Uber's Financial Performance And Investment Potential

Table of Contents

Analyzing Uber's Revenue Streams and Growth Trajectory

H3: Revenue Breakdown: Uber's revenue is diversified across multiple segments, contributing to its overall financial health. While ride-sharing remains a significant contributor, Uber Eats and freight transportation are rapidly expanding. A recent analysis reveals the approximate revenue breakdown (figures may vary slightly depending on the reporting period):

- Ride-sharing: 40-50% (depending on geographic region and overall market conditions)

- Uber Eats: 30-40% (experiencing strong year-over-year growth)

- Freight: 10-15% (a relatively newer segment showing significant potential)

- Other (Micromobility, etc.): 5-10%

Year-over-year revenue growth rates vary depending on the segment and global economic conditions. Factors influencing this growth include aggressive market expansion into new cities and countries, increasing user base driven by marketing campaigns and app improvements, and strategic pricing adjustments.

H3: Geographic Diversification and Market Share: Uber boasts a significant global presence, operating in numerous countries across North America, Europe, Asia, and Latin America. However, market share varies considerably based on regional competition. In the US, it competes fiercely with Lyft, while in China, Didi Chuxing holds a dominant position. Uber's continued expansion into new markets, particularly in developing economies with burgeoning middle classes, presents significant revenue growth opportunities. However, navigating diverse regulatory environments and adapting to local market nuances poses considerable challenges.

