Authorities

Apr 24, 2025 -

Usd Strengthens Against Major Currencies As Trump Tones Down Fed Criticism

Apr 24, 2025

Usd Strengthens Against Major Currencies As Trump Tones Down Fed Criticism

Apr 24, 2025 -

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Latest Posts

-

Celtics Pritchard Takes Home Sixth Man Of The Year Award

May 12, 2025

Celtics Pritchard Takes Home Sixth Man Of The Year Award

May 12, 2025 -

Celtic Payton Pritchards Sixth Man Of The Year Win A Historic Nba Moment

May 12, 2025

Celtic Payton Pritchards Sixth Man Of The Year Win A Historic Nba Moment

May 12, 2025 -

The Role Of Payton Pritchards Childhood In His Latest Career Feat

May 12, 2025

The Role Of Payton Pritchards Childhood In His Latest Career Feat

May 12, 2025 -

Celtics Witness Double 40 Point Scoring A Statistical Anomaly

May 12, 2025

Celtics Witness Double 40 Point Scoring A Statistical Anomaly

May 12, 2025 -

Payton Pritchards Career Achievement The Impact Of His Childhood

May 12, 2025

Payton Pritchards Career Achievement The Impact Of His Childhood

May 12, 2025