XRP Holds $2: Reversal Signal Or Short-Lived Rally? Price Prediction Included

Table of Contents

Technical Analysis of XRP's Price Action Around $2

Chart Patterns and Indicators

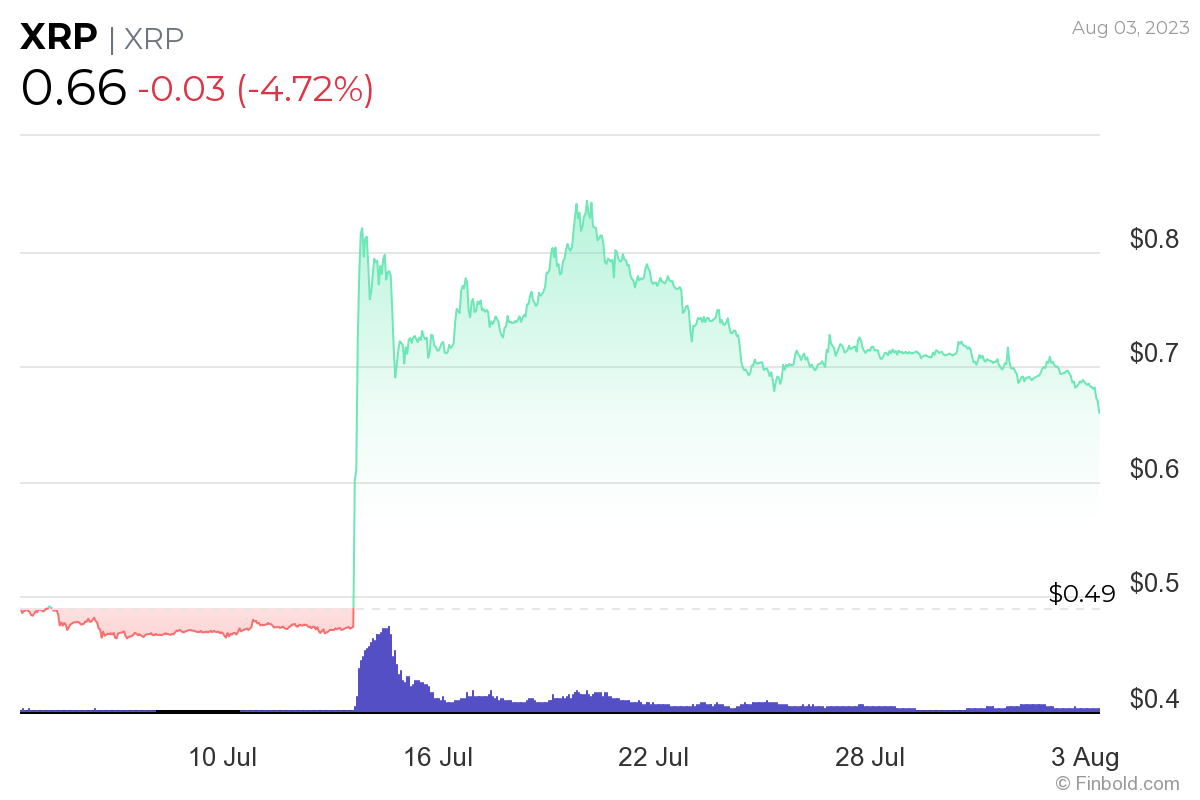

Analyzing XRP's recent price charts reveals some intriguing patterns. Candlestick charts show a potential "double bottom" formation around the $1.80 - $1.90 support level, suggesting a possible reversal. The Relative Strength Index (RSI) has moved above the oversold region (typically below 30), indicating a potential decrease in selling pressure. Conversely, the Moving Average Convergence Divergence (MACD) is still below the signal line, suggesting a bearish trend might persist.

- Potential Double Bottom: The formation of a double bottom is a bullish reversal pattern.

- RSI above Oversold: While above 30, the RSI isn't yet decisively bullish, suggesting caution.

- MACD Below Signal Line: This continues to signal bearish momentum.

[Insert image of XRP chart showing double bottom, RSI, and MACD indicators]

Volume Analysis

Examining trading volume alongside price movements provides further insight. While the price has held around $2, we haven't observed significantly high volume confirming the potential reversal. This suggests that the buying pressure, while present, might not be overwhelmingly strong. High volume accompanying a sustained price increase above $2 would be a more bullish signal.

