US Tariffs Prompt Brookfield To Re-evaluate Manufacturing Investments

Table of Contents

Brookfield's Significant Manufacturing Portfolio and Exposure to US Tariffs

Brookfield Asset Management, a global alternative asset manager, holds a substantial portfolio of investments in US manufacturing. This exposure makes them highly susceptible to the effects of US tariffs implemented in recent years. Specific sectors significantly impacted include steel, aluminum, and renewable energy—all industries heavily reliant on global supply chains and vulnerable to tariff-related price increases.

- Quantifiable Investment: While precise figures are not publicly available for all their manufacturing holdings, Brookfield's investments in these sectors represent a significant portion of their overall portfolio, amounting to billions of dollars in assets under management.

- Affected Companies: Although Brookfield doesn't publicly list every company affected, its investments in various industrial and energy infrastructure projects inevitably include entities impacted by tariffs on imported materials.

- Types of Manufacturing: The tariffs affect a wide range of manufacturing processes, from the production of steel used in construction projects to the creation of components for renewable energy infrastructure like wind turbines and solar panels. This broad reach emphasizes the systemic nature of the tariff's impact.

The Direct Impact of Tariffs on Brookfield's Investment Returns

The direct financial consequences of US tariffs on Brookfield's bottom line are considerable. Increased input costs due to tariffs on imported materials directly reduce profit margins. Furthermore, reduced global competitiveness due to higher production costs limits their ability to compete effectively in international markets.

- Increased Costs: Tariffs on steel and aluminum, for instance, have directly increased the cost of raw materials for manufacturers in Brookfield’s portfolio, impacting profitability across multiple projects. This translates into higher project costs and potentially lower returns.

- Impact on Profitability: While precise figures are unavailable for competitive reasons, analysts suggest a notable negative impact on Brookfield’s overall profitability, potentially impacting shareholder returns and future investment strategies.

- Job Losses and Restructuring: The increased costs driven by US tariffs have forced some companies within Brookfield's portfolio to consider job losses and restructuring to maintain profitability, a direct consequence of the trade policies.

Brookfield's Re-evaluation Strategies and Potential Mitigation Tactics

In response to the tariff challenges, Brookfield is actively reevaluating its investment strategies. This re-evaluation includes exploring various mitigation tactics to minimize the negative impact of tariffs on their portfolio companies.

- Diversification of Sourcing: Brookfield is likely exploring diversifying its sourcing of raw materials and components, potentially shifting away from tariff-affected countries and looking for alternative supply chains.

- Technological Upgrades: Investing in automation and technological upgrades to improve efficiency and reduce reliance on imported materials is another strategic response. This could lead to a long-term reduction in costs and increased competitiveness.

- Lobbying and Legal Challenges: Like many businesses impacted by tariffs, Brookfield may be engaging in lobbying efforts or exploring legal challenges to address what they perceive as unfair trade practices. This underscores the political and legal dimensions of the issue.

