U.S. Economy Adds 177,000 Jobs In April; Unemployment Rate Holds At 4.2%

Table of Contents

Detailed Breakdown of April's Job Growth

April's job growth, while not spectacular, demonstrates continued expansion across various sectors. The leisure and hospitality industry, a key indicator of economic health, saw significant gains, adding 35,000 jobs – a positive sign suggesting increased consumer spending and confidence. Professional and business services also contributed substantially, adding 40,000 jobs, reflecting continued strength in the overall economy and business investment. Other notable contributors included healthcare and education.

- Leisure and Hospitality: +35,000 jobs, showing a continued recovery from pandemic-related impacts.

- Professional and Business Services: +40,000 jobs, suggesting robust business activity and expansion.

- Healthcare: +20,000 jobs, reflecting ongoing demand for healthcare services.

- Education: +15,000 jobs, signaling continued investment in education and workforce development.

Compared to March's job growth of 230,000, April’s figures show a slight slowdown, but remain within a range consistent with sustainable economic growth. This moderation could indicate a natural leveling off after a period of rapid expansion or subtle shifts in economic activity. Further analysis is needed to determine the underlying causes of this minor decrease.

Unemployment Rate Remains Stable at 4.2%

The unemployment rate remaining steady at 4.2% suggests a balanced labor market. While a low unemployment rate is generally positive, signifying a healthy economy and low levels of joblessness, it also presents challenges. The stable figure doesn’t necessarily imply a complete absence of concerns. The labor force participation rate, the percentage of the working-age population actively employed or seeking work, remains an important factor influencing the unemployment rate. A low participation rate could hide underemployment or discouragement among potential workers.

- Unemployment Rate Calculation: The unemployment rate is calculated by dividing the number of unemployed individuals by the total labor force (employed plus unemployed).

- Historical Comparison: The current 4.2% unemployment rate is relatively low compared to historical averages, indicating a strong labor market.

- Potential Contributing Factors: Several factors contribute to the stability, including steady job creation, despite the minor slowdown in April.

- Concerns: We should monitor the participation rate closely, as a persistently low rate might signal underemployment or discouraged workers not actively seeking jobs.

Wage Growth and Inflationary Pressures

Average hourly earnings increased by 0.4% in April, representing a year-over-year increase of 4.4%. This wage growth, while positive for workers, fuels concerns about inflationary pressures. The Federal Reserve carefully monitors wage growth as a key indicator for setting monetary policy, particularly interest rates. High wage growth can lead to increased consumer spending and demand-pull inflation, potentially necessitating further interest rate hikes to curb inflation.

- Average Hourly Earnings: +0.4% month-over-month, +4.4% year-over-year.

- Wages and Inflation: The relationship between wage growth and inflation is complex and requires careful analysis. While wage increases benefit workers, they can contribute to inflationary pressures.

- Potential Interest Rate Hikes: The Federal Reserve will likely continue to monitor wage growth closely and could adjust interest rates accordingly to manage inflation.

- Expert Opinions: Economists hold varying perspectives on the outlook, with some predicting sustained growth and others anticipating potential slowdowns.

Long-Term Implications for the U.S. Labor Market

The April jobs report provides a snapshot of the current state of the U.S. labor market, but it is not a crystal ball for the future. Several factors will influence the long-term outlook. Continued technological advancements will likely reshape certain industries, leading to shifts in employment sectors. Geopolitical instability and potential global economic slowdowns could impact U.S. job growth.

- Future Job Growth Predictions: The overall trend suggests continued, although possibly moderated, job growth in the coming months.

- Employment Sector Shifts: Technological advancements will likely lead to increased demand in technology-related fields and decreased demand in certain traditional industries.

- Impact of Technological Advancements: Automation and artificial intelligence are likely to reshape the job market, creating new opportunities while potentially displacing workers in some sectors.

- Potential Risks to Economic Stability: Geopolitical events and global economic conditions could significantly impact the U.S. economy and its labor market.

