US Stock Futures Surge On Trump's Powell Remarks

Table of Contents

Trump's Criticism of Powell and the Federal Reserve

President Trump's comments on October 26th were, as usual, highly critical of Federal Reserve Chairman Jerome Powell and the Fed's current monetary policy. He expressed his dissatisfaction with the pace of interest rate cuts, arguing that they were insufficient to stimulate economic growth and maintain a robust stock market. Trump's statements, delivered via various media outlets, directly targeted Powell and the perceived slow response to what the President sees as a looming economic slowdown.

- Specific criticisms: Trump reiterated his belief that the Fed is being too cautious, hindering economic expansion and job creation. He explicitly called for more aggressive interest rate cuts and potentially quantitative easing measures.

- Reasons behind dissatisfaction: Trump's concerns stem from his focus on maintaining strong economic growth leading up to the 2020 presidential election. He views higher interest rates as detrimental to this goal.

- Historical context: Presidential criticism of the Federal Reserve is not unprecedented, though the intensity and frequency of Trump’s attacks have been noteworthy. Past presidents have also expressed their opinions on monetary policy, but the level of public pressure exerted by Trump is often seen as highly unusual.

Market Reaction to Trump's Remarks

The immediate impact of Trump's remarks was a significant surge in US stock futures. Major indices experienced a sharp upward trajectory, reflecting a positive market interpretation of Trump’s comments. The Dow Jones Industrial Average futures, for instance, saw a jump of over 200 points within minutes of the President's statements.

- Percentage increase: The S&P 500 futures rose by approximately 1%, while the Nasdaq futures also registered significant gains.

- Strongest gains: Financials and technology sectors demonstrated particularly strong gains, indicating market optimism regarding potential future stimulus measures.

- Trading volume and sentiment: Trading volumes increased substantially, reflecting heightened market activity and a shift towards bullish sentiment in anticipation of potential policy changes.

Powell's Response and Future Implications

Chairman Powell, as is customary, has maintained a stance of silence in response to Trump's direct criticisms. The Fed generally avoids direct engagement with political figures to preserve its independence and objectivity in making monetary policy decisions. This silence, however, has not prevented market speculation about the Fed's future course of action.

- Powell's past statements on Fed independence: Powell has consistently emphasized the importance of the Fed's independence from political pressure in prior press conferences.

- Potential scenarios: Analysts anticipate that the Fed will carefully consider the economic data before making further adjustments to its monetary policy. Further rate cuts remain a strong possibility, but the timing and magnitude remain uncertain.

- Expert opinions: Many economic experts caution that continued reliance on monetary policy stimulus to counter slower economic growth may lead to unintended long-term consequences, including potential inflation.

Understanding the Volatility of US Stock Futures

The volatility of US stock futures is influenced by a multitude of factors beyond presidential pronouncements. These factors create a complex and ever-changing market environment.

- Key macroeconomic indicators: Data releases such as GDP growth, inflation rates, and employment figures directly impact investor sentiment and trading activity.

- Geopolitical factors: International conflicts, trade wars, and political instability in key regions can significantly influence market movements.

- Strategies for navigating volatility: Diversification of investments, careful risk management, and a long-term investment strategy are essential for mitigating risks associated with market fluctuations.

Conclusion: Analyzing the Surge in US Stock Futures

In conclusion, President Trump's recent criticism of Jerome Powell and the Federal Reserve resulted in a substantial surge in US stock futures. This reaction highlights the significant influence that political rhetoric can have on market sentiment and trading activity. While the market reacted positively to the implied prospect of more stimulative monetary policy, the long-term implications of this interplay remain uncertain. The Fed's commitment to independence, the robustness of the current economic data, and evolving geopolitical dynamics will all play a crucial role in shaping the future trajectory of US stock futures. Stay tuned for further updates on US stock futures and the ongoing dialogue between the President and the Federal Reserve. Understanding the interplay between political statements and market movements is crucial for navigating the complexities of the US stock market.

