U.S. Dollar: Worst Start Since Nixon? Analyzing The First 100 Days

Table of Contents

The U.S. Dollar's Performance: A Deep Dive into the First 100 Days

Key Economic Indicators

The U.S. dollar's value is intricately linked to various economic indicators. Analyzing these indicators over the first 100 days provides valuable insights into the forces driving its performance.

- Inflation: High inflation erodes the purchasing power of the dollar, making it less attractive to foreign investors. A persistently high inflation rate, as measured by the Consumer Price Index (CPI), puts downward pressure on the currency exchange rates.

- Interest Rates: The Federal Reserve's monetary policy, particularly interest rate adjustments, significantly impacts the dollar's strength. Higher interest rates generally attract foreign investment, increasing demand for the U.S. dollar. Conversely, lower interest rates can weaken the dollar.

- GDP Growth: Strong GDP growth signals a healthy economy, bolstering investor confidence and increasing demand for the dollar. Conversely, sluggish GDP growth can lead to dollar weakness.

- Unemployment: Low unemployment rates generally support a strong dollar, reflecting a robust economy. High unemployment, however, can signal economic weakness, potentially leading to a decline in the dollar's value.

(Insert relevant charts and graphs visualizing the data for these indicators during the first 100 days.)

Comparison to the Post-Nixon Era

The current situation bears some resemblance to the period following Nixon's closure of the gold window in 1971, which marked the end of the Bretton Woods system of fixed exchange rates. This system had pegged the U.S. dollar to gold, providing stability. Its collapse ushered in an era of floating exchange rates and increased volatility for the U.S. dollar.

- Bretton Woods Collapse: The demise of the Bretton Woods system created uncertainty in global currency markets.

- Increased Volatility: The floating exchange rate system led to significantly more volatility in the value of the U.S. dollar.

- Historical Parallels: While the current situation is not an exact replica, the current levels of uncertainty and volatility share similarities with the post-Nixon era. A detailed comparison of the inflation rates, interest rate adjustments, and geopolitical events surrounding both periods would provide further insight.

Impact of Geopolitical Events

Geopolitical events play a significant role in influencing investor sentiment and capital flows, directly affecting the U.S. dollar's value.

- War in Ukraine: The ongoing conflict significantly impacts global energy markets and supply chains, increasing uncertainty and driving investors toward safe-haven assets, potentially weakening the dollar.

- Rising Global Tensions: Heightened geopolitical tensions worldwide can lead to increased risk aversion, causing investors to seek the safety of the U.S. dollar (as a safe-haven asset), though this effect can be temporary.

- Global Uncertainty: Any major global crisis or uncertainty typically strengthens the dollar temporarily as investors flee to safer assets. However, long-term, sustained uncertainty can negatively impact investor confidence and weaken the dollar.

Potential Causes of Dollar Weakness

Inflationary Pressures

High inflation is a key driver of dollar weakness. It erodes the purchasing power of the dollar and reduces its attractiveness to foreign investors.

- Eroding Purchasing Power: High inflation means goods and services become more expensive, reducing the value of the dollar domestically and internationally.

- Federal Reserve Response: The Federal Reserve's efforts to combat inflation through interest rate hikes can have a dual effect: curbing inflation but also potentially slowing economic growth, thereby influencing the dollar's value.

Monetary Policy Decisions

The Federal Reserve's monetary policy decisions significantly impact the dollar's value.

- Interest Rate Adjustments: Changes in interest rates directly affect currency exchange rates. Higher rates attract foreign investment, strengthening the dollar, while lower rates can weaken it.

- Quantitative Easing: Past quantitative easing policies, while intended to stimulate the economy, have also been associated with long-term inflationary pressures and potential dollar weakness.

Fiscal Policy Impacts

Government spending and budget deficits also influence the dollar's value.

- National Debt: High national debt can erode investor confidence in the long-term stability of the U.S. economy, weakening the dollar.

- Unsustainable Fiscal Policies: Fiscal policies perceived as unsustainable can lead to a decline in the dollar's value as investors seek investments in countries with more stable financial policies.

Consequences and Future Outlook for the U.S. Dollar

Impact on Global Trade

A weaker dollar can significantly impact U.S. competitiveness in global trade.

- Import and Export Prices: A weaker dollar makes imports more expensive for U.S. consumers but makes U.S. exports more competitive internationally.

