Understanding Stock Market Valuations: Why BofA Remains Optimistic

Table of Contents

BofA's Key Valuation Metrics and Their Rationale

BofA's optimistic outlook stems from a comprehensive analysis of various valuation metrics. Their assessment isn't based on a single indicator but rather a holistic view incorporating several key factors.

Price-to-Earnings Ratio (P/E): A Key Indicator

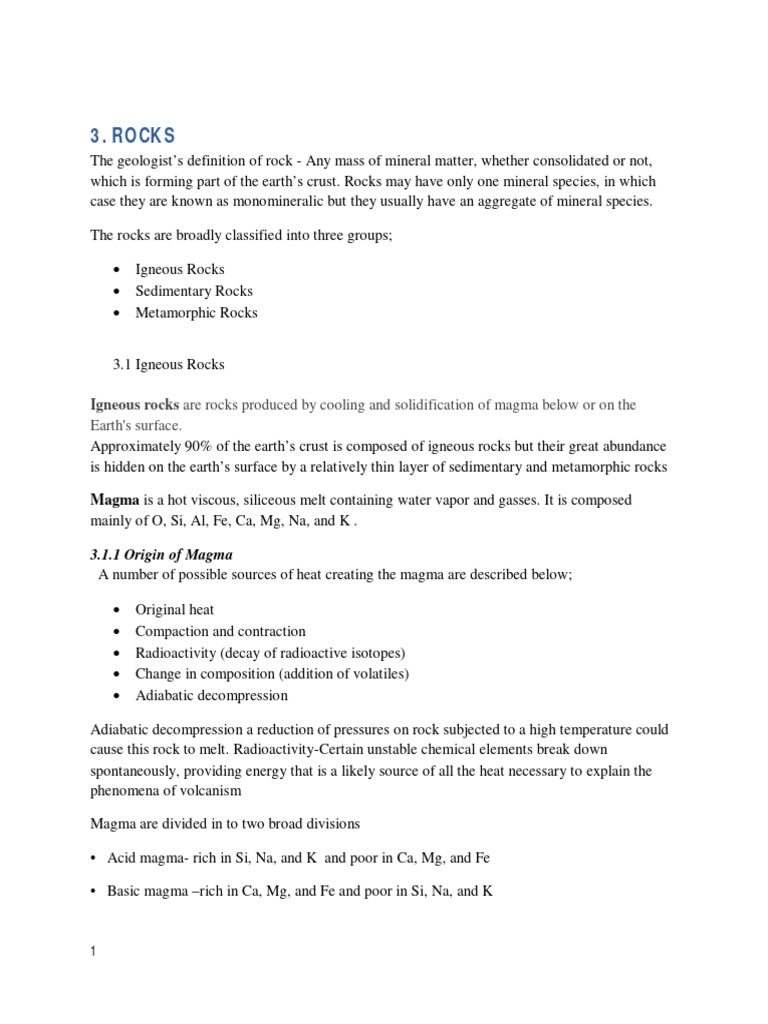

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric that compares a company's stock price to its earnings per share (EPS). A lower P/E ratio generally suggests a stock is undervalued relative to its earnings. BofA's analysis focuses on comparing current P/E ratios across various sectors to their historical averages and industry benchmarks.

- Current market P/E vs. historical averages: BofA notes that while the overall market P/E might be above its long-term average, certain sectors show significantly lower P/E ratios, indicating potential undervaluation.

- Sectors with low P/E ratios: BofA identifies specific sectors, potentially including energy, certain segments of technology, or financials, where they see attractive P/E ratios suggesting potential for growth. Their stock market analysis highlights these opportunities.

- Potential for growth in undervalued sectors: BofA's investment strategy considers the growth potential within these undervalued sectors, factoring in projected earnings growth and industry trends. Their optimistic outlook stems partly from this anticipated growth.

Analyzing the Shiller P/E (Cyclically Adjusted P/E)

The Shiller P/E, also known as the CAPE ratio, is a more sophisticated valuation metric that adjusts the P/E ratio for inflation and uses a 10-year average of earnings. This provides a longer-term perspective on market valuation, smoothing out short-term fluctuations.