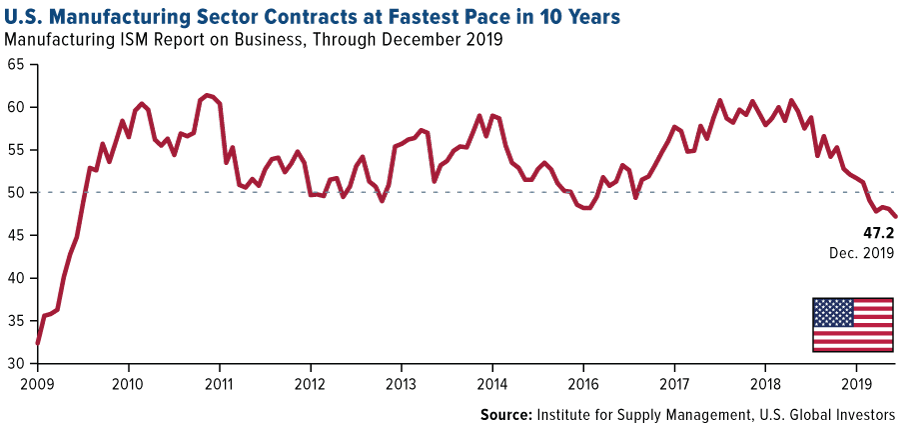

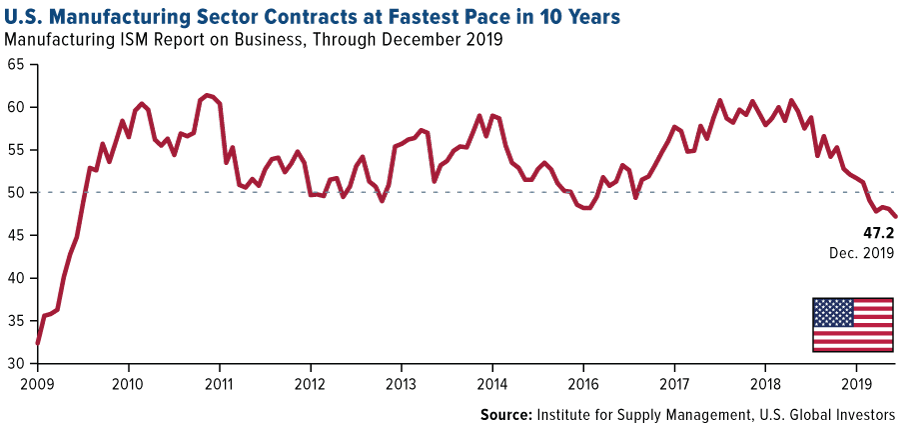

The Broader Implications for Foreign Investment in US Manufacturing

The impact of US tariffs extends far beyond Brookfield. These policies create significant uncertainty for foreign investors considering manufacturing investments in the US. The resulting decreased competitiveness and increased costs create a less attractive investment climate.

- Decline in Foreign Investment: Data suggests a potential decline in foreign direct investment in US manufacturing sectors affected by tariffs, indicating a broader chilling effect on economic growth.

- Long-Term Consequences: The long-term consequences could include reduced job creation in the US, a weakened manufacturing base, and a diminished role for the US in global manufacturing supply chains.

- Expert Opinion: Economists and industry analysts largely agree that US tariffs, while intended to protect certain sectors, have had unintended negative consequences for foreign investment and overall economic growth.

Conclusion

Brookfield's experience with US tariffs highlights the significant impact these policies have on major investors and the broader US manufacturing sector. The direct financial consequences on Brookfield's investments, including increased costs and reduced competitiveness, have prompted a strategic re-evaluation, including diversification and technological upgrades. The broader implications for foreign investment and the overall US economy are substantial, underscoring the need for a careful and comprehensive assessment of US trade policies. Understanding the ramifications of US tariffs and their multifaceted effect on manufacturing investment is crucial for businesses and policymakers alike. Further research into the long-term effects of these tariffs is essential for informed decision-making.

Featured Posts

-

After Celeb Traitors Daisy May And Charlie Cooper Sign On For Bbc Show

May 02, 2025

After Celeb Traitors Daisy May And Charlie Cooper Sign On For Bbc Show

May 02, 2025 -

Is Xrps 400 3 Month Rise Sustainable Investment Analysis

May 02, 2025

Is Xrps 400 3 Month Rise Sustainable Investment Analysis

May 02, 2025 -

Mental Health Literacy Education Empowering Individuals And Communities

May 02, 2025

Mental Health Literacy Education Empowering Individuals And Communities

May 02, 2025 -

Breaking The Silence Dr Shradha Malik On The Importance Of Mental Health Awareness

May 02, 2025

Breaking The Silence Dr Shradha Malik On The Importance Of Mental Health Awareness

May 02, 2025 -

Wednesday April 9th Lotto Results Check The Winning Numbers

May 02, 2025

Wednesday April 9th Lotto Results Check The Winning Numbers

May 02, 2025