US-Dutch Trade Dispute Fuels Further Decline In Dutch Stock Prices

Table of Contents

The Impact of US Tariffs on Dutch Exports

The imposition of US tariffs on several key Dutch export sectors is a major contributor to the decline in Dutch stock prices. These tariffs directly impact the profitability and competitiveness of Dutch businesses, leading to reduced export volumes and revenue losses. Key sectors like agriculture, particularly dairy and flower exports, and various industrial goods, are feeling the brunt of these trade barriers. The consequences are quantifiable:

-

Specific examples of tariffs imposed by the US: Tariffs have been levied on Dutch dairy products, impacting cheese and other dairy exports to the US market. Similarly, tariffs on certain industrial goods have hindered Dutch manufacturers' ability to compete in the American market. The exact tariff rates vary depending on the specific product.

-

Percentage decline in exports to the US for affected sectors: Preliminary data suggests a double-digit percentage decline in exports to the US for affected sectors, although precise figures are still being analyzed. This decline translates to significant revenue losses for Dutch businesses.

-

Analysis of the competitive disadvantage faced by Dutch exporters: The imposed tariffs place Dutch exporters at a substantial competitive disadvantage compared to their counterparts from countries not facing similar tariffs. This decreased competitiveness forces Dutch businesses to either absorb the tariff costs or reduce their pricing, impacting their profitability margins.

-

Potential for retaliatory tariffs from the Netherlands: While the Netherlands has generally opted for diplomatic solutions, the possibility of retaliatory tariffs remains a potent concern, potentially escalating the trade war and further damaging both economies.

Investor Sentiment and Capital Flight

The US-Dutch trade dispute is significantly eroding investor confidence, triggering capital flight from the Dutch stock market. This negative sentiment is clearly reflected in the volatility of the Amsterdam Stock Exchange (AEX) index, which shows a strong negative correlation with the escalation of trade tensions. The uncertainty surrounding the future of trade relations between the two countries is driving investors towards perceived safer investment havens.

-

Decline in foreign direct investment (FDI) in the Netherlands: Reports indicate a noticeable decrease in FDI into the Netherlands, as investors become hesitant to commit capital to a market facing significant trade uncertainties.

-

Analysis of investor statements and reports regarding the trade dispute: Many financial analysts and investment firms have publicly expressed concerns about the negative impact of the trade dispute on the Dutch economy and its stock market.

-

Comparison of the AEX performance with other major European stock markets: The AEX index’s performance is lagging behind other major European stock markets, highlighting the disproportionate impact of the US-Dutch trade dispute on the Netherlands.

-

Discussion of potential long-term implications for FDI: Continued uncertainty could lead to a long-term decline in FDI, hindering economic growth and development in the Netherlands.

The Role of the Euro and Global Economic Uncertainty

The situation is further complicated by the weakening Euro and pervasive global economic uncertainty. The interconnected nature of the global economy means that the US-Dutch trade dispute doesn't exist in a vacuum. The weakening Euro makes Dutch exports more expensive in global markets, exacerbating the negative impact of US tariffs. Global economic slowdowns and uncertainties also reduce overall demand for Dutch products, compounding the problem.

-

Current Euro exchange rate and its impact on Dutch exports: The current Euro exchange rate against the US dollar makes Dutch exports relatively more expensive, reducing their competitiveness in the global marketplace.

-

Global economic growth forecasts and their implications for the Netherlands: Lower global growth forecasts directly impact demand for Dutch goods and services, further straining the already fragile economy.

-

Analysis of the interconnectedness of global trade and the impact of uncertainty: The interconnectedness of global trade means that disruptions in one region inevitably have knock-on effects on other economies. The uncertainty surrounding the US-Dutch dispute adds to broader global economic uncertainty.

Potential Mitigation Strategies for the Netherlands

The Dutch government needs to proactively implement mitigation strategies to lessen the negative effects of the trade dispute. Diversification of export markets, fostering new trade deals, and offering investment incentives are key approaches.

-

Specific examples of government policies aimed at supporting affected industries: The government could offer financial aid, tax breaks, or subsidies to businesses impacted by the tariffs.

-

Discussion of potential alternative export markets for Dutch businesses: Actively exploring and developing new export markets in Asia, Africa, and Latin America could help reduce reliance on the US market.

-

Analysis of the effectiveness of past government interventions in similar situations: Past government interventions in similar economic situations can be analyzed to inform the development of effective policies.

Conclusion

The US-Dutch trade dispute is significantly impacting the Dutch stock market, causing a decline in stock prices due to decreased exports, diminished investor confidence, and broader global economic uncertainties. The situation demands proactive government strategies and a concerted effort towards economic diversification. Failure to address these issues decisively could lead to more severe long-term economic consequences.

Call to Action: Stay informed about the evolving US-Dutch trade dispute and its potential impact on your investments. Monitor market trends closely, and consider diversifying your investment portfolio to mitigate the risks associated with this ongoing trade war. Understanding the complexities of this US-Dutch trade dispute is crucial for making sound investment decisions in this volatile climate.

