XRP Price Increase: Analyzing The Possible Impact Of Trump's Announcements.

Table of Contents

Trump's Announcements and Their Potential Ripple Effect on Cryptocurrencies

Trump's public statements, whether on economic policy, regulatory frameworks, or even seemingly unrelated topics, can send shockwaves through the financial markets, and the cryptocurrency market is no exception. Understanding the potential impact requires analyzing both the direct and indirect effects of these announcements.

Direct Impacts:

-

Regulatory Uncertainty: Statements hinting at potential changes to cryptocurrency regulation in the US, either directly or indirectly, can cause significant uncertainty among investors. A sudden shift in regulatory stance could lead to either a surge or a drop in XRP price, depending on the perceived favorability of the new regulations. For example, a statement suggesting stricter oversight might trigger a sell-off, while positive comments could stimulate buying.

-

Economic Policy Shifts: Trump's pronouncements on economic policies, such as taxation or monetary policy, can influence the overall market sentiment. A positive economic outlook might encourage investment in riskier assets like cryptocurrencies, potentially contributing to an XRP price increase. Conversely, pessimistic economic forecasts could lead to investors moving funds into safer havens, driving down cryptocurrency prices.

-

International Relations: Trump's actions and statements regarding international relations and trade can create uncertainty in global markets, affecting investor confidence across various asset classes, including cryptocurrencies. Increased geopolitical tension could negatively impact XRP, while improved relations could potentially stimulate investment.

Indirect Impacts:

-

Market Sentiment: Trump's pronouncements often trigger significant shifts in overall market sentiment. If the broader market is bullish, it can indirectly benefit XRP, leading to a price increase. However, a bearish market sentiment could drag down even the strongest cryptocurrencies, resulting in a price decline.

-

Dollar Strength: Changes in the US dollar's strength, potentially influenced by Trump's policies, can affect the value of cryptocurrencies like XRP, which are typically priced in USD. A stronger dollar could put downward pressure on XRP, while a weaker dollar might have the opposite effect.