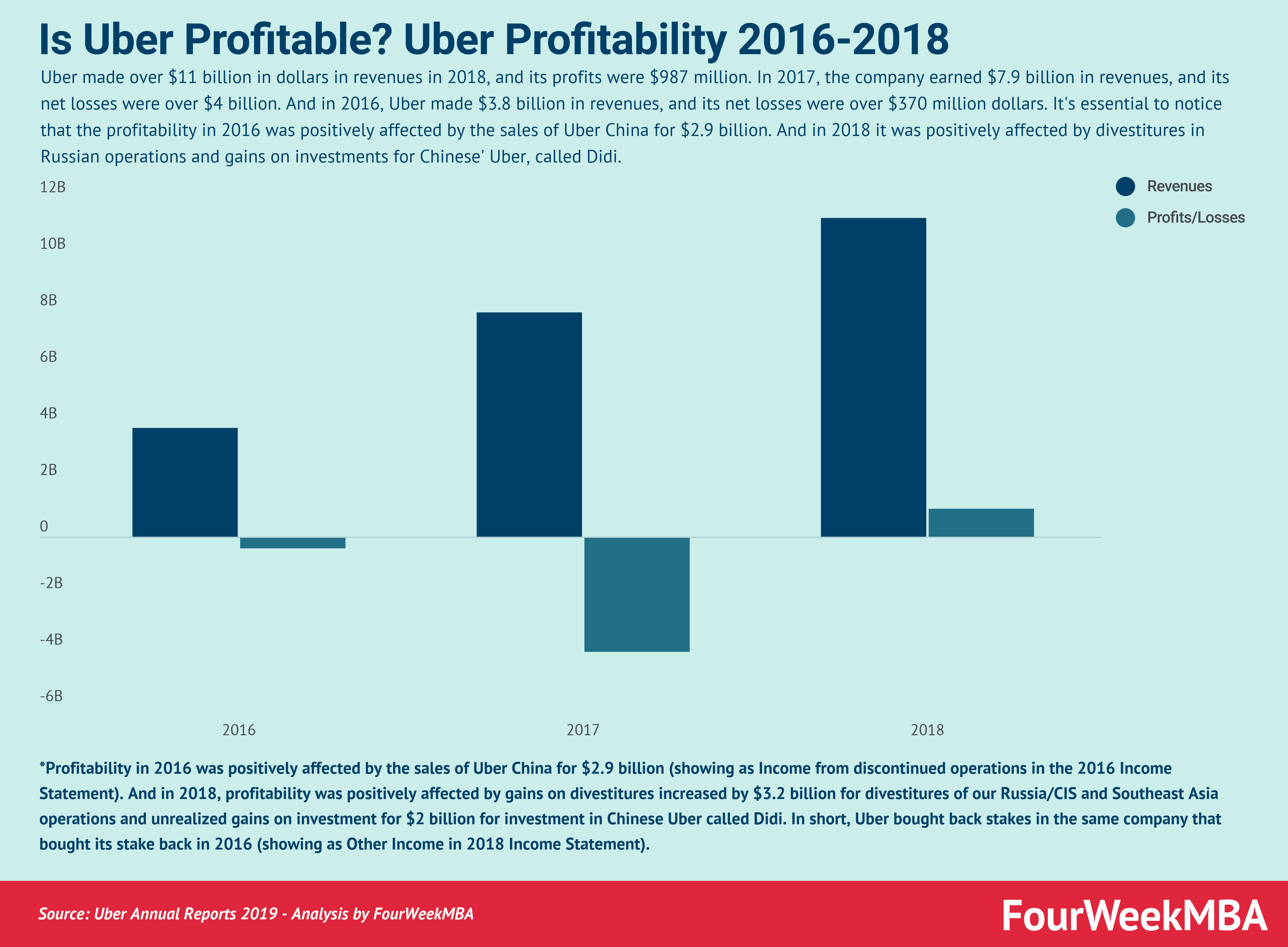

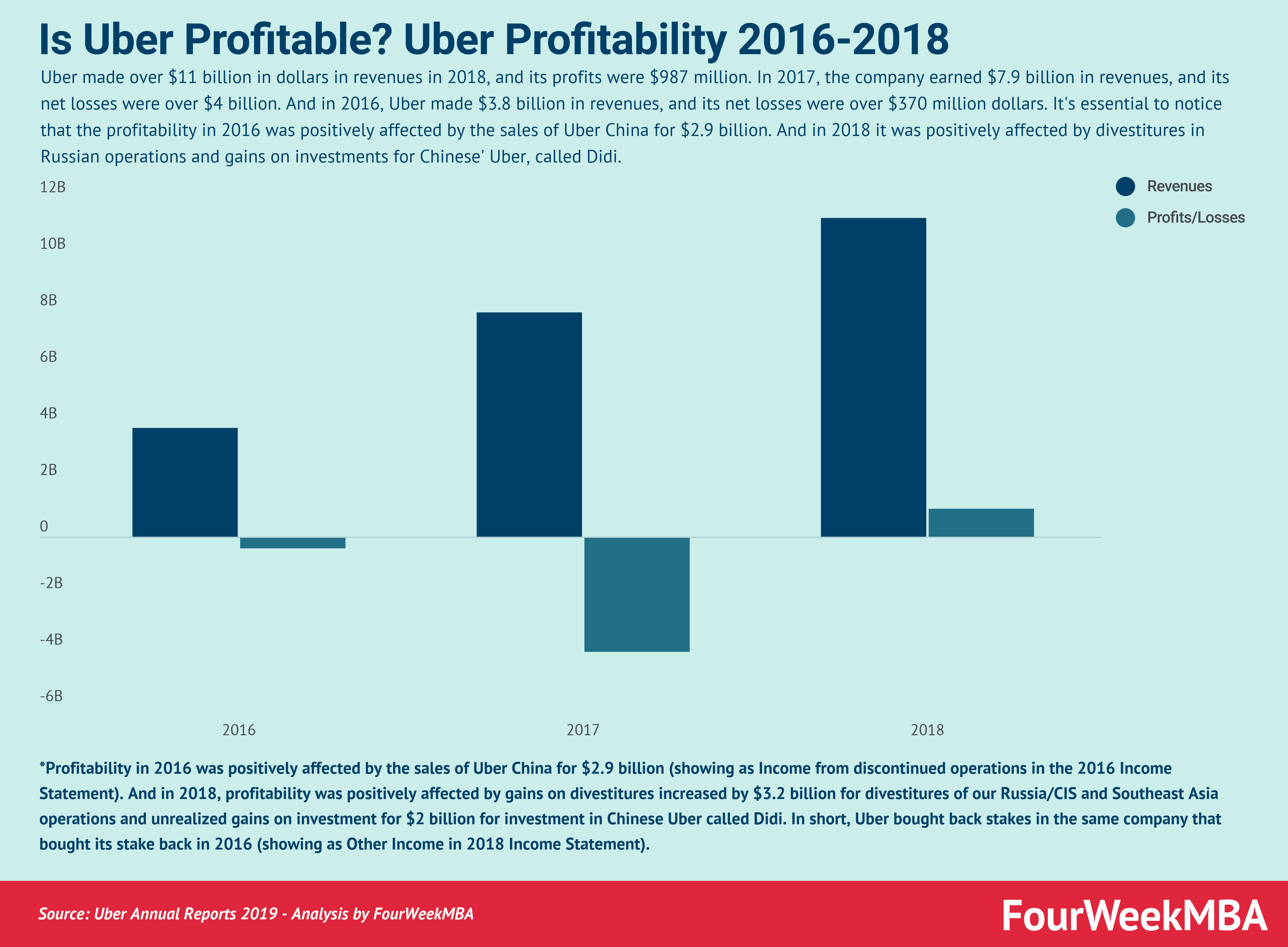

Assessing Uber's Profitability and Financial Stability

H3: Profitability Metrics: Uber's journey to profitability has been a long and complex one. While it has achieved significant revenue growth, consistently generating positive net income has remained elusive. Key profitability metrics, such as operating margin and EBITDA, show improvement but are still subject to fluctuations. Analyzing these trends over time is crucial for evaluating Uber's financial health. Factors impacting profitability include substantial operational costs (driver incentives, insurance, vehicle maintenance), heavy marketing expenses to attract and retain customers, and intense competition that often leads to price wars.

