Trump's Trade Threats Send Gold Prices Climbing

Table of Contents

Understanding the Safe Haven Appeal of Gold

Gold has long held a prominent position as a safe haven asset, a store of value sought during times of economic and political uncertainty. This enduring appeal stems from several key characteristics:

- Gold's lack of counterparty risk: Unlike stocks or bonds, gold's value isn't tied to the performance of any specific company or government. Its inherent value remains relatively stable, regardless of market fluctuations.

- Tangible asset offering protection against inflation: Gold is a tangible asset, meaning it has physical form. Historically, it has served as a hedge against inflation, retaining its value even as the purchasing power of fiat currencies declines.

- Historically strong performance during periods of market volatility: Throughout history, gold prices have tended to rise during periods of geopolitical instability, market crashes, and economic uncertainty, making it an attractive investment during times of stress.

These factors solidify gold's reputation as a reliable safe haven, particularly during periods of intense market volatility and investor anxiety, such as those triggered by unpredictable trade policies. Keywords: gold as safe haven, safe haven asset, inflation hedge, market volatility, gold investment

Trump's Trade Policies and Market Volatility

Trump's trade policies, characterized by the imposition of tariffs and the initiation of numerous trade disputes, have significantly contributed to global market volatility. His unpredictable approach to international trade has generated uncertainty, impacting investor sentiment and creating a climate of fear for many businesses.

- Impact of tariffs on specific industries and global trade: Tariffs imposed on goods from specific countries have disrupted supply chains, increased costs for businesses, and fueled trade wars, negatively impacting global trade growth.

- Increased uncertainty and market volatility due to unpredictable trade decisions: The frequent and often abrupt changes in trade policy have left businesses and investors struggling to adapt, leading to increased market volatility.

- Examples of specific trade disputes and their effect on investor sentiment: The trade disputes with China, for instance, significantly impacted investor confidence, creating a flight to safety and driving demand for safe haven assets like gold.

This uncertainty, coupled with the potential for further trade conflicts, has created a fertile ground for gold's price appreciation. Keywords: Trump tariffs, trade disputes, trade war, market uncertainty, investor sentiment, global trade

The Correlation Between Trade Threats and Gold Price Increases

The correlation between Trump's trade actions and the rise in gold prices is undeniable. Statistical data clearly shows a noticeable upward trend in gold prices following announcements of new tariffs or escalations in trade disputes.

- Statistical data showing the correlation between trade threat announcements and gold price movements: Numerous studies have demonstrated a statistically significant positive correlation between announcements of new trade measures and subsequent increases in gold prices.

- Analysis of investor behavior and capital flows into gold during periods of trade uncertainty: Investors, seeking to protect their portfolios from potential losses due to trade-related uncertainty, have consistently increased their investments in gold during such periods.

- Discussion of alternative investment strategies during times of trade war fears: While gold is a popular choice, other safe haven assets, such as government bonds and the US dollar, also experience increased demand during times of trade war fears. The choice often depends on individual investment goals and risk tolerance.

This demonstrates a clear flight to safety, with investors viewing gold as a reliable store of value in the face of trade uncertainty. Keywords: gold price correlation, trade war impact, gold investment strategy, investor behavior, capital flows

Analyzing Future Gold Price Predictions Based on Trade Tensions

Predicting future gold prices with complete accuracy is impossible, but analyzing potential scenarios based on ongoing trade tensions provides valuable insights.

- Discussion of different possible outcomes of ongoing trade disputes: Possible outcomes range from a de-escalation of tensions to a further escalation of trade wars, each with significant implications for gold prices.

- Analysis of expert opinions and market forecasts regarding gold prices: Market analysts and experts offer a range of predictions, with some anticipating further price increases based on sustained uncertainty and others suggesting potential corrections based on other market forces.

- Potential factors that could influence gold prices beyond trade tensions: Other global macroeconomic factors like inflation, interest rates, and central bank policies also influence gold prices. These factors can interact in complex ways with trade tensions.

