USD Strengthens Against Major Currencies As Trump Tones Down Fed Criticism

Table of Contents

The Impact of Trump's Previous Fed Criticism on the Dollar

President Trump's past criticisms of the Federal Reserve's monetary policy created significant uncertainty in the financial markets. His frequent attacks, often via Twitter, sowed doubt about the independence of the central bank and raised concerns about potential political interference in interest rate decisions. This uncertainty directly impacted investor confidence in the USD, leading to volatility in exchange rates. Investors often prefer stability and predictability, and Trump's actions introduced a level of risk that negatively affected the dollar's appeal.

-

US Dollar volatility: The unpredictability fueled by Trump's comments created a volatile environment, making it difficult for investors to accurately assess the USD's future value.

-

Trump Fed criticism: His public statements questioning the Fed's decisions often triggered immediate market reactions, leading to sharp fluctuations in the USD's value against other major currencies.

-

Market uncertainty: This uncertainty made it harder for businesses to plan for the future, impacting investment decisions and international trade.

-

Investor confidence: Negative comments from the President, seen as a powerful figure capable of influencing policy, eroded investor confidence in the US economy and its currency.

-

Bullet points:

- Example 1: In a July 2018 tweet, Trump criticized the Fed's interest rate hikes, stating they were "going loco." This led to a 1% drop in the USD against the Euro within hours.

- Example 2: On multiple occasions, Trump publicly called for lower interest rates, undermining the Fed's perceived autonomy and creating apprehension among investors.

- Impact: These criticisms resulted in periods of increased USD volatility and a general weakening of the currency against its major counterparts.

The Shift in Trump's Rhetoric and its Market Implications

Recently, there has been a noticeable shift in President Trump's tone regarding the Federal Reserve. He has largely ceased his public attacks and has even issued statements praising the Fed's actions on certain occasions. This change in rhetoric has significantly reduced market uncertainty. The absence of his constant criticism has fostered a more stable environment, boosting investor confidence in the USD. The market perceives this change as a positive signal, indicating less potential for political interference in monetary policy.

-

Trump's changed stance: The shift away from aggressive criticism towards the Fed is a key factor behind the USD's recent strengthening.

-

Fed policy: This change improved the perception of the Fed's independence and its ability to manage the economy effectively.

-

Reduced market volatility: The decreased uncertainty has led to more predictable market movements and stabilized USD exchange rates.

-

Improved investor sentiment: A more positive outlook on US economic policy has improved investor sentiment and increased demand for the USD.

-

Bullet points:

- Example 1: In a recent press conference, Trump acknowledged the Fed's efforts to support economic growth, highlighting their positive role in the economy.

- Example 2: The notable absence of direct public criticism of Fed Chair Jerome Powell has eased market anxieties.

- Impact: This change in tone has contributed significantly to a period of USD strength, reversing the negative trends observed during periods of heightened presidential criticism.

Other Contributing Factors to USD Strength

While the shift in Trump's rhetoric towards the Fed is a significant factor, it's crucial to acknowledge other elements contributing to the USD's recent rise. A robust US economy, characterized by strong GDP growth and positive employment figures, is a major driver. Furthermore, global economic uncertainty and geopolitical instability are increasing the demand for the USD as a safe-haven currency. Investors often flock to the dollar during times of global turmoil, viewing it as a reliable and stable asset.

-

US economic growth: Strong economic fundamentals, such as robust GDP growth and low unemployment, make the US economy an attractive destination for investment.

-

Global economic uncertainty: Concerns about slowing global growth and trade wars often drive capital flows towards the USD, perceived as a safer investment.

-

Safe haven currency: The USD's status as a global reserve currency enhances its appeal during periods of market instability.

-

Bullet points:

- Strong Q2 GDP growth: Solid economic data showcases the resilience of the US economy.

- Positive employment figures: Low unemployment rates demonstrate a healthy labor market.

- Geopolitical instability: Ongoing geopolitical tensions in various parts of the world are increasing demand for the USD as a safe haven.

Analyzing the Future of the USD and its Exchange Rates

While the current strength of the USD is encouraging, a cautious outlook is warranted. Several factors could impact the future trajectory of the USD’s value. Future Fed policy decisions, particularly regarding interest rates, will undoubtedly influence the USD's exchange rates. Furthermore, global economic developments, including potential trade disputes and shifts in global growth patterns, can significantly affect investor sentiment and consequently, the value of the dollar. Political events, such as upcoming elections, also introduce an element of uncertainty.

