Understanding The SEC's Classification Of XRP: Implications For Investors

Table of Contents

The SEC's Case Against Ripple and XRP

The SEC's Argument

The SEC alleges that Ripple conducted an unregistered securities offering by selling XRP. They argue XRP functions as an investment contract, meeting the Howey Test criteria. The Howey Test, a crucial element in securities law, defines an investment contract based on four factors:

- Investment of Money: Investors provided capital to Ripple in exchange for XRP.

- Common Enterprise: Investors participated in a shared venture with Ripple and other XRP holders.

- Expectation of Profits: Investors anticipated profits derived from Ripple's efforts and the future value of XRP.

- Efforts of Others: Investors relied on Ripple's efforts to increase the value of XRP.

The SEC's interpretation hinges on the argument that Ripple exerted significant control over XRP's development and distribution, suggesting it wasn't a truly decentralized cryptocurrency. They point to Ripple's sales of XRP to institutional investors and its marketing efforts as evidence of a securities offering.

Ripple's Defense

Ripple contends XRP is a digital currency, not a security, and therefore not subject to SEC registration requirements. Their defense rests on several key arguments:

- Decentralization: Ripple emphasizes XRP's decentralized nature, highlighting the independent operation of the XRP Ledger and its growing community of validators. They argue that Ripple's influence on XRP's development and price is diminishing.

- Utility: Ripple stresses XRP's utility as a functional cryptocurrency for payments and other transactions, independent of Ripple's activities. They cite its use in cross-border payments as evidence of its practical applications.

- Lack of Direct Control: Ripple maintains they do not directly control the price or distribution of XRP, a key distinction from a traditional security. They highlight the independent operation of exchanges and the community's role in XRP's ecosystem.

Ripple's defense involves demonstrating that XRP functions differently from a traditional security, operating more akin to other established cryptocurrencies like Bitcoin or Ethereum.

Potential Outcomes and Their Impact on Investors

Scenario 1: XRP Ruled a Security

If the court rules XRP to be a security, the implications for investors are substantial:

- Potential Legal Action Against Ripple: Investors might pursue legal action against Ripple for conducting an unregistered securities offering.

- Potential for Investors to Seek Restitution: Investors who purchased XRP might be eligible to seek compensation for their losses.

- Impact on XRP's Price and Trading Volume: The price of XRP could plummet, and trading volume might significantly decrease due to regulatory uncertainty. Exchanges may delist XRP.

Scenario 2: XRP Ruled Not a Security

A ruling in favor of Ripple would likely produce the opposite effects:

- Boost XRP's Price: Investor confidence would increase, potentially leading to a surge in XRP's price.

- Increase Investor Confidence: A positive ruling could legitimize XRP in the eyes of many investors and attract further investment.

- Potential Precedent for Other Cryptocurrencies: The decision could set a precedent for how other cryptocurrencies are classified under securities law.

The Legal Uncertainty and its Effects

The ongoing legal battle creates considerable uncertainty, leading to:

