Understanding The Credit Score Effects Of Delayed Student Loan Payments

Table of Contents

How Student Loan Payments Impact Your Credit Score

Student loans, like other forms of credit, are reported to credit bureaus like Experian, Equifax, and TransUnion. These bureaus use the information to calculate your credit score, a three-digit number that reflects your creditworthiness. Lenders report your payment history – whether you pay on time, late, or miss payments entirely. This information is crucial for determining your credit score.

Different credit scoring models, such as FICO and VantageScore, weigh various factors differently, but payment history is consistently a major component. Your student loan payment history significantly influences your overall creditworthiness.

- Late payments negatively impact your credit score. The longer you're late, the more your score will suffer.

- The severity of the impact depends on the length and frequency of delays. A single late payment will hurt less than multiple consecutive missed payments.

- Even one missed payment can significantly lower your score. This can have cascading effects, impacting your ability to obtain future credit at favorable rates.

- Consistent on-time payments are crucial for building positive credit history. This demonstrates responsible financial behavior to lenders.

Severity of the Impact: Delinquency and Default

Delinquency refers to late payments on your student loans. Default, on the other hand, occurs when you fail to make payments for a specific period, usually 90 days or more. The difference in the impact on your credit score is substantial.

Delinquency results in a significant credit score drop, affecting your ability to obtain new credit. Default leads to a catastrophic decline in your credit score, often plummeting it below 600, impacting your chances for favorable loan terms in the future.

- Delinquency results in a significant credit score drop. Your score may drop by 100 points or more depending on the severity and duration.

- Default results in a catastrophic credit score decline and further repercussions. Beyond the credit score damage, you may face wage garnishment, tax refund offset, and difficulty obtaining future loans or credit.

- Recovery from default is difficult and time-consuming. Rebuilding your credit after default can take years and requires diligent effort.

- Default impacts future borrowing opportunities. Lenders are far less likely to offer you favorable terms, if any at all, after a default.

Preventing Negative Credit Score Effects from Delayed Student Loan Payments

The best way to avoid negative impacts on your credit score is to consistently make on-time payments. This requires proactive planning and management of your finances.

- Set up automatic payments to avoid missed payments. This is the simplest and most effective way to ensure timely payments.

- Budget carefully to ensure consistent payments. Track your income and expenses to ensure you have enough money for your student loan payments each month.

- Contact your loan servicer immediately if you anticipate difficulty making payments. They may offer options like deferment or forbearance.

- Explore repayment options to manage your debt effectively. Consider income-driven repayment plans, which may lower your monthly payments.

- Consider debt consolidation or refinancing options (with caveats). While these options might help, carefully evaluate the terms before making a decision.

Income-Driven Repayment Plans and Their Impact on Credit

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. While they don't directly improve your credit score, they can prevent default by making payments more manageable. This indirectly protects your credit.

- Lower monthly payments can prevent missed payments. This is the primary benefit, keeping your payment history positive.

- May impact credit history differently from standard plans. The reporting to credit bureaus may vary slightly, but preventing delinquency is key.

- Forgiveness programs after a set period may improve your financial standing. While not an immediate credit boost, loan forgiveness can positively influence your long-term financial health.

Rebuilding Your Credit After Late Student Loan Payments

Rebuilding your credit after late payments or default requires consistent effort and responsible financial behavior.

- Maintain consistent on-time payments going forward. This demonstrates improved financial responsibility to lenders.

- Monitor your credit report regularly. Check for errors and track your progress.

- Dispute any inaccurate information on your report. Incorrect information can negatively affect your score.

- Consider a secured credit card. This can help rebuild your credit history.

Conclusion

Delayed student loan payments severely impact credit scores. Delinquency is damaging, but default is catastrophic. Proactive measures, careful budgeting, and communication with your loan servicer are crucial for preventing negative credit score effects. Don't let delayed student loan payments negatively impact your credit score. Take control of your student loan debt and secure your financial future today. Explore your repayment options and contact your loan servicer if you need assistance.

