Where To Invest: The Country's Rising Business Centers

Table of Contents

Technological Innovation Hubs: Silicon [Country Name]

This section focuses on cities experiencing rapid growth in tech, startups, and related industries. These areas are becoming synonymous with a thriving startup ecosystem, attracting significant venture capital investment and creating numerous high-paying jobs.

-

High concentration of tech talent and universities: Cities like [City Name 1] and [City Name 2] boast top-tier universities producing a steady stream of skilled graduates in computer science, engineering, and other tech-related fields. This readily available talent pool is a major draw for tech companies.

-

Government incentives and funding for tech startups: The government is actively promoting technological innovation through various initiatives, including tax breaks, grants, and incubator programs designed to support startups and foster entrepreneurship. These incentives significantly reduce the financial barriers to entry for new businesses.

-

Strong venture capital presence: A vibrant venture capital scene provides crucial funding for startups at various stages of development. Major VC firms and angel investors are actively seeking investment opportunities in promising tech companies located in these burgeoning hubs.

-

Examples of successful tech companies based in these areas: [Company A], [Company B], and [Company C] are just a few examples of successful tech companies that have chosen to establish their headquarters or major operations in these rising business centers, further solidifying their position as technological powerhouses.

-

Analysis of future growth potential and projected returns: The future growth potential in these tech hubs is immense, driven by continued innovation, expanding digital infrastructure, and increasing demand for technology-driven solutions across various sectors. Investors can expect high returns on investment in this dynamic sector.

Keywords: Tech Hub, Startup Ecosystem, Venture Capital, Technological Innovation, [City Name 1] Tech Scene, [City Name 2] Startups

Booming Logistics and Infrastructure Centers: [City/Region Name]

This section analyzes regions benefiting from strategic infrastructure development, attracting logistics and distribution businesses. The growth of e-commerce has fueled the demand for efficient logistics solutions, making these areas particularly attractive for investment.

-

Strategic location and improved transportation links (roads, railways, ports): [City/Region Name]'s strategic location, coupled with significant investment in modernizing its transportation infrastructure, provides seamless connectivity, facilitating the efficient movement of goods.

-

Government investment in infrastructure projects: Significant government investment in expanding and upgrading roads, railways, and ports has created a robust and reliable infrastructure network, crucial for logistics operations.

-

Growth of e-commerce and the demand for efficient logistics: The booming e-commerce sector is driving unprecedented demand for efficient and reliable logistics solutions. [City/Region Name] is well-positioned to capitalize on this trend, offering ample opportunities for warehouse development and related services.

-

Opportunities for warehouse development and logistics companies: The region offers significant opportunities for the development of modern, state-of-the-art warehouses and distribution centers to cater to the growing demand. This presents attractive investment prospects for logistics companies and real estate developers.

-

Analysis of job creation and economic impact: The expansion of logistics and infrastructure has a significant positive impact on job creation and overall economic growth in the region, making it an attractive destination for both investors and businesses.

Keywords: Logistics, Infrastructure, Supply Chain, E-commerce, Distribution Centers, [City/Region Name] Development, Warehouse Development

Renewable Energy Powerhouses: [Region Name]

This section examines regions leading the way in renewable energy, attracting investments in solar, wind, and other green technologies. The increasing global focus on sustainable development and the transition to clean energy makes this sector a promising investment area.

-

Abundant renewable energy resources (solar, wind, hydro): [Region Name] possesses abundant natural resources suitable for renewable energy generation, including extensive solar irradiance, strong wind resources, and hydroelectric potential.

-

Government support for renewable energy projects: The government's strong commitment to promoting renewable energy through supportive policies, tax incentives, and subsidies makes this region particularly appealing to investors.

-

Growing demand for clean energy solutions: The global demand for clean energy is rapidly increasing, driven by environmental concerns and the need to reduce carbon emissions. This presents a significant opportunity for investors in renewable energy projects.

-

Investment opportunities in renewable energy companies and projects: There are numerous investment opportunities available, ranging from direct investment in renewable energy companies to participation in large-scale solar, wind, and hydro projects.

-

Analysis of environmental and economic benefits: Investing in renewable energy not only provides economic returns but also contributes to environmental sustainability and reduces the carbon footprint, making it a socially responsible investment.

Keywords: Renewable Energy, Green Technology, Solar Power, Wind Energy, Sustainable Investment, [Region Name] Green Energy

Identifying Investment Risks and Mitigation Strategies

Investing in any emerging market carries inherent risks. Understanding and mitigating these risks is crucial for successful investment.

-

Market volatility and economic fluctuations: Market conditions can fluctuate, impacting investment returns. Diversification of investment portfolios can help mitigate this risk.

-

Regulatory changes and policy uncertainties: Changes in government regulations or policies can affect the profitability of investments. Thorough due diligence and staying informed about policy changes are essential.

-

Geopolitical risks: Geopolitical instability or events can negatively impact investments. Careful assessment of geopolitical risks and diversification are crucial strategies.

-

Strategies for due diligence and risk assessment: Conducting thorough due diligence, including market research, financial analysis, and risk assessment, is crucial before making any investment.

-

Diversification of investment portfolios: Diversifying investments across different sectors and geographical locations helps to minimize risk and improve overall portfolio performance.

