XRP Future: Post-SEC Ruling Price Prediction And Analysis

Table of Contents

The Ripple-SEC Lawsuit: A Recap and its Implications

The protracted legal battle between Ripple Labs and the SEC dominated headlines for years. The lawsuit questioned the classification of XRP as a security, significantly impacting its price and market sentiment.

Key Takeaways from the Ruling:

- The court's decision partially sided with Ripple, ruling that institutional sales of XRP were not securities, while programmatic sales were deemed securities. This created a nuanced legal landscape for XRP.

- The ruling's impact on Ripple's operations is still unfolding. While the immediate threat of a complete shutdown was averted, the company faces ongoing legal challenges and potential future regulatory scrutiny.

- The ruling provided some clarity, but didn't definitively classify XRP as a security or not, leaving lingering uncertainty for investors and regulators alike. This ambiguity continues to influence the XRP price and market sentiment.

Short-Term Market Reactions:

Following the ruling, the XRP price experienced significant volatility. Initially, there was a surge in price, reflecting positive investor sentiment. However, this was followed by periods of consolidation as the market digested the implications of the ruling.

-

Trading volume spiked immediately after the ruling, indicating heightened investor interest and activity.

-

Market sentiment shifted dramatically, moving from uncertainty and fear to cautious optimism, depending on the interpretation of the court's decision.

-

Many exchanges, initially delisting XRP, have since reinstated it, though regulatory considerations vary across different jurisdictions.

-

Positive Consequences: Reduced regulatory uncertainty for some XRP transactions; increased investor interest in the long term.

-

Negative Consequences: Continued regulatory uncertainty remains; lingering legal risks for Ripple and future XRP sales.

-

Impact on Future Regulation: The ruling sets a precedent, but its long-term impact on the regulatory landscape for cryptocurrencies remains uncertain, leading to ongoing volatility in the XRP price.

Factors Influencing Future XRP Price

Several interconnected factors will shape XRP's future price. Understanding these is crucial for any investor attempting to predict the XRP future.

Technological Advancements and Adoption:

Ripple continues to develop its RippleNet platform, focusing on enhancing cross-border payment solutions.

- RippleNet's expanding network of financial institutions demonstrates growing adoption of XRP’s utility in facilitating faster and cheaper international transactions.

- Increased adoption by banks and payment providers could significantly boost demand and the price of XRP. This is a key factor for a positive XRP future.

Market Sentiment and Investor Confidence:

The SEC ruling dramatically shifted market sentiment toward XRP.

- Post-ruling, investor confidence gradually increased, although volatility persists as investors interpret the legal nuances and future regulatory landscape.

- Social media and news coverage play a significant role in shaping investor sentiment, amplifying both positive and negative narratives.

- Large institutional investors' decisions and actions will significantly influence XRP’s price trajectory. Significant institutional adoption could propel its growth.

Regulatory Landscape and Global Adoption:

Global regulatory clarity (or lack thereof) significantly impacts XRP's price.

-

Varying regulatory approaches across different jurisdictions will continue to create complexities and potential challenges for XRP adoption. Navigating these diverse regulatory environments is crucial for Ripple.

-

Regulatory clarity in major markets could unlock significant growth potential for XRP, positively impacting its price. Clearer guidelines contribute to a more stable XRP future.

-

Widespread global adoption of XRP for cross-border payments remains a key driver of its long-term value.

-

Potential Partnerships: Collaborations with other financial institutions or technology companies can increase adoption and positive market sentiment, driving up XRP’s price.

-

Competition: The competitive landscape of cryptocurrencies and blockchain technologies influences XRP’s market share and, subsequently, its price.

-

Long-Term Growth: XRP's long-term potential is tied to its market adoption, the success of RippleNet, and overall cryptocurrency market growth.

XRP Price Prediction Models and Expert Opinions

Predicting the future price of XRP involves combining technical and fundamental analysis and considering expert opinions.

Technical Analysis:

Technical analysis examines price charts and trading volume to identify trends and predict future price movements.

- Chart patterns, support and resistance levels, and various technical indicators (e.g., moving averages, RSI) can provide insights into potential price movements.

- While technical analysis can offer valuable signals, it's crucial to remember that it's not a perfect predictive tool and is subject to market fluctuations.

Fundamental Analysis:

Fundamental analysis focuses on evaluating the underlying value of XRP based on Ripple's operations, technology, and market adoption.

- Assessing Ripple's financial health, its partnerships, and its technological advancements provides insights into the long-term potential of XRP.

- Examining XRP's utility in real-world applications and its adoption rate among financial institutions contributes to a comprehensive fundamental analysis.

Expert Forecasts:

Many cryptocurrency analysts offer forecasts on XRP's future price.

-

It's important to note that these predictions vary widely, reflecting the uncertainty inherent in forecasting cryptocurrency prices.

-

Comparing and contrasting diverse expert perspectives helps gain a more comprehensive understanding of potential scenarios.

-

Disclaimer: All price predictions are speculative and should be treated as such. Past performance is not indicative of future results.

-

Due Diligence: Conduct your own thorough research before making any investment decisions.

-

Responsible Investing: Only invest what you can afford to lose.

