Understanding Stock Market Valuations: BofA's Guidance For Investors

Table of Contents

Key Valuation Metrics Explained

Accurately assessing stock market valuations relies heavily on understanding and applying key valuation metrics. Let's examine some of the most commonly used, and how BofA might utilize them.

Price-to-Earnings Ratio (P/E Ratio)

- Definition: The P/E ratio is a valuation ratio that compares a company's stock price to its earnings per share (EPS). It shows how much investors are willing to pay for each dollar of a company's earnings.

- Calculation Formula: P/E Ratio = Market Value per Share / Earnings per Share

- Interpretation of High vs. Low P/E Ratios: A high P/E ratio suggests that investors are willing to pay a premium for the company's earnings, potentially indicating high growth expectations or strong investor confidence. Conversely, a low P/E ratio might suggest undervaluation or concerns about the company's future prospects. However, it's crucial to compare P/E ratios within the same industry sector.

- Sector Comparisons: A P/E ratio of 20 might be considered high for a utility company but average for a technology company. BofA analysts likely use sector benchmarks to evaluate relative valuation.

Details: The P/E ratio has limitations. It can be skewed by accounting practices and doesn't account for a company's debt load. BofA's analysis likely considers growth prospects and industry benchmarks to compensate for these limitations. Analyzing the forward P/E ratio (based on projected earnings) is often more insightful than trailing P/E (based on past earnings).

Price-to-Book Ratio (P/B Ratio)

- Definition: The P/B ratio compares a company's market capitalization to its book value of equity. Book value represents the net asset value of a company's assets minus liabilities.

- Calculation Formula: P/B Ratio = Market Capitalization / Book Value of Equity

- Interpreting High vs. Low P/B Ratios: A high P/B ratio suggests that the market values the company's assets at a premium to their book value, often indicating high growth potential or intangible assets (like strong brands). A low P/B ratio might signal undervaluation or potential issues with the company's assets. This varies significantly by sector; financial companies often have lower P/B ratios than technology companies.

- Application in Different Sectors: The interpretation of the P/B ratio differs across sectors. For financial institutions, a lower P/B ratio might be considered normal, while a high P/B ratio is more typical for technology companies with significant intangible assets.

Details: The P/B ratio also has limitations. It doesn't reflect the company's future earnings potential and can be affected by accounting methods. BofA likely uses it in conjunction with other metrics for a comprehensive valuation.

Discounted Cash Flow (DCF) Analysis

- Definition: DCF analysis is a more sophisticated valuation method that estimates a company's intrinsic value by discounting its projected future cash flows back to their present value.

- Key Assumptions: Accurate forecasting of free cash flows, choosing an appropriate discount rate (often the weighted average cost of capital or WACC), and determining the terminal value (the value of the company beyond the explicit forecast period).

- Calculation Steps: Project free cash flows, determine the discount rate, discount the projected cash flows to their present value, and calculate the terminal value. Summing these gives the present value of the company.

- Advantages and Disadvantages: DCF offers a more comprehensive valuation approach than simpler ratios but relies heavily on potentially inaccurate forecasts. The discount rate significantly impacts the valuation.

Details: BofA likely employs sophisticated DCF models incorporating sensitivity analysis to account for uncertainty in the key assumptions. Accurate forecasting is crucial for a reliable DCF valuation; this is where BofA's in-depth industry expertise comes into play.

BofA's Approach to Stock Market Valuations

BofA, being a major financial institution, employs a multifaceted approach to stock market valuations.

Identifying Undervalued Stocks

- Screening Techniques: BofA likely uses quantitative screening techniques to identify potentially undervalued companies based on their valuation metrics. This involves filtering through vast datasets based on pre-defined criteria (e.g., low P/E ratio relative to industry peers).

- Fundamental Analysis: Their analysts conduct thorough fundamental analysis to assess a company's financial health, competitive landscape, and growth potential. This involves reviewing financial statements, industry reports, and management discussions.

