Unlocking Potential: How Saudi Arabia's New ABS Rules Are Changing The Game

Table of Contents

Boosting Investment in Saudi Arabia through ABS Regulations

The new ABS framework in Saudi Arabia has significantly improved the ease of issuing Asset-Backed Securities. This streamlined process makes it considerably more attractive for businesses to access capital, fostering economic growth and attracting substantial foreign direct investment (FDI). The simplified regulatory environment offers several key advantages:

- Simplified regulatory procedures: The new rules have reduced bureaucratic hurdles, accelerating the issuance process and minimizing delays.

- Reduced transaction costs: Streamlined procedures and increased efficiency translate to lower costs for issuers, making ABS a more cost-effective financing option.

- Increased transparency and standardization: Clearer guidelines and standardized processes enhance transparency, attracting investors who value predictable and reliable regulatory frameworks.

- Attraction of international investors: The improved regulatory environment and increased transparency build confidence among international investors, leading to a significant inflow of FDI.

This easier access to capital through ABS is vital for Saudi Arabia's continued economic growth and diversification. The resulting increase in FDI fuels job creation, infrastructure development, and overall economic prosperity.

Diversifying Saudi Arabia's Financial Market with ABS

ABS are playing a crucial role in diversifying funding sources for Saudi businesses. By offering an alternative to traditional bank loans, ABS open up new avenues for capital acquisition, particularly for projects that may not qualify for traditional financing. This diversification is fueling growth across various sectors:

- Funding for infrastructure projects: Large-scale infrastructure projects, crucial for Saudi Arabia's development, can now access financing more readily through ABS.

- Support for SMEs (Small and Medium Enterprises): SMEs, often struggling to secure funding, can benefit significantly from ABS, stimulating growth and innovation within the Saudi economy.

- Growth in the real estate and renewable energy sectors: These key sectors, integral to Vision 2030, will see increased investment and development thanks to the easier access to capital through ABS.

- Development of a more robust and resilient financial ecosystem: The increased availability of diverse funding sources contributes to a healthier, more resilient, and dynamic financial market.

Enhanced Transparency and Regulatory Oversight in Saudi Arabia's ABS Market

The new ABS regulations emphasize transparency and robust regulatory oversight. This strengthened regulatory framework instills confidence among investors by mitigating risks and protecting their interests. Key improvements include:

- Clearer regulatory guidelines: The new rules provide clear and concise guidelines, leaving little room for ambiguity and promoting fair market practices.

- Stronger investor protection measures: Investors are better protected through increased transparency and robust enforcement mechanisms.

- Increased market integrity: Clear rules and effective enforcement deter fraudulent activities, strengthening the integrity of the Saudi ABS market.

- Reduced instances of fraud and mismanagement: The improved regulatory environment reduces the likelihood of fraud and mismanagement, fostering a more trustworthy investment climate.

The Impact of Saudi Arabia's ABS Rules on Regional and Global Markets

Saudi Arabia's ABS reforms are not limited to domestic impact; they have significant regional and global implications. The kingdom's strategic move is setting a precedent for other developing economies and attracting increased attention from international investors:

- Attracting regional investment into Saudi Arabia: The improved regulatory environment attracts investment not only from global players but also from neighboring countries.

- Setting a precedent for other developing economies: Saudi Arabia's success with ABS reforms can inspire similar reforms in other developing nations, promoting broader economic growth across the region.

- Increased global awareness of Saudi Arabia's financial sector: The reforms highlight Saudi Arabia’s commitment to modernizing its financial sector, improving its global reputation.

- Potential for collaboration with international financial institutions: The improved regulatory framework facilitates collaboration with international financial institutions, fostering further development and integration into the global financial system.

Unlocking the Future of Finance in Saudi Arabia with ABS

The new ABS rules represent a significant step forward for Saudi Arabia's financial landscape. By streamlining the issuance process, enhancing transparency, and attracting significant investment, these regulations are driving economic diversification and fostering sustainable growth. The improved regulatory framework unlocks significant potential for growth in various sectors, strengthening the kingdom's position as a regional and global investment hub. Learn more about the exciting opportunities presented by Saudi Arabia's new ABS rules and unlock your investment potential today!

