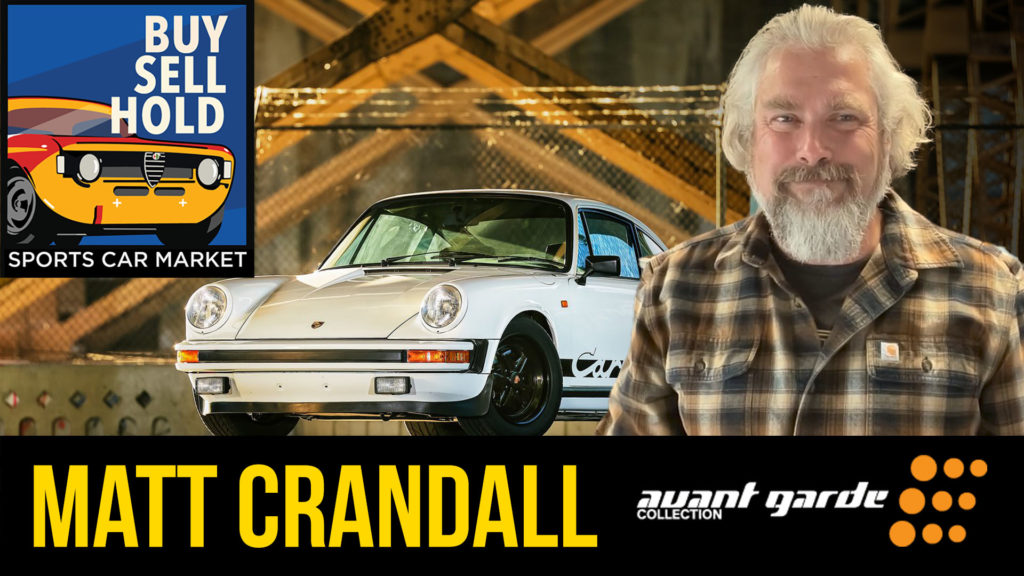

Understanding The Recent 400% XRP Price Movement: Buy, Sell, Or Hold?

Table of Contents

Factors Contributing to the XRP Price Surge

Several interconnected factors have contributed to the recent explosive growth in XRP's price. Understanding these elements is crucial for assessing the sustainability of this surge and its potential impact on your investment portfolio.

Positive Ripple Legal Developments

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has been a major factor influencing XRP's price. Recent developments have significantly impacted investor sentiment.

- Recent court filings: Favorable court rulings and filings have injected renewed optimism into the market. Specific examples include [cite specific court cases and their positive implications].

- Positive judge statements: Statements from the presiding judge hinting at a potential positive outcome for Ripple have further boosted confidence.

- Impact on investor sentiment: This positive news flow has dramatically reduced the uncertainty surrounding XRP, leading to increased investor confidence and a surge in buying pressure.

- Reduced uncertainty surrounding Ripple's legal battle with the SEC: The clearer path forward for Ripple, despite the ongoing legal proceedings, has been a catalyst for the price increase. A potential positive resolution could significantly boost XRP's long-term value.

Increased Institutional Adoption

Growing interest from institutional investors is another key driver of the XRP price surge. This increased institutional adoption signifies a shift towards broader acceptance of XRP within the financial landscape.

- Growing interest from institutional investors: Several large financial institutions have shown increased interest in XRP, signaling growing acceptance within the traditional financial system. [Cite examples of institutional interest if available].

- Potential partnerships with financial institutions: Rumors of upcoming partnerships with major financial players have fueled speculation and contributed to the price increase.

- Impact of increasing trading volume on price: The surge in trading volume, partly driven by institutional activity, has directly influenced XRP's price trajectory, creating upward momentum.

Market Speculation and FOMO (Fear Of Missing Out)

The rapid XRP price movement has also been fueled by market speculation and the pervasive fear of missing out (FOMO). Social media and news outlets have played a significant role in amplifying this effect.

- Role of social media hype: Social media platforms have been abuzz with discussions about XRP's price surge, creating a self-fulfilling prophecy as more investors jump on the bandwagon.

- Influence of influencers and news outlets: Prominent cryptocurrency influencers and news outlets reporting on the price movement have further amplified the excitement and fueled speculative trading.

- Impact of short squeezes: Short squeezes, where investors covering short positions drive up the price, may have also played a role in the rapid price increase.

Broader Cryptocurrency Market Trends

The recent XRP price surge is also influenced by broader trends within the cryptocurrency market. Positive sentiment across the crypto space generally benefits individual cryptocurrencies like XRP.

