What Recession? Stock Investors Remain Bullish

Table of Contents

Strong Corporate Earnings and Positive Growth in Specific Sectors

Many companies continue to report strong earnings, defying recessionary predictions. This robust performance, coupled with positive growth in specific sectors, is a major factor contributing to investor bullishness. Analyzing corporate profits and earnings reports provides crucial insight into the overall health of the economy and the resilience of individual companies.

- Many companies continue to report strong earnings, defying recessionary predictions. Despite widespread concerns about an impending recession, numerous companies across various sectors have exceeded earnings expectations, indicating underlying economic strength. This positive performance counters the narrative of a widespread economic collapse.

- Certain sectors, such as technology and healthcare, show robust growth despite broader economic challenges. While some sectors struggle, others experience significant growth, showcasing the uneven impact of economic downturns. The technology sector, driven by innovation and technological advancements, remains a significant growth driver. Similarly, the healthcare sector consistently shows resilience due to the ever-increasing demand for healthcare services.

- Positive consumer spending in key areas indicates resilience in the face of inflation. While inflation remains a concern, consumer spending in certain key areas, such as essential goods and services, remains relatively strong, indicating continued consumer confidence and resilience.

- Examples: Tech giants like Apple and Microsoft continue to post impressive revenue growth, while pharmaceutical companies are benefiting from an aging population and increased healthcare spending. These examples illustrate the continued strength within specific sectors.

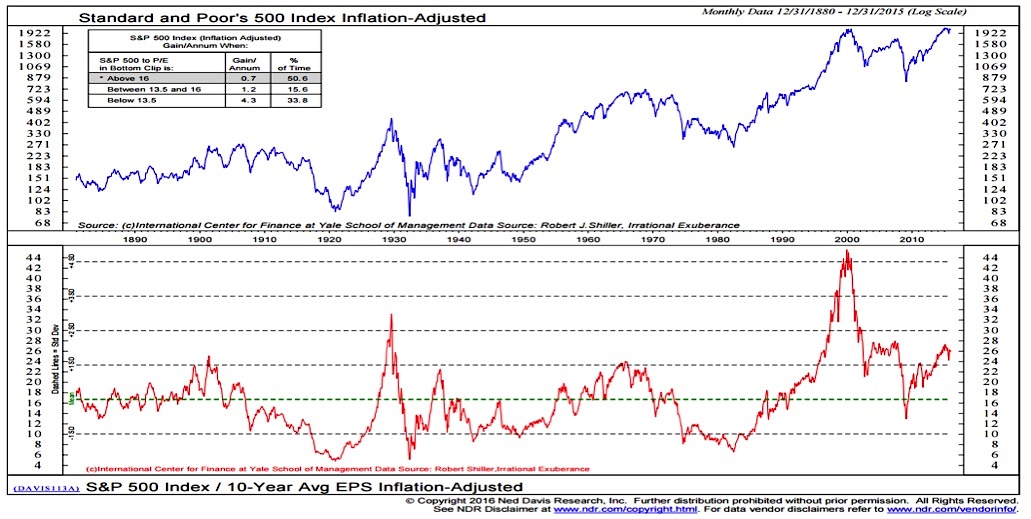

Historical Precedents and Market Resilience

Examining past recessions reveals that stock markets often rebound faster than anticipated. Understanding historical market cycles and investor sentiment during previous economic downturns provides valuable perspective on the current situation. Historical data offers crucial insights into market resilience and the potential for future growth.

- Examining past recessions reveals that stock markets often rebound faster than anticipated. History shows that market downturns, while painful, are often followed by periods of significant growth. This historical precedent suggests that current concerns may be overblown.

- Historical data suggests that periods of economic uncertainty are often followed by strong market growth. The market tends to anticipate future growth, often pricing in potential downturns early. This means that buying during periods of uncertainty can offer significant long-term gains.

- Analysis of investor behavior during previous downturns highlights the importance of long-term investment strategies. Panicking and selling during a downturn often locks in losses. A disciplined, long-term approach is typically more rewarding.

- Historical Examples: The dot-com bubble burst and the 2008 financial crisis both resulted in significant market declines, but were ultimately followed by periods of strong growth. These examples showcase the market’s ability to recover from even severe economic shocks.

