Will XRP ETFs Disappoint Investors? Analyzing Supply And Demand

Table of Contents

Understanding the XRP Supply Dynamics

XRP's supply dynamics play a crucial role in determining the potential success of XRP ETFs. Analyzing both the current circulation and future releases is vital for predicting price movements and assessing potential risks.

Current XRP Circulation and its Impact

The total supply of XRP is capped at 100 billion tokens. However, the circulating supply, which represents the number of XRP actively in circulation, is a more relevant metric for price analysis. A higher circulating supply can lead to increased selling pressure, potentially impacting the price.

-

Impact of XRP's pre-mined nature on market liquidity: XRP's pre-mined nature means a significant portion of the tokens were released before the public market. This initial distribution can affect liquidity, especially during periods of high trading volume. Understanding this historical distribution is crucial for analyzing current market dynamics.

-

Role of Ripple's XRP holdings and their potential impact on the market: Ripple Labs, the company behind XRP, holds a substantial amount of XRP. Their decisions regarding selling or holding these tokens can significantly influence market sentiment and price stability. Any large-scale releases from Ripple's holdings could create significant selling pressure.

-

Historical price movements in relation to circulating supply: Analyzing past price movements alongside changes in the circulating supply can reveal correlations and help predict future price behavior. This historical analysis provides valuable insights into how the market reacts to changes in XRP's supply.

Future XRP Releases and Their Market Implications

Future releases of XRP, whether planned or unexpected, can significantly influence investor confidence and price stability.

-

Potential for increased selling pressure from future releases: Any additional releases of XRP into the market could increase selling pressure, especially if demand doesn't keep pace with the increased supply. This could lead to downward price pressure and potentially disappoint investors.

-

How market demand might react to predictable or unpredictable XRP releases: The market's reaction will depend on whether the releases are anticipated or surprise the market. Predictable releases might be absorbed more easily, while unexpected releases could trigger volatility.

-

Regulatory factors affecting XRP release schedules: Regulatory developments and court decisions related to Ripple's XRP sales could impact future release schedules and influence investor perception of the asset. This uncertainty adds to the complexity of predicting XRP's future price.

Assessing the Demand for XRP ETFs

The success of XRP ETFs heavily depends on the level of investor demand. Analyzing investor sentiment and assessing the potential for ETF adoption are key to understanding the future outlook.

Investor Sentiment and Market Interest

Current investor sentiment towards XRP and the broader cryptocurrency market plays a critical role in driving demand for XRP ETFs.

-

Role of media coverage and regulatory updates on investor sentiment: Positive news coverage and favorable regulatory developments can boost investor confidence and increase demand. Conversely, negative news or regulatory setbacks can dampen investor enthusiasm.

-

Potential demand from institutional investors versus retail investors: Institutional investors, with their larger capital and sophisticated investment strategies, could significantly contribute to the demand for XRP ETFs. However, retail investor participation is equally important for broader market adoption.

-

Comparative appeal of XRP ETFs versus other crypto ETFs: XRP ETFs will compete with other crypto ETFs for investor capital. The relative appeal of XRP compared to other cryptocurrencies will influence its market share and overall demand.

Potential ETF Adoption and its Impact on Demand

Widespread adoption of XRP ETFs could dramatically increase liquidity and influence XRP's price.

-

Role of accessibility and ease of investment in driving demand: The ease of access to XRP through ETFs could attract a broader range of investors, driving up demand. This accessibility is a key factor in the success of any ETF.

-

Potential price fluctuations based on ETF trading volume: High trading volume in XRP ETFs could lead to increased price volatility, both upwards and downwards. This volatility presents both opportunities and risks for investors.

-

Potential for ETF arbitrage opportunities: Differences in pricing between XRP on exchanges and within ETFs could create arbitrage opportunities, further influencing market dynamics.

Analyzing the Supply and Demand Equilibrium for XRP ETFs

Predicting the future price of XRP and the success of its ETFs requires analyzing the interplay between supply and demand.