H3: Debt and Equity Structure: Uber's capital structure involves a mix of debt and equity. Understanding its debt-to-equity ratio is crucial to assess its financial risk profile. High debt levels can strain financial stability, particularly during economic downturns. However, Uber's consistent fundraising activities and overall investor sentiment suggest a degree of confidence in its long-term prospects. Monitoring its debt management strategies is paramount for potential investors.

Evaluating the Competitive Landscape and Future Growth Opportunities

H3: Competitive Analysis: The ride-sharing and food delivery markets are fiercely competitive. Key competitors include Lyft (primarily in the US), Didi Chuxing (China), and numerous regional players. Uber's competitive advantages lie in its strong brand recognition, vast network effects, technological innovation in its platform and logistics, and substantial data-driven insights. However, maintaining this competitive edge requires continuous investment in research and development, as well as adaptation to rapidly evolving technological trends.

H3: Future Growth Potential: Uber's future growth hinges on exploring opportunities in emerging technologies. Autonomous vehicles, drone delivery, and other innovations hold immense potential to transform the company's operations, improve efficiency, and create entirely new revenue streams. However, the development and implementation of these technologies involve considerable financial and technological hurdles. Regulatory uncertainties and safety concerns pose significant challenges to the successful integration of these advancements.

Investment Implications and Risk Assessment of Uber Stock

H3: Valuation and Stock Performance: Uber's stock valuation fluctuates based on various factors, including financial performance, market sentiment, and industry trends. Comparing its valuation to industry peers provides context. Analyzing past stock performance and identifying key influencers of future stock price movements is crucial for investors.

H3: Investment Risks: Investing in Uber stock involves inherent risks. Regulatory risks from changing laws concerning ride-sharing and employment classification, intense competition from established and emerging players, economic downturns impacting consumer spending, and technological disruptions are all potential challenges. Investors should carefully weigh the potential risks and rewards before making any investment decisions.

Conclusion: The Verdict on Uber's Financial Performance and Investment Potential

Uber's financial performance is a complex picture. While significant revenue growth is evident, profitability remains a key challenge. Its diversified business model and global reach offer potential for long-term growth, particularly with advancements in autonomous vehicles and other technologies. However, intense competition, regulatory risks, and economic uncertainties present substantial challenges. Understanding Uber's financial performance and investment potential requires diligent research. Use this analysis as a starting point to inform your investment strategy and further explore the complexities of this influential company. Remember to conduct thorough due diligence before making any investment decisions related to Uber or any other publicly traded company.

Featured Posts

-

Snl Audiences Uncensored Moment A G105 Controversy

May 18, 2025

Snl Audiences Uncensored Moment A G105 Controversy

May 18, 2025 -

Kanye West And Bianca Censori A Recent Sighting In Spain Fuels Reunion Speculation

May 18, 2025

Kanye West And Bianca Censori A Recent Sighting In Spain Fuels Reunion Speculation

May 18, 2025 -

Analysis Of Recent Labor Actions Affecting Las Vegas Casinos

May 18, 2025

Analysis Of Recent Labor Actions Affecting Las Vegas Casinos

May 18, 2025 -

Maneskin On Jimmy Kimmel Live Damiano Davids Show Stopping Performance

May 18, 2025

Maneskin On Jimmy Kimmel Live Damiano Davids Show Stopping Performance

May 18, 2025 -

6 4 Win For Dodgers Confortos Historic First Home Run

May 18, 2025

6 4 Win For Dodgers Confortos Historic First Home Run

May 18, 2025

Latest Posts

-

Fine Wines At Il Palagio Four Seasons Firenzes Weekly Wine List Feature

May 19, 2025

Fine Wines At Il Palagio Four Seasons Firenzes Weekly Wine List Feature

May 19, 2025 -

The Current Wine List At Il Palagio Restaurant Four Seasons Firenze

May 19, 2025

The Current Wine List At Il Palagio Restaurant Four Seasons Firenze

May 19, 2025 -

Minervois Wine Affordable Luxury From The South Of France

May 19, 2025

Minervois Wine Affordable Luxury From The South Of France

May 19, 2025 -

Fabrication Du Salami Au Chocolat Une Recette Francaise Simple

May 19, 2025

Fabrication Du Salami Au Chocolat Une Recette Francaise Simple

May 19, 2025 -

Salami Au Chocolat Gouter La France A La Maison

May 19, 2025

Salami Au Chocolat Gouter La France A La Maison

May 19, 2025