-

USD future outlook: The outlook for the USD remains uncertain despite the recent strengthening.

-

Exchange rate predictions: Accurate predictions are challenging due to the interplay of numerous economic and political factors.

-

Risks to USD: Potential risks include rising inflation, escalating trade disputes, and unforeseen global economic shocks.

-

Global economic factors: International events and economic conditions significantly influence the USD's performance.

-

Bullet points:

- Potential impact of upcoming elections: Political uncertainty can introduce volatility into the market.

- Risk of rising inflation: Increased inflation could erode the USD's purchasing power.

- Impact of potential trade disputes: Further trade tensions could negatively affect the US economy and the USD's value.

Conclusion: Understanding the USD's Strength and What's Next

The recent strengthening of the USD is a multifaceted phenomenon. While the reduction in uncertainty caused by President Trump’s toned-down criticism of the Federal Reserve has played a role, other factors, such as strong US economic data and global economic uncertainty, have also contributed significantly. It’s crucial to remember that currency exchange rates are influenced by a complex interplay of political, economic, and geopolitical factors. To effectively navigate this dynamic environment, it's vital to stay informed about USD exchange rates and the various factors impacting its value. Monitor USD strength and track USD exchange rates closely to understand the forces driving USD movements and make informed decisions.

Featured Posts

-

Analyzing John Travoltas Surprisingly Poor Rotten Tomatoes Record

Apr 24, 2025

Analyzing John Travoltas Surprisingly Poor Rotten Tomatoes Record

Apr 24, 2025 -

Understanding The Value Of Middle Managers Benefits For Employees And The Organization

Apr 24, 2025

Understanding The Value Of Middle Managers Benefits For Employees And The Organization

