Wildfire Speculation: Examining The Market For LA Disaster Bets.

Table of Contents

Types of Wildfire Bets and Investment Vehicles

Several avenues exist for individuals and institutions to speculate on LA wildfires. These range from sophisticated financial instruments to more direct real estate plays. Understanding the nuances of each is crucial before engaging in any form of wildfire speculation.

Insurance Derivatives

Catastrophe bonds (cat bonds), reinsurance contracts, and other insurance-linked securities (ILS) are designed to transfer wildfire risk from insurers to investors. Cat bonds, for example, pay investors a predetermined return unless a predefined wildfire event occurs, at which point the principal may be lost. Reinsurance contracts, on the other hand, involve transferring a portion of the insurer's risk to a reinsurer.

- Examples: Cat bonds issued by specialized insurance companies, reinsurance contracts with large multinational firms.

- Regulations: These instruments are highly regulated, requiring complex risk assessment and disclosure.

- Risks: While offering potentially high returns, these investments carry significant downside risk, especially if a major wildfire event occurs.

Prediction Markets

While no dedicated prediction market specifically exists for LA wildfires, broader prediction platforms might include relevant events. These markets allow participants to bet on the probability of certain outcomes, influencing the collective wisdom and potentially reflecting emerging wildfire risks. However, biases and manipulation can distort predictions.

- Limitations: Accuracy depends heavily on the quality of information and the participation of informed individuals.

- Biases: Market manipulation or inaccurate information can lead to skewed results.

Real Estate Speculation

Wildfire risk significantly impacts LA real estate prices. Properties in high-risk areas may see decreased values, while those in safer zones could appreciate. Savvy investors might attempt to capitalize on these fluctuations.

- Examples: Buying properties in low-risk zones expecting appreciation, or purchasing high-risk properties at a discount, anticipating future redevelopment or insurance payouts.

- Vulnerable Areas: Areas with significant brush surrounding homes, located in canyons or on hillsides, are particularly susceptible to price changes based on wildfire risk.

Assessing the Risk: Wildfire Probability and Severity in Los Angeles

Accurately assessing the risk of wildfire in LA is critical for anyone considering wildfire speculation. Several factors contribute to the overall risk.

Historical Data Analysis

Analyzing historical wildfire data in LA reveals patterns of frequency, severity, and affected areas. This data, coupled with geographical information, helps to identify high-risk zones. [Insert map/chart showcasing historical wildfire data here. Alt text: Map showing historical wildfire locations and intensity in Los Angeles].

- Key Factors: Wind patterns, vegetation density, drought conditions, and proximity to urban areas.

- Statistical Data: [Insert relevant statistical data here, e.g., average number of wildfires per year, acreage burned, property damage].

Predictive Modeling and Forecasting

Sophisticated models, developed by organizations such as Cal Fire and the National Weather Service, aim to forecast wildfire risk. However, these models have limitations due to the complexity of wildfire behavior.

- Accuracy: While improving, predictive models are not perfect and should be considered alongside historical data and other risk factors.

- Organizations: Cal Fire, the US Forest Service, and various academic institutions contribute to wildfire risk assessment in LA.

Ethical Considerations and Societal Impact of Wildfire Speculation

Profiting from natural disasters raises significant ethical concerns. Wildfire speculation, in particular, presents several challenges.

Impact on Vulnerable Communities

Wildfires disproportionately impact low-income and marginalized communities in LA, who may lack the resources to prepare for or recover from such events. Speculation exacerbates existing inequalities.

- Arguments Against: Profits from disasters are morally questionable, especially when they come at the expense of vulnerable populations.

Moral Hazard

The existence of a market for wildfire bets could incentivize risky behavior, potentially increasing the likelihood of wildfires through negligence or lack of preventative measures.

- Increased Risk: Knowing that insurance or investment payouts might offset losses can reduce the incentive to implement proper fire safety measures.