- Long-term perspective on market valuation: BofA utilizes the Shiller P/E to gain a more nuanced understanding of market valuation, considering historical trends and cyclical variations.

- Significance of inflation adjustments: The inflation adjustment in the Shiller P/E offers a more accurate picture of true earnings power, mitigating the impact of inflation on valuation analysis.

- Comparison with previous market cycles: By comparing the current Shiller P/E to previous market cycles, BofA gains valuable insights into potential market overvaluation or undervaluation, informing their stock market predictions.

Other Relevant Valuation Metrics Considered by BofA

BofA's comprehensive stock market analysis doesn't rely solely on P/E ratios. They also consider other valuation metrics, including:

- Price-to-Sales (P/S): This compares a company's market capitalization to its revenue.

- Price-to-Book (P/B): This compares a company's market capitalization to its net asset value.

- Dividend Yields: This represents the annual dividend payment relative to the stock price.

BofA integrates these metrics into their overall assessment, creating a more robust and nuanced view of market valuation. Their stock market analysis utilizes this combined approach to identify undervalued opportunities.

Macroeconomic Factors Supporting BofA's Optimism

BofA's optimistic outlook isn't solely based on valuation metrics; it's also underpinned by their macroeconomic forecasts.

Interest Rate Projections and Their Impact

BofA's interest rate projections play a key role in their valuation outlook.

- Expected interest rate trajectory: BofA's analysis considers the expected trajectory of interest rates, factoring in potential central bank actions and economic conditions.

- Impact on corporate earnings: Interest rate changes impact corporate borrowing costs and profitability, which directly affects stock valuations.

- Influence on investor sentiment: Interest rate changes significantly influence investor sentiment and market risk appetite.

Economic Growth Forecasts and Corporate Earnings

BofA's economic growth forecasts are crucial for projecting corporate earnings.

- GDP growth forecasts: Their analysis incorporates GDP growth forecasts, influencing projected corporate revenue and profitability.

- Projected corporate profit margins: BofA's analysis estimates profit margins based on their economic forecasts, influencing their overall stock market valuation assessment.

- Sector-specific growth predictions: BofA also provides sector-specific growth predictions, allowing for more targeted investment strategies based on their market analysis.

Inflation Expectations and Their Influence

Inflation significantly impacts stock valuations.

- Inflation rate projections: BofA's analysis incorporates inflation rate projections to assess their impact on corporate costs and consumer spending.

- Impact on consumer spending: Inflation affects consumer purchasing power, impacting demand for goods and services and therefore corporate earnings.

- Effect on company pricing strategies: Companies adjust pricing strategies based on inflation, which in turn affects profit margins and stock valuations.

Potential Risks and Considerations

Despite their optimism, BofA acknowledges potential risks.

Geopolitical Uncertainties and Their Influence

Geopolitical events can significantly influence market stability.

- Specific geopolitical risks: BofA's stock market analysis incorporates geopolitical risks, such as trade wars or political instability, and their potential impact on global markets.

- Potential market reactions: Their analysis includes estimates of potential market reactions to geopolitical events, influencing their valuation models.

- BofA's contingency plans in their analysis: BofA's analysis considers contingency plans, mitigating the potential negative impact of geopolitical uncertainty.

Unexpected Economic Slowdowns and Recessionary Fears

The possibility of an economic downturn remains a key consideration.

- Probability of a recession: BofA assesses the probability of a recession and its potential impact on market valuations.

- Potential market reactions: Their analysis includes potential market reactions during an economic slowdown or recession.

- BofA's strategies for mitigating risk: BofA incorporates strategies for mitigating risks associated with potential economic downturns in their investment strategy.

Conclusion

BofA's optimistic outlook on stock market valuations is based on a careful analysis of key metrics like the P/E ratio and Shiller P/E, combined with their macroeconomic forecasts and a considered assessment of potential risks. While uncertainties remain, their analysis suggests potential opportunities for investors. Understanding stock market valuations is crucial, and by carefully considering BofA's perspective and conducting your own thorough research, you can make informed investment decisions. Learn more about effectively utilizing stock market valuations and developing a sound investment strategy today!