- Moderate Volume: Current volume levels don't strongly confirm a significant reversal.

- Increased Volume Needed: Higher trading volume is required to validate a sustained upward trend in XRP price.

Fundamental Factors Influencing XRP's Price

Ripple's Ongoing Legal Battle

The SEC lawsuit against Ripple remains a significant factor impacting XRP's price. A favorable outcome could trigger a substantial price surge, while an unfavorable ruling could lead to further price drops. Experts are divided on the likely outcome, with some suggesting a settlement is possible, while others predict a protracted legal battle.

- Potential Outcomes: Settlement, partial victory for Ripple, or a complete SEC victory.

- Price Implications: A positive outcome could send XRP significantly higher; a negative outcome could exacerbate downward pressure.

Adoption and Partnerships

Despite the legal uncertainty, XRP continues to gain traction. Recent partnerships with financial institutions for cross-border payments highlight its potential for real-world application. Increased transaction volume through these partnerships could translate into increased demand and price appreciation.

- Growing Institutional Adoption: Increased use by financial institutions strengthens XRP's fundamental value proposition.

- Increased Transaction Volume: Higher transaction volume suggests growing demand for XRP.

Overall Market Sentiment

The general sentiment towards cryptocurrencies also influences XRP's price. Positive market sentiment tends to boost prices across the board, while negative sentiment can cause significant sell-offs. Social media sentiment, while not always a reliable indicator, can offer a glimpse into overall investor confidence.

- Positive Crypto Market: A bullish crypto market generally benefits XRP.

- Negative Crypto Market: A bearish market can impact XRP negatively, regardless of its fundamentals.

Price Prediction for XRP

Short-Term Prediction (Next 1-3 Months)

Based on the technical and fundamental analysis, we predict a short-term trading range of $1.80 - $2.50 for XRP over the next 1-3 months. A decisive break above $2.50, accompanied by high volume, would signal a stronger bullish trend. Conversely, a fall below $1.80 could indicate further downward pressure.

- Support Level: $1.80

- Resistance Level: $2.50

- Key Factor: Resolution of the SEC lawsuit will significantly influence the price.

Long-Term Prediction (Next 6-12 Months)

The long-term outlook for XRP is heavily dependent on the SEC lawsuit's outcome and broader crypto market adoption. A positive resolution could see XRP reach significantly higher price levels, while a negative outcome could hamper its long-term growth. However, continued institutional adoption and growing usage could still drive price appreciation even in a challenging regulatory environment.

- Positive Regulatory Outcome: Potential for significant price appreciation.

- Negative Regulatory Outcome: Price appreciation will likely be slower and more dependent on adoption.

Conclusion: XRP Holds $2: Final Thoughts and Call to Action

Our analysis suggests that XRP's hold around $2 is a complex situation, influenced by both technical patterns and fundamental factors. The short-term price is likely to remain volatile, depending on the overall crypto market sentiment and the progress of the SEC lawsuit. Long-term prospects, however, remain dependent on a positive resolution and continued adoption. It's crucial to remember that this is just a prediction, and investing in XRP carries inherent risks. Always conduct your own thorough research before investing.

What are your thoughts on the future of XRP? Share your price predictions in the comments below! Stay tuned for more in-depth analyses on XRP price movements and other crypto market trends.

Featured Posts

-

Could Xrp Reach 5 By 2025 Factors To Consider

May 08, 2025

Could Xrp Reach 5 By 2025 Factors To Consider

May 08, 2025 -

Copa Libertadores Liga De Quito Vs Flamengo Termina En Empate

May 08, 2025

Copa Libertadores Liga De Quito Vs Flamengo Termina En Empate

May 08, 2025 -

Cornilles Vs Babouins Qui Possede Les Meilleures Competences Geometriques

May 08, 2025

Cornilles Vs Babouins Qui Possede Les Meilleures Competences Geometriques

May 08, 2025 -

The Biggest Oscars Snubs An Examination Of Controversial Award Decisions

May 08, 2025

The Biggest Oscars Snubs An Examination Of Controversial Award Decisions

May 08, 2025 -

The Post Roe Landscape Analyzing The Significance Of Over The Counter Birth Control

May 08, 2025

The Post Roe Landscape Analyzing The Significance Of Over The Counter Birth Control

May 08, 2025