Analyzing the April U.S. Jobs Report and its Future Implications

In conclusion, the April 2024 jobs report reflects a resilient yet moderating U.S. economy. While 177,000 jobs added is a positive sign, the slight slowdown compared to previous months, combined with a steady unemployment rate of 4.2% and rising wages, requires careful consideration. The interplay between wage growth and inflation will continue to be a key factor shaping the Federal Reserve's monetary policy decisions and the overall economic outlook. The long-term implications depend on various factors, including technological advancements, geopolitical stability, and global economic conditions. Stay informed about future U.S. job growth and unemployment rate reports by regularly checking reputable economic news sources to gain a better understanding of this dynamic and important aspect of the U.S. economy. Understanding these fluctuations is critical for making informed decisions about your own financial future.

Featured Posts

-

Aprils U S Jobs Report 177 000 Jobs Added Unemployment Rate At 4 2

May 04, 2025

Aprils U S Jobs Report 177 000 Jobs Added Unemployment Rate At 4 2

May 04, 2025 -

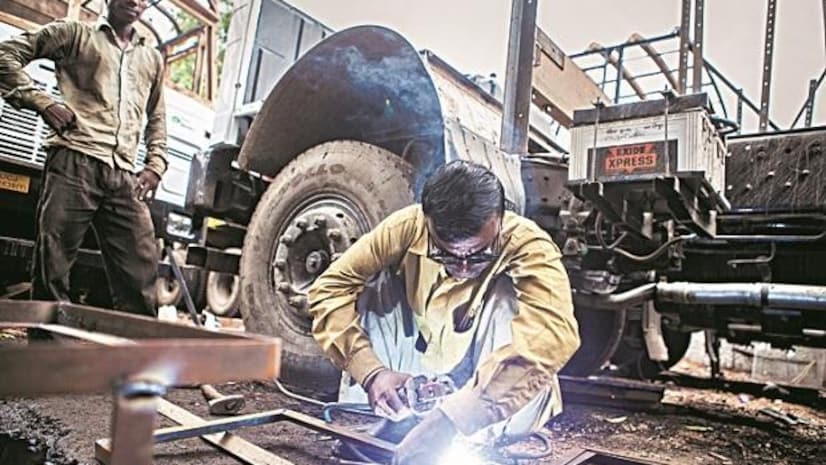

Analyzing The Nhl Standings Stakes High On Friday

May 04, 2025

Analyzing The Nhl Standings Stakes High On Friday

May 04, 2025 -

The Future Of Darjeeling Tea Challenges And Uncertainties

May 04, 2025

The Future Of Darjeeling Tea Challenges And Uncertainties

May 04, 2025 -

Understanding Cocaines Global Expansion Potent Powder And Innovative Trafficking Methods

May 04, 2025

Understanding Cocaines Global Expansion Potent Powder And Innovative Trafficking Methods

