US Dollar Soars: Trump's Less Aggressive Tone On The Fed Fuels Rally

Table of Contents

Trump's Shift in Tone Towards the Fed

For years, President Trump consistently criticized the Federal Reserve's monetary policy, particularly its interest rate hikes. His public pronouncements, often made via Twitter, frequently expressed dissatisfaction with what he perceived as overly tight monetary policy, hindering economic growth. For example, in 2018 and 2019, his repeated criticisms of Fed Chair Jerome Powell directly contributed to market volatility and uncertainty, impacting the US dollar's value negatively. The perceived political interference in the Fed's independence created uncertainty and negatively impacted investor confidence.

- Highlighting the Change: Recently, however, Trump's public statements regarding the Fed have become noticeably more subdued. He has largely refrained from publicly criticizing the Fed's decisions, a stark contrast to his previous outspokenness.

- Specific Instances: While specific examples are difficult to pinpoint definitively without detailed records, the absence of highly critical tweets and public statements is a significant indicator of the shift. The change is evident in the reduced frequency and intensity of his public commentary on monetary policy.

- Reasons Behind the Shift: Several factors likely contribute to this change. The upcoming election could be a significant motivator, prompting a more conciliatory approach to avoid further market instability. Furthermore, growing economic concerns might have led him to adopt a less confrontational stance, allowing the Fed more leeway to manage the economy. The potential impact of "Trump's Fed criticism" on his re-election prospects could also be a major factor.

Market Reaction to the Less Aggressive Stance

The markets have reacted positively to Trump's less aggressive stance towards the Fed. The change in tone signaled a reduction in political uncertainty surrounding monetary policy, boosting investor confidence.

- Impact on Exchange Rates: The US dollar has strengthened against major currencies like the Euro (EUR/USD), Japanese Yen (USD/JPY), and British Pound (GBP/USD) following the shift in Trump's rhetoric. This indicates increased demand for the US dollar.

- Movement in US Treasury Yields: Treasury yields, a reflection of investor confidence in US debt, have also shown positive movement, suggesting increased demand for US government bonds.

- Investor Sentiment: The shift in Trump's tone has noticeably improved investor sentiment and reduced market volatility. The decreased uncertainty translates to increased confidence in the US economy, leading to greater investment and bolstering the US dollar. This improved "investor confidence" is clearly reflected in currency market performance.

Implications for the US Economy and Global Markets

A stronger US dollar has significant implications for both the US economy and global markets.

- Impact on US Trade: A stronger dollar makes US exports more expensive for foreign buyers and imports cheaper for domestic consumers. This could negatively impact US exporters but benefit US consumers.

- Inflationary Pressures: Cheaper imports can exert downward pressure on inflation, potentially benefitting consumers. However, a strong dollar can also lead to deflationary pressures in certain sectors.

- Global Trade and Economic Growth: A stronger dollar can impact global trade dynamics, making it more challenging for other countries to compete with US goods. This could potentially slow down global economic growth in some regions. The "global economic impact" is complex and multifaceted.

Uncertainty Remains

Despite the current rally, uncertainty regarding the future remains.

- Future Shifts in Trump's Stance: Trump's approach might shift again depending on economic developments or political considerations. Any unexpected change in his rhetoric could cause renewed market volatility.

- External Factors: Geopolitical events, such as escalating trade wars or global economic slowdowns, could influence the dollar's value irrespective of Trump's stance.

- Ongoing Fed Policy Debate: The ongoing debate surrounding the appropriate monetary policy response to evolving economic conditions continues to be a source of uncertainty.

Conclusion

The recent surge in the US dollar is largely attributed to President Trump's less aggressive approach towards the Federal Reserve. This shift in tone has calmed market uncertainty and boosted investor confidence, leading to a strengthening of the greenback. The implications for the US economy and global markets are significant and warrant close monitoring. The interplay between the US Dollar, Trump's policies, and the Federal Reserve's actions continues to be a dominant force shaping global finance.

