Unclaimed Savings: Thousands Unbeknownst To Them Owe HMRC Money

Table of Contents

Understanding Unclaimed Savings with HMRC

"Unclaimed savings" in the context of HMRC refers to various forms of overpayments or forgotten funds held by the government. This isn't just about finding lost coins down the back of the sofa; it's about significant sums of money that many people are simply unaware of. These unclaimed funds can stem from a variety of sources:

- Overpaid Income Tax: Perhaps you overpaid your income tax due to a change in circumstances or an error in your tax return. This overpayment could be substantial.

- Unclaimed Child Benefit: If you've been entitled to Child Benefit but haven't claimed it, or if there have been overpayments, this money could be waiting for you.

- Forgotten Savings Accounts Held by HMRC: Dormant accounts, often forgotten or unknown, can accumulate significant amounts of unclaimed savings over time.

- Unclaimed Tax Credits: Similar to Child Benefit, if you're entitled to tax credits but haven't claimed them or there's been an overpayment, this falls under unclaimed savings.

- Other Potential Government Overpayments: Various other government programs and schemes may result in overpayments that remain unclaimed.

The sheer scale of this problem is significant. While precise figures aren't readily available, anecdotal evidence and media reports suggest that millions of pounds in HMRC refunds remain unclaimed each year. This means a substantial tax rebate could be waiting for you.

How to Check for Unclaimed Savings

Checking for unclaimed savings with HMRC is relatively straightforward. The most efficient way is through the official HMRC website:

- Navigate to the HMRC website: Find the section dedicated to checking your tax and benefit details. (Include a direct link here to the relevant HMRC page when available).

- Log in securely: You'll need your Government Gateway user ID and password. If you don't have one, you'll need to create an account.

- Access your tax records: Once logged in, you can access your tax returns, payment history, and benefit details. Scrutinize these records carefully for any discrepancies or overpayments.

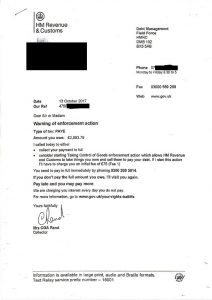

- Review your correspondence: Check any previous letters or emails from HMRC for information about overpayments or potential refunds.

If you cannot find what you are looking for online, or encounter problems, you can contact HMRC directly through their helpline or via post.

Claiming Your Unclaimed Savings: A Simple Guide

Once you've identified unclaimed savings, claiming them is typically a straightforward process:

- Gather Necessary Documentation: This usually involves proof of identity, bank details, and any relevant supporting documents pertaining to the unclaimed savings (e.g., payslips, benefit award letters).

- Complete the Claim Form: HMRC provides online claim forms for various types of overpayments. (Include a link to the relevant HMRC page, if possible).

- Submit Your Claim: Submit your completed form and supporting documentation via post or online, following the instructions provided.

To speed up the claims process, ensure all your information is accurate and complete. Clear, concise documentation will prevent delays. Be prepared for potential delays, as processing times can vary.

Avoiding Unclaimed Savings in the Future

Preventing unclaimed savings requires proactive measures:

- Keep Accurate Records: Maintain thorough records of all tax payments, benefit claims, and financial transactions.

- Regularly Review Your HMRC Account: Log in regularly to check your tax and benefit details for any anomalies or potential overpayments.

- Update HMRC with Changes: Notify HMRC immediately of any changes in your circumstances that could affect your tax liability or benefit entitlement.

By taking these preventative steps, you can significantly reduce the risk of leaving money unclaimed. Effective HMRC tax planning minimizes the chances of overpayment.

Reclaim Your Unclaimed Savings Today!

This article highlighted various types of unclaimed savings you might be owed by HMRC, including overpaid income tax, unclaimed child benefit, and forgotten dormant accounts. We've provided step-by-step instructions on how to check your entitlement and claim your rightful money. Prevent future unclaimed savings through meticulous record-keeping and prompt updates to HMRC. Don't let thousands of pounds sit unclaimed! Check your entitlement now! [Insert Direct Link to Relevant HMRC Page Here] Claim your HMRC refund today and find your unclaimed money!

Featured Posts

-

Thousands Receive Hmrc Letters New Tax Thresholds Explained

May 20, 2025

Thousands Receive Hmrc Letters New Tax Thresholds Explained

May 20, 2025 -

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Appelle A La Collaboration Des Maires

May 20, 2025

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Appelle A La Collaboration Des Maires

May 20, 2025 -

Analysis Of Agatha Christies Towards Zero Episode 1 Wheres The Murder

May 20, 2025

Analysis Of Agatha Christies Towards Zero Episode 1 Wheres The Murder

May 20, 2025 -

The Deployment Of The Typhon Missile System In The Philippines A Critical Assessment

May 20, 2025

The Deployment Of The Typhon Missile System In The Philippines A Critical Assessment

May 20, 2025 -

Update Zachary Cunhas New Position In Private Law

May 20, 2025

Update Zachary Cunhas New Position In Private Law

May 20, 2025

Latest Posts

-

Atkinsrealis Droit Expertise Juridique Et Conseils D Affaires

May 20, 2025

Atkinsrealis Droit Expertise Juridique Et Conseils D Affaires

May 20, 2025 -

The Decamerons Lou Gala A Deep Dive Into Her Character And Performance

May 20, 2025

The Decamerons Lou Gala A Deep Dive Into Her Character And Performance

May 20, 2025 -

Nigeria Navigating Pragmatism And The Kite Runner Dilemma

May 20, 2025

Nigeria Navigating Pragmatism And The Kite Runner Dilemma

May 20, 2025 -

Understanding Lou Galas Rise To Fame In The Decameron

May 20, 2025

Understanding Lou Galas Rise To Fame In The Decameron

May 20, 2025 -

New Online Archive Showcases Burnham And Highbridges Past

May 20, 2025

New Online Archive Showcases Burnham And Highbridges Past

May 20, 2025