Analyzing Market Sentiment and Trading Volume Around Trump's Statements

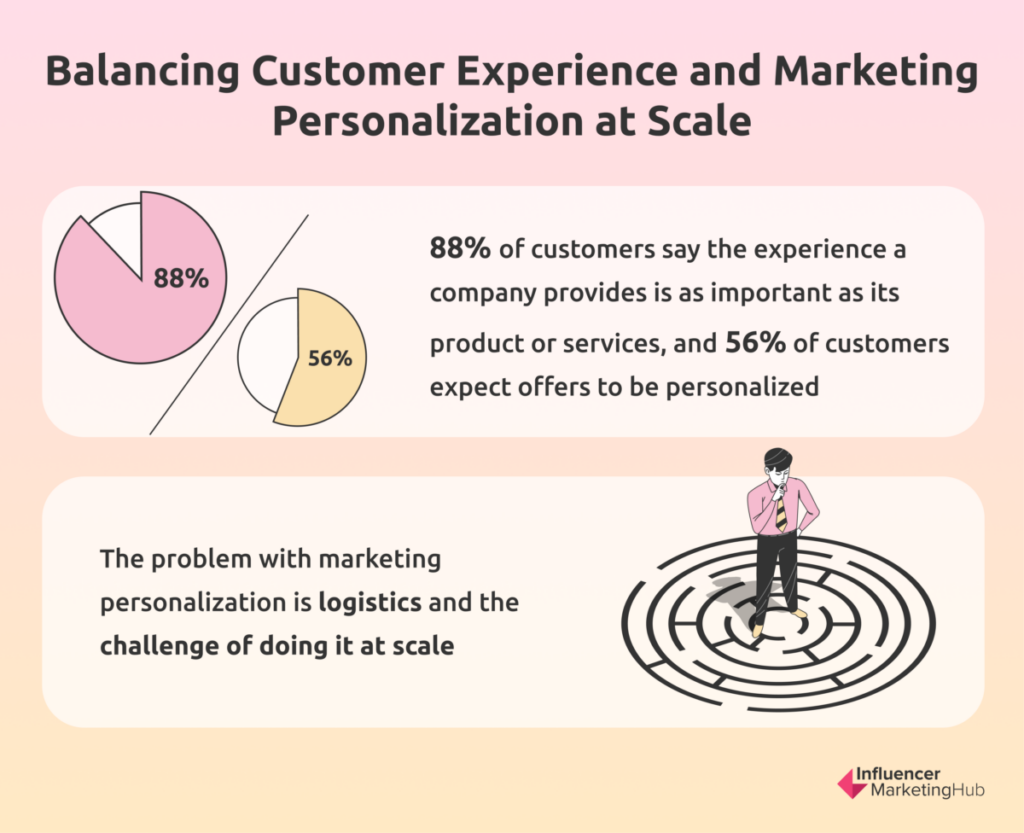

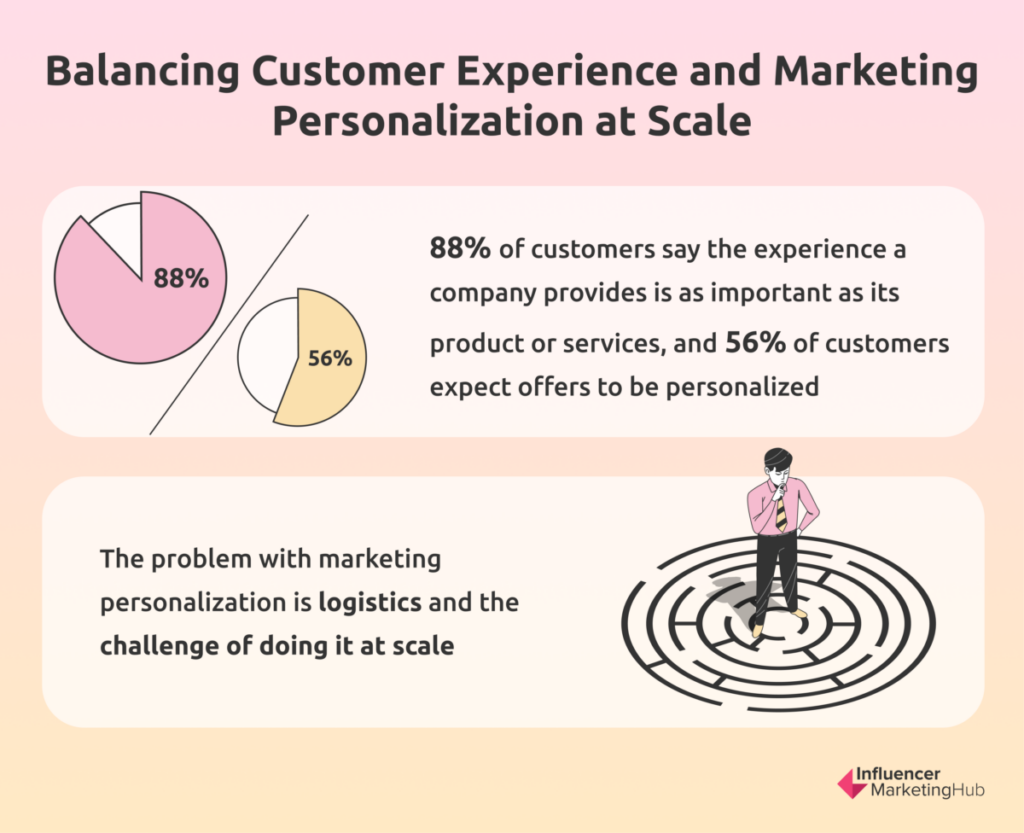

To understand the impact of Trump's announcements on XRP, we must analyze both the market sentiment and trading volume surrounding these events.

