TSX Composite Index Hits Record High: What It Means For Canadian Investors

Table of Contents

Factors Contributing to the TSX Record High

Several key factors have propelled the TSX Composite Index to its record high. Understanding these factors is crucial for informed investment decisions.

Strong Corporate Earnings

Canadian companies across numerous sectors have reported robust profits, significantly boosting the TSX.

- Energy Sector: The energy sector has been a major driver, benefiting from high commodity prices, particularly oil and natural gas. Companies like Suncor Energy and Canadian Natural Resources have seen substantial growth.

- Technology Sector: The tech sector, though experiencing some volatility globally, has shown resilience with several Canadian tech companies posting strong earnings.

- Materials Sector: Increased global demand for raw materials has fueled growth in the materials sector, with companies involved in mining and other resource extraction experiencing significant gains.

These strong earnings reports have attracted increased investor interest, leading to higher stock prices and pushing the TSX to record levels. For example, [Insert specific data point, e.g., "The combined market capitalization of the top 5 energy companies increased by X% in the last quarter"].

Global Economic Factors

Positive global economic trends have also played a significant role in the TSX's performance.

- Increased Commodity Prices: The rise in global commodity prices, driven by factors such as increased demand and geopolitical instability, has benefited Canadian resource-based companies.

- Global Economic Growth: Sustained global economic growth, though showing signs of slowing in some regions, generally contributes to positive investor sentiment and increased investment in Canadian equities.

- Positive Investor Sentiment: Overall optimism in the global market has translated into increased investment in the Canadian stock market.

However, it's important to acknowledge potential geopolitical factors, such as [mention specific geopolitical events and their potential impact, e.g., the ongoing war in Ukraine and its effect on energy prices], which can introduce volatility. Key economic indicators like [mention specific indicators, e.g., GDP growth, inflation rates] should be closely monitored.

Interest Rate Impacts

Interest rate changes significantly influence investor behavior and market performance. The current interest rate environment, while seeing adjustments, has [explain the current interest rate policy and its effect on the TSX, e.g., "helped to temper inflation without significantly dampening economic growth," or "created uncertainty, leading to some market volatility"].

- Impact of Current Policies: [Explain specific effects, e.g., "Higher rates have increased borrowing costs for companies, potentially impacting future earnings," or "Lower rates have encouraged investment, stimulating market growth."]

- Future Rate Adjustments: Future interest rate adjustments by the Bank of Canada are anticipated to [explain the prediction, e.g., "continue to rise gradually," or "stabilize and potentially decrease,"] which could [explain the potential market reaction, e.g., "further boost the market," or "cause a market correction"].

- Interest Rates and Stock Valuations: Interest rates and stock valuations have an inverse relationship; rising rates generally decrease stock valuations while falling rates increase them.

Investment Strategies for Canadian Investors in a Bull Market

While the TSX is at a record high, responsible investment strategies are crucial.

Diversification

A diversified portfolio is paramount for mitigating risk.

- Sector Diversification: Don't put all your eggs in one basket. Spread investments across various sectors, reducing vulnerability to sector-specific downturns.

- Asset Class Diversification: Consider diversifying beyond stocks, including bonds, real estate, and other asset classes to balance risk and return.

- Geographic Diversification: While focusing on the Canadian market, consider international diversification to reduce exposure to regional economic fluctuations.

Diversification reduces the impact of a single investment performing poorly, offering a more stable portfolio.

Risk Management

Even in a bull market, risk management remains critical.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses if the market takes a downturn.

- Dollar-Cost Averaging: Invest consistently over time, reducing the risk of investing a large sum at a market peak.

- Portfolio Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation and manage risk.

Understanding your risk tolerance is crucial; align your investment strategy accordingly.

Long-Term Investing

A long-term approach helps weather market fluctuations.

- Riding Out Corrections: Market corrections are inevitable. A long-term approach allows you to ride out these temporary dips.