Government Intervention and Monetary Policy Influence

Government interventions and monetary policy adjustments can significantly impact investor confidence. The actions of central banks, such as the Federal Reserve, and government fiscal policies play a crucial role in shaping the market outlook and investor behavior. Understanding these interventions is crucial for assessing the overall economic landscape.

- Government interventions and monetary policy adjustments can significantly impact investor confidence. Government stimulus packages and interest rate adjustments directly influence investor sentiment and market activity.

- The Federal Reserve's actions to control inflation and stimulate economic growth play a vital role. The Fed's monetary policy decisions, including interest rate hikes or cuts, significantly impact borrowing costs and investment decisions.

- Analysis of the current monetary policy and its potential effects on the stock market. Current monetary policy focuses on managing inflation, which can lead to short-term market volatility, but can also lay the groundwork for long-term stability.

- Examples: Government infrastructure spending or tax cuts can boost economic activity and investor confidence, while interest rate hikes can curb inflation but potentially slow economic growth.

Long-Term Investment Strategies and Risk Tolerance

Many long-term investors are less concerned by short-term market volatility. Adopting a long-term perspective and implementing robust risk management strategies are key to maintaining a bullish outlook during periods of economic uncertainty. Focus on diversification and asset allocation allows investors to weather market fluctuations.

- Many long-term investors are less concerned by short-term market volatility. Short-term market fluctuations are less relevant to investors with a long-term investment horizon.

- Diversification strategies mitigate risks associated with economic downturns. A diversified portfolio, spread across different asset classes and sectors, reduces the impact of any single sector performing poorly.

- A well-defined investment horizon allows investors to weather market fluctuations. Understanding your investment goals and timeframe allows for a more patient and less reactive approach to market volatility.

- Key elements of successful long-term investment strategies: Regular portfolio rebalancing, consistent investing, and seeking professional advice when needed are all crucial components of a long-term approach.

Conclusion

While recessionary concerns remain, a substantial number of stock investors maintain a bullish outlook due to strong corporate earnings, historical market resilience, government interventions, and the adoption of long-term investment strategies. This optimistic sentiment reflects a belief in the underlying strength of the economy and the potential for future growth. Understanding the nuances of the current market is crucial for navigating potential economic headwinds. Learn more about developing a robust investment strategy that can help you remain bullish even during periods of uncertainty. Stay informed about the latest developments influencing the stock market and adapt your approach accordingly. Don't let recession fears sideline your investment goals; plan strategically and remain bullish on your future financial success!

Featured Posts

-

Stock Market Valuations Bof As Reassurance For Investors

May 06, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 06, 2025 -

Putin Reassures No Planned Use Of Nuclear Weapons In Ukraine

May 06, 2025

Putin Reassures No Planned Use Of Nuclear Weapons In Ukraine

May 06, 2025 -

Arnold Schwarzenegger On Patrick Schwarzeneggers Nude Photography

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nude Photography

May 06, 2025 -

Extreme Price Hike Projected For V Mware Following Broadcom Acquisition

May 06, 2025

Extreme Price Hike Projected For V Mware Following Broadcom Acquisition

May 06, 2025 -

Ai Driven Podcast Creation Transforming Scatological Data Into Engaging Content

May 06, 2025

Ai Driven Podcast Creation Transforming Scatological Data Into Engaging Content

May 06, 2025

Latest Posts

-

Trotyl Polski Nitro Chem Wiodacy Producent W Europie

May 06, 2025

Trotyl Polski Nitro Chem Wiodacy Producent W Europie

May 06, 2025 -

Celebrating 25 Years Tnts Impact Through Max Saya

May 06, 2025

Celebrating 25 Years Tnts Impact Through Max Saya

May 06, 2025 -

Polski Nitro Chem Producent Trotylu O Europejskiej Renomie

May 06, 2025

Polski Nitro Chem Producent Trotylu O Europejskiej Renomie

May 06, 2025 -

Polski Nitro Chem Lider W Produkcji Trotylu W Europie

May 06, 2025

Polski Nitro Chem Lider W Produkcji Trotylu W Europie

May 06, 2025 -

25 Years Of Max Saya Tnts Legacy In The Philippines

May 06, 2025

25 Years Of Max Saya Tnts Legacy In The Philippines

May 06, 2025