Featured Posts

-

Onibus Universitario Se Envolve Em Acidente Grave Numero De Mortos Confirmados

May 17, 2025

Onibus Universitario Se Envolve Em Acidente Grave Numero De Mortos Confirmados

May 17, 2025 -

Josh Alexander Aew Don Callis And More 97 1 Double Q Interview

May 17, 2025

Josh Alexander Aew Don Callis And More 97 1 Double Q Interview

May 17, 2025 -

Ontario Budget Reveals 14 6 Billion Deficit Breakdown And Implications

May 17, 2025

Ontario Budget Reveals 14 6 Billion Deficit Breakdown And Implications

May 17, 2025 -

1050 Price Hike At And Ts Concerns Over Broadcoms V Mware Acquisition

May 17, 2025

1050 Price Hike At And Ts Concerns Over Broadcoms V Mware Acquisition

May 17, 2025 -

Find The Best Online Casino In Ontario Mirax Casino Review And Guide

May 17, 2025

Find The Best Online Casino In Ontario Mirax Casino Review And Guide

May 17, 2025

Latest Posts

-

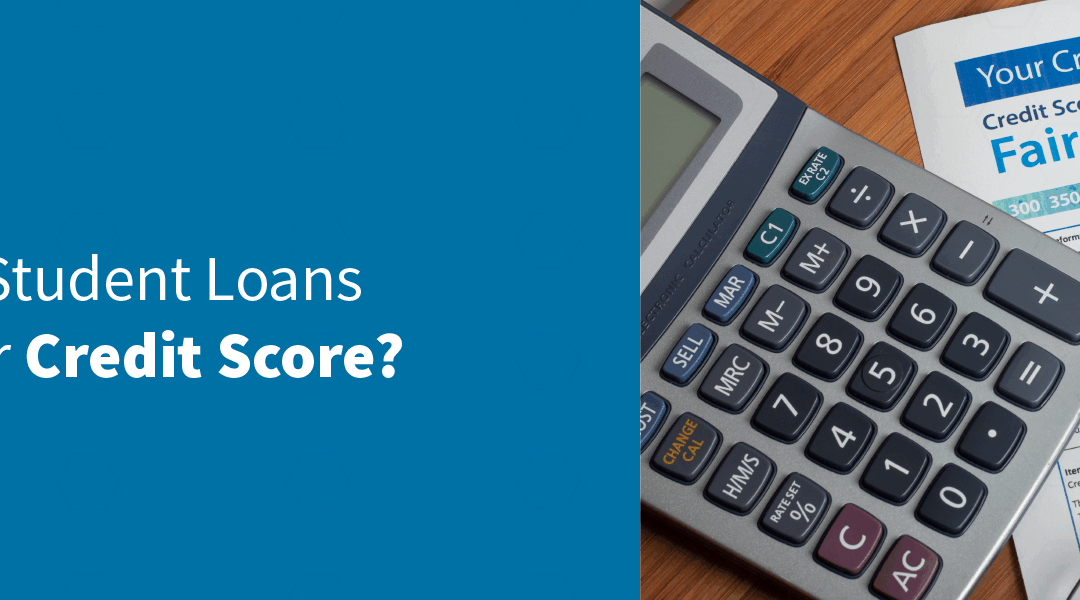

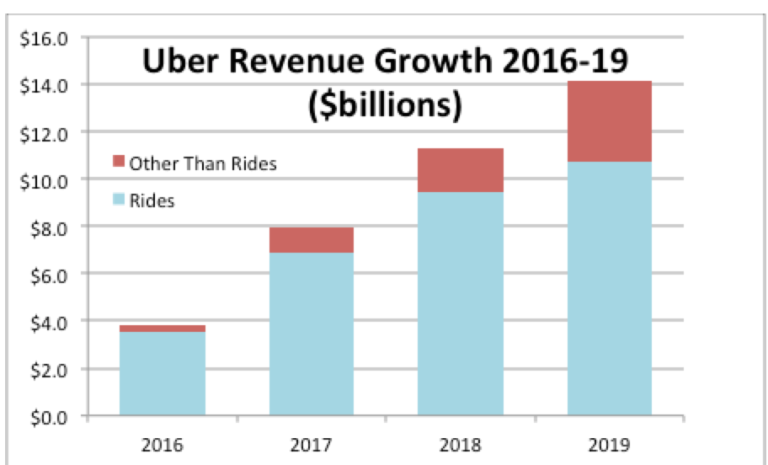

Analyzing Ubers Resilience In A Potential Recession

May 17, 2025

Analyzing Ubers Resilience In A Potential Recession

May 17, 2025 -

Taking Your Pet On Uber In Mumbai Complete Guide

May 17, 2025

Taking Your Pet On Uber In Mumbai Complete Guide

May 17, 2025 -

Ubers Stock Performance Defying Recessionary Trends

May 17, 2025

Ubers Stock Performance Defying Recessionary Trends

May 17, 2025 -

Why Uber Might Weather An Economic Downturn

May 17, 2025

Why Uber Might Weather An Economic Downturn

May 17, 2025 -

Uber Pet Policy Mumbai How To Transport Your Furry Friend

May 17, 2025

Uber Pet Policy Mumbai How To Transport Your Furry Friend

May 17, 2025