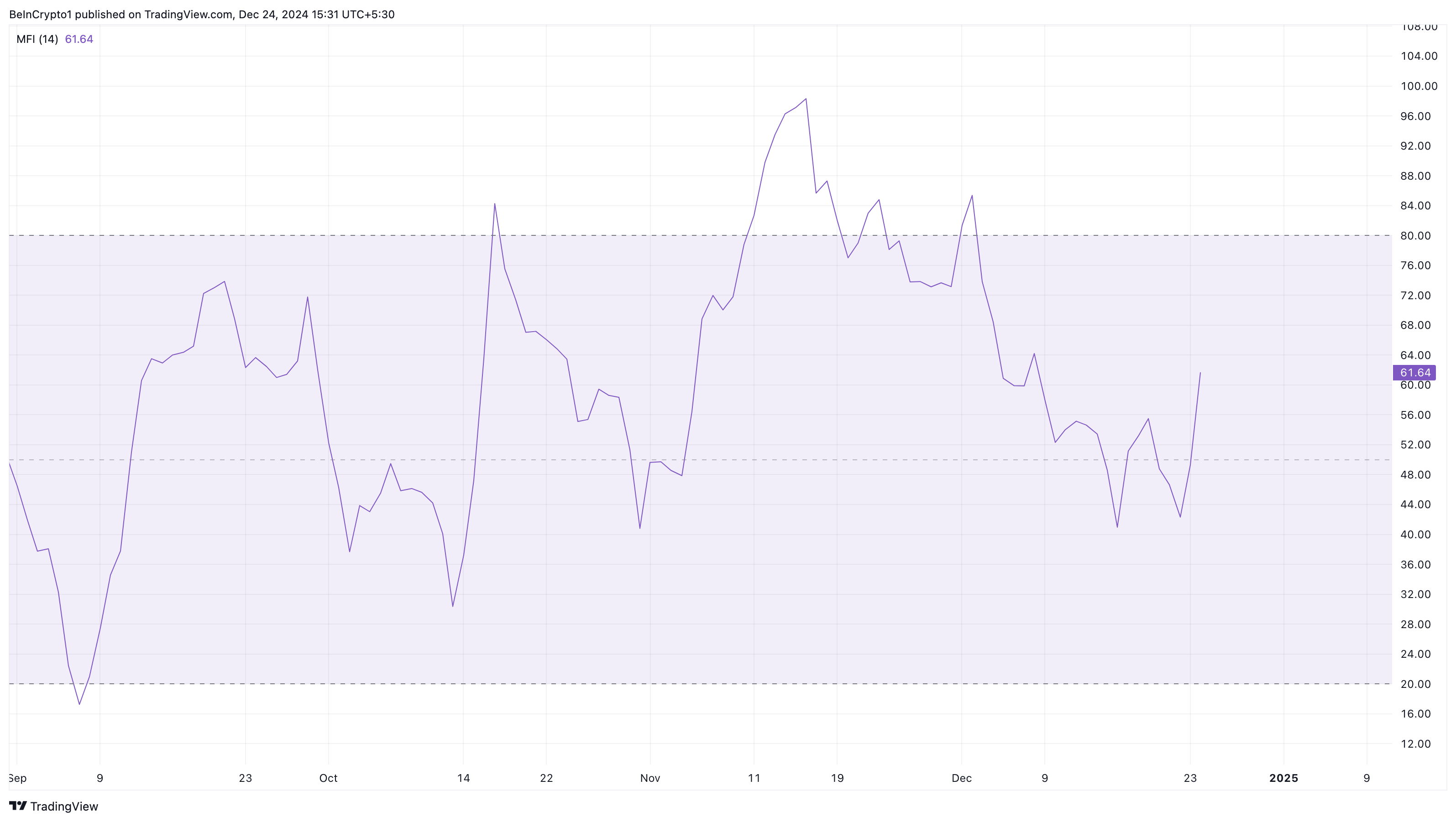

- Volatility in XRP Price: The price of XRP has experienced significant volatility throughout the legal proceedings.

- Hesitation Among Investors: Many investors are hesitant to invest in XRP until the legal uncertainty is resolved.

- Regulatory Implications for Other Crypto Projects: The outcome will significantly influence future regulatory approaches to cryptocurrencies.

Navigating the Uncertainty: Advice for Investors

Due Diligence and Risk Assessment

Investors should always conduct thorough research before investing in any cryptocurrency, especially during times of regulatory uncertainty:

- Importance of Diversifying Investments: Never put all your eggs in one basket. Diversify your portfolio to mitigate risk.

- Understanding the Legal Landscape: Stay informed about the legal and regulatory environment surrounding cryptocurrencies.

- Seeking Advice from Financial Professionals: Consider consulting with a financial advisor who understands the complexities of cryptocurrency investments.

Monitoring Regulatory Developments

Stay informed about the SEC's decision and subsequent legal developments by:

- Following Reputable News Sources: Rely on trusted and credible sources for information about the case.

- Understanding Potential Future Regulatory Actions: The SEC's decision will likely influence future regulatory actions concerning cryptocurrencies.

