Trump's Trade War: IMF Warns Of Systemic Financial Risk

Table of Contents

The Escalation of Trump's Trade War and its Global Impact

Tariffs and Retaliatory Measures

Trump's administration implemented significant trade tariffs, particularly targeting China. These "trade tariffs" included a 25% tariff on steel imports and a similar levy on aluminum, sparking immediate retaliatory measures. The resulting "trade disputes" spiraled into a broader trade war, impacting numerous sectors and countries.

- 25% tariff on steel imports from China: This led to higher steel prices globally and retaliatory tariffs on American goods.

- 10% tariff on $200 billion worth of Chinese goods: This triggered a series of escalating tariffs from China, affecting various industries.

- Retaliatory tariffs from the EU, Canada, and Mexico: These measures further intensified the trade war and disrupted global trade flows. The keyword "retaliation" accurately reflects this tit-for-tat escalation.

Disruption of Global Supply Chains

The "trade war" severely disrupted "global supply chains," causing significant "supply chain disruptions." Businesses faced increased "production costs" due to tariffs and logistical challenges, leading to higher prices for consumers. This impacted "global supply chains" in unforeseen ways.

- Increased shipping costs due to trade restrictions and port congestion.

- Delays in manufacturing and production due to disrupted supply chains.

- Higher prices for consumers due to increased import costs and reduced competition. "Inflation" became a tangible concern.

Impact on Emerging Markets

Emerging markets were disproportionately affected by Trump's trade war. Their vulnerability to external shocks and reliance on global trade made them particularly susceptible to "economic vulnerability." The threat of a "debt crisis" loomed large for some nations, while others experienced significant "capital flight."

- Reduced export demand from developed countries led to economic slowdowns in several emerging markets.

- Increased borrowing costs for some emerging market countries as investors sought safer havens.

- Currency depreciations in several emerging economies due to capital flight and reduced trade.

IMF's Assessment of Systemic Financial Risk

The IMF's Report and its Findings

The IMF released several reports highlighting the systemic financial risk posed by Trump's trade war. The "IMF report" detailed the potential for "financial instability" on a global scale, echoing concerns about a potential "global financial crisis." The keyword "systemic risk" encapsulates the IMF's core concern.

- Decreased investment due to uncertainty and reduced global trade.

- Reduced economic growth globally due to decreased trade and investment.

- Potential banking crises due to increased corporate debt and decreased profitability.

Models and Projections

The IMF utilized sophisticated "economic modeling" and "risk assessment" techniques to project the potential damage from Trump's trade policies. Their "forecasting" methods revealed alarming potential outcomes. The "macroeconomic impact" was significant and multifaceted.

- Projections of significant reductions in global GDP growth.

- Predictions of increased poverty and inequality in several countries.

- Estimates of substantial losses in global trade volume.

Policy Recommendations

To mitigate the risks, the IMF advocated for several key policy recommendations, emphasizing the importance of "policy response" and international cooperation. "Trade negotiations" and "de-escalation" were key components, alongside "economic stimulus" measures.

- Immediate de-escalation of trade tensions through negotiations and dialogue.

- Increased international cooperation to address global trade imbalances.

- Implementation of fiscal and monetary policies to stimulate economic growth.

Long-Term Consequences and the Current State of Global Trade

Lingering Effects of Trump's Trade Policies

Trump's trade policies left a lasting impact on global trade relations, fostering increased "protectionism" and damaging trust between nations. The resulting "geopolitical risks" and "economic uncertainty" continue to reverberate today.

- Increased trade barriers and protectionist measures adopted by various countries.

- Damaged trust between major trading partners, hindering future cooperation.

- Increased uncertainty and volatility in global markets.

The Biden Administration's Approach

The Biden administration adopted a significantly different approach to trade, emphasizing "multilateralism" and a renewed focus on international cooperation. This contrasts sharply with Trump's unilateralist approach. "Biden trade policy" actively seeks to rebuild alliances and reform the global trading system.