Conclusion

The SEC ruling on Ripple has created a complex and dynamic landscape for XRP. While uncertainty remains, the long-term outlook depends heavily on technological adoption, regulatory clarity, and overall market sentiment. While no one can definitively predict the future price of XRP, analyzing the factors discussed above, along with conducting your own thorough research, will aid in making informed investment decisions. Remember to always conduct your own research and manage your risk when considering investing in XRP or any other cryptocurrency. Stay updated on the latest developments regarding the XRP future and the evolving regulatory environment to navigate this exciting but volatile market.

Featured Posts

-

Gillian Andersons X Files Return Fears And Excitement

May 01, 2025

Gillian Andersons X Files Return Fears And Excitement

May 01, 2025 -

Caso Becciu Il Risarcimento Ai Principali Accusatori

May 01, 2025

Caso Becciu Il Risarcimento Ai Principali Accusatori

May 01, 2025 -

69th Eurovision Song Contest Betting Odds And Expert Predictions

May 01, 2025

69th Eurovision Song Contest Betting Odds And Expert Predictions

May 01, 2025 -

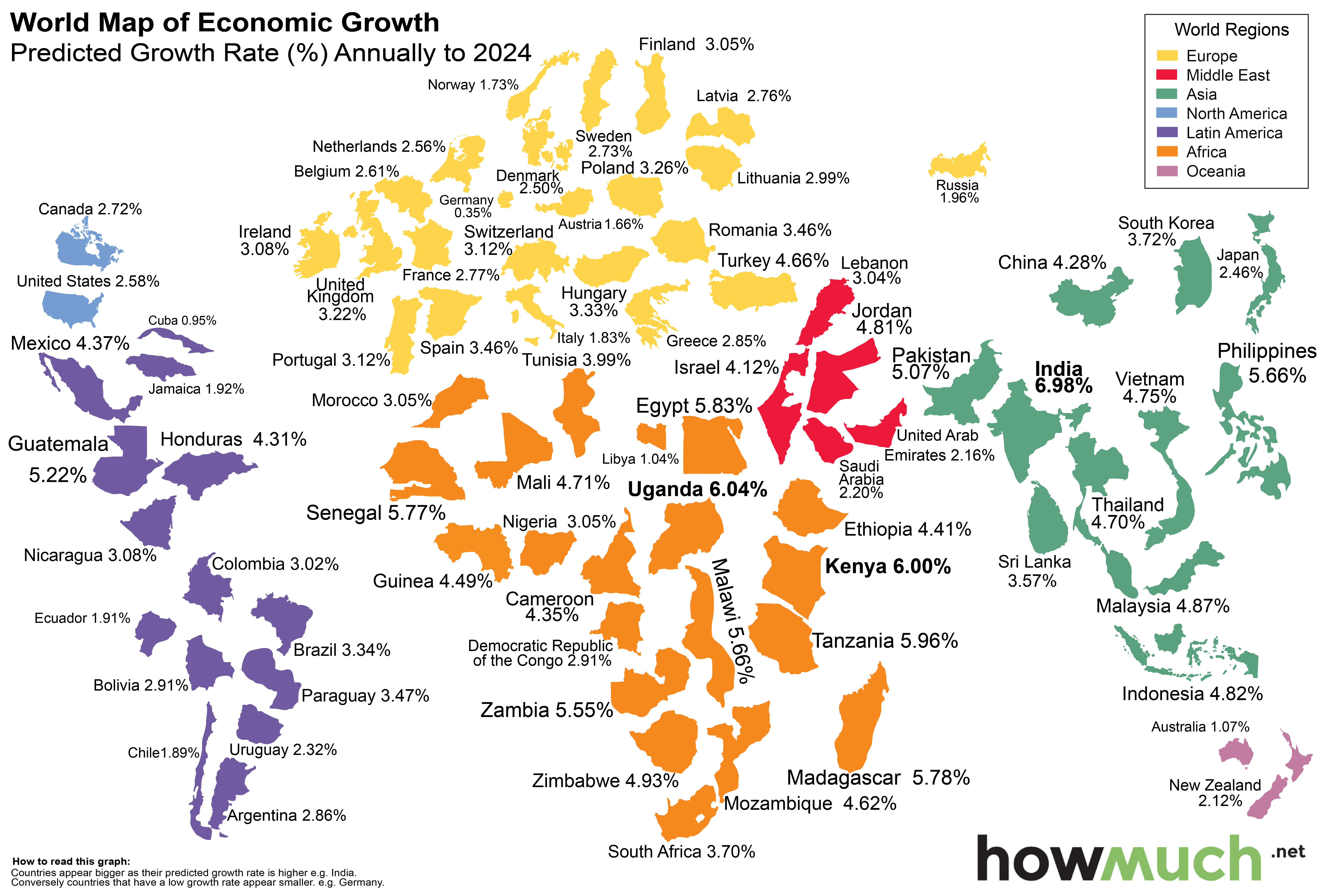

Where To Invest A Map Of The Countrys Top Business Growth Areas

May 01, 2025

Where To Invest A Map Of The Countrys Top Business Growth Areas

May 01, 2025 -

Edward Big Night Leads Minnesota Timberwolves Past Brooklyn Nets

May 01, 2025

Edward Big Night Leads Minnesota Timberwolves Past Brooklyn Nets

May 01, 2025