May 04, 2025 -

Update More Payment Choices On Spotifys I Phone App

May 04, 2025

Update More Payment Choices On Spotifys I Phone App

May 04, 2025

Latest Posts

-

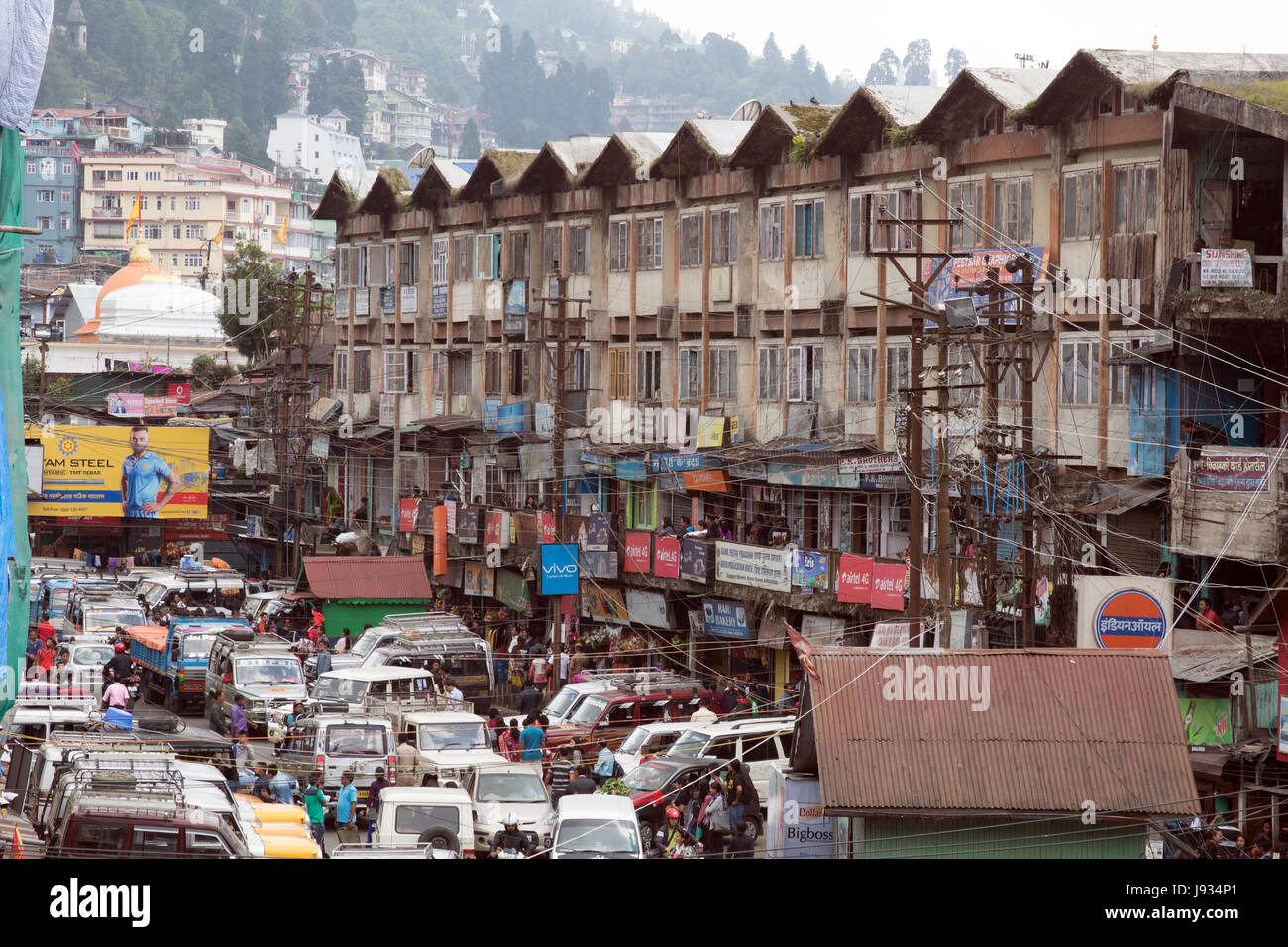

Improving Traffic Flow In Darjeeling Strategies And Challenges

May 04, 2025

Improving Traffic Flow In Darjeeling Strategies And Challenges

May 04, 2025 -

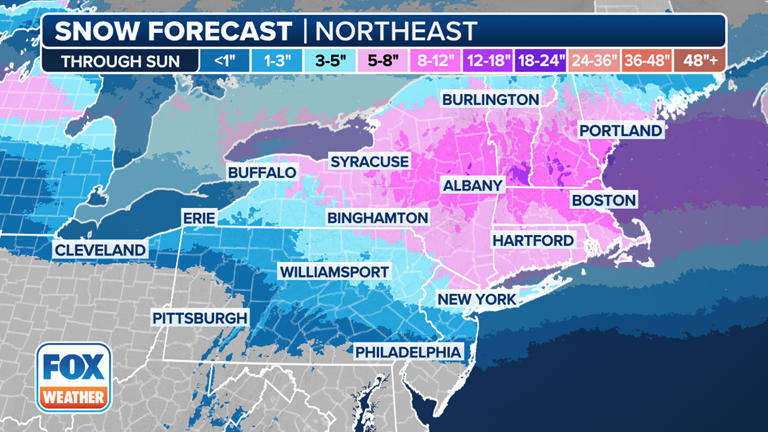

Snow Storm Forecast When Will Snow Return To Ny Nj And Ct

May 04, 2025

Snow Storm Forecast When Will Snow Return To Ny Nj And Ct

May 04, 2025 -

Darjeelings Slow Moving Traffic A Growing Concern

May 04, 2025

Darjeelings Slow Moving Traffic A Growing Concern

May 04, 2025 -

Addressing Slow Traffic Movement In Darjeeling

May 04, 2025

Addressing Slow Traffic Movement In Darjeeling

May 04, 2025 -

Darjeeling Traffic Congestion Causes And Solutions

May 04, 2025

Darjeeling Traffic Congestion Causes And Solutions

May 04, 2025