U.S. Steel And Nippon Steel Deal: President Trump's Approval And Market Reactions

Table of Contents

The Deal's Details and Proposed Benefits

The proposed merger between U.S. Steel and Nippon Steel aimed to create a global steel powerhouse, combining the strengths of both companies. U.S. Steel, a major player in the North American market, would benefit from Nippon Steel's advanced technologies and global reach. Conversely, Nippon Steel would gain access to a significant portion of the lucrative North American steel market. The rationale behind the merger included several key benefits:

- Increased market share in key sectors: The combined entity would command a larger market share in various steel sectors, including automotive, construction, and energy. This increased market presence would translate into greater pricing power and enhanced profitability.

- Synergies in production and distribution: The merger would allow for streamlining operations, optimizing production processes, and creating a more efficient distribution network, leading to significant cost savings.

- Technological advancements and innovation: By pooling their resources and expertise, the merged company could accelerate technological innovation and develop new, high-performance steel products.

- Potential cost savings and efficiency gains: Economies of scale, resulting from the merger, would lead to substantial cost reductions in procurement, manufacturing, and logistics.

- Strengthened competitive position against global rivals: A combined U.S. Steel and Nippon Steel would be better equipped to compete with other major steel producers globally, enhancing its overall market dominance.

President Trump's Role and Stance

President Trump's administration played a significant role in shaping the narrative surrounding the U.S. Steel and Nippon Steel deal. His "America First" policy emphasized protecting domestic industries, and the proposed merger had the potential to significantly influence this agenda. While the specifics of his involvement and ultimate stance on the deal remain crucial points of analysis, understanding his potential influence on the decision-making process is critical.

- Analysis of Trump's "America First" policy and its relevance to the deal: The deal's impact on American jobs and the steel industry were central considerations. Trump’s approval or disapproval would heavily depend on how the merger aligned with these objectives.

- Impact of any tariffs or trade negotiations on the deal's feasibility: Existing or potential tariffs imposed by the Trump administration could have influenced the attractiveness and feasibility of the merger for both companies.

- How his stance affected market sentiment and investor confidence: Trump's public pronouncements would have undoubtedly influenced investor confidence and market sentiment surrounding the deal. A positive statement could boost stock prices, while negative comments could lead to market uncertainty.

- Consideration of any political pressure brought to bear on the decision: The administration's involvement may have involved political pressure on regulatory bodies or negotiations influencing the deal's final outcome.

