U.S. Tariff Pause Triggers 8% Stock Market Rise In Amsterdam

Table of Contents

The Impact of the U.S. Tariff Pause on European Businesses

The pause in U.S. tariffs provided immediate relief to European businesses, particularly those heavily reliant on exporting goods to the U.S. market. The previous threat of increased tariffs created significant uncertainty and hampered business planning. This pause has dramatically altered the landscape.

- Reduced uncertainty for businesses planning future exports: Companies can now make more informed decisions about production, investment, and long-term strategies without the looming threat of increased tariffs impacting their bottom line.

- Increased profitability due to lower export costs: The absence of additional tariffs translates directly into higher profit margins for European exporters, boosting their competitiveness.

- Improved competitiveness against non-European exporters: European businesses now enjoy a more level playing field against competitors from countries not subject to the same tariff pressures. This could lead to increased market share in the U.S.

- Potential for increased investment and job creation: With improved profitability and reduced risk, businesses are more likely to invest in expansion, leading to potential job creation within the Netherlands and across Europe.

Specific sectors in Amsterdam and the Netherlands, like agriculture (particularly flowers and horticultural products) and manufacturing (certain high-tech components), were particularly hard hit by the previous tariff threats. The pause has noticeably eased these pressures, allowing businesses to breathe easier and refocus on growth. Companies like [Insert example of a Dutch company benefiting from the tariff pause] reported a positive impact on their Q3 earnings.

Amsterdam Stock Exchange's Reaction to the Tariff News

The Amsterdam Stock Exchange reacted swiftly and significantly to the news of the U.S. tariff pause. The 8% rise was observed primarily within the first 24 hours following the announcement, with a slight correction in the following days.

- Immediate market reaction following the announcement: The market opened sharply higher, reflecting immediate investor optimism and confidence.

- Investor confidence and sentiment analysis: The surge indicated a considerable boost in investor confidence, suggesting a positive outlook on future U.S.-EU trade relations.

- Comparison with other European stock market responses: While other European markets also experienced positive reactions, the Amsterdam Stock Exchange showed a particularly strong response, likely due to its high concentration of businesses directly impacted by U.S. trade policy.

- Volume of trades during the period: Trading volume increased significantly during this period, reflecting heightened activity as investors reacted to the news.

[Insert chart or graph here showing the Amsterdam Stock Exchange's performance around the time of the tariff pause announcement]. Analysts at [Name of reputable financial institution] commented that this rise reflects a growing belief that de-escalation of trade tensions is possible. The market's positive response suggests investors believe the tariff pause could be a precursor to a more favorable trade environment.

Global Implications and Wider Market Trends

The U.S. tariff pause had repercussions far beyond the Amsterdam Stock Exchange. The interconnectedness of global markets meant that the decision had a ripple effect across the globe.

- Impact on the Euro against the US dollar: The positive market sentiment contributed to a slight strengthening of the Euro against the US dollar.

- Ripple effects on other European economies: Other European economies, particularly those with significant exports to the U.S., also experienced positive but less pronounced effects.

- Potential for similar responses in other global markets: Similar, albeit smaller, positive responses were seen in other stock markets globally, indicating a widespread relief reaction to the reduced trade tensions.

- Long-term implications for international trade relations: While the immediate impact is positive, the long-term implications depend on the sustainability of the tariff pause and the overall direction of U.S. trade policy.

However, it’s crucial to note potential risks. The pause might be temporary, and uncertainty about future U.S. trade policy remains a significant factor influencing investor decisions.

Uncertainty Remains: Future Outlook on U.S. Tariffs

Despite the positive short-term impact, significant uncertainty remains regarding the future of U.S. trade policy.

- Potential for future tariff increases or changes in policy: The possibility of future tariff changes remains a considerable risk for businesses relying on U.S. trade.

- Ongoing trade negotiations and their implications: The outcome of ongoing trade negotiations between the U.S. and other countries will significantly affect the stability of the global trade environment.

- Factors that could influence future U.S. tariff decisions: Domestic political factors and broader global economic conditions will heavily influence future U.S. tariff decisions.

The volatile nature of U.S. trade policy necessitates a cautious approach for businesses engaging in international trade. Careful monitoring of policy shifts is essential for effective risk management.

Conclusion

The unexpected pause in U.S. tariffs triggered an impressive 8% rise in the Amsterdam Stock Exchange, reflecting the significant impact of U.S. trade policy on global markets. The positive reaction highlights the relief felt by European businesses, particularly those in Amsterdam and the Netherlands, that had faced considerable uncertainty due to the threat of increased tariffs. While this is positive news for the U.S. Tariff Pause Amsterdam Stock Market relationship, the long-term implications remain uncertain, dependent on future developments in U.S. trade policy.

