Understanding The Economic Consequences Of Student Loan Defaults

Table of Contents

Individual Consequences of Student Loan Defaults

Defaulting on student loans triggers a cascade of negative economic consequences for individuals, severely impacting their financial stability and future opportunities.

Damaged Credit Score and Financial Instability

The most immediate consequence of student loan default is a severely damaged credit score. A default is reported to the major credit bureaus (Equifax, Experian, and TransUnion), resulting in a significant drop in your FICO score. This drastically reduces your creditworthiness, making it incredibly difficult to access essential financial services.

-

Difficulty accessing credit: Securing a mortgage, auto loan, or even a credit card becomes nearly impossible with a damaged credit score. This limits your ability to make major purchases or manage unexpected expenses.

-

Challenges in securing employment: Many employers conduct credit checks as part of the hiring process. A poor credit score due to student loan default can significantly hinder your job prospects, limiting your earning potential and perpetuating the cycle of financial instability.

-

Higher interest rates on future loans: Even if you manage to secure credit, the interest rates will be substantially higher, making borrowing significantly more expensive.

-

Wage garnishment: Your wages can be legally garnished to repay the defaulted loan, leaving you with significantly reduced income.

-

Difficulty renting an apartment: Landlords often conduct credit checks, and a poor credit history can make it difficult to secure housing.

-

Higher interest rates on future loans: Any future borrowing, whether for a car, a house, or even a small personal loan, will come with significantly higher interest rates.

Wage Garnishment and Legal Actions

Beyond damaged credit, defaulting on student loans can lead to aggressive legal action. The Department of Education can initiate wage garnishment, seizing a portion of your paycheck to repay the debt. This can create significant financial strain, especially for individuals with families or other financial obligations.

- Tax refund offset: Your federal and state tax refunds can be seized to cover the outstanding debt.

- Bank account levies: The government can also levy your bank accounts to recover the funds.

- Potential lawsuits: In some cases, the government may file lawsuits to recover the debt, leading to additional legal fees and judgments.

Impact on Future Financial Opportunities

The long-term impact of student loan default extends far beyond immediate financial difficulties. It casts a long shadow over future financial opportunities, limiting your ability to achieve crucial financial milestones.

- Limited access to higher education for children: Your poor credit history can make it difficult for your children to secure student loans for their own education.

- Inability to build wealth: The inability to access credit and the financial strain of debt repayment severely limit your ability to save, invest, and build wealth over time.

- Reduced overall financial well-being: The stress and anxiety associated with student loan default significantly impact mental health and overall quality of life.

Societal Consequences of Student Loan Defaults

The economic ramifications of student loan defaults extend far beyond the individual level, impacting the broader economy and placing a significant burden on taxpayers.

Burden on Taxpayers

When student loans default, the government ultimately absorbs a significant portion of the losses. Taxpayer dollars are used to cover these losses, impacting government budgets and potentially leading to reduced funding for other essential programs.

- Increased tax burden: The cost of covering defaulted loans is ultimately borne by taxpayers through increased taxes or reduced government services.

- Reduced government funding for other programs: The need to allocate funds to cover defaulted loans can reduce funding for other essential programs such as education, infrastructure, and healthcare.

Economic Slowdown and Reduced Consumer Spending

High rates of student loan default can contribute to an economic slowdown. Individuals struggling with debt repayment have less disposable income, leading to reduced consumer spending.

- Decreased demand for goods and services: Reduced consumer spending decreases demand for goods and services, impacting businesses and potentially leading to job losses.

- Reduced economic activity: Lower consumer spending translates to reduced economic activity and slower economic growth.

- Lower tax revenue: A weakened economy results in lower tax revenue for the government, creating a negative feedback loop and further straining government budgets.

Conclusion

The economic consequences of student loan defaults are significant and far-reaching, impacting both individuals and the broader economy. Understanding the potential for damaged credit, wage garnishment, and long-term financial limitations is crucial for responsible financial planning. The societal burden of defaulted loans, including increased taxpayer costs and economic slowdown, highlights the importance of proactive debt management. Understanding the potential economic consequences of student loan defaults is crucial for responsible financial planning. Take proactive steps to manage your student loan debt effectively and avoid the serious repercussions of default. Explore available resources to find solutions and prevent the negative economic consequences of student loan defaults. Visit websites like the National Foundation for Credit Counseling (NFCC) or the Federal Student Aid website for more information on student loan repayment strategies and debt management options. Effective student loan debt management is key to securing your financial future.