Predicting Price Volatility Based on Supply and Demand Interactions

Understanding how supply and demand interact is crucial for forecasting price movements.

-

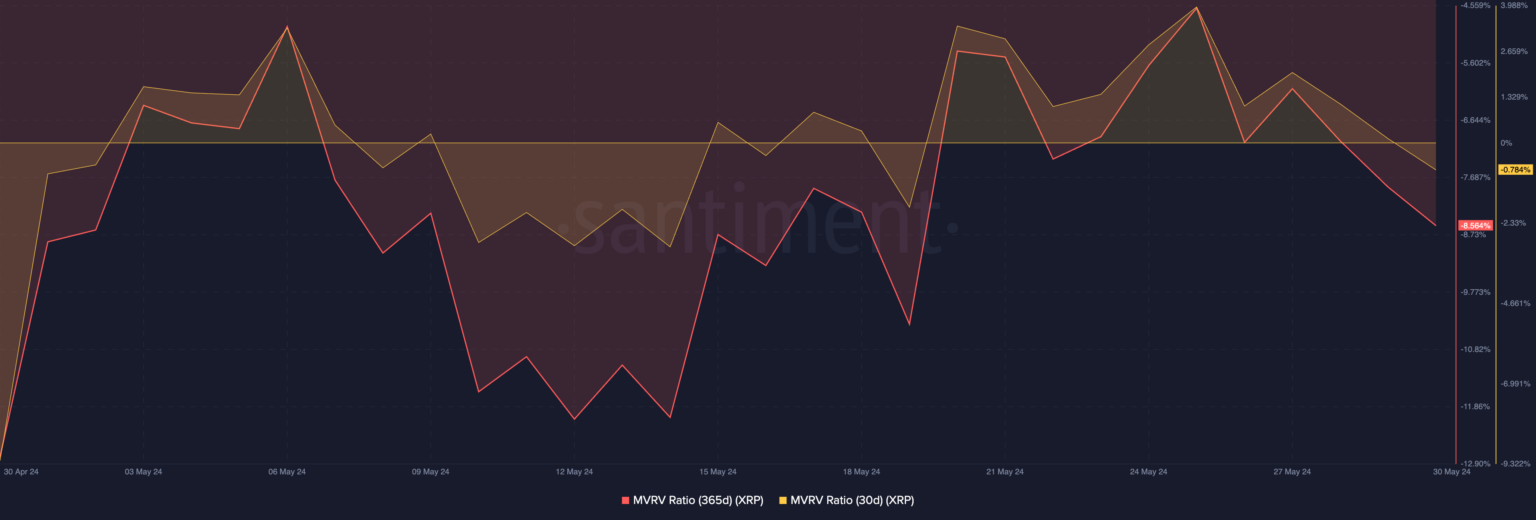

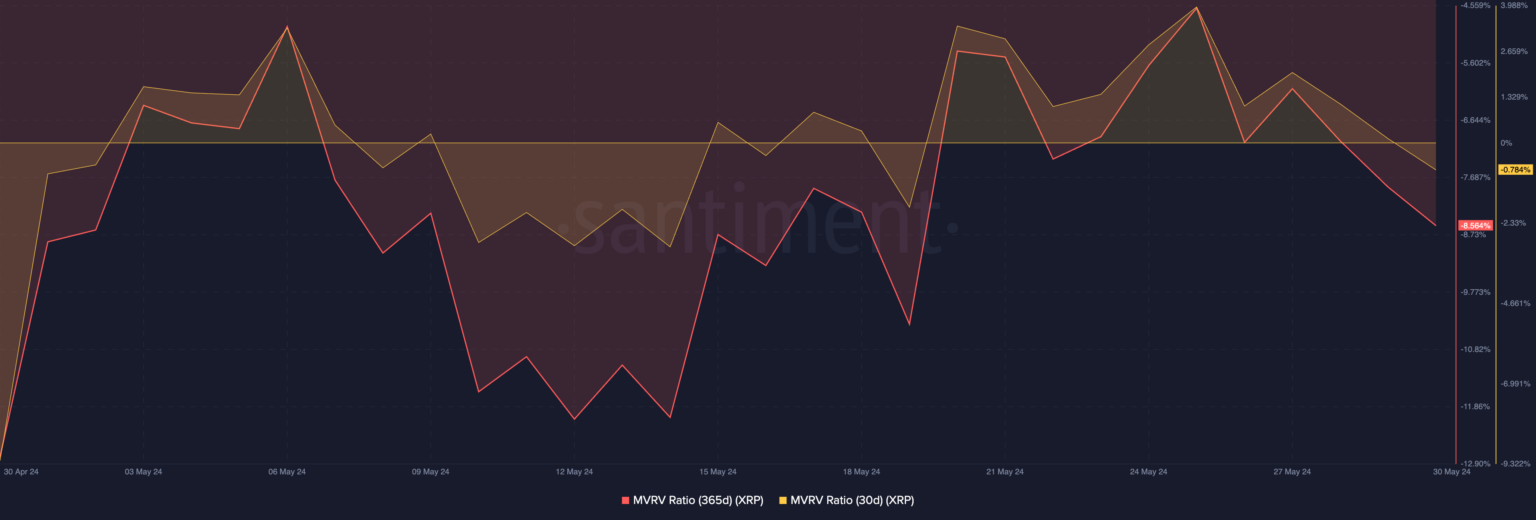

Use charts and graphs to visualize potential price scenarios: Visual representations, such as supply and demand curves, can illustrate potential price scenarios based on different supply and demand levels.

-

Implications of a supply glut or a demand shortage: A supply glut could lead to price declines, while a demand shortage could result in price increases. Understanding these scenarios is crucial for risk management.

-

Use of technical analysis tools in predicting future price movements: Technical analysis tools, such as moving averages and relative strength index (RSI), can provide further insights into potential price trends and volatility.

Risk Assessment for XRP ETF Investors

Investing in XRP ETFs carries inherent risks. Understanding these risks is essential for responsible investing.

-

Importance of diversification in investment portfolios: Diversification is key to mitigating risk. Investing solely in XRP ETFs is not recommended.

-

Potential for losses and the importance of managing risk: Investors should be prepared for the possibility of losses. Effective risk management strategies are crucial.

-