Apr 24, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025 -

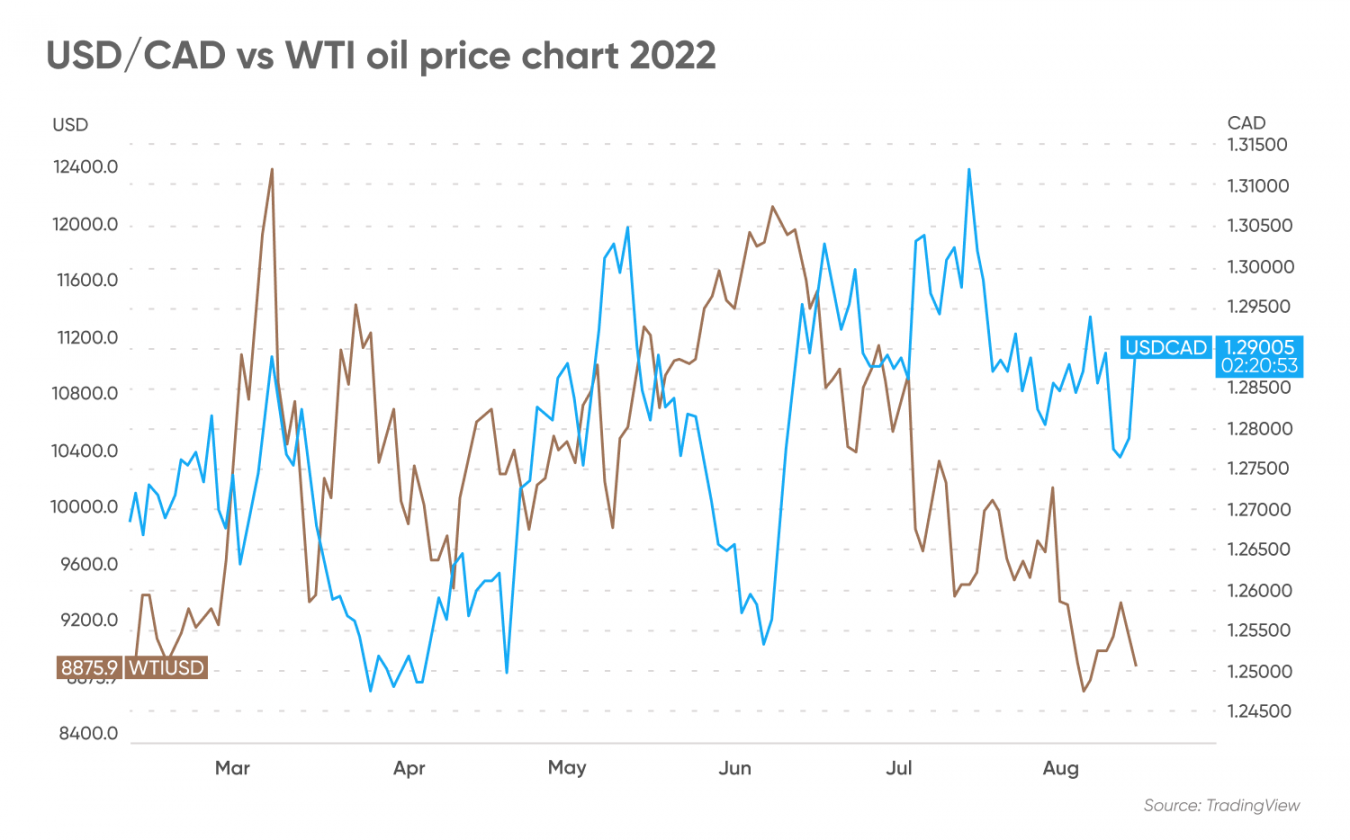

Understanding The Recent Fluctuations In The Canadian Dollar

Apr 24, 2025

Understanding The Recent Fluctuations In The Canadian Dollar

Apr 24, 2025 -

Us Lawyer Stonewalling Ends Judge Abrego Garcias Ruling

Apr 24, 2025

Us Lawyer Stonewalling Ends Judge Abrego Garcias Ruling

Apr 24, 2025

Latest Posts

-

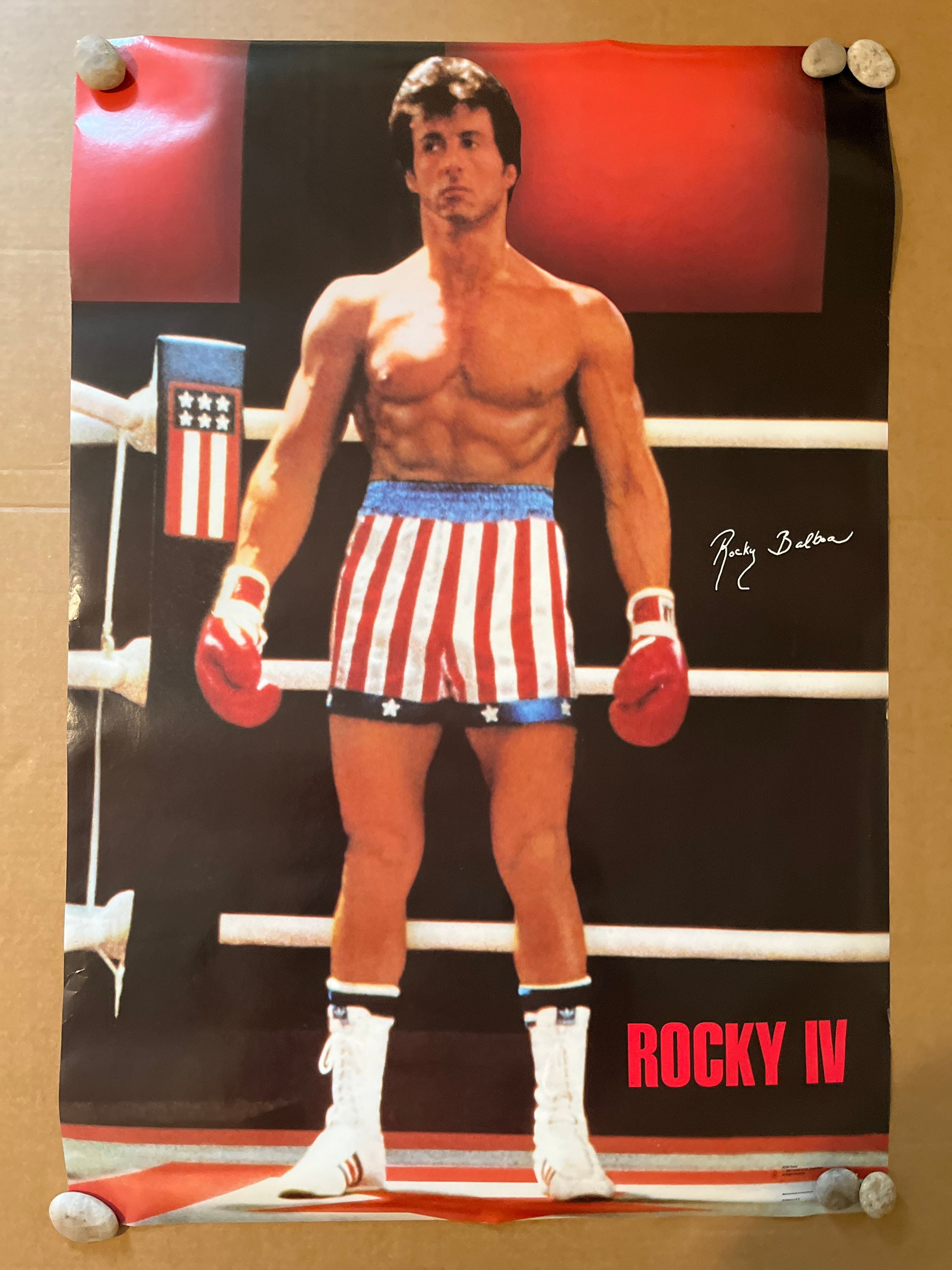

Stallone On Rocky Which Film Touches Him Most

May 12, 2025

Stallone On Rocky Which Film Touches Him Most

May 12, 2025 -

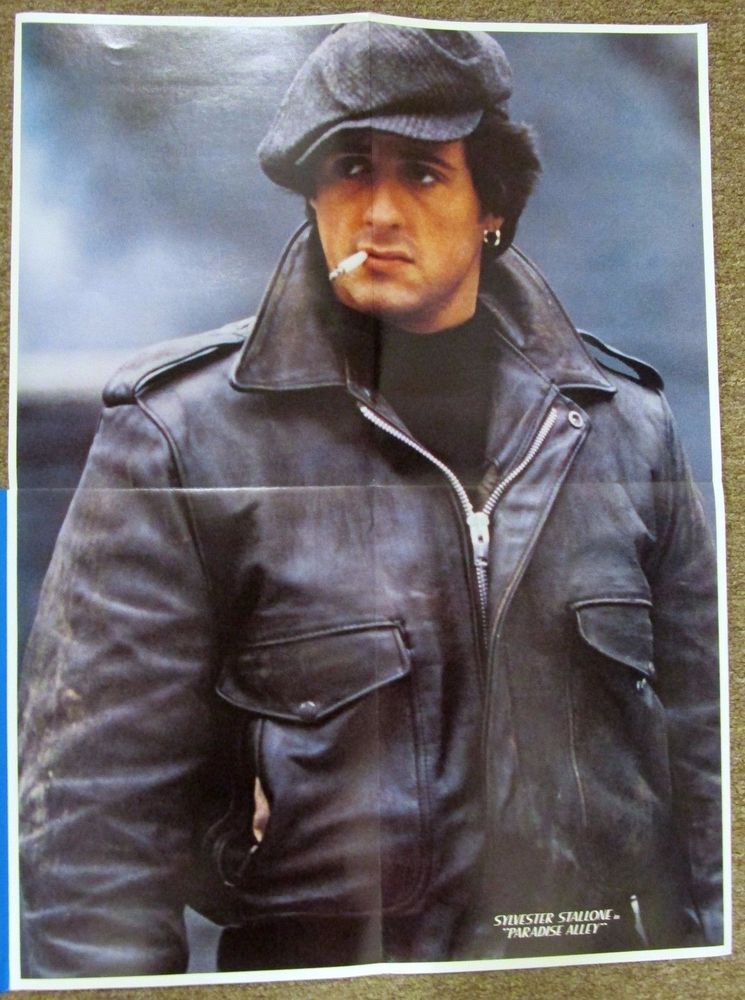

The One Movie Sylvester Stallone Directed But Didnt Star In A Critical Analysis

May 12, 2025

The One Movie Sylvester Stallone Directed But Didnt Star In A Critical Analysis

May 12, 2025 -

Sylvester Stallone And Coming Home A Look At A Lost Oscar Opportunity

May 12, 2025

Sylvester Stallone And Coming Home A Look At A Lost Oscar Opportunity

May 12, 2025 -

Action Thriller Armor Starring Sylvester Stallone Available For Free Streaming

May 12, 2025

Action Thriller Armor Starring Sylvester Stallone Available For Free Streaming

May 12, 2025 -

Coming Home 1978 Sylvester Stallones Biggest Regret

May 12, 2025

Coming Home 1978 Sylvester Stallones Biggest Regret

May 12, 2025