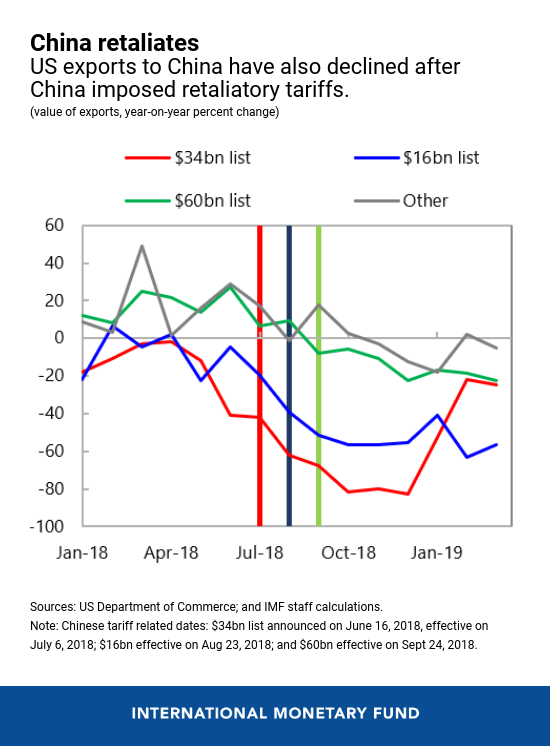

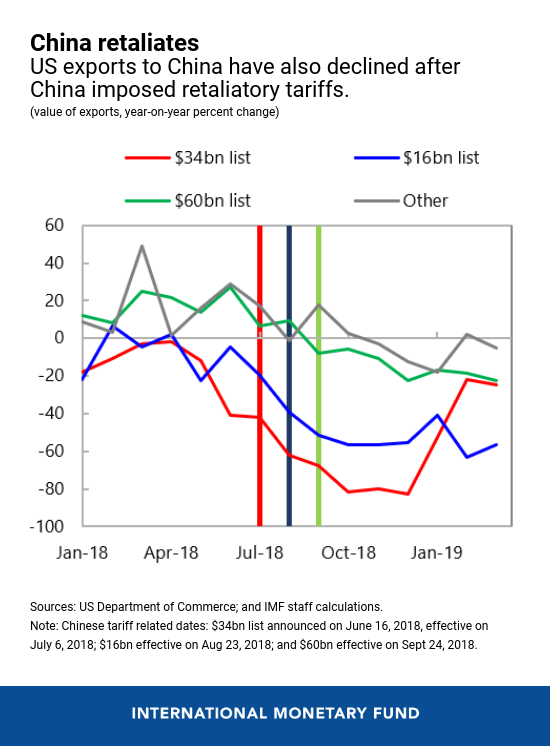

Understanding The Economic Consequences Of Reduced Tariffs Between The U.S. And China

Table of Contents

Impact on Consumer Prices

Reduced tariffs would directly impact consumer wallets. Lower import duties translate to lower prices for consumers on a wide range of goods. This effect is the most immediate and potentially significant consequence of reduced US-China tariffs.

Lower Prices for Goods

- Increased affordability leads to higher consumer demand. Cheaper goods mean more disposable income for consumers, boosting overall spending and potentially stimulating economic growth. This increased purchasing power can ripple through the economy.

- Potential for increased competition among retailers, benefiting consumers. With lower barriers to entry, retailers may compete more aggressively, leading to even lower prices and more choices for consumers. This increased competition is a key driver of consumer benefits in a free market.

- Analysis of specific product categories and their potential price reductions. Sectors like electronics, apparel, and furniture stand to see the most dramatic price decreases, given China's role as a major producer. This analysis requires careful examination of supply chains and pricing models.

Inflationary Pressures

While lower prices are generally positive, a sudden influx of cheaper goods could also create inflationary pressures. This paradox requires nuanced understanding.

- Examination of industries most vulnerable to increased competition. Domestic manufacturers of goods directly competing with Chinese imports might face challenges, potentially leading to job losses or plant closures. This impacts sectors like textiles and certain manufacturing specializations.

- Discussion of potential job displacement and the need for worker retraining programs. Government intervention might be necessary to assist workers displaced by increased competition from cheaper imports. Retraining initiatives and support for transitioning to new sectors are crucial to mitigate this negative impact.

- Analysis of the overall impact on inflation rates. While some prices fall, others may rise due to increased demand or supply chain disruptions. A thorough macroeconomic analysis is needed to predict the overall impact on inflation.

Effects on Businesses and Industries

The impact of reduced US-China tariffs extends far beyond consumer prices, significantly altering the business landscape.

Increased Trade and Investment

Lower tariffs would likely lead to a surge in bilateral trade and investment. This increased economic activity can lead to significant benefits.

- Analysis of specific industries poised for growth (e.g., technology, manufacturing). Sectors heavily reliant on international trade and supply chains will experience significant growth opportunities. The technology sector, in particular, stands to benefit greatly.

