Why The Fed Is Different: A Look At Interest Rate Policy

Table of Contents

The Fed's Dual Mandate and its Impact on Interest Rate Policy

The Fed operates under a dual mandate: promoting maximum employment and price stability. This differs significantly from many other central banks that primarily focus on price stability alone. This dual mandate significantly influences the Fed's interest rate decisions. For instance, during periods of low inflation but high unemployment, the Fed might opt for lower interest rates to stimulate economic growth and job creation, even if it means slightly higher inflation in the short term. Conversely, during periods of high inflation, the Fed might raise interest rates to curb inflation, potentially slowing economic growth and increasing unemployment.

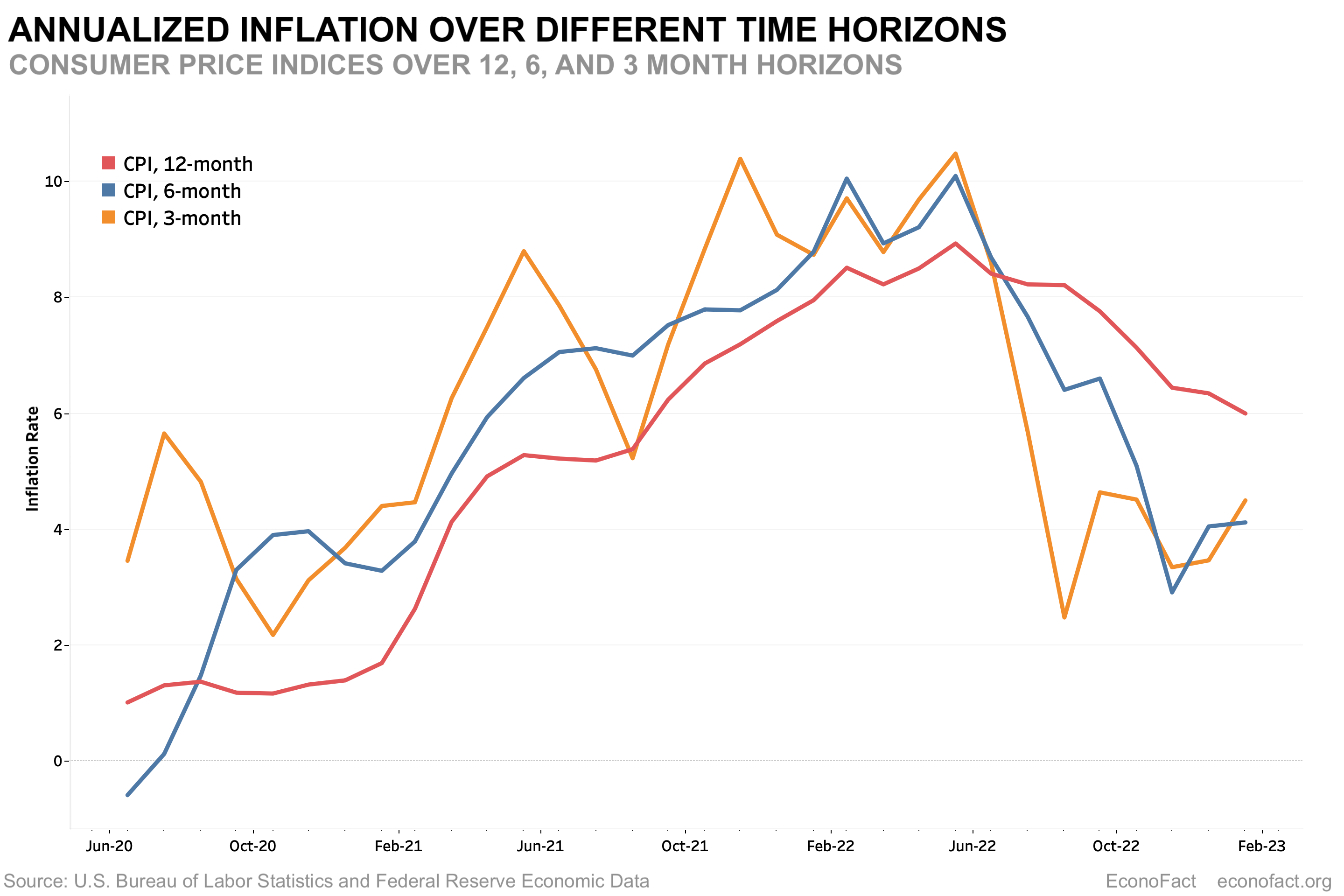

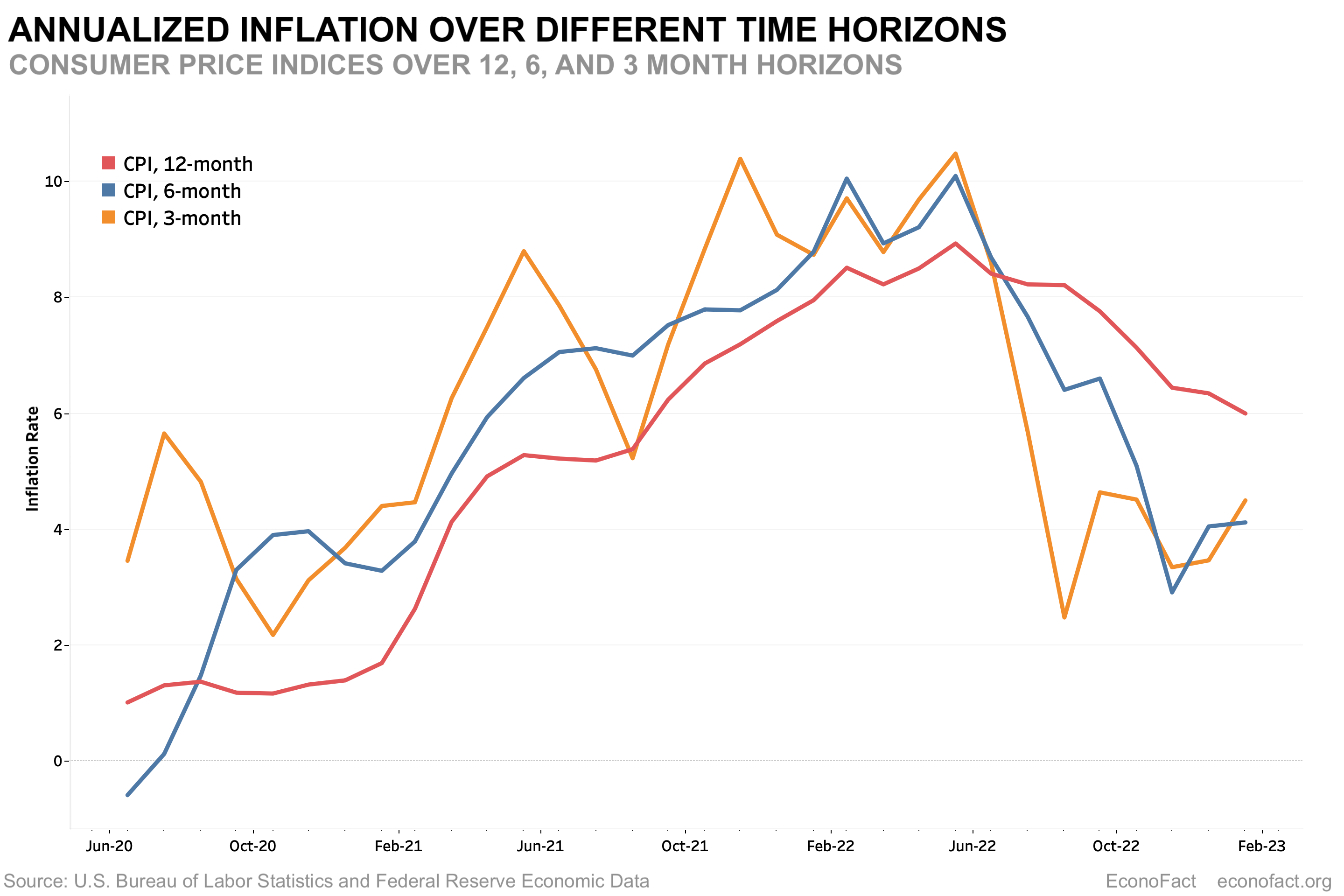

- Examples of how the dual mandate influences rate hikes or cuts: The 2008 financial crisis saw the Fed aggressively cut interest rates to stimulate the economy and combat high unemployment, even with inflationary pressures. Conversely, in the face of rising inflation in 2022, the Fed implemented a series of interest rate hikes despite concerns about potential economic slowdown.

- Challenges in balancing both goals simultaneously: Balancing maximum employment and price stability is a delicate act. Sometimes, policies aimed at boosting employment might fuel inflation, and vice versa. The Fed constantly weighs these competing goals, analyzing economic data and forecasts to make informed decisions.

