Understanding The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Table of Contents

What is the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV?

The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is a powerful investment tool offering exposure to a broad range of global equities. Let's break down the key components of its name:

-

UCITS ETF: This stands for Undertakings for Collective Investment in Transferable Securities. A UCITS ETF is a type of investment fund regulated under EU law, offering a high level of investor protection and allowing for easy cross-border investment across various European Economic Area countries. This regulatory framework ensures transparency and standardized reporting.

-

MSCI World Index: This ETF tracks the MSCI World Index, a widely recognized benchmark representing large and mid-cap equities across developed markets globally. Investing in this ETF gives you diversified exposure to a vast number of companies across numerous sectors and countries, mirroring the performance of this key global index.

-

USD Hedged: This crucial feature means the ETF employs a currency hedging strategy to minimize the impact of fluctuations between the Euro (the base currency of the fund) and the US dollar. This hedging helps to protect investors from losses due to unfavorable currency movements. For investors with USD as their base currency, this significantly reduces the volatility associated with currency exchange rates.

-

Dist NAV: "Dist" signifies that the ETF distributes its dividends regularly. "NAV" refers to the Net Asset Value, the value of the ETF's underlying assets per share. The "Dist NAV" structure means that when dividends are paid out, the NAV of the ETF will decrease accordingly.

Here's a summary of its key features:

- Tracks the MSCI World Index, providing broad global market exposure.

- Currency hedging minimizes risk associated with fluctuations in the USD exchange rate.

- Distributes dividends regularly, offering income potential.

- UCITS compliant, allowing for investment across various European jurisdictions.

- Offers diversification across a wide range of global sectors and countries.

Understanding the Benefits of Currency Hedging

Currency hedging is a vital aspect of the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV. It plays a crucial role in mitigating investment risk.

-

Reduced Volatility: Currency fluctuations can significantly impact investment returns. Hedging minimizes this volatility, leading to more predictable returns in the investor's base currency (USD).

-

Predictable Returns: By reducing the uncertainty caused by currency movements, currency hedging helps investors better anticipate their returns. This is especially beneficial for long-term investors.

-

Protection Against Losses: Unhedged currency exposure can lead to significant losses if the exchange rate moves unfavorably. Hedging acts as a safety net, protecting your investment from such adverse movements.

-

Improved Risk-Adjusted Return: By mitigating currency risk, hedging often improves the overall risk-adjusted return, meaning you achieve a better return for the level of risk you take.

The absence of currency hedging exposes investors to the risk of significant losses in their base currency if the value of the Euro appreciates against the USD. The hedging strategy employed by this ETF actively manages this risk.

Dividend Distribution and NAV Implications

The "Dist NAV" designation indicates that the Amundi MSCI World II UCITS ETF USD Hedged distributes dividends regularly to its shareholders.

-

Regular Income Stream: Dividend payouts provide a regular income stream, which can be reinvested or used for other purposes.

-

Dividend Reinvestment: Many investors opt to reinvest their dividends, leading to compound growth over time.

-

NAV Adjustment: After a dividend distribution, the NAV of the ETF decreases by the amount of the dividend per share. This is a normal occurrence and doesn't reflect a loss in underlying asset value.

-

Tax Implications: It is crucial to understand the tax implications of dividend distributions. These vary significantly depending on your location and individual tax circumstances. Consult with a tax advisor for personalized guidance.

Amundi MSCI World II UCITS ETF USD Hedged Dist NAV vs. Alternatives

Several other globally diversified ETFs compete with the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV. A direct comparison depends on specific performance data at the time of review. However, key factors for comparison include:

-

Expense Ratio (TER): This represents the annual cost of managing the fund. A lower expense ratio generally results in higher returns for investors.

-

Tracking Error: This measures how closely the ETF tracks its benchmark index (MSCI World Index). A lower tracking error signifies a more accurate representation of the index's performance.

-

Dividend Policy: The frequency and amount of dividend payouts differ across ETFs.