Featured Posts

-

Barcelonas Quarter Final Berth Raphinhas Crucial Role

May 28, 2025

Barcelonas Quarter Final Berth Raphinhas Crucial Role

May 28, 2025 -

Exclusive New Details Emerge About Bianca Censoris Concerns Regarding Kanye West

May 28, 2025

Exclusive New Details Emerge About Bianca Censoris Concerns Regarding Kanye West

May 28, 2025 -

Mbappe E Vinicius Jr Entre Os Investigados Pela Uefa No Real Madrid

May 28, 2025

Mbappe E Vinicius Jr Entre Os Investigados Pela Uefa No Real Madrid

May 28, 2025 -

Source Reveals Bianca Censoris Apprehensions About Kanye West Exclusive

May 28, 2025

Source Reveals Bianca Censoris Apprehensions About Kanye West Exclusive

May 28, 2025 -

Oleh Oleh Khas Bali Temukan 8 Kuliner Unik Selain Pie Susu

May 28, 2025

Oleh Oleh Khas Bali Temukan 8 Kuliner Unik Selain Pie Susu

May 28, 2025

Latest Posts

-

Pccs Downtown Seattle Return A New Era Of Grocery Shopping

May 29, 2025

Pccs Downtown Seattle Return A New Era Of Grocery Shopping

May 29, 2025 -

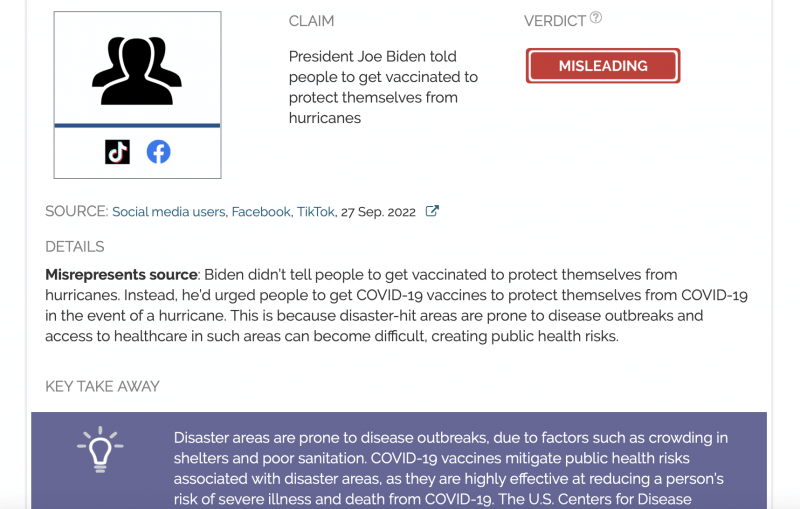

Can Covid 19 Vaccines Protect Against Long Covid

May 29, 2025

Can Covid 19 Vaccines Protect Against Long Covid

May 29, 2025 -

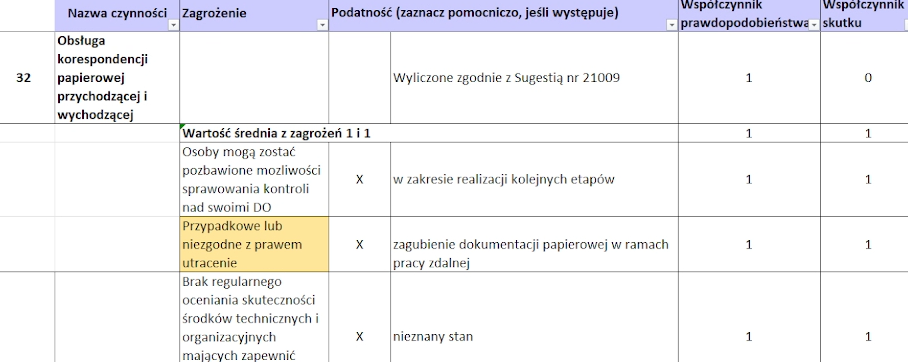

Analiza Ryzyka Opoznienia I Podwyzki Kosztow Flagowej Inwestycji Pcc

May 29, 2025

Analiza Ryzyka Opoznienia I Podwyzki Kosztow Flagowej Inwestycji Pcc

May 29, 2025 -

Long Covid Prevention The Role Of Covid 19 Vaccines

May 29, 2025

Long Covid Prevention The Role Of Covid 19 Vaccines

May 29, 2025 -

Przyszlosc Flagowej Inwestycji Pcc Opoznienia I Wyzsze Koszty

May 29, 2025

Przyszlosc Flagowej Inwestycji Pcc Opoznienia I Wyzsze Koszty

May 29, 2025