- Potential conflicts between price stability and employment targets: A classic example of conflict arises when the economy is overheating. High employment and strong economic growth can lead to inflationary pressures, forcing the Fed to choose between sustaining growth or taming inflation via interest rate hikes.

Tools Used by the Fed to Influence Interest Rates

The Fed employs several powerful tools to influence interest rates and steer the economy. These include:

-

The federal funds rate: This is the target rate that the Fed sets for overnight lending between banks. By adjusting this rate, the Fed influences borrowing costs across the entire economy. A higher federal funds rate makes borrowing more expensive, slowing down economic activity.

-

Reserve requirements: This refers to the percentage of deposits banks must hold in reserve. Changes to reserve requirements affect the amount of money available for lending, impacting interest rates.

-

Quantitative easing (QE): This unconventional monetary policy involves the Fed purchasing long-term government securities and other assets to increase the money supply and lower long-term interest rates.

-

Reverse repurchase agreements (RRP): This tool allows the Fed to drain liquidity from the banking system, providing a counterbalance to QE and other expansionary policies. The Fed uses RRP to manage the federal funds rate effectively.

-

Explanation of the federal funds rate and its mechanism: The federal funds rate acts as a benchmark for other interest rates in the economy, influencing borrowing costs for consumers and businesses.

-

Description of quantitative easing (QE) and its application: QE is typically employed during periods of economic crisis to inject liquidity into the financial system and lower long-term interest rates.

-

Analysis of the effectiveness of each tool under various economic conditions: The effectiveness of these tools can vary depending on the state of the economy. For instance, QE might be highly effective during a recession but less so during periods of rapid economic growth.

Transparency and Communication in the Fed's Interest Rate Policy

The Fed's commitment to transparency is a hallmark of its interest rate policy. This commitment is reflected in regular communication, press conferences, and the publication of economic forecasts. This transparency aims to manage market expectations and enhance economic stability. The Fed regularly publishes FOMC statements, providing insights into its reasoning and future policy direction. This contrasts with some other central banks that are less forthcoming in their communication.

- Examples of Fed communication strategies (e.g., FOMC statements): The FOMC (Federal Open Market Committee) releases statements after each meeting, explaining its decisions and outlining its outlook for the economy. These statements are closely scrutinized by investors and economists.

- Analysis of the impact of clear communication on market volatility: Transparent communication helps to reduce market uncertainty and volatility, as investors have a clearer understanding of the Fed's intentions.

- Discussion of the potential challenges of maintaining transparency: Maintaining transparency while balancing the need for flexibility can be challenging. Premature disclosure of policy intentions could lead to market manipulation.

The Fed's Independence and its Role in Interest Rate Policy

The Fed's independence from political influence is a critical aspect of its ability to effectively manage interest rate policy. This independence allows the Fed to make decisions based on economic data and analysis, without political pressure. This is crucial because short-term political considerations could undermine long-term economic stability.

- Examples of instances where the Fed's independence was crucial: Maintaining independence during periods of economic crisis, like the 2008 financial crisis, was vital in allowing the Fed to take necessary actions without political interference.

- Discussion of potential risks associated with political interference: Political interference could lead to decisions driven by short-term electoral gains rather than long-term economic considerations.

- Analysis of the long-term implications of maintaining central bank independence: Maintaining the Fed's independence is essential to preserving the credibility and effectiveness of its monetary policy.

Conclusion

The Fed's approach to interest rate policy differs significantly from many other central banks due to its dual mandate, the range of tools it employs, its commitment to transparency, and its independence from political influence. Understanding these unique aspects is critical to comprehending the dynamics of the US economy. The Fed's actions regarding interest rate policy directly impact borrowing costs, investment decisions, and overall economic growth.

Key Takeaways: The Fed's dual mandate, its diverse toolkit including the federal funds rate and quantitative easing, its commitment to transparent communication, and its crucial independence from political pressures collectively shape its unique approach to interest rate policy.

Call to Action: Learn more about how the Fed's unique approach to interest rate policy affects your financial future. Stay informed about upcoming changes in Federal Reserve interest rate decisions and their implications for the US economy and your personal finances. Understanding the impact of interest rate policies is crucial for making informed financial decisions.