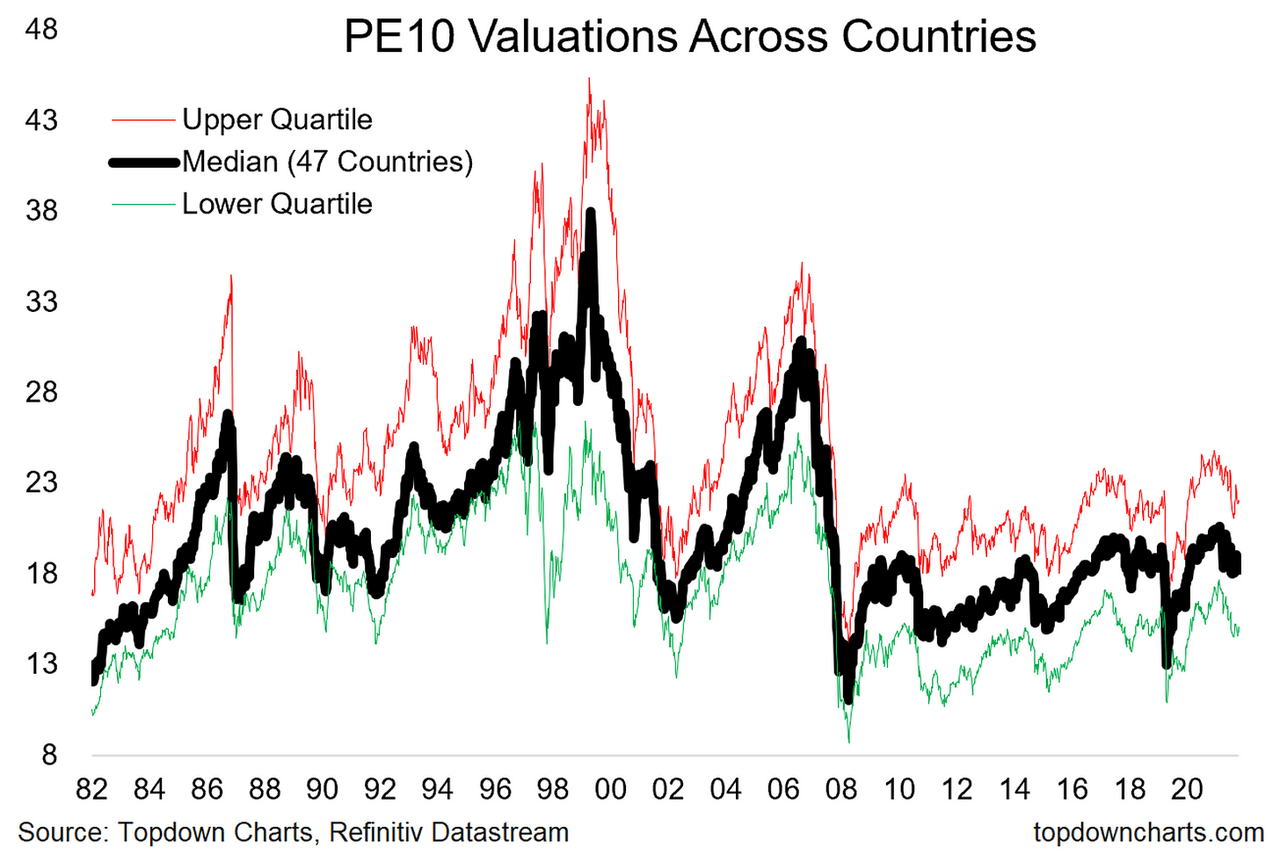

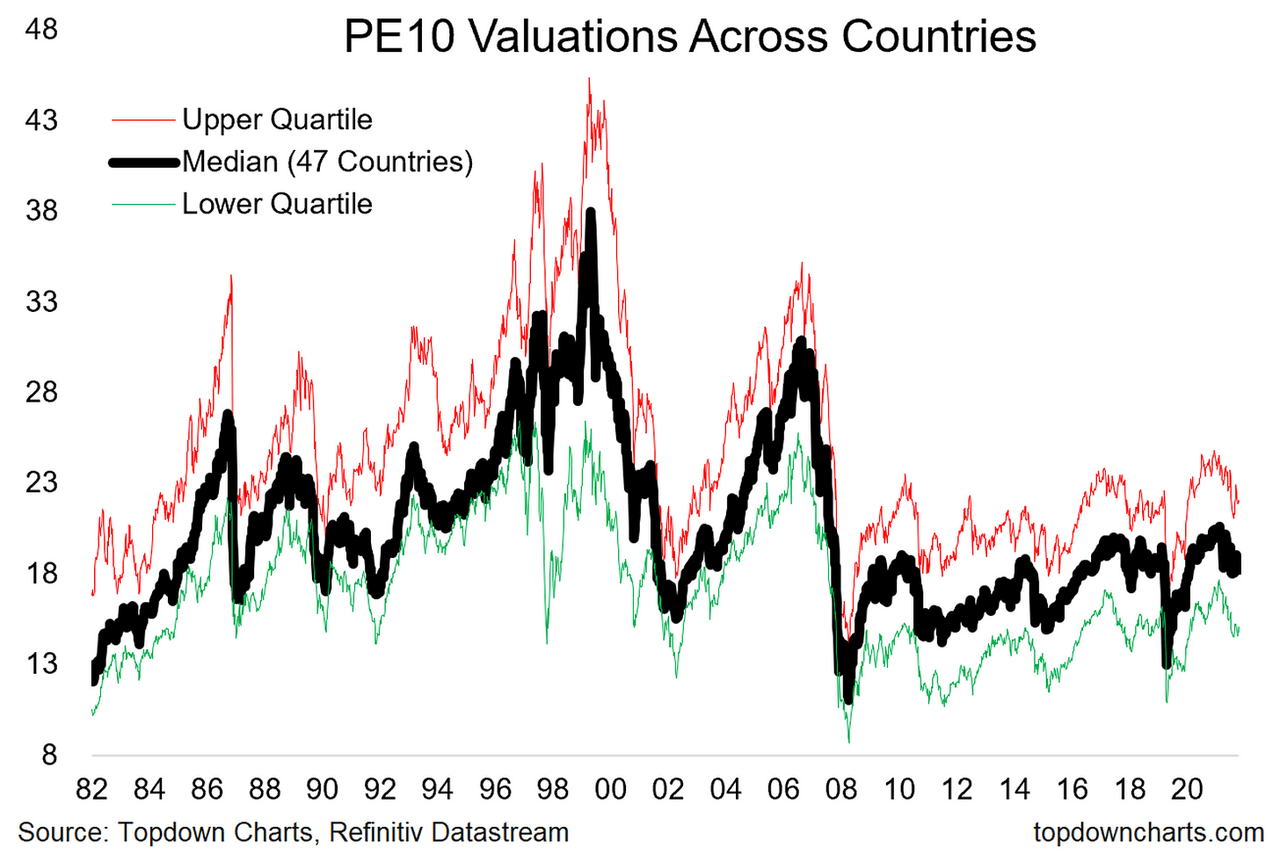

- Comparing Valuation Metrics to Historical Data and Industry Averages: They compare valuation metrics against a company’s historical performance and industry averages to determine if a stock is trading at a discount.

Details: BofA's recommendations often incorporate detailed rationale, explaining why a specific company is deemed undervalued based on their valuation model and market outlook.

Managing Risk in Valuation

Valuation analysis involves inherent risks and potential biases. BofA likely employs strategies to mitigate these.

- Survivorship Bias: They acknowledge that data often reflects only surviving companies, ignoring those that failed. Their analysis considers this bias.

- Data Limitations: BofA accounts for the limitations of available financial data and the potential for inaccuracies in reported figures.

- Management Bias: They recognize that management's own projections can be overly optimistic and adjust accordingly.