- Compounding Returns: Long-term investing allows for compounding returns, which significantly enhances your investment growth over time.

- Goal Alignment: Align your investment strategy with your long-term financial goals, such as retirement planning.

Potential Risks and Challenges

Despite the current record high, potential risks and challenges exist.

Market Corrections

Market corrections are a normal part of the market cycle.

- Cyclical Nature: The stock market naturally experiences periods of growth and decline.

- Navigating Corrections: Having a robust investment strategy and a diversified portfolio can help navigate market corrections.

- Opportunities in Corrections: Corrections can present buying opportunities for long-term investors.

Inflationary Pressures

Inflation can erode purchasing power and investment returns.

- Inflation's Impact: High inflation reduces the real value of your investments.

- Inflation Hedging: Consider investments that tend to perform well during inflationary periods, such as commodities or inflation-protected securities.

- Monitoring Inflation: Keep a close eye on inflation rates and adjust your investment strategy as needed.

Geopolitical Uncertainty

Geopolitical events can significantly impact the TSX.

- Global Events: International conflicts, political instability, and unexpected events can create market volatility.

- Risk Assessment: Assess potential geopolitical risks and adjust your portfolio accordingly.

- Diversification as a Hedge: Diversification helps reduce the impact of geopolitical events on your investment portfolio.

Conclusion: Navigating the Highs and Lows of the TSX Composite Index

The record high of the TSX Composite Index presents both opportunities and challenges for Canadian investors. While the current market conditions are positive, understanding the factors driving this growth and the potential risks is vital. Diversification, effective risk management, and a long-term investment strategy are crucial for navigating the highs and lows of the TSX. Remember to make informed decisions, consulting reliable sources and, most importantly, seeking personalized advice from a qualified financial advisor before making any investment decisions related to the TSX Composite Index. This ensures your investment strategy aligns with your individual financial situation and risk tolerance. Further research into "TSX investment strategies," "Canadian portfolio diversification," and "managing risk in the TSX" is strongly recommended.