Featured Posts

-

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 10, 2025

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 10, 2025 -

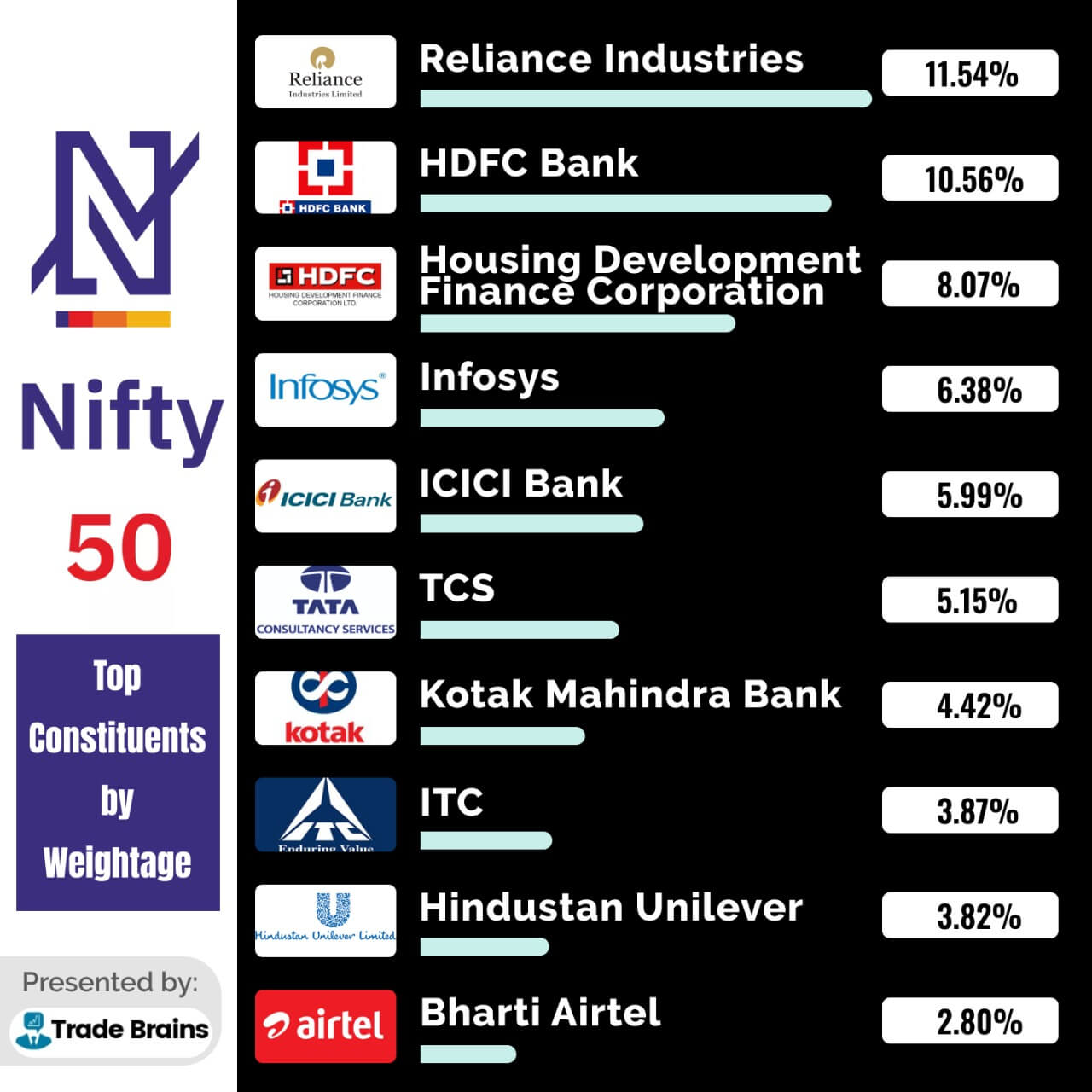

Choppy Trade Flat Finish Analyzing Todays Sensex And Nifty 50 Performance

May 10, 2025

Choppy Trade Flat Finish Analyzing Todays Sensex And Nifty 50 Performance

May 10, 2025 -

Dakota Johnson Suzeidimas Naujos Detales Apie Incidenta

May 10, 2025

Dakota Johnson Suzeidimas Naujos Detales Apie Incidenta

May 10, 2025 -

Brian Brobbeys Strength A Nightmare For Europa League Opponents

May 10, 2025

Brian Brobbeys Strength A Nightmare For Europa League Opponents

May 10, 2025 -

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025