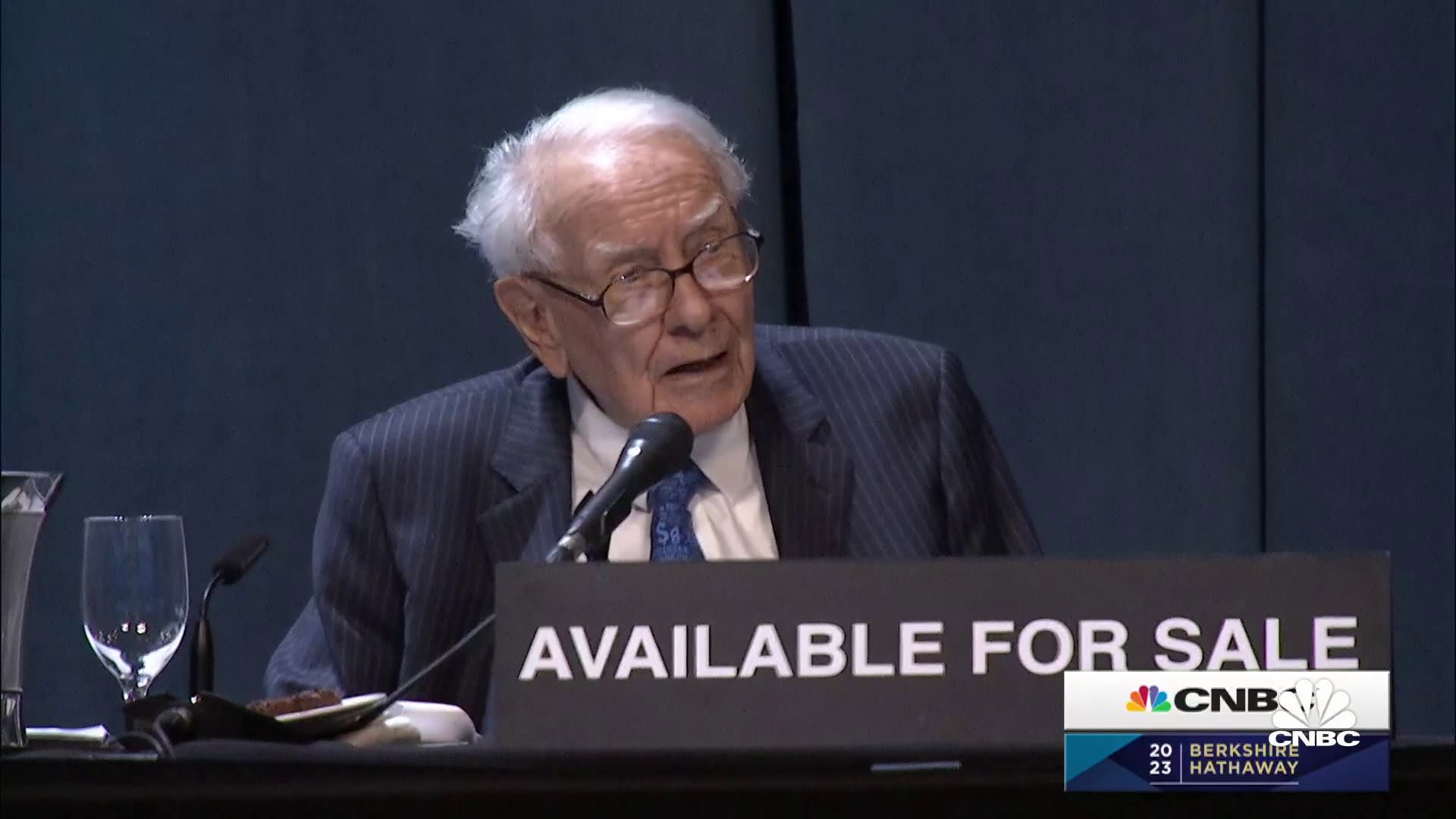

Who Will Succeed Warren Buffett? Examining A Canadian Billionaire Contender

Table of Contents

The Legacy of Warren Buffett and the Challenges of Succession

Buffett's Unparalleled Investment Success and Influence

Warren Buffett's impact on the investment world is undeniable. His value investing strategy, focusing on long-term growth and intrinsic value, has generated extraordinary returns for Berkshire Hathaway shareholders.

- Strategic Acquisitions: Buffett's shrewd acquisitions of companies like Coca-Cola and American Express demonstrate his ability to identify undervalued assets with strong long-term potential.

- Berkshire Hathaway's Growth: Under Buffett's leadership, Berkshire Hathaway transformed from a textile company into a massive conglomerate spanning insurance, railroads, energy, and more, showcasing his exceptional business acumen.

- Long-Term Vision: Buffett's patient, long-term investment approach, often defying short-term market fluctuations, has been a hallmark of his success. His focus on building wealth steadily over decades rather than chasing quick profits is a key lesson for aspiring investors.

Key Qualities Needed in a Successor

Replacing Warren Buffett requires a near-impossible blend of skills and traits:

- Investment Expertise: A deep understanding of financial markets, valuation techniques, and risk management is paramount. The successor needs to be able to identify and capitalize on profitable investment opportunities.