Call to Action: Stay informed about the evolving landscape of U.S. trade policy and its impact on global markets. Regularly monitor news and analysis related to the U.S. tariff pause and its influence on the Amsterdam Stock Market and other global financial centers. Understanding these shifts is crucial for investors and businesses alike. Keep a close eye on future developments impacting the U.S. Tariff Pause Amsterdam Stock Market dynamic.

Featured Posts

-

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025 -

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 25, 2025

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 25, 2025 -

Brazilian Banking Reshaped Brb And Banco Master Combine Forces

May 25, 2025

Brazilian Banking Reshaped Brb And Banco Master Combine Forces

May 25, 2025 -

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 25, 2025

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 25, 2025 -

Buy And Hold Facing The Challenges Of Long Term Investing

May 25, 2025

Buy And Hold Facing The Challenges Of Long Term Investing

May 25, 2025

Latest Posts

-

Gregor Robertson Affordable Housing Without A Market Crash

May 25, 2025

Gregor Robertson Affordable Housing Without A Market Crash

May 25, 2025 -

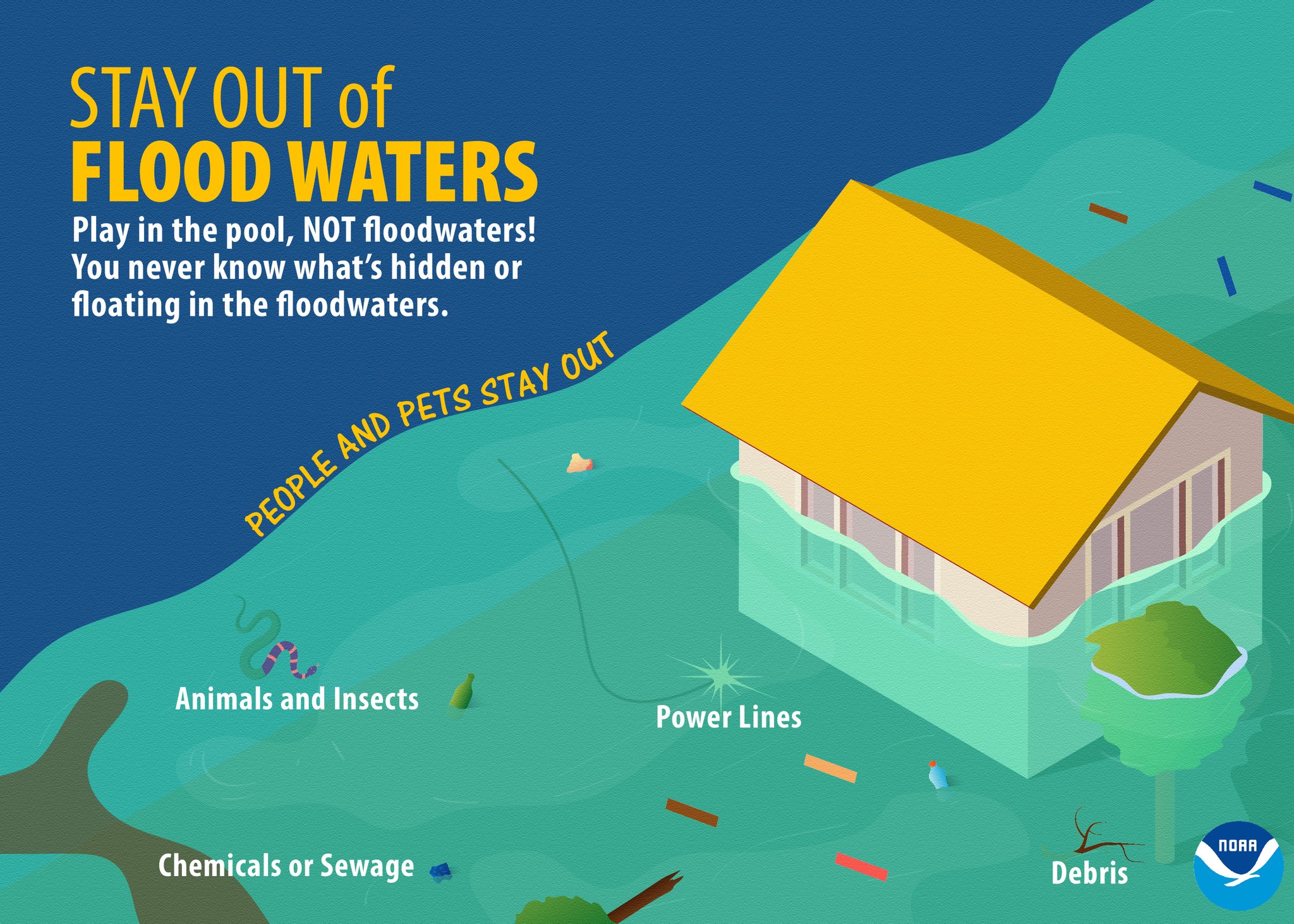

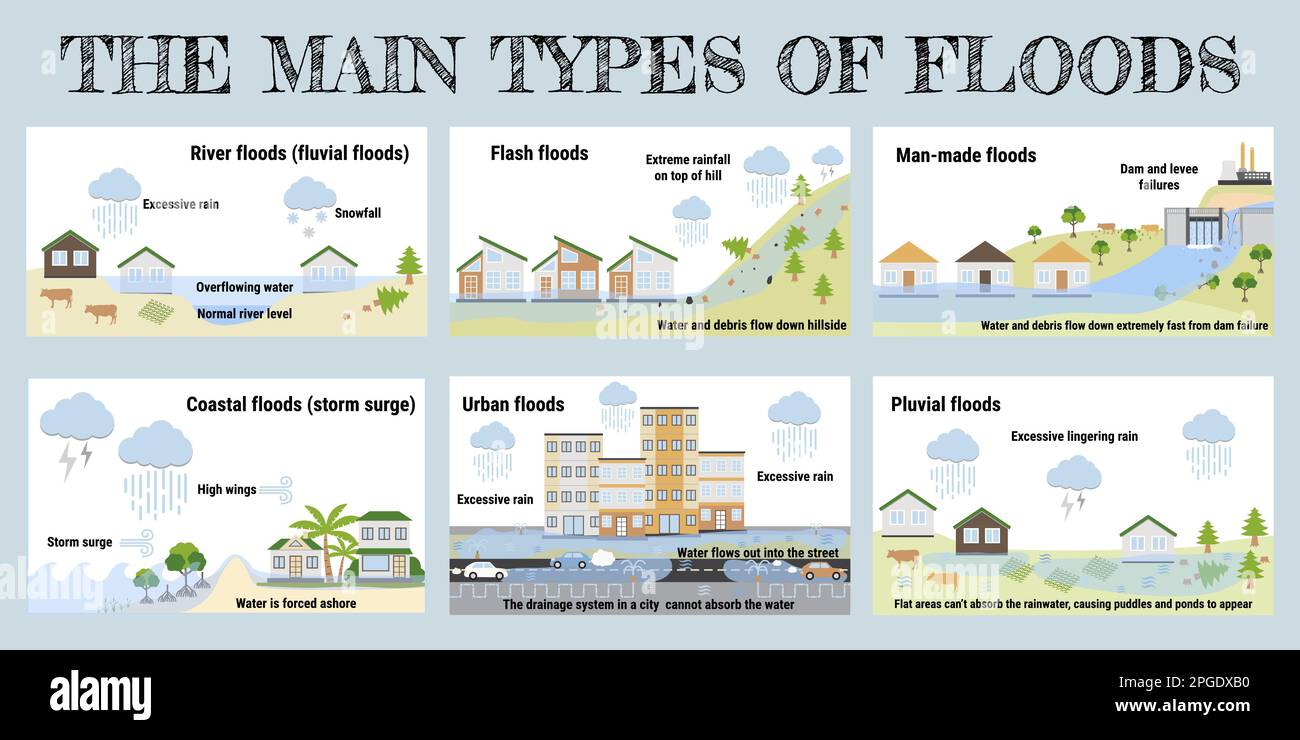

Flash Flood Warning What You Need To Know About Potential Flood Alerts

May 25, 2025

Flash Flood Warning What You Need To Know About Potential Flood Alerts

May 25, 2025 -

Understanding Flash Floods How To Prepare For And Respond To Flood Warnings

May 25, 2025

Understanding Flash Floods How To Prepare For And Respond To Flood Warnings

May 25, 2025 -

Exploring New Avenues For Canada Mexico Trade Amidst Us Tariff Disputes

May 25, 2025

Exploring New Avenues For Canada Mexico Trade Amidst Us Tariff Disputes

May 25, 2025 -

Tariffs Largely Ignored At G7 Finance Ministers Meeting

May 25, 2025

Tariffs Largely Ignored At G7 Finance Ministers Meeting

May 25, 2025