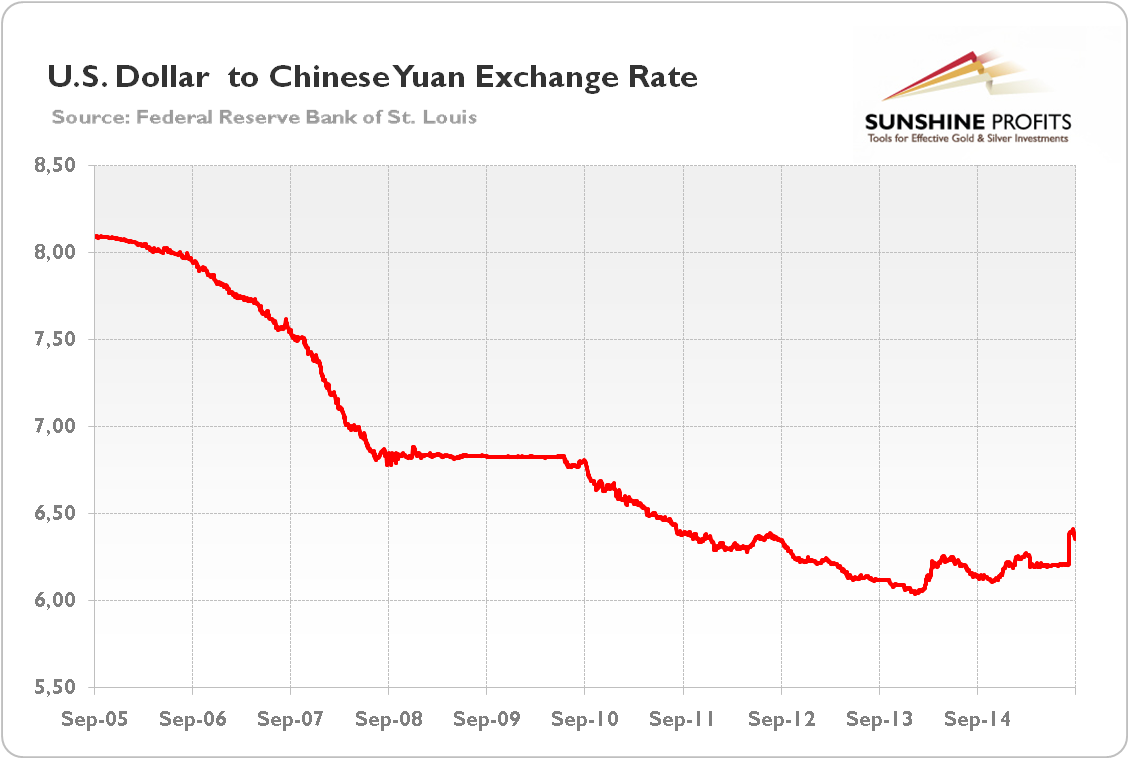

- Macroeconomic Factors: BofA integrates macroeconomic factors (interest rates, inflation, economic growth) into their valuation models, recognizing that these can heavily impact company performance and valuations.

Details: Strategies include incorporating a margin of safety (investing at a price significantly below the estimated intrinsic value), scenario planning (modeling different economic outcomes), and diversification (spreading investments across multiple assets).

Practical Application for Investors

Investors can leverage BofA's insights and develop their own valuation skills.

Building Your Valuation Model

- Data Sources: Access financial data from sources like company filings (10-K, 10-Q), financial news websites, and Bloomberg Terminal (for professional investors).

- Software Tools: Excel spreadsheets, dedicated financial modeling software, and even specialized online platforms can assist in building and managing valuation models.

- Step-by-Step Process for Calculating Key Metrics: Follow a systematic approach, calculating key metrics like P/E, P/B, and conducting DCF analysis based on reliable data.

Details: Regularly review and update your models based on new information and changing market conditions. Continuous learning is essential to improving your valuation skills.

Integrating BofA's Insights into Your Investment Strategy

- Utilizing BofA Reports and Research: BofA publishes research reports and analyses that provide insights into specific companies and sectors. Utilize this research for ideas, but remember it's just one perspective.

- Comparing their Valuation with Your Own Analysis: Don't blindly follow any analyst's recommendation. Conduct your own independent research and compare your findings to BofA's.

- Diversifying Investment Strategies: Diversification reduces risk. Don't concentrate your investments based solely on one source of valuation analysis.

Details: Critical thinking is crucial. Understanding the limitations of any single source of analysis, including BofA’s, is key to making sound investment decisions.

Conclusion

Understanding stock market valuations is paramount for successful investing. By mastering key metrics like the P/E and P/B ratios and employing techniques like DCF analysis, investors can make more informed decisions. BofA's approach offers valuable insights, but remember to conduct thorough independent research and incorporate a margin of safety. Don't hesitate to leverage various resources and develop your own robust valuation models to effectively navigate the complexities of stock market valuations. Start improving your understanding of stock market valuations today and make smarter investment choices!

Featured Posts

-

Vont Weekend Photos April 4th 6th 2025 96 1 Kissfm

May 16, 2025

Vont Weekend Photos April 4th 6th 2025 96 1 Kissfm

May 16, 2025 -

Tarifstreit Bvg Endgueltige Einigung Erzielt Keine Streiks Mehr

May 16, 2025

Tarifstreit Bvg Endgueltige Einigung Erzielt Keine Streiks Mehr

May 16, 2025 -

Pbocs Yuan Support A Below Estimate Performance

May 16, 2025

Pbocs Yuan Support A Below Estimate Performance

May 16, 2025 -

12 Golov V Pley Off Ovechkin Obnovlyaet Rekord N Kh L

May 16, 2025

12 Golov V Pley Off Ovechkin Obnovlyaet Rekord N Kh L

May 16, 2025 -

Androids Updated Design Whats Changed

May 16, 2025

Androids Updated Design Whats Changed

May 16, 2025

Latest Posts

-

Alex Ovechkins 894th Goal A Historic Tie With Wayne Gretzky

May 16, 2025

Alex Ovechkins 894th Goal A Historic Tie With Wayne Gretzky

May 16, 2025 -

Nhl News Ovechkin Ties Gretzkys All Time Goal Record

May 16, 2025

Nhl News Ovechkin Ties Gretzkys All Time Goal Record

May 16, 2025 -

Ovechkins 893rd Goal The Pursuit Of Gretzkys Record

May 16, 2025

Ovechkins 893rd Goal The Pursuit Of Gretzkys Record

May 16, 2025 -

Ovechkin Scores 894 Goals Matching Gretzkys Nhl Record

May 16, 2025

Ovechkin Scores 894 Goals Matching Gretzkys Nhl Record

May 16, 2025 -

Ovechkin On The Verge Of Nhl History One Goal From Gretzky

May 16, 2025

Ovechkin On The Verge Of Nhl History One Goal From Gretzky

May 16, 2025