- Strong Leadership Skills: Managing Berkshire Hathaway's diverse portfolio and vast network of businesses necessitates exceptional leadership and the ability to inspire confidence in employees, shareholders, and stakeholders.

- Ethical Conduct: Buffett's reputation for integrity and ethical business practices is integral to Berkshire Hathaway's success. His successor must uphold these same values.

- Long-Term Vision: A commitment to long-term value creation, mirroring Buffett's approach, is crucial for sustainable growth.

- Portfolio Management: The ability to effectively manage a vast and complex portfolio across various industries is essential.

Introducing the Canadian Billionaire Contender: [Billionaire's Name]

Background and Career Highlights

[Replace this section with details about the chosen Canadian billionaire, including their background, key achievements, significant investments, and business ventures. Use bullet points to highlight specific accomplishments and quantify their successes wherever possible. For example: Founded [Company Name] in [Year], which achieved [X% growth] in [Number] years. Successfully invested in [Industry] leading to a [Dollar amount] return.]

Investment Philosophy and Strategy Compared to Warren Buffett’s

[Compare and contrast the Canadian billionaire's investment philosophy and strategy with Warren Buffett's. Identify similarities and differences using specific examples. For example: Both favor long-term investments, but [Billionaire's Name] may show a greater interest in [Specific Investment Area] than Buffett. Quantify the comparisons whenever possible. ]

Leadership Style and Philanthropic Activities

[Discuss the Canadian billionaire's leadership style, company culture, and charitable contributions. Provide concrete examples. For instance: Known for a collaborative management style, fostering innovation within the company. or Significant charitable contributions focused on [Cause] totaling [Dollar amount].]

A Comparative Analysis: [Billionaire's Name] vs. Buffett's Successor Profile

Strengths and Weaknesses of the Canadian Billionaire as a Potential Successor

[Present a balanced assessment of the Canadian billionaire's strengths and weaknesses as a potential successor to Warren Buffett. Back up your claims with evidence and data wherever possible. Use bullet points to list specific strengths and weaknesses, following each with a brief explanation and evidence.]

Areas Where the Canadian Billionaire Excels and Areas for Improvement

[Based on the previous analysis, highlight areas where the Canadian billionaire excels and areas where they could improve to better fit the profile of a successful Warren Buffett successor. Again, use concrete examples to illustrate your points.]

The Probability of the Canadian Billionaire Succeeding Warren Buffett

[Discuss the realistic probability of the Canadian billionaire succeeding Warren Buffett. Consider factors such as market conditions, economic climate, and personal circumstances that could impact their chances. Be realistic in your assessment, avoiding hyperbole.]

Conclusion: The Search for Warren Buffett's Heir Continues – Could a Canadian Billionaire Be the Answer?

This article has explored the monumental task of finding a successor to Warren Buffett and examined the potential of a prominent Canadian billionaire. While no one can perfectly replicate the Oracle of Omaha's success, [Billionaire's Name]'s impressive achievements and strategic investment approach offer compelling reasons for consideration. However, significant challenges remain, particularly in replicating Buffett's unique combination of investment acumen, leadership, and philanthropic commitment. Ultimately, the question of who will succeed Warren Buffett? remains open for debate.

What are your thoughts? Do you think this Canadian billionaire possesses the necessary qualities? Share your opinions and join the conversation! #WarrenBuffettSuccessor #CanadianBillionaire #InvestmentStrategy #[Billionaire'sLastName]

Featured Posts

-

Young Thugs Absence Confirmed No Blue Origin Flight

May 10, 2025

Young Thugs Absence Confirmed No Blue Origin Flight

May 10, 2025 -

Apple And Google An Unexpected Symbiosis

May 10, 2025

Apple And Google An Unexpected Symbiosis

May 10, 2025 -

Greenlands Future Pentagon Weighs Transfer To Us Northern Command Amid Concerns

May 10, 2025

Greenlands Future Pentagon Weighs Transfer To Us Northern Command Amid Concerns

May 10, 2025 -

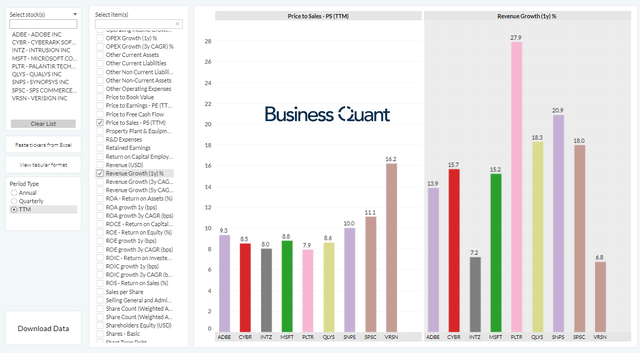

Is Palantir Stock A Good Investment Evaluating The Risks And Rewards

May 10, 2025

Is Palantir Stock A Good Investment Evaluating The Risks And Rewards

May 10, 2025 -

Liberation Day Tariffs The Financial Fallout For Trumps Wealthy Allies

May 10, 2025

Liberation Day Tariffs The Financial Fallout For Trumps Wealthy Allies

May 10, 2025