Conclusion

Identifying the right place to invest is crucial for maximizing returns. This article highlighted several promising rising business centers across the country, offering diverse investment opportunities in technology, logistics, and renewable energy. While potential risks exist, careful planning and risk mitigation strategies can help investors capitalize on the significant growth potential these areas present. Start your research today and discover the best place for your investment in the country’s rising business centers!

Featured Posts

-

O Tzon Travolta Apoxaireta Ton Tzin Xakman Me Sygkinitiki Anartisi

Apr 24, 2025

O Tzon Travolta Apoxaireta Ton Tzin Xakman Me Sygkinitiki Anartisi

Apr 24, 2025 -

Finns Promise To Liam The Bold And The Beautiful Spoilers For Wednesday April 23rd

Apr 24, 2025

Finns Promise To Liam The Bold And The Beautiful Spoilers For Wednesday April 23rd

Apr 24, 2025 -

Improved Trade Relations Boost Chinese Stocks Listed In Hong Kong

Apr 24, 2025

Improved Trade Relations Boost Chinese Stocks Listed In Hong Kong

Apr 24, 2025 -

April 23 Oil Market Report Prices News And Analysis

Apr 24, 2025

April 23 Oil Market Report Prices News And Analysis

Apr 24, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025

Latest Posts

-

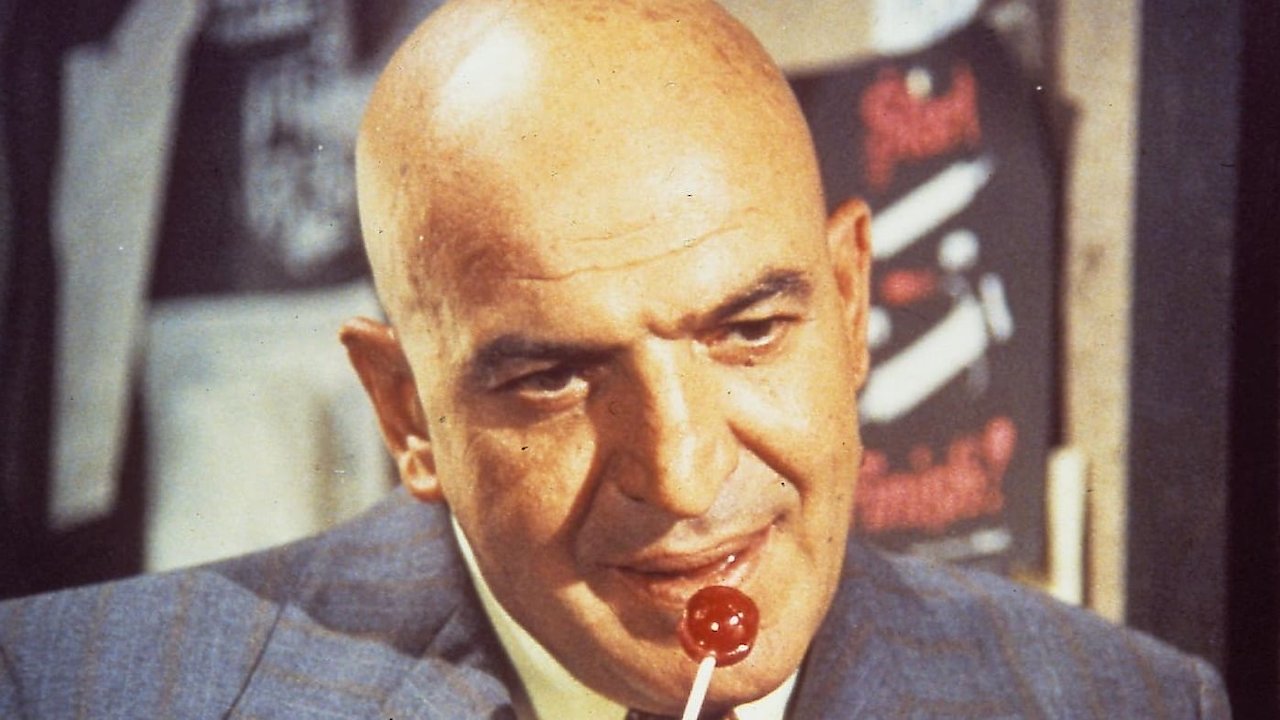

Kojak Full Episode Listings And Air Times On Itv 4

May 12, 2025

Kojak Full Episode Listings And Air Times On Itv 4

May 12, 2025 -

De Schoonheid Van Sylvester Stallones Dochter Foto Gaat Viraal

May 12, 2025

De Schoonheid Van Sylvester Stallones Dochter Foto Gaat Viraal

May 12, 2025 -

Itv 4 Kojak Schedule When And Where To Watch

May 12, 2025

Itv 4 Kojak Schedule When And Where To Watch

May 12, 2025 -

Atelier D Artiste Rencontre Exceptionnelle Avec Sylvester Stallone

May 12, 2025

Atelier D Artiste Rencontre Exceptionnelle Avec Sylvester Stallone

May 12, 2025 -

Beeldschone Foto Van Sylvester Stallones Dochter

May 12, 2025

Beeldschone Foto Van Sylvester Stallones Dochter

May 12, 2025