Considering Tax Implications

The classification of XRP has significant tax implications:

- Consult with a Tax Professional: Seek professional advice to understand potential capital gains or losses and tax liabilities.

Conclusion

The SEC's classification of XRP is a landmark case with significant implications for the cryptocurrency market and investors. Understanding the arguments presented by both sides, the potential outcomes, and the associated risks is crucial for navigating this complex landscape. Investors should prioritize due diligence, risk assessment, and staying informed about regulatory developments. The ongoing legal battle surrounding the SEC's classification of XRP underscores the need for careful consideration before investing in cryptocurrencies. Stay informed on the latest developments concerning the SEC's classification of XRP to make informed decisions.

Featured Posts

-

Bitcoin Price Analysis Rally Potential Identified May 6 Chart

May 08, 2025

Bitcoin Price Analysis Rally Potential Identified May 6 Chart

May 08, 2025 -

Daily Lotto Results For Tuesday April 15 2025

May 08, 2025

Daily Lotto Results For Tuesday April 15 2025

May 08, 2025 -

Ubers New Cash Only Auto Service What You Need To Know

May 08, 2025

Ubers New Cash Only Auto Service What You Need To Know

May 08, 2025 -

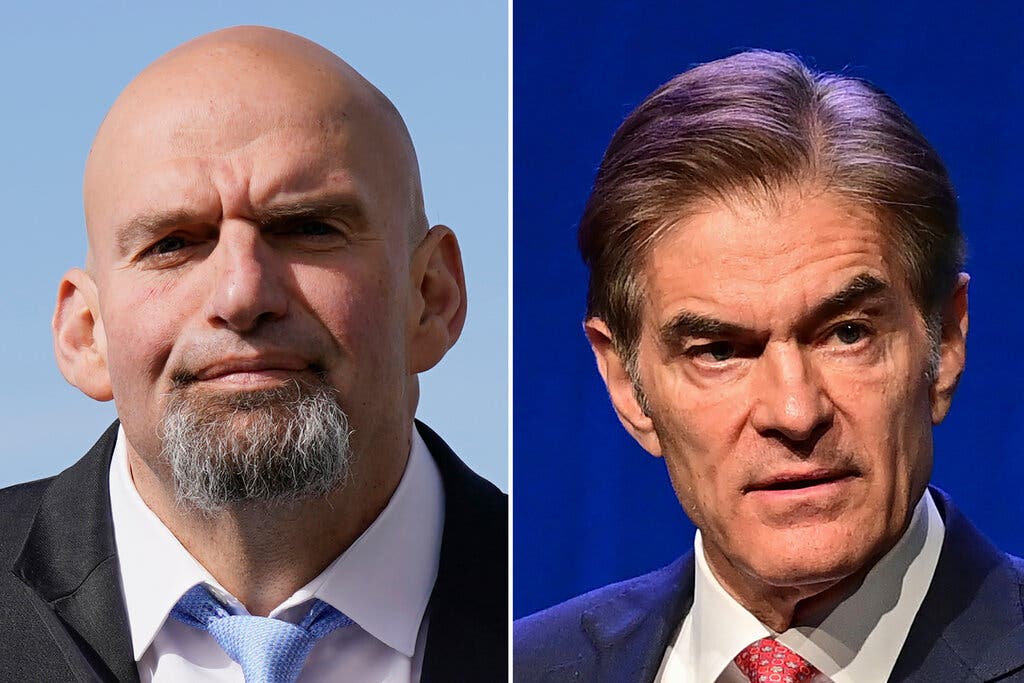

Senator Fetterman Rebuts Ny Magazine Article On Fitness To Serve

May 08, 2025

Senator Fetterman Rebuts Ny Magazine Article On Fitness To Serve

May 08, 2025 -

Find Your Perfect Boston Celtics Item Shop The Fanatics Collection Now

May 08, 2025

Find Your Perfect Boston Celtics Item Shop The Fanatics Collection Now

May 08, 2025