Warren Buffett And Apple: Deconstructing A Winning Investment

Table of Contents

Buffett's Shift from Value Investing to a Tech Giant

Understanding Buffett's Traditional Value Investing Approach

Warren Buffett's investment philosophy is deeply rooted in value investing. He famously searches for fundamentally strong companies trading below their intrinsic value – companies with a proven track record, strong cash flow, and a sustainable competitive advantage. He looks for businesses he understands, often with durable moats protecting them from competition. This "buy and hold" strategy, emphasizing long-term growth over short-term market fluctuations, is the cornerstone of his success. Keywords like "undervalued stocks," "intrinsic value," and "long-term investment" are central to this approach.

The Apple Anomaly: A Deviation from Tradition?

Buffett's significant investment in Apple represents a notable departure from his traditional value investing style. Apple, a technology company known for its innovative products and powerful brand, doesn't perfectly fit the profile of the typical Buffett investment. However, the company’s exceptional brand strength, consistent growth, and remarkably loyal customer base attracted the legendary investor.

- Contrast: Unlike Buffett's usual targets – often established businesses in less volatile sectors – Apple operates in a fast-paced, technology-driven industry known for its rapid innovation and disruption.

- Evolving Landscape: The tech industry's evolution, characterized by the emergence of powerful tech giants with enduring market positions, played a significant role in shaping Buffett's strategy.

- Long-Term Growth: The potential for Apple's long-term growth, driven by recurring revenue from services and a vast ecosystem of products, ultimately swayed Buffett's decision. This illustrates an adaptability in his investment style, always seeking long-term value creation regardless of sector.

Analyzing the Apple Investment's Success Factors

Apple's Brand Strength and Customer Loyalty

Apple's unparalleled brand strength and customer loyalty are critical to understanding the success of Buffett's investment. This translates into predictable revenue streams and long-term growth, exactly the kind of stability Buffett prizes. The "Apple ecosystem" creates a sticky environment, ensuring repeat purchases and a constant stream of revenue from services.

Consistent Financial Performance and Growth

Apple’s consistent financial performance is undeniable. Year after year, the company demonstrates strong profitability, impressive revenue growth, and robust cash flow. This predictability is highly attractive to value investors.

- Revenue: Apple's revenue consistently shows impressive growth year over year.

- Profit Margins: Apple maintains exceptionally high profit margins compared to its competitors.

- Cash Flow: The company's strong and consistent cash flow provides ample resources for reinvestment, acquisitions, and shareholder returns.

Effective Management and Innovation

Apple's success is also attributable to its skilled management team and relentless innovation. The company's ability to consistently launch groundbreaking products and services has maintained its competitive edge and fueled continuous growth.

- Product Launches: The iPhone, iPad, and Apple Watch, among others, have revolutionized their respective markets.

- Marketing & Brand Building: Apple's masterful marketing strategies have cultivated a powerful brand image, synonymous with quality, innovation, and desirability.

Lessons for Investors from the Warren Buffett and Apple Success Story

The Importance of Long-Term Perspective

The Warren Buffett and Apple investment highlights the crucial importance of a long-term investment horizon. Patience and a steadfast commitment to a well-researched investment strategy are key to weathering market fluctuations and realizing long-term gains.

Adaptability and Recognizing Evolving Market Dynamics

Buffett’s Apple investment demonstrates the importance of adapting investment strategies to changing market conditions and identifying opportunities in evolving sectors. While adhering to fundamental principles, successful investors need to be open to reconsidering approaches in light of new market realities.

Identifying Companies with Strong Moats

The concept of a "moat" – a sustainable competitive advantage – is central to Buffett’s philosophy. Apple possesses several moats, including its powerful brand, loyal customer base, and innovative ecosystem, providing protection against competition and ensuring long-term success.

- Metrics: Investors should evaluate companies based on metrics such as brand strength, customer loyalty, market share, recurring revenue, and barriers to entry.

- Portfolio Building: A diversified portfolio, including a mix of value and growth stocks, can mitigate risk and optimize returns.

- Competitive Advantages: Seek companies with clear and durable competitive advantages that protect them from disruption.

Conclusion: Unlocking Investment Wisdom from Warren Buffett and Apple

The "Warren Buffett and Apple" investment story reveals several key takeaways: a long-term perspective, adaptability to changing market dynamics, and the identification of companies with strong competitive advantages are crucial for investment success. The success of this investment, seemingly unconventional for Buffett, shows that even the most established investors can adapt and profit from new opportunities.

Invest wisely, invest like Buffett! Learn from the Warren Buffett and Apple investment strategy today! Continue your education on value investing and long-term investment strategies to build a robust and successful portfolio.