Regulatory Framework

The current regulatory framework regarding disaster bets is still evolving, requiring further consideration and potential modifications.

The Future of Wildfire Speculation in Los Angeles

The future of wildfire speculation in LA will be shaped by technological advancements, climate change impacts, and community resilience efforts.

Technological Advancements

Improvements in wildfire prediction models, early warning systems, and fire-resistant building materials may alter the investment landscape.

Climate Change Impacts

Climate change is expected to increase wildfire frequency and severity, impacting investment strategies and creating both opportunities and risks for speculators.

Community Resilience Strategies

Community-based efforts to mitigate wildfire risk, such as improved forest management and defensible space creation, could influence the market for wildfire bets.

Conclusion

Wildfire speculation in LA presents a complex interplay of financial opportunity, risk assessment, and ethical considerations. The different types of wildfire bets, ranging from insurance derivatives to real estate speculation, offer various approaches to profit from or hedge against wildfire events. However, the inherent risks and ethical implications require careful consideration. The potential for exacerbating existing inequalities and creating moral hazard demands responsible investment strategies and possibly a more robust regulatory framework. Before engaging in any form of wildfire speculation or LA disaster bets, thorough research and understanding of the inherent risks are paramount. Explore resources from organizations like Cal Fire and FEMA to learn more about wildfire risk mitigation and responsible investing. Don't let the allure of quick profits overshadow the potential for significant losses and the ethical dilemmas associated with profiting from natural disasters. Understand the intricacies of wildfire speculation and make informed decisions.