- U.S. Businesses: The impact on U.S. businesses depends on their reliance on imports versus exports.

Implications for Investment

Dollar weakness influences global investment strategies.

- Portfolio Diversification: Investors may adjust their portfolios to mitigate risks associated with a weakening dollar.

- Risk Management: Currency hedging becomes crucial for investors to protect themselves against exchange rate fluctuations.

Predictions and Forecasts

Predicting the future trajectory of the U.S. dollar is complex and requires cautious analysis. Several factors could influence its future value:

- Inflation Control: The success of the Federal Reserve in controlling inflation will be a key determinant.

- Geopolitical Stability: A reduction in global uncertainties would likely stabilize the dollar.

- Economic Growth: Stronger economic growth in the U.S. would generally support a stronger dollar.

Conclusion:

The U.S. dollar's performance during its first 100 days presents a complex picture, with parallels to the post-Nixon era but also significant differences. Inflationary pressures, monetary policy decisions, fiscal policy impacts, and geopolitical events all play significant roles in determining its value. Understanding these factors is crucial for investors, businesses, and policymakers. The key takeaway is that the U.S. dollar's future trajectory depends on the interplay of several economic and geopolitical factors. To stay informed about the U.S. dollar and its potential future movements, subscribe to reputable financial news sources and continue monitoring key economic indicators. Staying updated on the U.S. dollar is crucial for navigating the complexities of global financial markets.

Featured Posts

-

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 29, 2025

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 29, 2025 -

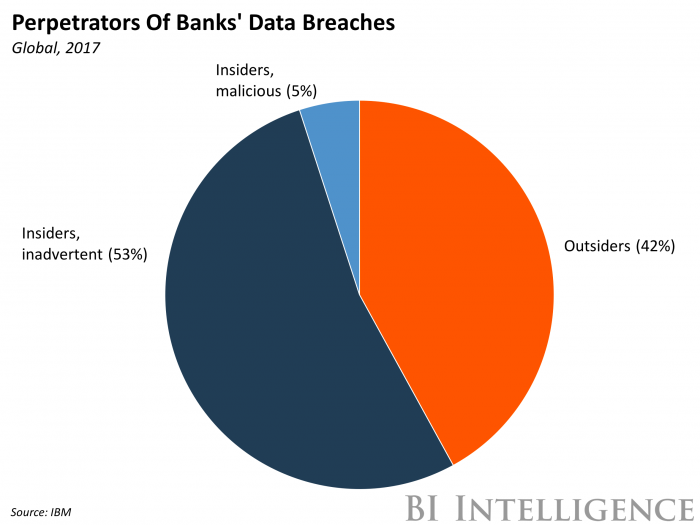

Millions Made From Office365 Breaches Insider Threat Exposed

Apr 29, 2025

Millions Made From Office365 Breaches Insider Threat Exposed

Apr 29, 2025 -

Activision Blizzard Acquisition Ftcs Appeal And Future Of The Gaming Industry

Apr 29, 2025

Activision Blizzard Acquisition Ftcs Appeal And Future Of The Gaming Industry

Apr 29, 2025 -

Subsystem Issue Forces Blue Origin To Abort Rocket Launch

Apr 29, 2025

Subsystem Issue Forces Blue Origin To Abort Rocket Launch

Apr 29, 2025 -

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025

Latest Posts

-

Eligibility Of Convicted Cardinal To Participate In Papal Conclave

Apr 29, 2025

Eligibility Of Convicted Cardinal To Participate In Papal Conclave

Apr 29, 2025 -

Debate Erupts Over Convicted Cardinals Vote In Next Papal Conclave

Apr 29, 2025

Debate Erupts Over Convicted Cardinals Vote In Next Papal Conclave

Apr 29, 2025 -

Convicted Cardinal Challenges Eligibility For Papal Election

Apr 29, 2025

Convicted Cardinal Challenges Eligibility For Papal Election

Apr 29, 2025 -

Papal Conclave Convicted Cardinals Unexpected Demand

Apr 29, 2025

Papal Conclave Convicted Cardinals Unexpected Demand

Apr 29, 2025 -

Cardinals Conclave Voting Rights A Legal Battle

Apr 29, 2025

Cardinals Conclave Voting Rights A Legal Battle

Apr 29, 2025