Featured Posts

-

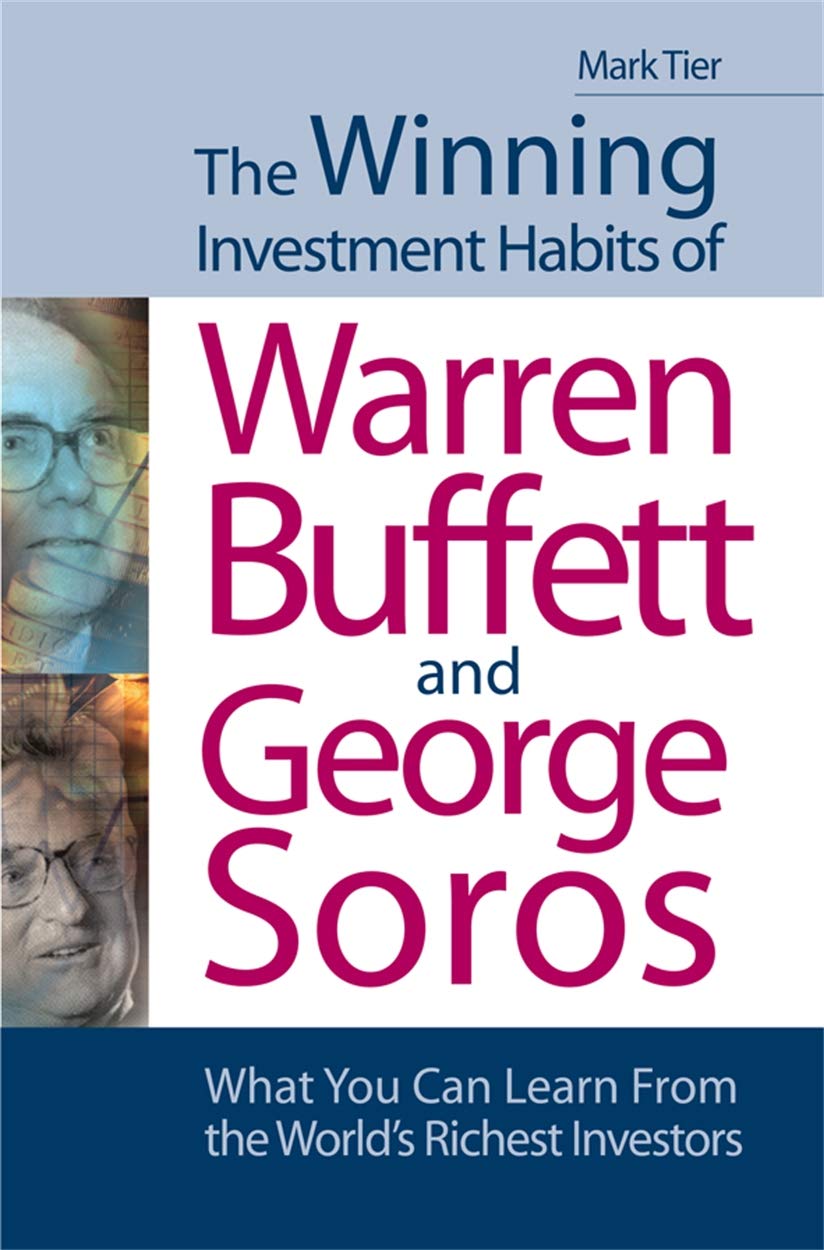

Analysis Dollars Weakness And Asian Currency Fluctuations

May 06, 2025

Analysis Dollars Weakness And Asian Currency Fluctuations

May 06, 2025 -

Maria Shrivers Comments On Patrick Schwarzenegger And His White Lotus Character

May 06, 2025

Maria Shrivers Comments On Patrick Schwarzenegger And His White Lotus Character

May 06, 2025 -

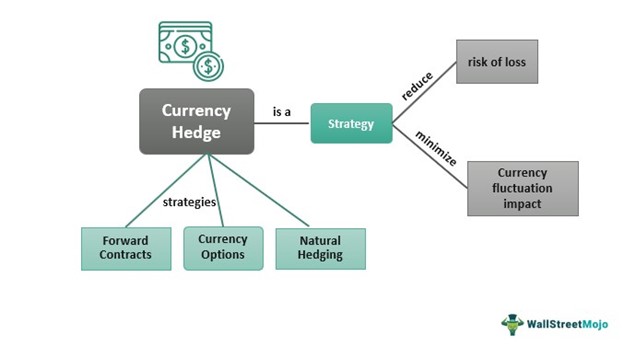

Investigation Into Prolonged Presence Of Toxic Chemicals Post Ohio Derailment

May 06, 2025

Investigation Into Prolonged Presence Of Toxic Chemicals Post Ohio Derailment

May 06, 2025 -

Trumps Trade Agenda A Risk Assessment Amid Economic Uncertainty

May 06, 2025

Trumps Trade Agenda A Risk Assessment Amid Economic Uncertainty

May 06, 2025 -

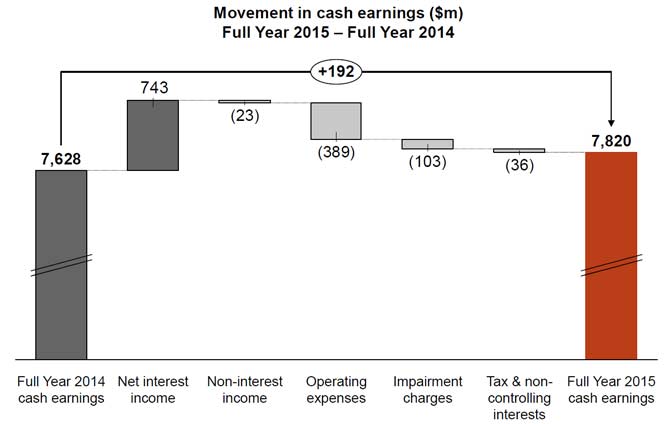

Australian Banking Sector Under Pressure Westpac Wbc Profit Dip

May 06, 2025