Featured Posts

-

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025 -

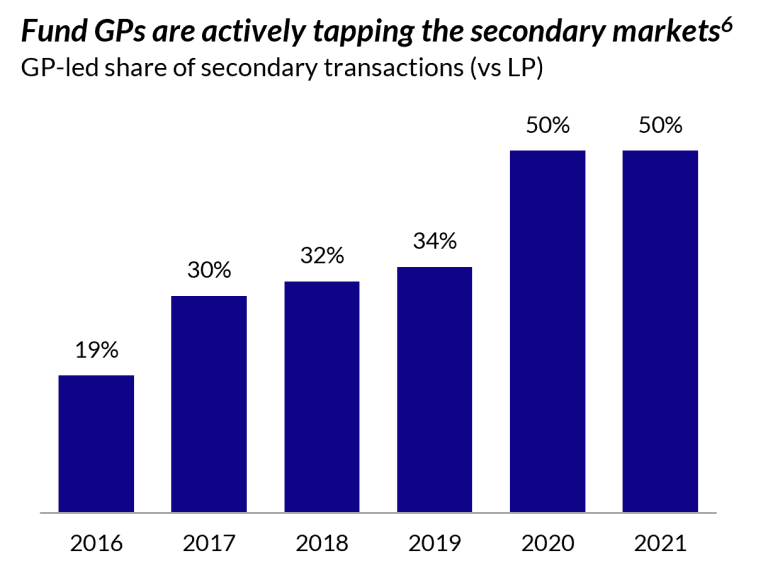

Understanding The Surge In The Venture Capital Secondary Market

Apr 29, 2025

Understanding The Surge In The Venture Capital Secondary Market

Apr 29, 2025 -

North Carolina University Shooting Leaves One Dead Six Injured

Apr 29, 2025

North Carolina University Shooting Leaves One Dead Six Injured

Apr 29, 2025 -

Chicago Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025

Chicago Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025 -

Increased Rent In La After Fires Landlords Under Scrutiny

Apr 29, 2025

Increased Rent In La After Fires Landlords Under Scrutiny

Apr 29, 2025

Latest Posts

-

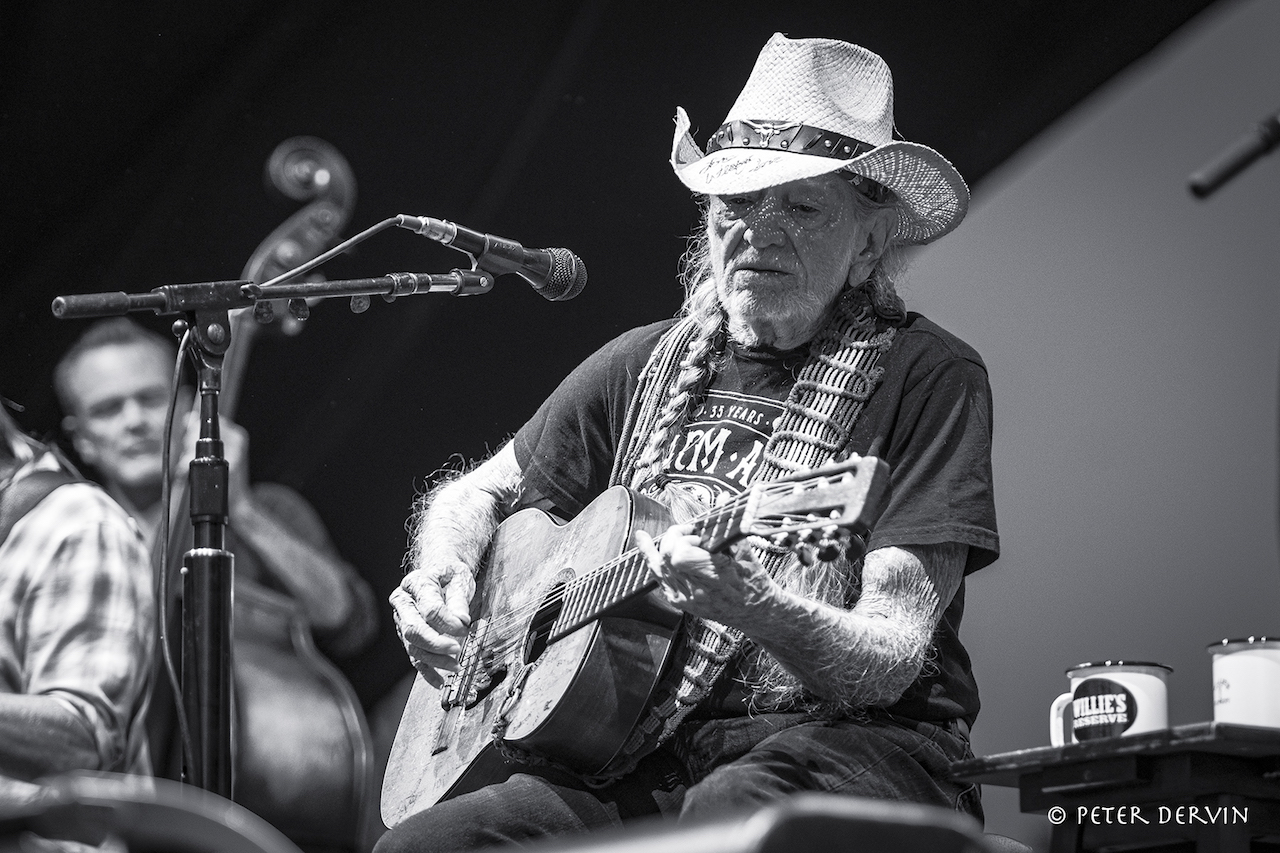

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025 -

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025 -

Quick Facts About Willie Nelsons Life And Career

Apr 29, 2025

Quick Facts About Willie Nelsons Life And Career

Apr 29, 2025 -

Listen Now Willie Nelsons 154th Album Oh What A Beautiful World

Apr 29, 2025

Listen Now Willie Nelsons 154th Album Oh What A Beautiful World

Apr 29, 2025 -

Examining The Post Debt Sale Financials Of Elon Musks X

Apr 29, 2025

Examining The Post Debt Sale Financials Of Elon Musks X

Apr 29, 2025