- Correlation with Bitcoin's price movements: XRP's price often correlates with Bitcoin's price; therefore, positive movements in Bitcoin's price can have a ripple effect on other cryptocurrencies, including XRP.

- Overall market sentiment towards cryptocurrencies: An overall positive market sentiment, often driven by macroeconomic factors or technological advancements, tends to lift the entire crypto market, including XRP.

- Influence of macroeconomic factors: Global economic conditions and regulatory developments can impact overall investor sentiment towards cryptocurrencies, indirectly influencing XRP's price.

Risks Associated with XRP Investment

While the recent XRP price surge is exciting, it's crucial to acknowledge the inherent risks associated with investing in cryptocurrencies. Understanding these risks is paramount before making any investment decisions.

Volatility and Market Risk

Cryptocurrencies are notoriously volatile, and XRP is no exception. The price can fluctuate dramatically in short periods, leading to significant potential losses.

- High volatility of cryptocurrencies: XRP's price can experience sharp increases and decreases in a matter of hours or days.

- Potential for significant price drops: The rapid price surge could be followed by an equally sharp correction, leading to substantial losses for investors who bought at the peak.

- Importance of risk tolerance: Investors must carefully assess their risk tolerance before investing in XRP or any other cryptocurrency.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies remains uncertain globally, posing a significant risk to XRP's future.

- Ongoing regulatory scrutiny of cryptocurrencies globally: Governments worldwide are still grappling with how to regulate cryptocurrencies, and this uncertainty can impact XRP's price and adoption.

- Potential for future regulations impacting XRP's value: New regulations could negatively impact XRP's value, either through restrictions on its use or increased compliance costs.

Security Risks

Investing in cryptocurrencies involves inherent security risks associated with both exchanges and individual wallets.

- Risks associated with cryptocurrency exchanges: Cryptocurrency exchanges are susceptible to hacking and theft, which can result in the loss of investors' funds.

- Potential for hacking and theft: Investors need to choose reputable exchanges and implement robust security measures to protect their investments.

- Importance of secure storage: Storing XRP in secure, offline wallets (cold storage) significantly reduces the risk of theft.

Should You Buy, Sell, or Hold XRP?

The decision to buy, sell, or hold XRP depends entirely on your individual circumstances, risk tolerance, and investment goals.

Analyzing Your Investment Strategy

Before making any decisions, carefully consider your risk tolerance, investment goals, and long-term outlook.

- Consider your risk tolerance: Are you comfortable with the high volatility inherent in XRP investments?

- Investment goals: Does XRP align with your short-term or long-term investment goals?

- Analyze your personal financial situation: Only invest what you can afford to lose. Never invest borrowed money in cryptocurrencies.

Diversification and Portfolio Management

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket.

- Importance of diversifying your investment portfolio: Spread your investments across different asset classes, including stocks, bonds, and other cryptocurrencies.

- Don't put all your eggs in one basket: Over-reliance on a single cryptocurrency, especially one as volatile as XRP, can lead to significant losses.

- Consider other asset classes: A well-diversified portfolio minimizes risk and maximizes the potential for long-term growth.

Conclusion

The recent 400% XRP price surge is a multifaceted event driven by legal developments, institutional interest, market speculation, and broader market trends. However, investing in XRP carries significant risks, including volatility, regulatory uncertainty, and security concerns. Therefore, deciding whether to buy, sell, or hold XRP necessitates a thorough assessment of your risk tolerance, investment goals, and a diversified investment strategy. Conduct thorough research and consider consulting a qualified financial advisor before making any decisions regarding your XRP investment. Understanding the risks associated with XRP price movements is crucial for making informed investment decisions. Remember to always conduct your own thorough research before investing in any cryptocurrency, including XRP.

Featured Posts

-

Could Xrp Reach 5 By 2025 Factors To Consider

May 08, 2025

Could Xrp Reach 5 By 2025 Factors To Consider

May 08, 2025 -

Dodgers Historico Inicio De Temporada Superaran La Marca De Los Yankees

May 08, 2025

Dodgers Historico Inicio De Temporada Superaran La Marca De Los Yankees

May 08, 2025 -

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025 -

Could Xrp Etf Approval Unleash 800 Million In First Week Investments

May 08, 2025

Could Xrp Etf Approval Unleash 800 Million In First Week Investments

May 08, 2025 -

Bitcoin Rally Analyst Predicts Start Of Uptrend May 6 Chart Analysis

May 08, 2025

Bitcoin Rally Analyst Predicts Start Of Uptrend May 6 Chart Analysis

May 08, 2025