What Caused BigBear.ai (BBAI) Stock To Plummet In 2025?

Table of Contents

In 2025, BigBear.ai (BBAI) stock experienced a dramatic plummet, leaving investors reeling. This article delves into the multifaceted reasons behind this significant market downturn, examining both macroeconomic influences and company-specific challenges that contributed to the BBAI stock price crash. We will analyze key factors to understand the volatility and provide insights for future investment decisions related to BBAI stock performance.

Macroeconomic Factors Impacting BBAI Stock Performance in 2025

The Broader Tech Stock Market Correction

2025 witnessed a substantial correction in the technology sector. Rising interest rates implemented by central banks globally to combat inflation significantly impacted tech valuations. These higher rates increased borrowing costs for tech companies, reducing their profitability and making future growth prospects seem less certain. Investors, seeking safer havens, shifted their focus from high-growth, high-risk tech stocks to more stable investments like government bonds.

- Increased Discount Rates: Higher interest rates directly translate to higher discount rates used in financial modeling, reducing the present value of future earnings for tech companies like BBAI.

- Reduced Investor Appetite for Risk: The uncertain economic climate led to decreased risk tolerance among investors, prompting a sell-off in riskier assets, including many tech stocks.

- Market Data: (Insert hypothetical data here, e.g., "The NASDAQ Composite Index fell by X% in the first half of 2025, reflecting the overall tech sector downturn.")

Geopolitical Instability and its Ripple Effect

Geopolitical instability played a significant role in the market's volatility. Increased tensions between major world powers led to uncertainty and reduced investor confidence. This uncertainty impacted global supply chains, potentially affecting BBAI's operations and its ability to deliver projects on time and within budget.

- Supply Chain Disruptions: Potential disruptions to the supply of crucial components or resources could have negatively impacted BBAI's production and profitability.

- Reduced Global Demand: Geopolitical uncertainty can dampen global economic activity, reducing demand for BBAI's data analytics and AI services.

- Increased Operational Costs: Navigating geopolitical complexities often involves increased operational costs for businesses, impacting profitability.

Inflation and its Effect on Consumer Spending and Tech Investment

High inflation in 2025 directly impacted consumer spending and business investment in technology. With increased prices for goods and services, consumers tightened their belts, reducing discretionary spending. Businesses also became more cautious about technology investments, opting for cost-cutting measures rather than expanding their technology budgets.

- Decreased Consumer Discretionary Spending: Reduced consumer spending directly impacted the demand for AI-powered solutions and data analytics services, affecting BBAI's revenue streams.

- Reduced Business Investments: Companies prioritized cost-cutting and operational efficiency, leading to decreased investment in new technologies and services.

- Impact on BBAI Revenue Projections: The combination of reduced consumer and business spending likely resulted in lower-than-anticipated revenue for BBAI in 2025.

Company-Specific Challenges Contributing to the BBAI Stock Decline

Missed Earnings Expectations and Revenue Shortfalls

BigBear.ai (BBAI) likely missed its earnings expectations and experienced revenue shortfalls in 2025. Several factors could have contributed to this, including:

- Decreased Contract Awards: Competition in the AI and data analytics market is fierce. Failure to secure new contracts or delays in existing projects could have significantly impacted revenue.

- Operational Inefficiencies: Internal operational issues, such as difficulties in scaling operations or managing resources effectively, could have led to reduced profitability.

- Financial Data: (Insert hypothetical financial data here, e.g., "Q2 2025 earnings per share (EPS) missed analyst estimates by X%, and revenue fell short by Y%.")

Increased Competition and Market Saturation

The AI and data analytics sector is increasingly competitive. Larger, more established companies with greater resources and market share pose a significant threat to BBAI. The emergence of new competitors further intensifies this pressure.

- Market Share Erosion: The presence of major players likely led to a reduction in BBAI's market share.

- Pricing Pressure: Competition can lead to downward pressure on pricing, reducing BBAI's profit margins.

- Innovation Gap: Failure to innovate and stay ahead of the curve in a rapidly evolving technological landscape could have contributed to the decline.

Concerns Regarding BBAI's Long-Term Growth Strategy

Investor concerns regarding BBAI's long-term growth strategy likely played a role in the stock price decline. This might stem from:

- Technological Limitations: BBAI might have faced challenges in keeping pace with technological advancements in AI and data analytics.

- Market Penetration Difficulties: The company may have struggled to effectively penetrate new markets or expand its customer base.

- Analyst Reports and Investor Comments: (Mention any hypothetical negative analyst reports or investor concerns expressed publicly).

Conclusion

The dramatic decline in BigBear.ai (BBAI) stock in 2025 was a result of a confluence of factors. Macroeconomic headwinds, including a broader tech sector correction, geopolitical instability, and inflationary pressures, significantly impacted investor confidence. Simultaneously, company-specific challenges such as missed earnings, intensified competition, and concerns over BBAI’s long-term growth strategy further exacerbated the situation, leading to the observed stock price plummet.

Call to Action: Understanding the contributing factors to the BBAI stock crash is crucial for informed investment decisions. Continue researching the BigBear.ai (BBAI) stock and its evolving market position to make well-informed decisions about your investment portfolio. Stay updated on BBAI news and financial reports to navigate the volatility of the AI and data analytics sector. Analyzing BBAI's future strategies and the broader economic landscape is key to understanding the potential for future growth or continued decline of the BBAI stock.