Australian Banking Sector Under Pressure Westpac Wbc Profit Dip

May 06, 2025

Latest Posts

-

Amerykanska Armia Otrzyma Trotyl Z Polski

May 06, 2025

Amerykanska Armia Otrzyma Trotyl Z Polski

May 06, 2025 -

Polska Firma Dostarczy Trotyl Dla Amerykanskiej Armii

May 06, 2025

Polska Firma Dostarczy Trotyl Dla Amerykanskiej Armii

May 06, 2025 -

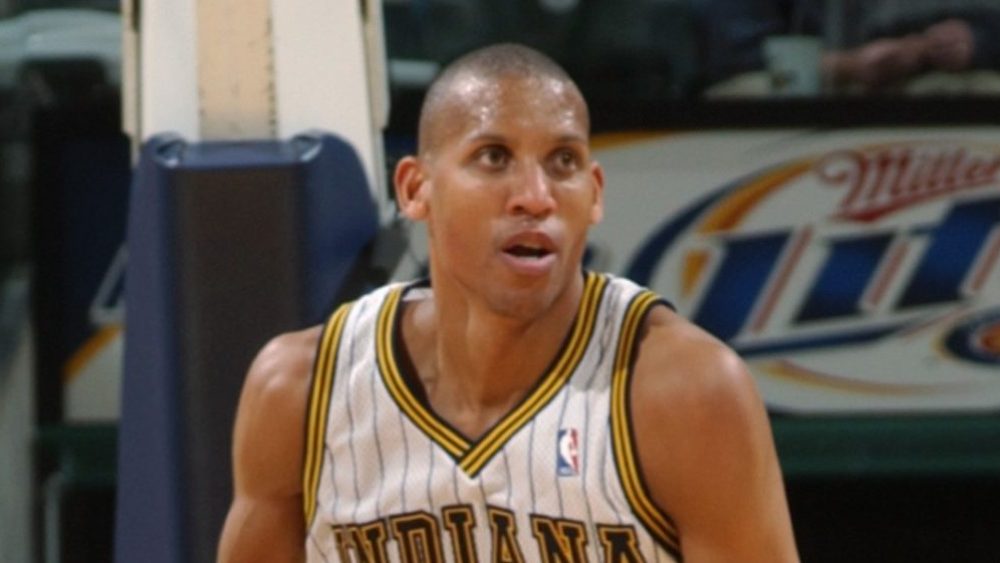

The Future Of Nba Broadcasting Reggie Millers Move To Nbc And What It Means

May 06, 2025

The Future Of Nba Broadcasting Reggie Millers Move To Nbc And What It Means

May 06, 2025 -

Nbcs Nba Coverage Gets A Boost Reggie Miller Takes On Lead Analyst Role

May 06, 2025

Nbcs Nba Coverage Gets A Boost Reggie Miller Takes On Lead Analyst Role

May 06, 2025 -

Nba Broadcast Shakeup Reggie Miller Confirmed As Nbcs Lead Analyst

May 06, 2025

Nba Broadcast Shakeup Reggie Miller Confirmed As Nbcs Lead Analyst

May 06, 2025