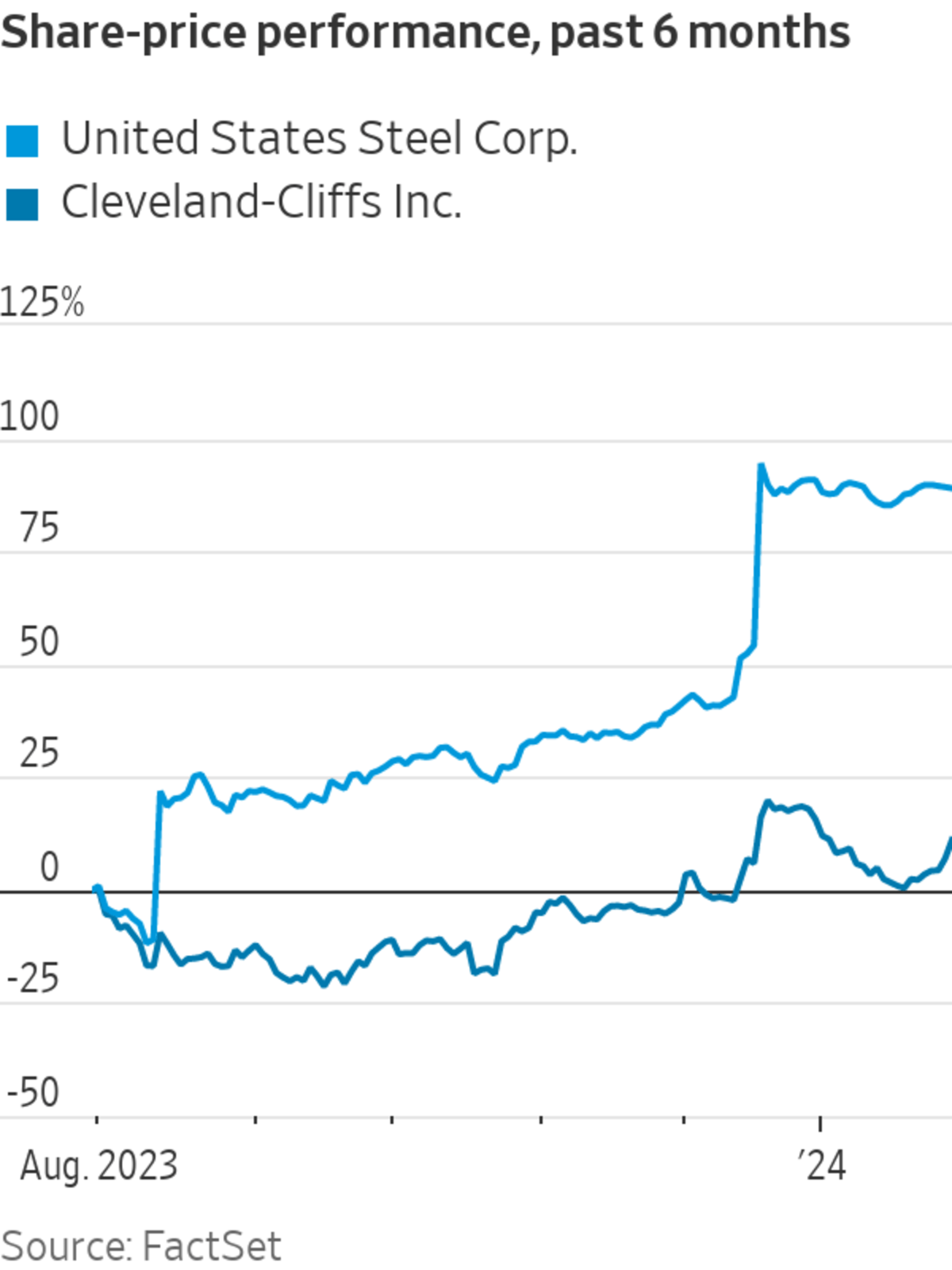

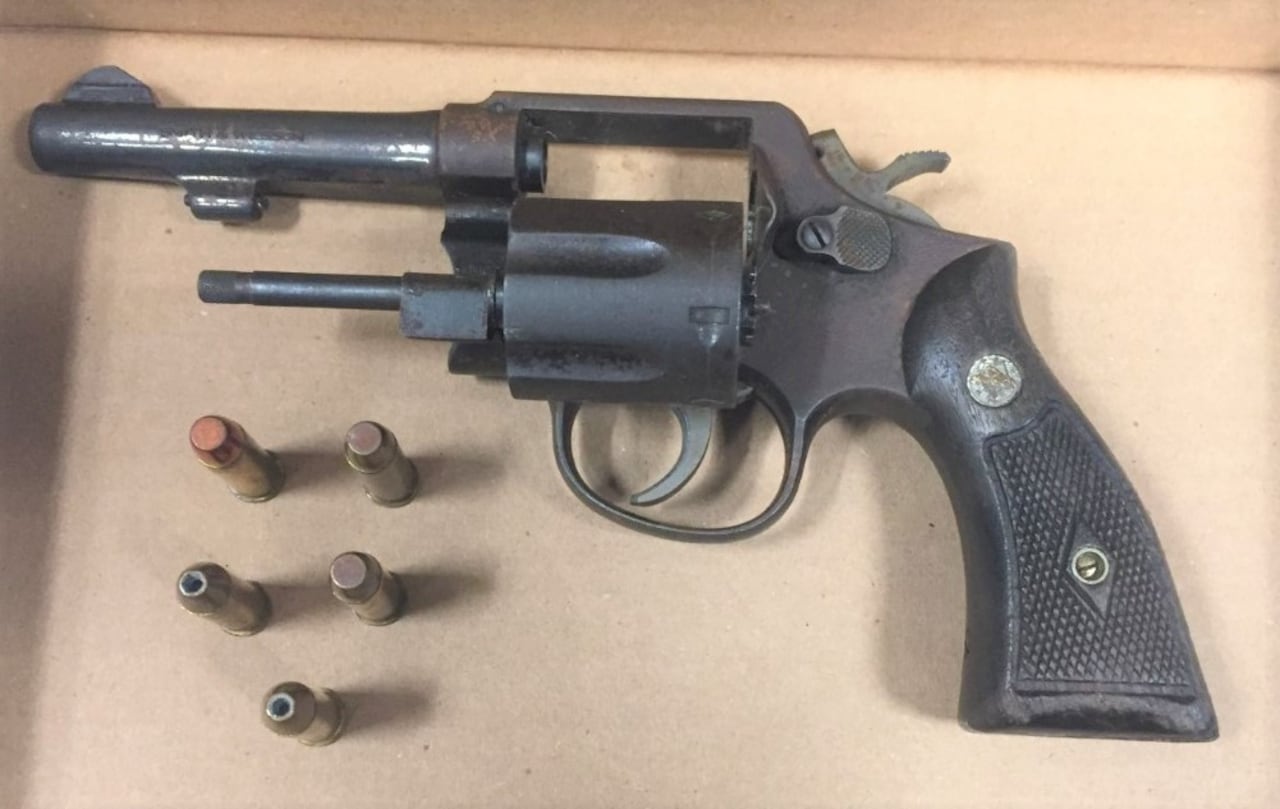

Market Reactions and Stock Performance

The announcement of the potential U.S. Steel and Nippon Steel deal, coupled with anticipated President Trump's stance, generated significant market activity. The immediate and long-term reactions revealed investor sentiment and expectations regarding the deal's success.

- Stock price fluctuations for both U.S. Steel and Nippon Steel: News of the potential merger likely triggered substantial fluctuations in the stock prices of both companies. A positive market response would indicate investor confidence in the deal's prospects, while negative reactions could signal skepticism.

- Impact on the broader steel industry's stock performance: The announcement's impact extended beyond the two primary companies, influencing the overall performance of the broader steel industry. Investor perception of the deal's overall implications would likely affect other steel companies' stock prices.

- Investor sentiment and analyst predictions following the announcement: Analyst predictions and investor sentiment would have provided crucial insights into the market's perception of the deal's potential benefits and risks.

- Analysis of market volatility and uncertainty related to the deal: The deal's uncertainty and President Trump's potential involvement would likely cause increased market volatility, particularly in the steel sector.

International Implications and Global Steel Market Impact

The U.S. Steel and Nippon Steel deal had significant international implications, impacting global steel market dynamics and competition.