Comparison Table (Illustrative - Data needs to be updated regularly):

| ETF | Expense Ratio | Tracking Error | Dividend Policy |

|---|---|---|---|

| Amundi MSCI World II UCITS ETF USD Hedged Dist NAV | 0.20% (example) | 0.10% (example) | Annual/Semi-Annual (example) |

| iShares Core MSCI World UCITS ETF (example) | 0.22% (example) | 0.12% (example) | Annual (example) |

| Vanguard FTSE All-World UCITS ETF (example) | 0.25% (example) | 0.15% (example) | Semi-Annual (example) |

(Note: The figures in this table are for illustrative purposes only and should be verified with up-to-date data from respective providers.)

This ETF is particularly suitable for investors seeking broad global diversification with reduced currency risk and a regular dividend income stream. However, investors with different risk profiles and investment goals might find alternative ETFs more suitable.

Conclusion

The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV offers a diversified approach to global equity investing, providing both growth potential and income through dividend distribution. Understanding the nuances of its currency hedging and dividend policy is crucial for making informed investment decisions. This ETF presents a compelling option for investors seeking broad global exposure with reduced currency risk. Before investing, it’s recommended to conduct thorough research and consider your personal financial goals and risk tolerance. Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV and explore if it's the right fit for your investment portfolio.

Featured Posts

-

Amundi Msci World Catholic Principles Ucits Etf Acc How To Monitor Its Net Asset Value

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc How To Monitor Its Net Asset Value

May 24, 2025 -

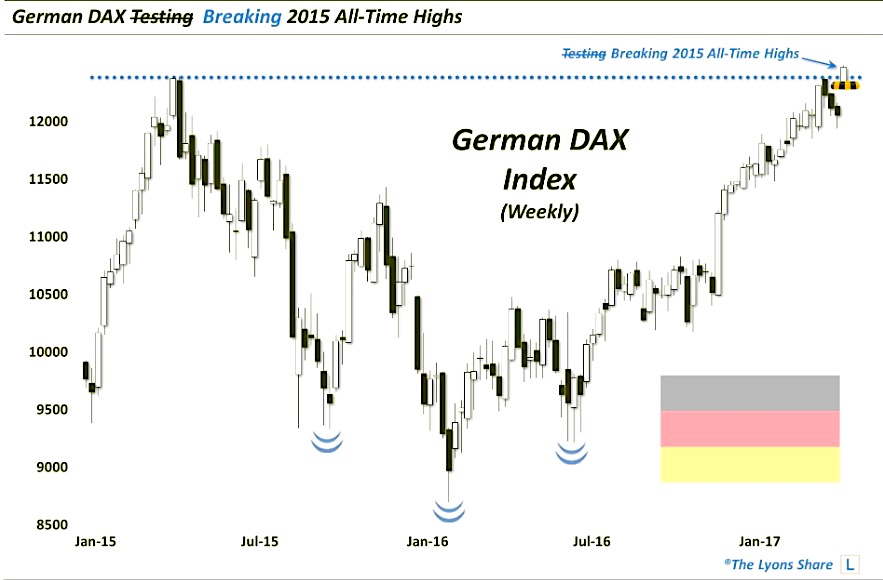

Will A Resurgent Wall Street Undermine The German Daxs Rise

May 24, 2025

Will A Resurgent Wall Street Undermine The German Daxs Rise

May 24, 2025 -

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Masuk Msci

May 24, 2025

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Masuk Msci

May 24, 2025 -

Your Escape To The Country Choosing The Right Location And Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Location And Lifestyle

May 24, 2025 -

Annie Kilner Shows Off Huge Diamond Ring After Walker Spotting

May 24, 2025

Annie Kilner Shows Off Huge Diamond Ring After Walker Spotting

May 24, 2025

Latest Posts

-

Revealed Kyle Walkers Milan Party With Models Following Wifes Return To Uk

May 24, 2025

Revealed Kyle Walkers Milan Party With Models Following Wifes Return To Uk

May 24, 2025 -

Kyle Walker Partied In Milan With Serbian Models Following Wifes Uk Trip

May 24, 2025

Kyle Walker Partied In Milan With Serbian Models Following Wifes Uk Trip

May 24, 2025 -

Kyle Walker Milan Night Out With Models After Wifes Return

May 24, 2025

Kyle Walker Milan Night Out With Models After Wifes Return

May 24, 2025 -

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025 -

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025