Sentiment Analysis:

Various tools are used to gauge market sentiment, including social media sentiment analysis, news sentiment scores, and surveys of investor opinion. By tracking these metrics, we can identify changes in investor confidence before, during, and after Trump's statements. A positive shift in sentiment often correlates with a rise in XRP price, while negative sentiment often predicts a drop.

Trading Volume Fluctuations:

Examining XRP's trading volume during periods surrounding Trump's announcements provides crucial insight. A significant increase in trading volume can indicate heightened investor activity and speculation. This increased volume, coupled with positive sentiment, could contribute to an XRP price increase. Conversely, a decrease in trading volume during periods of negative sentiment could signify a lack of investor confidence.

XRP's Unique Position in the Crypto Market and its Vulnerability to External Factors

XRP occupies a unique position in the cryptocurrency market. Understanding its strengths, weaknesses, and regulatory landscape is crucial for assessing its vulnerability to external factors like Trump's announcements.

Technological Factors:

XRP's technology, including its speed and scalability, plays a role in determining its resilience to market fluctuations. However, its reliance on centralized validators also makes it susceptible to regulatory changes and security concerns, influencing investor confidence.

Regulatory Landscape:

The regulatory environment surrounding XRP is complex and dynamic. Ongoing legal battles and potential regulatory actions can significantly influence its price volatility. Negative news on this front could create uncertainty and lead to price declines, while positive developments could have the opposite effect.

Competition Within the Cryptocurrency Market:

XRP competes with other cryptocurrencies for market share and investor attention. Announcements affecting other major cryptocurrencies can indirectly influence XRP's price, either positively or negatively.

Conclusion: Understanding the Future of XRP Price and Trump's Influence

Trump's announcements can significantly influence XRP price, but predicting future price movements remains challenging. Market sentiment, trading volume, and XRP's unique position in the crypto market are all critical factors to consider. While positive sentiment and increased trading volume can potentially lead to an XRP price increase, negative news or regulatory uncertainty could cause significant price drops. To successfully navigate the complexities of the XRP market, it is crucial to continuously monitor market trends, trading volume, and regulatory developments. Stay informed about political and economic developments and track the XRP price increase closely, paying attention to the impact of any future pronouncements from key political figures. Follow the impact of Trump's announcements on XRP and other relevant news to make informed investment decisions. Monitor XRP price volatility and adapt your strategies accordingly.

Featured Posts

-

Antisemitism Investigation Boeing Seattle Campus Under Scrutiny

May 08, 2025

Antisemitism Investigation Boeing Seattle Campus Under Scrutiny

May 08, 2025 -

Lahore And Punjab Weather Eid Ul Fitr Forecast Next 2 Days

May 08, 2025

Lahore And Punjab Weather Eid Ul Fitr Forecast Next 2 Days

May 08, 2025 -

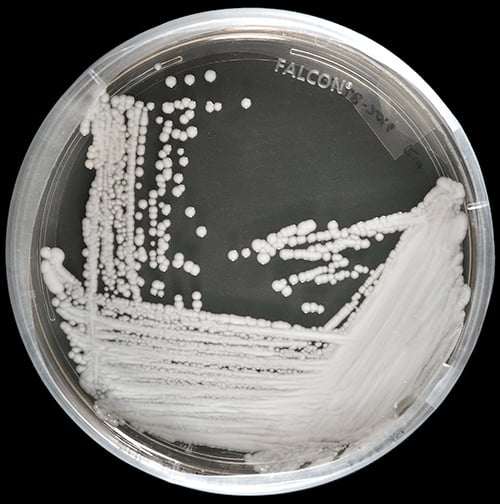

Deadly Fungi The Emerging Superbug Crisis

May 08, 2025

Deadly Fungi The Emerging Superbug Crisis

May 08, 2025 -

Psg Angers Macini Hangi Kanalda Ve Nasil Izleyebilirim

May 08, 2025

Psg Angers Macini Hangi Kanalda Ve Nasil Izleyebilirim

May 08, 2025 -

Lotto Draw Results Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 08, 2025

Lotto Draw Results Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 08, 2025