- Reactions from competing steel producers worldwide: Competitors would have closely monitored the deal's progression, assessing its potential impact on their market share and competitive landscape.

- Potential impacts on steel prices globally: The merger's success could lead to changes in global steel pricing, depending on the combined entity's market power and production capacity.

- Analysis of the deal's effects on international trade relationships: The deal's impact on international trade relations, particularly concerning steel exports and imports, would warrant careful evaluation.

Conclusion

The potential U.S. Steel and Nippon Steel deal presented a complex scenario with far-reaching implications. President Trump's involvement, alongside market reactions and international consequences, significantly shaped the narrative. Analyzing stock fluctuations, investor sentiment, and global impacts is crucial in understanding the long-term effects of this significant potential merger. Understanding this merger's potential impact requires continuous monitoring of the steel industry and related geopolitical factors.

Call to Action: Stay updated on the latest developments surrounding the U.S. Steel and Nippon Steel deal and its ongoing impact on the steel market. Further analysis of this landmark potential agreement is crucial for understanding future trends in the industry, especially considering the ever-changing dynamics within the global steel industry.

Featured Posts

-

Sharp Decline In Amsterdam Stock Market Down 7 At Opening Due To Trade War Concerns

May 25, 2025

Sharp Decline In Amsterdam Stock Market Down 7 At Opening Due To Trade War Concerns