- Rejoining the World Trade Organization (WTO) and seeking to reform its dispute settlement mechanism.

- Emphasis on negotiating new trade agreements and strengthening existing ones.

- Focus on tackling climate change and promoting sustainable trade practices.

Conclusion: Understanding the Systemic Risks of Trade Wars – Lessons from Trump's Policies

The IMF's warning about the systemic financial risk stemming from Trump's trade war proved prescient. The far-reaching consequences, including disrupted supply chains, reduced economic growth, and increased inequality, serve as a stark reminder of the dangers of protectionist policies. Analyzing Trump's trade war reveals the critical importance of international cooperation and responsible trade policies to prevent future crises. The impact of trade wars is far-reaching and needs careful consideration. To prevent future trade wars, a commitment to multilateralism, open dialogue, and a rules-based trading system is essential. We must continue to analyze Trump's trade war and learn from its consequences to safeguard global economic stability. Learn more about the impact of trade policies on the global economy and stay informed about the ongoing effects of Trump's trade war and its legacy.

Featured Posts

-

Guemueshane Valiligi Nden Okul Tatil Aciklamasi 24 Subat

Apr 23, 2025

Guemueshane Valiligi Nden Okul Tatil Aciklamasi 24 Subat

Apr 23, 2025 -

The Impact Of Trumps Tariffs On Canadian Households Limited Options Remain

Apr 23, 2025

The Impact Of Trumps Tariffs On Canadian Households Limited Options Remain

Apr 23, 2025 -

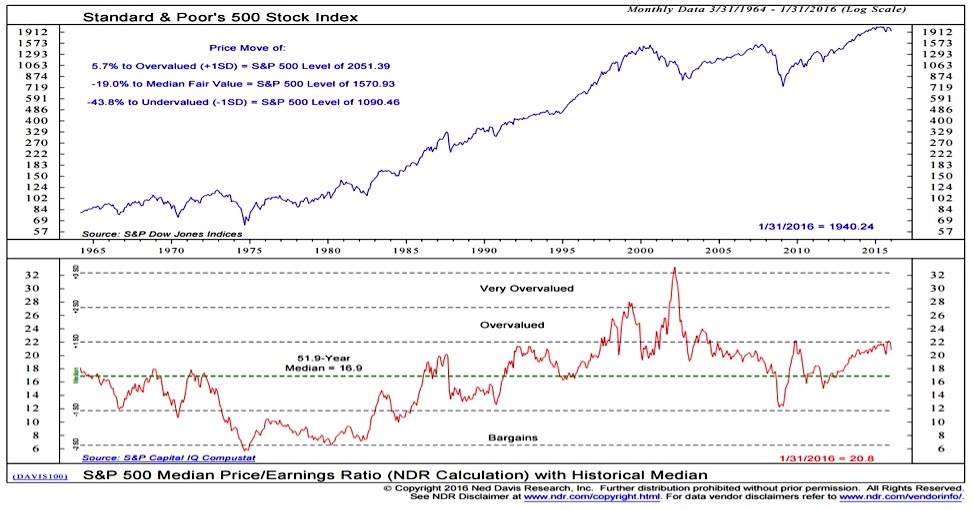

Why Current Stock Market Valuations Are Not A Red Flag A Bof A Analysis

Apr 23, 2025

Why Current Stock Market Valuations Are Not A Red Flag A Bof A Analysis

Apr 23, 2025 -

Florida Condo Market Crash Why Owners Are Selling Now

Apr 23, 2025

Florida Condo Market Crash Why Owners Are Selling Now

Apr 23, 2025 -

Mining Meaning From Mundane Matters An Ai Approach To Scatological Podcast Content

Apr 23, 2025

Mining Meaning From Mundane Matters An Ai Approach To Scatological Podcast Content

Apr 23, 2025