Call to Action: Stay informed about the ongoing developments concerning the US dollar and the Federal Reserve's monetary policy. Understanding the factors influencing the US dollar's value is crucial for making informed financial decisions. Continue to follow our analysis for further updates on the US dollar and the impact of President Trump's policies on currency markets. Learn more about the US dollar's future by subscribing to our newsletter.

Featured Posts

-

La Palisades Fire Which Celebrities Lost Their Homes

Apr 24, 2025

La Palisades Fire Which Celebrities Lost Their Homes

Apr 24, 2025 -

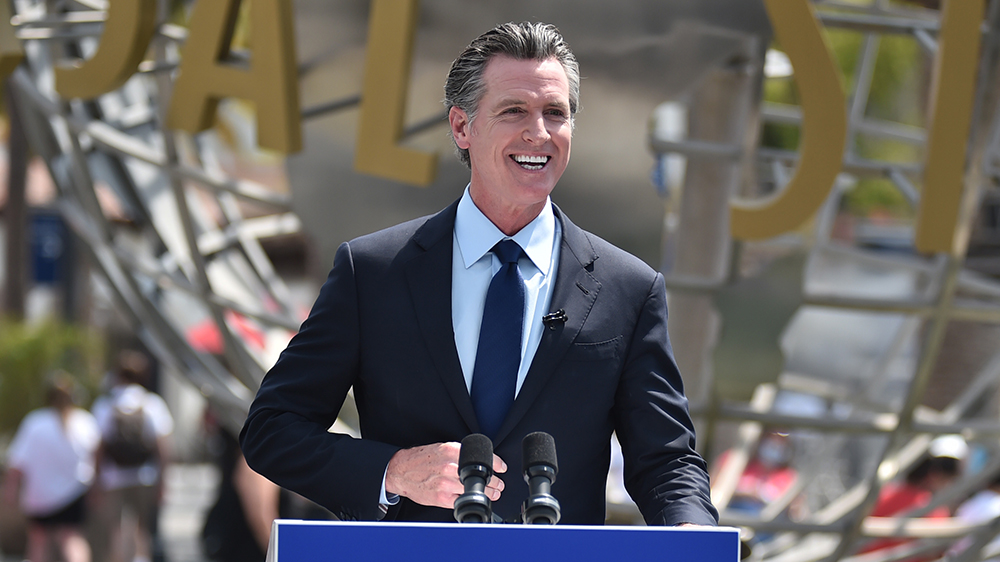

California Gas Prices Governor Newsom Seeks Oil Industry Partnership To Ease Costs

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Oil Industry Partnership To Ease Costs

Apr 24, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 24, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 24, 2025 -

Is Cantor Leading A 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Is Cantor Leading A 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

John Travoltas Daughter Ella Bleu 24 Shows Off Daring New Look

Apr 24, 2025

John Travoltas Daughter Ella Bleu 24 Shows Off Daring New Look

Apr 24, 2025

Latest Posts

-

White House Minimizes Auto Industry Concerns Over Uk Trade Deal

May 12, 2025

White House Minimizes Auto Industry Concerns Over Uk Trade Deal

May 12, 2025 -

Car Dealerships Intensify Opposition To Mandatory Ev Sales

May 12, 2025

Car Dealerships Intensify Opposition To Mandatory Ev Sales

May 12, 2025 -

Auto Dealers Double Down On Resistance To Electric Vehicle Regulations

May 12, 2025

Auto Dealers Double Down On Resistance To Electric Vehicle Regulations

May 12, 2025 -

Investigation Persistence Of Toxic Chemicals In Buildings Following Ohio Train Derailment

May 12, 2025

Investigation Persistence Of Toxic Chemicals In Buildings Following Ohio Train Derailment

May 12, 2025 -

Ohio Derailment Prolonged Presence Of Toxic Chemicals In Buildings

May 12, 2025

Ohio Derailment Prolonged Presence Of Toxic Chemicals In Buildings

May 12, 2025