May 25, 2025 -

Naomi Kempbell U Vidvertikh Obrazakh Dlya Novogo Glyantsyu

May 25, 2025

Naomi Kempbell U Vidvertikh Obrazakh Dlya Novogo Glyantsyu

May 25, 2025 -

Dave Turmel Canadas Most Wanted Arrested In Italy

May 25, 2025

Dave Turmel Canadas Most Wanted Arrested In Italy

May 25, 2025 -

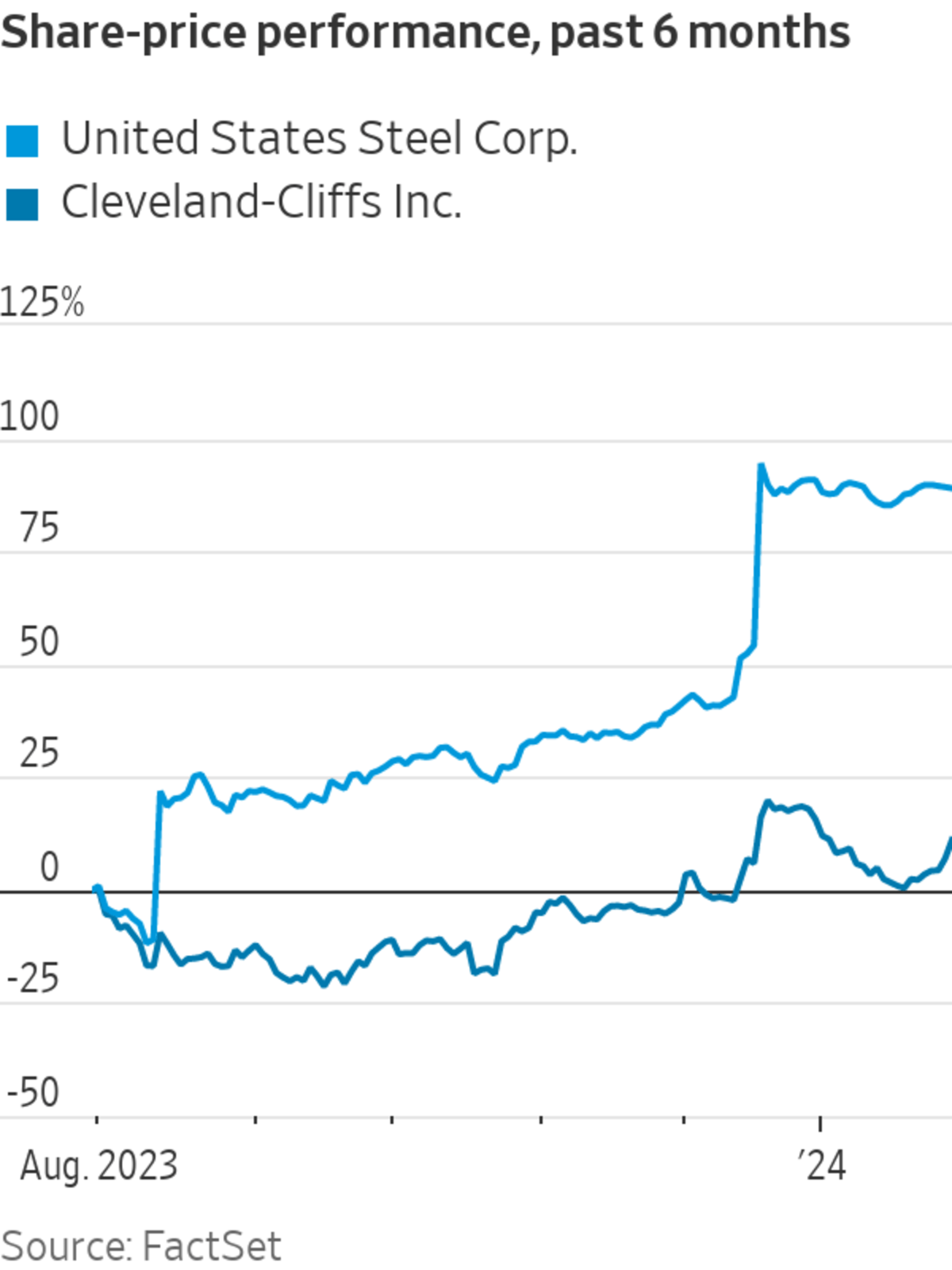

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 In Gun Trafficking Case

May 25, 2025

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 In Gun Trafficking Case

May 25, 2025 -

Investigation Into 2002 Submarine Deal French Prosecutors Accuse Malaysias Najib Razak

May 25, 2025

Investigation Into 2002 Submarine Deal French Prosecutors Accuse Malaysias Najib Razak

May 25, 2025

Latest Posts

-

Qui Est Melanie Thierry Parcours Et Succes D Une Actrice Talentueuse

May 25, 2025

Qui Est Melanie Thierry Parcours Et Succes D Une Actrice Talentueuse

May 25, 2025 -

Did Michael Schumachers Driving Style Create Unnecessary Friction

May 25, 2025

Did Michael Schumachers Driving Style Create Unnecessary Friction

May 25, 2025 -

Melanie Thierry Roles Prix Et Recompenses

May 25, 2025

Melanie Thierry Roles Prix Et Recompenses

May 25, 2025 -

Michael Schumacher And His Rivals Fact Vs Fiction

May 25, 2025

Michael Schumacher And His Rivals Fact Vs Fiction

May 25, 2025 -

Accusations De Machisme Contre Thierry Ardisson Analyse De L Impact Du Mea Culpa De Laurent Baffie

May 25, 2025

Accusations De Machisme Contre Thierry Ardisson Analyse De L Impact Du Mea Culpa De Laurent Baffie

May 25, 2025