Need for thorough due diligence before investing: Before investing in any XRP ETF, investors should conduct thorough research and understand the risks involved.

Conclusion

The success of XRP ETFs depends on a balanced interplay between supply and demand. While the potential for high returns exists, investors should carefully weigh the associated risks. Thorough analysis of supply dynamics, understanding investor sentiment, and predicting the interaction of supply and demand are vital to mitigating potential disappointments. Before investing in XRP ETFs, conduct comprehensive research and diversify your portfolio to manage risk effectively. Remember to always make informed decisions when evaluating XRP ETFs and other cryptocurrency investments.

Featured Posts

-

Berkshire Hathaways Investment Boosts Japan Trading House Stock Prices

May 08, 2025

Berkshire Hathaways Investment Boosts Japan Trading House Stock Prices

May 08, 2025 -

Cowherds Latest Comments On Jayson Tatum Spark Debate

May 08, 2025

Cowherds Latest Comments On Jayson Tatum Spark Debate

May 08, 2025 -

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025 -

Confrontacion Violenta Entre Jugadores De Flamengo Y Botafogo

May 08, 2025

Confrontacion Violenta Entre Jugadores De Flamengo Y Botafogo

May 08, 2025 -

Rain Delayed Thriller Paris Home Run Lifts Angels Past White Sox

May 08, 2025

Rain Delayed Thriller Paris Home Run Lifts Angels Past White Sox

May 08, 2025