Featured Posts

-

How Much Does The Fortnite Cowboy Bebop Faye Valentine And Spike Spiegel Skin Bundle Cost

May 02, 2025

How Much Does The Fortnite Cowboy Bebop Faye Valentine And Spike Spiegel Skin Bundle Cost

May 02, 2025 -

Rust Movie Review Examining The Film Amidst Controversy

May 02, 2025

Rust Movie Review Examining The Film Amidst Controversy

May 02, 2025 -

Frimpong And Elliott Latest Liverpool Transfer Updates

May 02, 2025

Frimpong And Elliott Latest Liverpool Transfer Updates

May 02, 2025 -

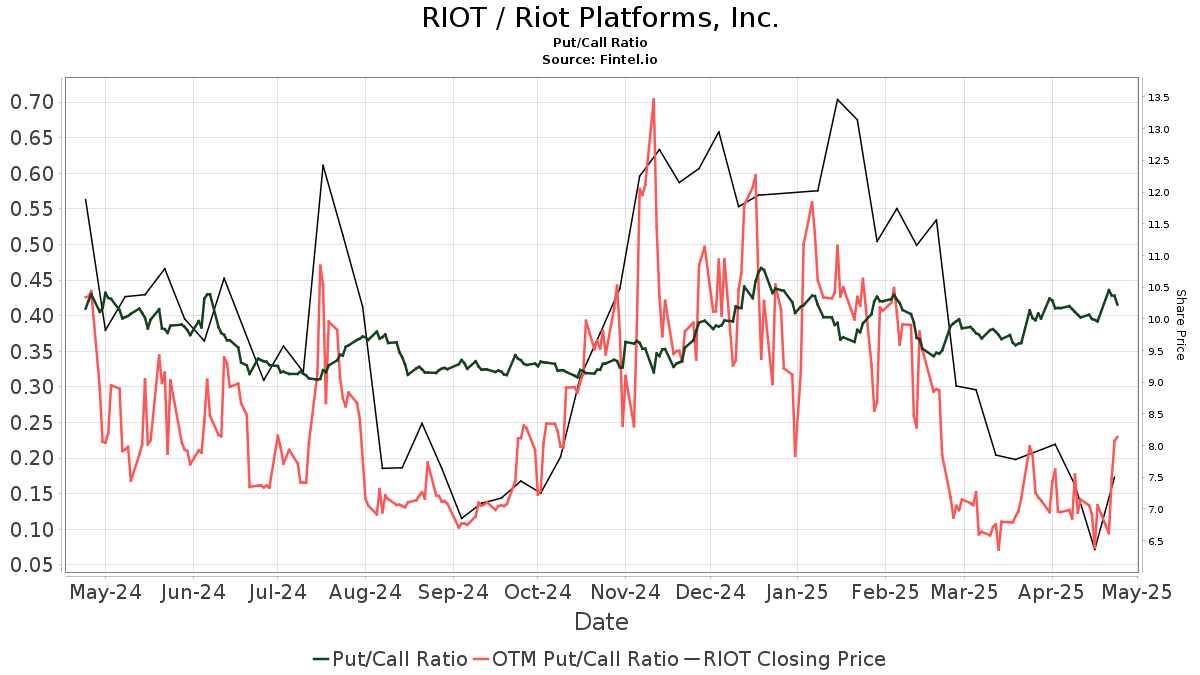

Riot Platforms Inc Early Warning Report And Irrevocable Proxy Waiver Press Release

May 02, 2025

Riot Platforms Inc Early Warning Report And Irrevocable Proxy Waiver Press Release

May 02, 2025 -

Inisiatif Tabung Baitulmal Sarawak 125 Pelajar Asnaf Sibu Terima Bantuan Kembali Ke Sekolah

May 02, 2025

Inisiatif Tabung Baitulmal Sarawak 125 Pelajar Asnaf Sibu Terima Bantuan Kembali Ke Sekolah

May 02, 2025