Featured Posts

-

Us Bands Glastonbury Gig Unofficial Reveal Sparks Fan Frenzy

May 24, 2025

Us Bands Glastonbury Gig Unofficial Reveal Sparks Fan Frenzy

May 24, 2025 -

Zapreschenniy Garazh Istoriya Protivostoyaniya Ryazanova I Tsenzury Pri Brezhneve

May 24, 2025

Zapreschenniy Garazh Istoriya Protivostoyaniya Ryazanova I Tsenzury Pri Brezhneve

May 24, 2025 -

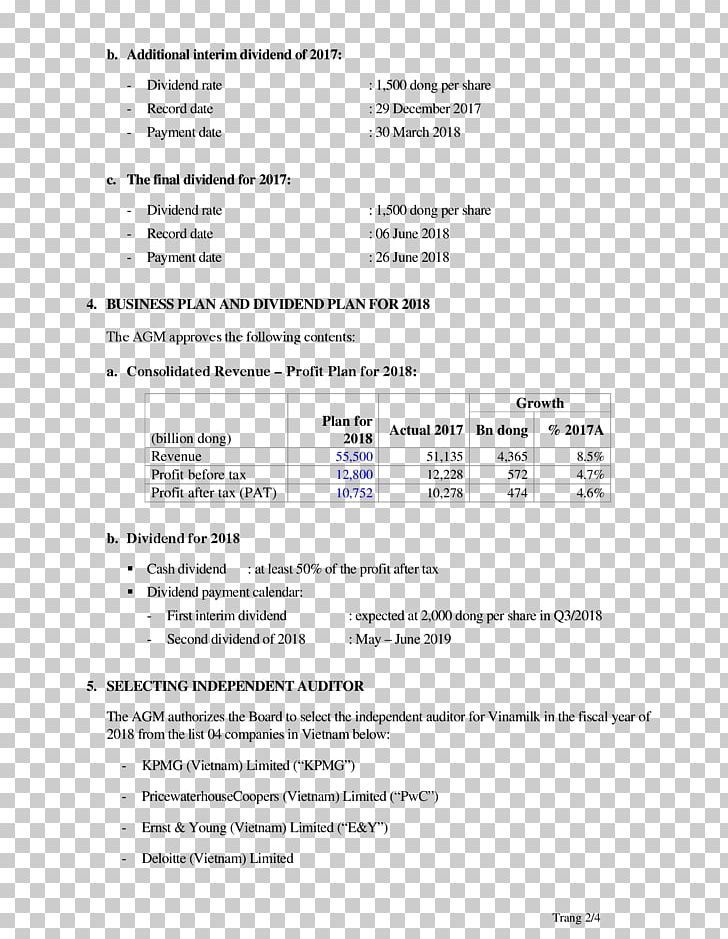

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025 -

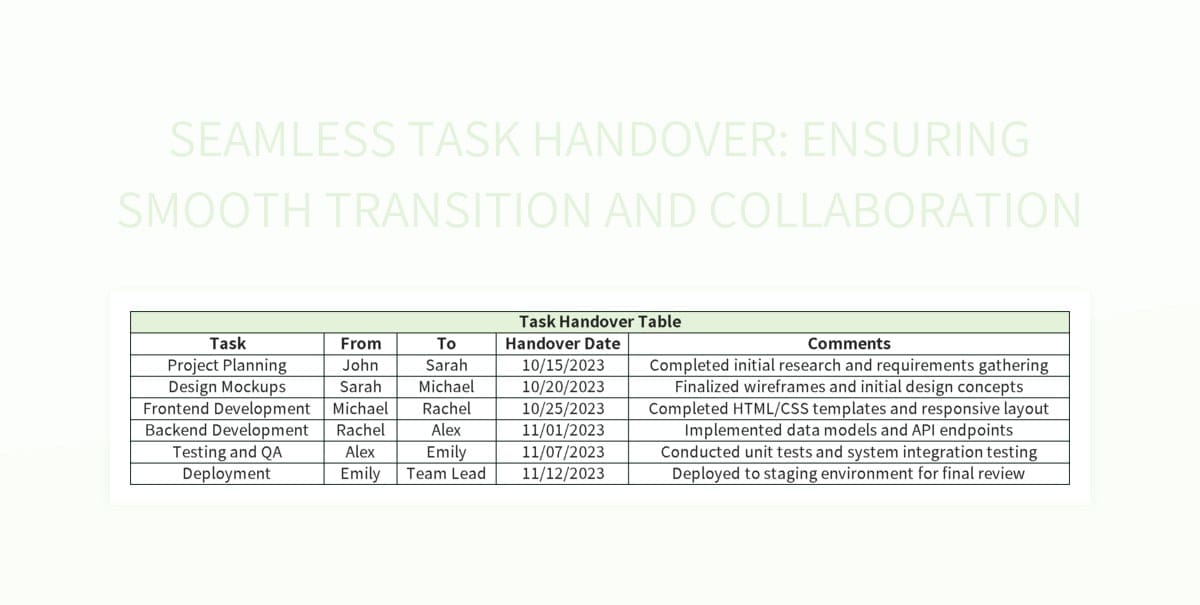

A Relaxing Escape To The Country Considerations For A Smooth Transition

May 24, 2025

A Relaxing Escape To The Country Considerations For A Smooth Transition

May 24, 2025

Latest Posts

-

A Data Driven Look At The Countrys New Business Hot Spots

May 24, 2025

A Data Driven Look At The Countrys New Business Hot Spots

May 24, 2025 -

La Rent Increases After Fires Spark Price Gouging Controversy

May 24, 2025

La Rent Increases After Fires Spark Price Gouging Controversy

May 24, 2025 -

Scrutiny Of Thames Water Executive Bonuses Were They Justified

May 24, 2025

Scrutiny Of Thames Water Executive Bonuses Were They Justified

May 24, 2025 -

Pilbaras Future Rio Tinto Responds To Forrests Wasteland Claims

May 24, 2025

Pilbaras Future Rio Tinto Responds To Forrests Wasteland Claims

May 24, 2025 -

3 Billion Cut To Sse Spending Plan Impact Of Slower Economic Growth

May 24, 2025

3 Billion Cut To Sse Spending Plan Impact Of Slower Economic Growth

May 24, 2025