Featured Posts

-

2 4 Billion Catalyst Business Deal Honeywell Takes Over From Johnson Matthey

May 23, 2025

2 4 Billion Catalyst Business Deal Honeywell Takes Over From Johnson Matthey

May 23, 2025 -

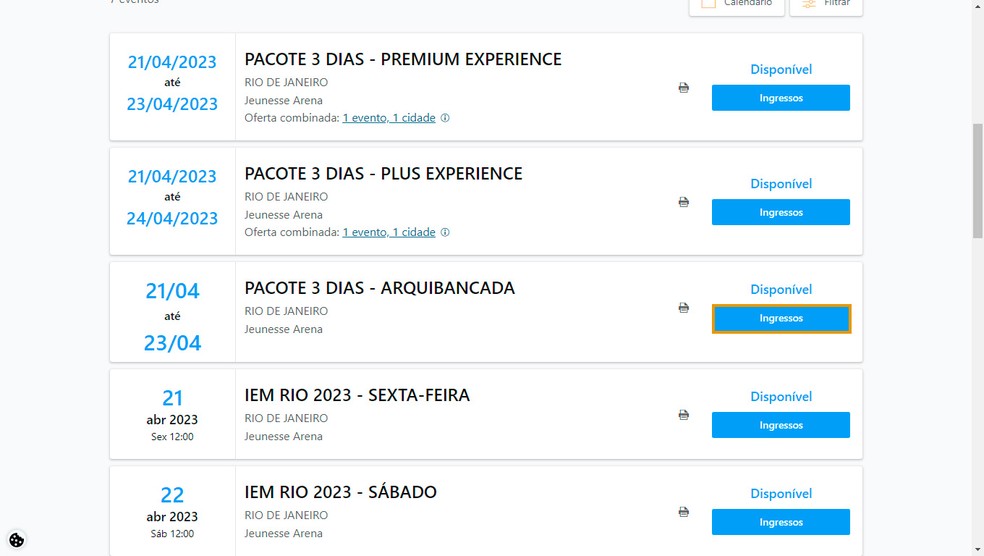

Atlantida Celebration Santa Catarina Line Up Completo E Como Comprar Ingressos

May 23, 2025

Atlantida Celebration Santa Catarina Line Up Completo E Como Comprar Ingressos

May 23, 2025 -

Grand Ole Oprys Historic London Concert Royal Albert Hall Debut

May 23, 2025

Grand Ole Oprys Historic London Concert Royal Albert Hall Debut

May 23, 2025 -

Englands Test Squad Dealt Fresh Injury Blow Ahead Of Zimbabwe Match

May 23, 2025

Englands Test Squad Dealt Fresh Injury Blow Ahead Of Zimbabwe Match

May 23, 2025 -

Decoding The Big Rig Rock Report 3 12 97 1 Double Q

May 23, 2025

Decoding The Big Rig Rock Report 3 12 97 1 Double Q

May 23, 2025

Latest Posts

-

2025 Commencement Kermit The Frog To Address University Of Maryland Graduates

May 23, 2025

2025 Commencement Kermit The Frog To Address University Of Maryland Graduates

May 23, 2025 -

Maryland University Selects Kermit The Frog For 2025 Graduation Ceremony

May 23, 2025

Maryland University Selects Kermit The Frog For 2025 Graduation Ceremony

May 23, 2025 -

University Of Maryland Announces Kermit The Frog As Commencement Speaker

May 23, 2025

University Of Maryland Announces Kermit The Frog As Commencement Speaker

May 23, 2025 -

Kermit The Frog Commencement Speaker At University Of Maryland In 2025

May 23, 2025

Kermit The Frog Commencement Speaker At University Of Maryland In 2025

May 23, 2025 -

Kermit The Frog To Address University Of Maryland Graduates

May 23, 2025

Kermit The Frog To Address University Of Maryland Graduates

May 23, 2025