Will Berkshire Hathaway Sell Apple Stock After Buffett's Departure?

Table of Contents

Buffett's Legacy and Apple's Importance to Berkshire Hathaway

Buffett's investment philosophy centers on identifying fundamentally strong companies with durable competitive advantages and long-term growth potential. His rationale for the substantial Apple investment aligns perfectly with this approach. Apple's brand recognition, loyal customer base, and consistent innovation resonated deeply with Buffett's value-oriented investment strategy. The significant returns Berkshire Hathaway has reaped from its Apple investment further solidify the success of this decision.

- Buffett's Public Statements Regarding Apple: Buffett has consistently expressed his admiration for Apple's business model and management team, publicly praising the company's strong brand and innovative products.

- Strategic Alignment: Apple's strong cash flow, consistent profitability, and global reach perfectly align with Berkshire Hathaway's investment goals of long-term value creation and capital preservation.

- Long-Term Perspective: Buffett's emphasis on long-term investment strategies, rather than short-term market fluctuations, has instilled a patient and enduring approach within Berkshire Hathaway, suggesting a continued holding of Apple stock regardless of short-term market volatility.

Succession Planning at Berkshire Hathaway and its Impact on Apple Holdings

The succession plan at Berkshire Hathaway is a critical factor in determining the future of its Apple holdings. While Buffett's influence is undeniable, the individuals inheriting investment decision-making power will ultimately shape the company's investment strategy. Will they maintain the same unwavering commitment to Apple as Buffett? This remains a key question.

- Key Figures in Berkshire Hathaway's Investment Team: Greg Abel and Ajit Jain are key figures who will play significant roles in shaping future investment decisions. Understanding their investment philosophies is crucial to assessing the potential future of Berkshire Hathaway's Apple investment.

- Public Statements from Successors: Any public statements made by Abel and Jain regarding their views on Apple and Berkshire Hathaway's investment strategy will offer valuable insights into the future of the Apple holdings.

- Potential Shift in Investment Strategy: The possibility of a shift in investment strategy post-Buffett, perhaps towards increased diversification or a different risk appetite, could significantly impact Berkshire Hathaway's Apple holdings.

Apple's Financial Performance and Future Prospects

Apple's current financial health and future growth potential are paramount to Berkshire Hathaway's decision-making process. Is Apple still a strong, stable investment, or are there emerging risks that could warrant a reduction in holdings?

- Recent Financial Reports: Examining Apple's recent financial reports, focusing on revenue growth, profitability, and cash flow, will provide crucial data for assessing its long-term viability.

- Market Analysis and Predictions: Analyzing market predictions and expert opinions on Apple's future performance will help gauge the potential returns and risks associated with maintaining a significant stake in the company.

- Competitive Landscape: Evaluating the competitive landscape and potential threats to Apple's market share (e.g., rising competition from Android devices) is crucial in understanding potential challenges that could impact Apple's future performance.

Alternative Investment Opportunities and Berkshire Hathaway's Diversification Strategy

Berkshire Hathaway's diversification strategy is another factor impacting the future of its Apple holdings. While Apple has been a stellar investment, are there other sectors or companies offering equally compelling opportunities for growth?

- Attractive Investment Sectors: Berkshire Hathaway might seek investments in sectors like renewable energy, healthcare technology, or other high-growth industries that offer diversification benefits.

- Portfolio Rebalancing: The concept of portfolio rebalancing, which involves adjusting the weightings of assets within a portfolio to maintain a desired risk profile, could lead to a reduction in Apple holdings to accommodate other investments.

- Prioritizing Diversification: Berkshire Hathaway's successors might prioritize diversification over maintaining large concentrated positions in individual stocks, leading to a reduction in the Apple stake.

Conclusion: The Future of Berkshire Hathaway's Apple Stock

The question of "Will Berkshire Hathaway Sell Apple Stock After Buffett's Departure?" remains complex and multifaceted. While Buffett's legacy and Apple's strong financial performance suggest continued holdings, succession planning, Apple's future prospects, and Berkshire Hathaway's diversification strategy all play significant roles. The uncertainty underscores the need for continuous monitoring of Berkshire Hathaway's investment decisions and Apple's performance. Stay informed about the evolving situation, and continue researching "Will Berkshire Hathaway Sell Apple Stock After Buffett's Departure?" – check back for future updates on this critical investment story.