Featured Posts

-

Los Angeles Wildfires And The Ethics Of Disaster Gambling

Apr 24, 2025

Los Angeles Wildfires And The Ethics Of Disaster Gambling

Apr 24, 2025 -

Federal Investigation Millions Stolen Through Office365 Infiltration

Apr 24, 2025

Federal Investigation Millions Stolen Through Office365 Infiltration

Apr 24, 2025 -

Liams Health Crisis And Hopes Housing Change The Bold And The Beautiful Recap April 3

Apr 24, 2025

Liams Health Crisis And Hopes Housing Change The Bold And The Beautiful Recap April 3

Apr 24, 2025 -

Resistance Mounts Car Dealerships Push Back On Ev Mandates

Apr 24, 2025

Resistance Mounts Car Dealerships Push Back On Ev Mandates

Apr 24, 2025 -

Ai Driven Growth Propels Sk Hynix To Top Dram Market Share Outpacing Samsung

Apr 24, 2025

Ai Driven Growth Propels Sk Hynix To Top Dram Market Share Outpacing Samsung

Apr 24, 2025

Latest Posts

-

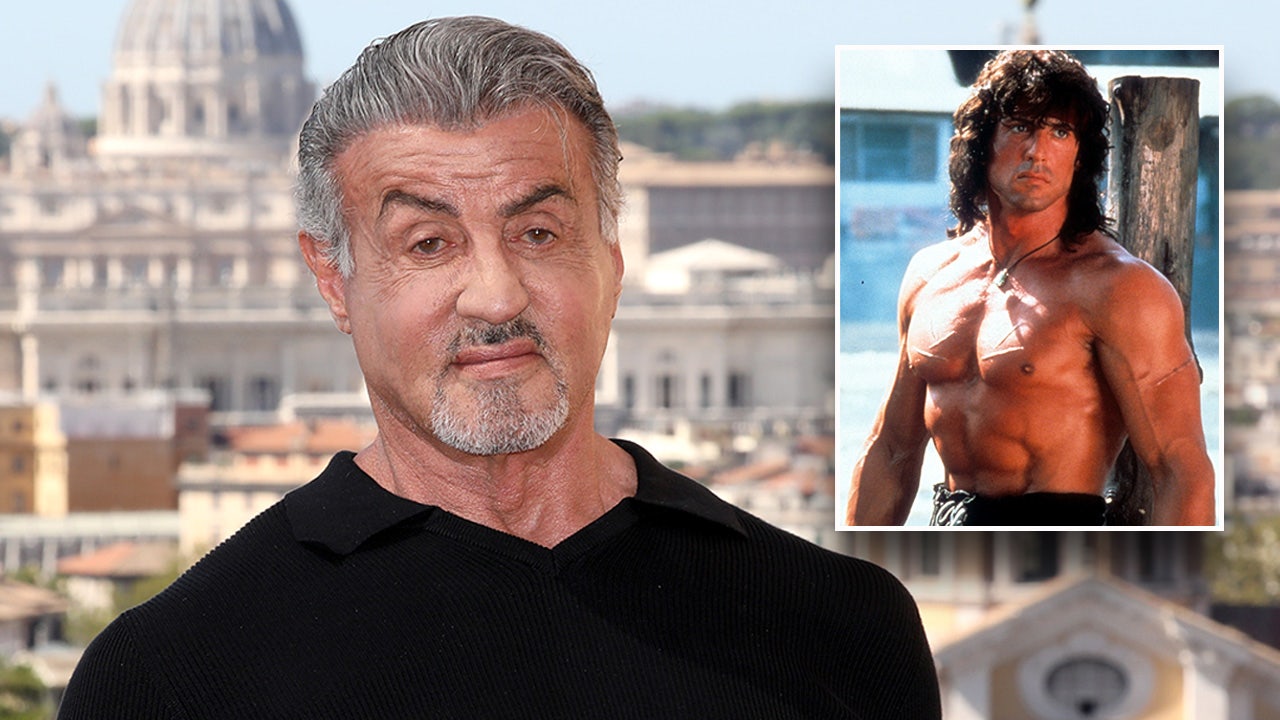

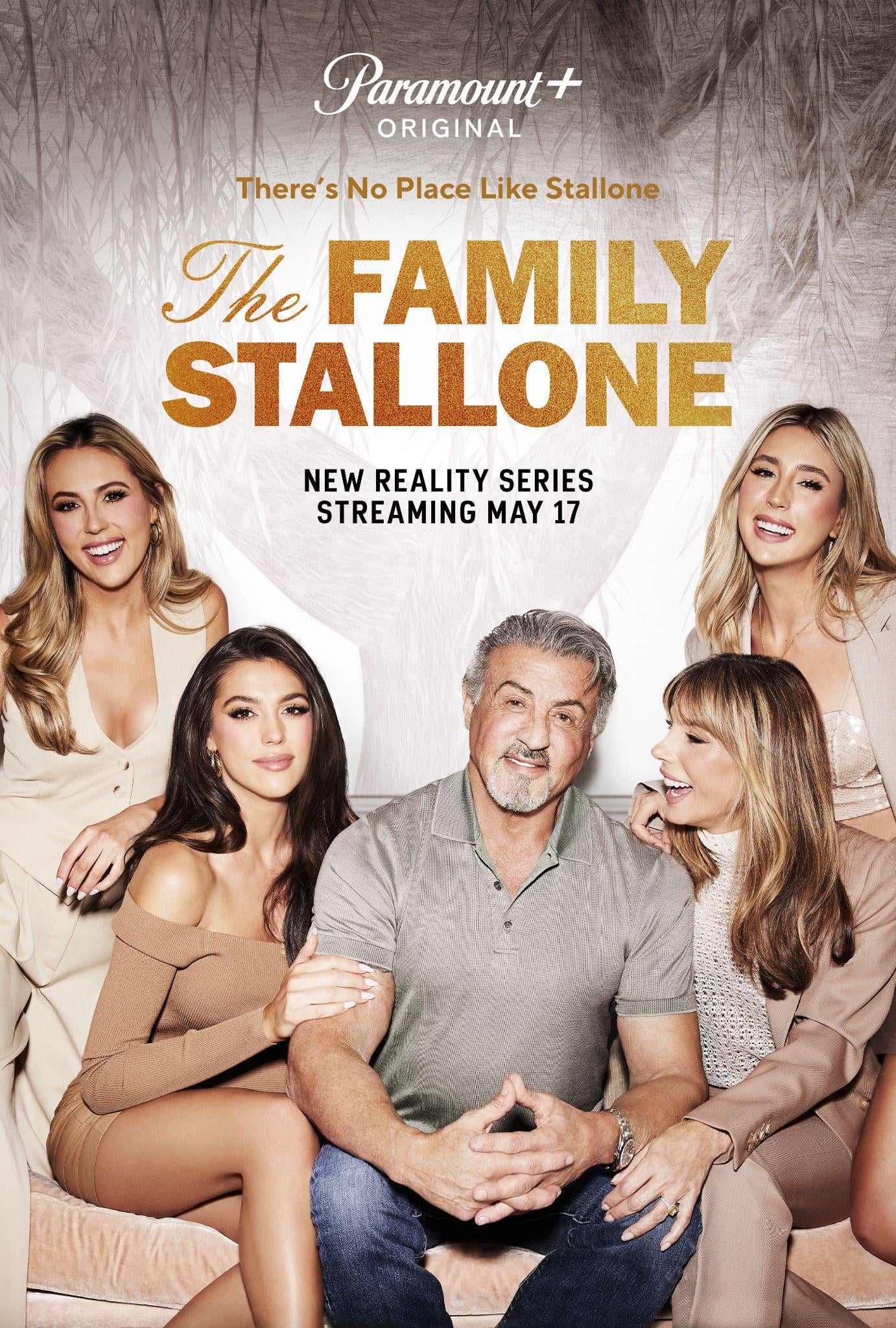

Stallones Almost Made Crime Thriller Sequel A Look Back

May 12, 2025

Stallones Almost Made Crime Thriller Sequel A Look Back

May 12, 2025 -

Revisitando A Adaptacao Em Quadrinhos De Stallone Uma Avaliacao

May 12, 2025

Revisitando A Adaptacao Em Quadrinhos De Stallone Uma Avaliacao

May 12, 2025 -

Cobra Les Regrets De Sylvester Stallone Sur Un Classique Des Annees 80

May 12, 2025

Cobra Les Regrets De Sylvester Stallone Sur Un Classique Des Annees 80

May 12, 2025 -

Sylvester Stallone E A Adaptacao De Quadrinhos Subestimada

May 12, 2025

Sylvester Stallone E A Adaptacao De Quadrinhos Subestimada

May 12, 2025 -

Sylvester Stallone Regrette T Il Cobra Un Thriller Des Annees 80

May 12, 2025

Sylvester Stallone Regrette T Il Cobra Un Thriller Des Annees 80

May 12, 2025