XRP ETF: High Supply And Low Institutional Interest Raise Concerns

Table of Contents

The Abundance of XRP: A Supply-Side Challenge

XRP's massive circulating supply presents a significant challenge to its price stability and, consequently, the attractiveness of an XRP ETF. Unlike Bitcoin with its capped supply, XRP boasts a considerably larger circulating supply, currently exceeding 50 billion tokens. This inherent abundance can lead to price suppression, making it difficult for an XRP ETF to offer the high returns investors typically seek.

- Total XRP supply vs. Bitcoin or Ethereum: XRP's circulating supply dwarfs that of Bitcoin and Ethereum, impacting its price dynamics and market capitalization. This difference significantly impacts the potential for price appreciation.

- Impact of XRP's release schedule on market dynamics: The ongoing release of XRP into the market can put downward pressure on its price, affecting investor confidence and the overall appeal of an XRP ETF.

- Comparison with other cryptocurrencies with similar or lower supply: A comparison with cryptocurrencies possessing a more constrained supply highlights XRP's unique supply-side challenge and its influence on investment strategies.

Large-scale XRP sales by holders could exacerbate this price pressure, creating further volatility and potentially discouraging ETF investment. Managing this supply-side risk is crucial for the viability of any future XRP ETF.

Lack of Institutional Backing: A Hurdle for XRP ETF Adoption

Institutional adoption is paramount for the success of any ETF. However, XRP faces a notable shortfall in this area. Several factors contribute to the relatively low institutional interest:

- Regulatory uncertainty surrounding XRP: The ongoing legal battle between Ripple and the SEC casts a long shadow over XRP's future and its regulatory standing. This uncertainty makes institutional investors hesitant to allocate significant capital.

- Concerns regarding its centralized nature compared to decentralized cryptocurrencies: Unlike fully decentralized cryptocurrencies like Bitcoin, XRP's perceived centralized nature raises concerns among some investors prioritizing decentralization.

- Lack of widespread adoption by major payment processors or financial institutions: Limited integration into mainstream financial systems hinders institutional adoption, as many large institutions require robust infrastructure and widespread usage before considering investment.

Comparing XRP's institutional adoption with that of Bitcoin or Ethereum reveals a significant gap. Bitcoin and Ethereum have garnered substantial institutional backing, a stark contrast to XRP's current situation. For example, major institutional investors like BlackRock have invested heavily in Bitcoin and Ethereum-based products. This lack of institutional interest directly impacts the demand for an XRP ETF.

Regulatory Scrutiny and the Path to an XRP ETF

The legal battles faced by Ripple significantly impact XRP's regulatory landscape and the potential for an ETF. Regulatory clarity is paramount; without it, ETF approval is highly unlikely.

- SEC's stance on XRP and its classification as a security: The SEC's view on XRP's classification as a security remains a major hurdle. A favorable ruling is crucial for future ETF prospects.

- Potential future regulatory changes that might favor XRP: Changes in regulatory frameworks, either in the US or internationally, could create a more favorable environment for XRP ETFs.

- International regulatory frameworks and their approach to cryptocurrencies: The varying regulatory landscapes globally present both opportunities and challenges for the launch of XRP ETFs in different jurisdictions.

Alternative Investment Vehicles and Future Outlook for XRP

Investors seeking XRP exposure can explore alternative avenues outside of an ETF, such as direct purchases through cryptocurrency exchanges. However, the challenges surrounding XRP do not negate its long-term potential.

- Successful resolution of legal battles: A positive resolution of Ripple's legal issues could significantly boost XRP's price and attract institutional investors.

- Increased adoption by financial institutions: Wider adoption by payment processors and financial institutions could propel XRP's value and desirability.

- Development of new use cases for XRP: New applications and use cases for XRP could broaden its appeal and drive demand.

Conclusion: Weighing the Risks and Rewards of an XRP ETF

The high XRP supply and low institutional interest represent substantial obstacles to the successful launch of an XRP ETF. Regulatory clarity is crucial, and the ongoing legal battles surrounding Ripple will significantly influence the future of XRP and its investment prospects. While an XRP ETF presents potential rewards, investors must carefully weigh these against considerable risks. Stay informed about the evolving regulatory landscape and the potential for future XRP ETF launches. Continue your research on XRP and the cryptocurrency market to make informed investment decisions.

Featured Posts

-

Hong Kongs Monetary Policy Significant Interest Rate Cut Following Intervention

May 08, 2025

Hong Kongs Monetary Policy Significant Interest Rate Cut Following Intervention

May 08, 2025 -

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025 -

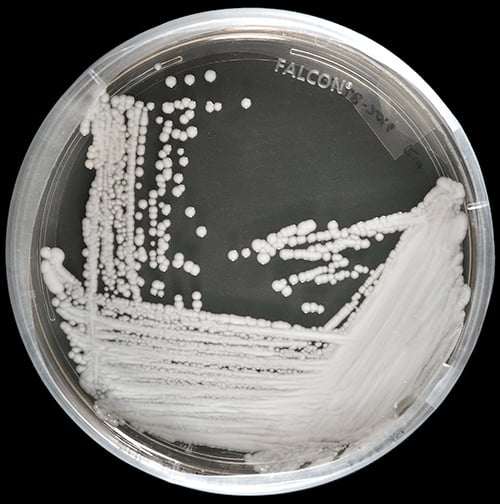

Deadly Fungi The Emerging Superbug Crisis

May 08, 2025

Deadly Fungi The Emerging Superbug Crisis

May 08, 2025 -

Brezilya Da Bitcoin Maas Oedemelerinde Yeni Bir Doenem

May 08, 2025

Brezilya Da Bitcoin Maas Oedemelerinde Yeni Bir Doenem

May 08, 2025