- Discussion of the potential for new supply chains and manufacturing partnerships. Businesses could establish new partnerships, streamline supply chains, and increase efficiency. This optimized efficiency translates into higher profits and potentially lower prices.

- The role of increased FDI in stimulating economic growth. Foreign direct investment from both countries will boost economic activity, creating jobs and fostering innovation. Attracting foreign investment is key to economic growth and development.

Impact on Domestic Industries

The benefits of reduced US-China tariffs are not evenly distributed. Certain domestic industries may face significant challenges.

- Identifying sectors most susceptible to competitive pressure. Industries with high labor costs or those already struggling with competition from other countries might experience the most negative impacts.

- Strategies for domestic industries to adapt and compete. Domestic businesses might need to focus on innovation, higher value-added products, and niche markets to maintain competitiveness. This requires adaptable strategies and possibly government support.

- Government policies to mitigate negative impacts on domestic industries. Policies like targeted subsidies, tax incentives, and worker retraining programs can help struggling industries adapt to the new economic realities.

Geopolitical Implications

The implications of reduced US-China tariffs extend beyond purely economic considerations, affecting the geopolitical landscape.

Improved US-China Relations

Lower tariffs could symbolize a significant step towards improved US-China relations, fostering greater cooperation on various global issues.

- Analysis of the potential for increased diplomatic engagement. Improved trade relations can pave the way for increased cooperation on issues like climate change, global health security, and non-proliferation.

- Discussion of potential collaboration on issues like climate change and global health. Joint efforts on shared challenges can lead to more effective solutions. This collaboration is a key potential positive outcome.

- Assessment of the overall impact on international stability. Easing trade tensions can contribute to greater global stability and predictability.

Shifting Global Trade Dynamics

Reduced US-China tariffs could trigger a ripple effect on global trade, affecting relationships with other countries.

- Analysis of the potential impact on other trading partners. Countries that compete with either the US or China might experience shifts in their trading relationships. This could require adjustments in trade policy.

- Discussion of potential trade negotiations and agreements with other countries. Existing trade agreements might need to be renegotiated or new ones established.

- The overall impact on the global trade landscape. The global trade order may undergo significant restructuring, requiring adaptation from all participating nations.

Conclusion

The potential economic consequences of reduced US-China tariffs are multifaceted and far-reaching, impacting consumer prices, businesses, and global geopolitical dynamics. While lower prices and increased trade present significant benefits, careful consideration must be given to the potential challenges faced by domestic industries. Understanding these potential impacts is crucial for informed decision-making. To stay abreast of the latest developments and gain a deeper understanding of the implications of reduced US-China tariffs, continue to research and follow reputable economic news sources. Further exploration of lower US-China tariffs and their impact is encouraged.

Featured Posts

-

Inside Our Adhd Minds Navigating Challenges And Embracing Strengths

May 13, 2025

Inside Our Adhd Minds Navigating Challenges And Embracing Strengths

May 13, 2025 -

Western Automakers In China Examining The Challenges Faced By Bmw Porsche And Competitors

May 13, 2025

Western Automakers In China Examining The Challenges Faced By Bmw Porsche And Competitors

May 13, 2025 -

Alarm An Braunschweiger Schule Details Zum Vorfall Und Massnahmen

May 13, 2025

Alarm An Braunschweiger Schule Details Zum Vorfall Und Massnahmen

May 13, 2025 -

O Mpalntok Kai I Anodos Tis Sefilnt Gioynaitent I Niki Sto Ntermpi Kai I Afairesi Tis Fanelas

May 13, 2025

O Mpalntok Kai I Anodos Tis Sefilnt Gioynaitent I Niki Sto Ntermpi Kai I Afairesi Tis Fanelas

May 13, 2025 -

Landman Season 2 Casting News Demi Moores Role And Fan Reactions

May 13, 2025

Landman Season 2 Casting News Demi Moores Role And Fan Reactions

May 13, 2025

Latest Posts

-

Povernennya Damiano Davida Na Yevrobachennya Scho Vidomo

May 14, 2025

Povernennya Damiano Davida Na Yevrobachennya Scho Vidomo

May 14, 2025 -

Yevrobachennya 2024 Khto Predstavit Ukrayinu Uchasniki Ta Detali

May 14, 2025

Yevrobachennya 2024 Khto Predstavit Ukrayinu Uchasniki Ta Detali

May 14, 2025 -

Prognozi Schodo Povernennya Damiano Davida Na Yevrobachennya

May 14, 2025

Prognozi Schodo Povernennya Damiano Davida Na Yevrobachennya

May 14, 2025 -

Koli I De Divitisya Yevrobachennya 2024 Povniy Gayd

May 14, 2025

Koli I De Divitisya Yevrobachennya 2024 Povniy Gayd

May 14, 2025 -

Damiano David Ta Yevrobachennya Novini Ta Prognozi

May 14, 2025

Damiano David Ta Yevrobachennya Novini Ta Prognozi

May 14, 2025