The outlook for gold prices remains intertwined with the resolution, or escalation, of ongoing trade disputes. Keywords: gold price prediction, future gold price, trade war forecast, market outlook, gold market analysis

Conclusion

Trump's trade threats have undeniably fueled a surge in gold prices, driven by increased demand for this safe haven asset amidst significant market uncertainty. The correlation between trade policy announcements and gold price movements is statistically evident, reflecting investor behavior and capital flows seeking protection from trade war risks. Understanding this relationship is crucial for navigating the complexities of the current market landscape.

Call to Action: Are you looking to protect your portfolio from the uncertainty caused by Trump's trade threats? Consider diversifying your investments with gold. Learn more about investing in gold and navigate the complexities of the current market landscape. Keywords: gold investment, Trump trade threats, safe haven asset, protect portfolio, gold price.

Featured Posts

-

La Charentaise Histoire D Un Succes A Saint Brieuc

May 25, 2025

La Charentaise Histoire D Un Succes A Saint Brieuc

May 25, 2025 -

Fresh R And B Sounds Leon Thomas And Flos New Music

May 25, 2025

Fresh R And B Sounds Leon Thomas And Flos New Music

May 25, 2025 -

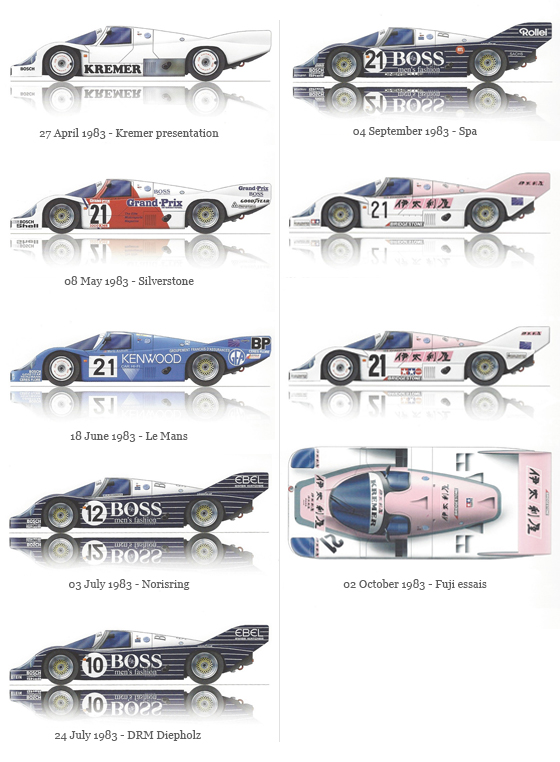

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025 -

Gold Price Surge Trumps Eu Threats Fuel Trade War Fears

May 25, 2025

Gold Price Surge Trumps Eu Threats Fuel Trade War Fears

May 25, 2025 -

Match Monaco Nice L Equipe Selectionnee

May 25, 2025

Match Monaco Nice L Equipe Selectionnee

May 25, 2025

Latest Posts

-

Klasemen Moto Gp Terbaru Jadwal Balapan Silverstone And Performa Marquez

May 26, 2025

Klasemen Moto Gp Terbaru Jadwal Balapan Silverstone And Performa Marquez

May 26, 2025 -

Moto Gp Inggris Di Silverstone Jadwal Balapan Klasemen Dan Analisis Marquez

May 26, 2025

Moto Gp Inggris Di Silverstone Jadwal Balapan Klasemen Dan Analisis Marquez

May 26, 2025 -

Jadwal Lengkap Moto Gp Inggris Di Silverstone Update Klasemen And Posisi Marquez

May 26, 2025

Jadwal Lengkap Moto Gp Inggris Di Silverstone Update Klasemen And Posisi Marquez

May 26, 2025 -

Jadwal Moto Gp Inggris 2024 Silverstone Klasemen Terbaru And Prediksi Marquez

May 26, 2025

Jadwal Moto Gp Inggris 2024 Silverstone Klasemen Terbaru And Prediksi Marquez

May 26, 2025 -

Jadwal Detail Moto Gp Argentina 2025 Termasuk Sprint Race Minggu

May 26, 2025

Jadwal Detail Moto Gp Argentina 2025 Termasuk Sprint Race Minggu

May 26, 2025