Featured Posts

-

Is Elon Musk Abandoning Dogecoin An Analysis

May 25, 2025

Is Elon Musk Abandoning Dogecoin An Analysis

May 25, 2025 -

Is A Us Band Secretly Playing Glastonbury Social Media Explodes

May 25, 2025

Is A Us Band Secretly Playing Glastonbury Social Media Explodes

May 25, 2025 -

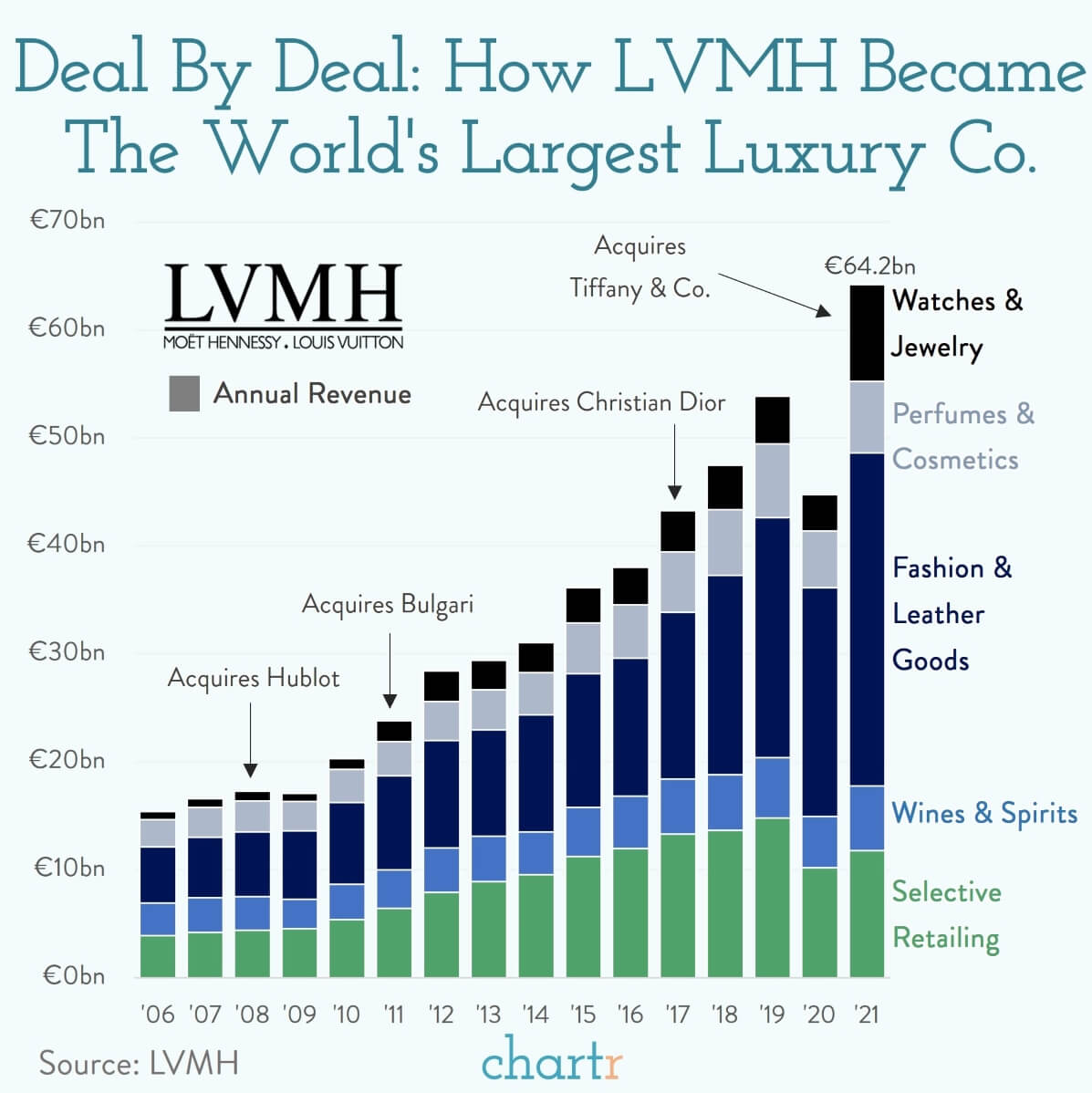

Lvmh Stock Takes A Hit 8 2 Decline Following Q1 Sales Report

May 25, 2025

Lvmh Stock Takes A Hit 8 2 Decline Following Q1 Sales Report

May 25, 2025 -

When To Fly For The Cheapest Memorial Day 2025 Airfare

May 25, 2025

When To Fly For The Cheapest Memorial Day 2025 Airfare

May 25, 2025 -

The Nvidia Rtx 5060 Launch What Went Wrong And What It Means For Gamers

May 25, 2025

The Nvidia Rtx 5060 Launch What Went Wrong And What It Means For Gamers

May 25, 2025

Latest Posts

-

What To Do During A Flash Flood Emergency A Step By Step Guide

May 25, 2025

What To Do During A Flash Flood Emergency A Step By Step Guide

May 25, 2025 -

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025 -

Flash Flood Emergency Causes Effects And Mitigation Strategies

May 25, 2025

Flash Flood Emergency Causes Effects And Mitigation Strategies

May 25, 2025 -

Flood Alerts And Warnings Key Differences And Actions To Take

May 25, 2025

Flood Alerts And Warnings Key Differences And Actions To Take

May 25, 2025 -

How To Recognize And Respond To A Flash Flood Emergency

May 25, 2025

How To Recognize And Respond To A Flash Flood Emergency

May 25, 2025