Featured Posts

-

Sasol Sol Analyzing The 2023 Strategy Update And Investor Reaction

May 20, 2025

Sasol Sol Analyzing The 2023 Strategy Update And Investor Reaction

May 20, 2025 -

Madrid Open Sabalenka Rallies Past Mertens To Secure Top Spot

May 20, 2025

Madrid Open Sabalenka Rallies Past Mertens To Secure Top Spot

May 20, 2025 -

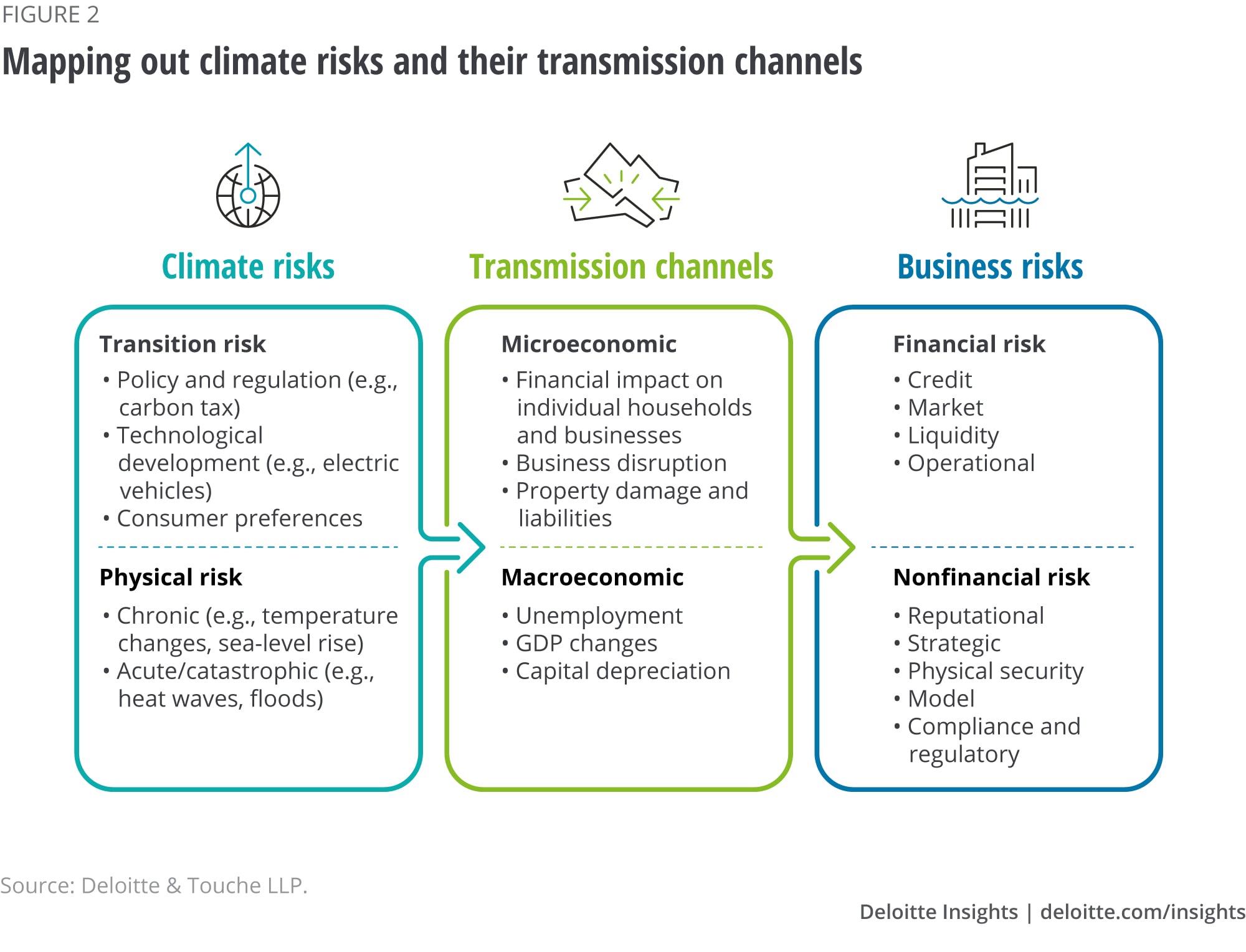

Climate Change And Your Home Loan Understanding The Credit Risk

May 20, 2025

Climate Change And Your Home Loan Understanding The Credit Risk

May 20, 2025 -

New Hmrc Nudge Letters For E Bay Vinted And Depop Users What You Need To Know

May 20, 2025

New Hmrc Nudge Letters For E Bay Vinted And Depop Users What You Need To Know

May 20, 2025 -

L Integrale Agatha Christie Une Exploration De Son Univers

May 20, 2025

L Integrale Agatha Christie Une Exploration De Son Univers

May 20, 2025

Latest Posts

-

Comparing And Contrasting Gangsta Granny With Other Works

May 20, 2025

Comparing And Contrasting Gangsta Granny With Other Works

May 20, 2025 -

Creative Writing Prompts Inspired By Gangsta Granny

May 20, 2025

Creative Writing Prompts Inspired By Gangsta Granny

May 20, 2025 -

David Walliams Comment Leaves Lorraine Kelly Uncomfortable A Tv Moment

May 20, 2025

David Walliams Comment Leaves Lorraine Kelly Uncomfortable A Tv Moment

May 20, 2025 -

The Impact Of Gangsta Granny On Childrens Literature

May 20, 2025

The Impact Of Gangsta Granny On Childrens Literature

May 20, 2025 -

Lorraine Kelly Reacts To David Walliams Controversial Cancelled Remarks

May 20, 2025

Lorraine Kelly Reacts To David Walliams Controversial Cancelled Remarks

May 20, 2025