Featured Posts

-

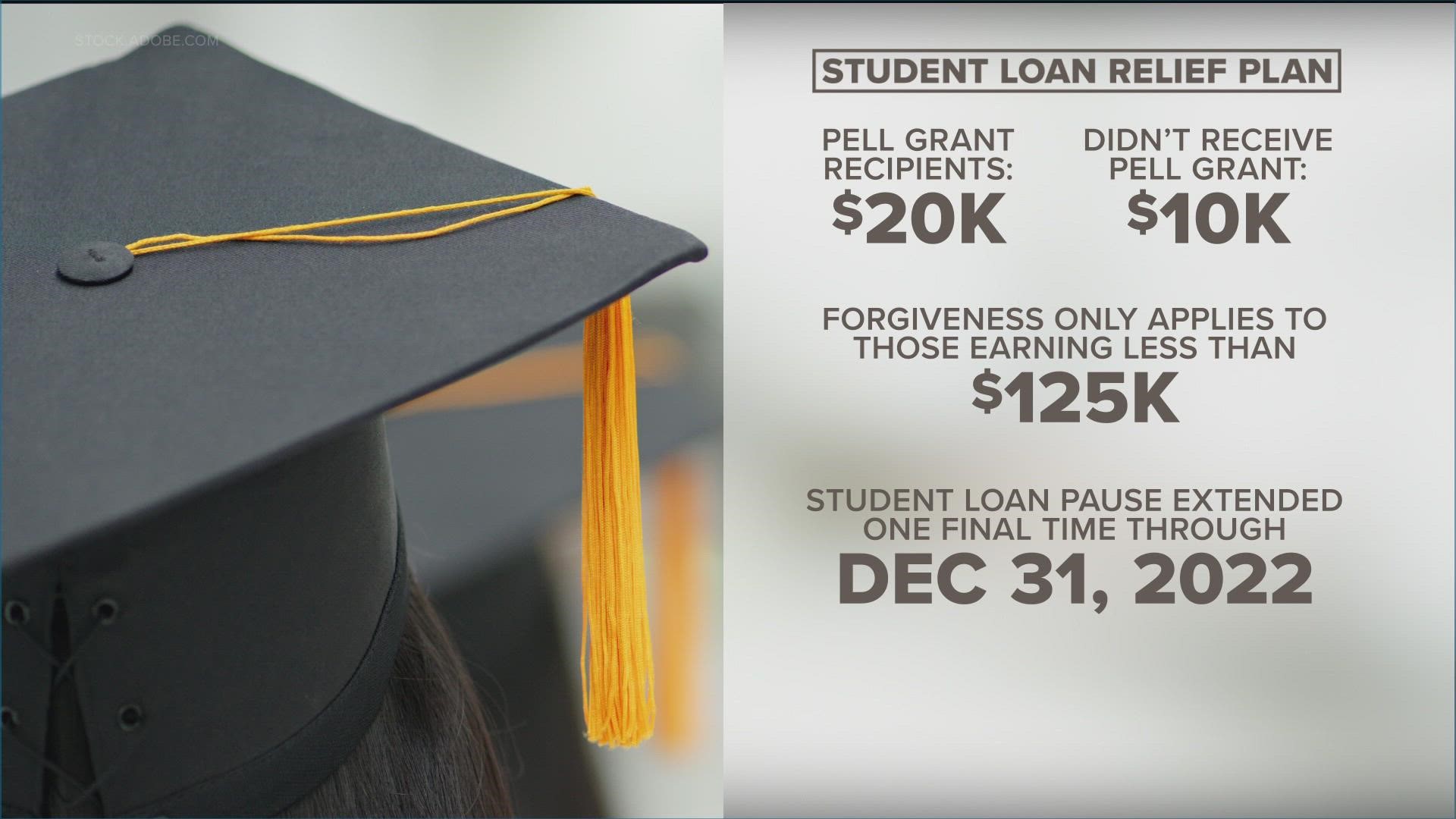

Gops Student Loan Plan What You Need To Know About Pell Grants And Repayment

May 17, 2025

Gops Student Loan Plan What You Need To Know About Pell Grants And Repayment

May 17, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Claims At The Center Of Lawsuit

May 17, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Claims At The Center Of Lawsuit

May 17, 2025 -

The Steepening Yield Curve In Japan Implications For Investors And Economic Policy

May 17, 2025

The Steepening Yield Curve In Japan Implications For Investors And Economic Policy

May 17, 2025 -

Wnba Salary Dispute Angel Reeses Perspective On A Potential Strike

May 17, 2025

Wnba Salary Dispute Angel Reeses Perspective On A Potential Strike

May 17, 2025 -

Chrisean Rock Interview Fallout Angel Reese Claps Back At Critics

May 17, 2025

Chrisean Rock Interview Fallout Angel Reese Claps Back At Critics

May 17, 2025

Latest Posts

-

Numero Mortos Em Acidente Com Onibus Universitario Investigacao Em Andamento

May 17, 2025

Numero Mortos Em Acidente Com Onibus Universitario Investigacao Em Andamento

May 17, 2025 -

Fargo Educator Recognized For Outstanding Science Teaching Eagleson Honored

May 17, 2025

Fargo Educator Recognized For Outstanding Science Teaching Eagleson Honored

May 17, 2025 -

Acidente Com Onibus Universitario Local Registra Diversas Vitimas

May 17, 2025

Acidente Com Onibus Universitario Local Registra Diversas Vitimas

May 17, 2025 -

Sheyenne High School Honors Eagleson For Excellence In Science Education

May 17, 2025

Sheyenne High School Honors Eagleson For Excellence In Science Education

May 17, 2025 -

Onibus Universitario Se Envolve Em Acidente Grave Numero De Mortos Confirmados

May 17, 2025

Onibus Universitario Se Envolve Em Acidente Grave Numero De Mortos Confirmados

May 17, 2025