XRP Price Prediction: Analyzing The $2 Support Level For A Potential Reversal

Table of Contents

The price of XRP, Ripple's native cryptocurrency, has recently experienced significant volatility. A key focal point for investors is the $2 support level – a critical price point that could determine whether XRP rebounds or continues its downward trend. This article provides an in-depth analysis of this crucial level, examining various factors to formulate a comprehensive XRP price prediction. We'll explore technical indicators, market sentiment, and the ongoing legal challenges facing Ripple to paint a clearer picture of XRP's future.

Technical Analysis of the $2 Support Level

Identifying Key Support and Resistance Levels

Analyzing XRP's chart reveals crucial support and resistance levels. The $2 mark acts as a significant support level, and its breach could signal a more substantial price drop. Conversely, a strong bounce from this level suggests buying pressure and potential for a reversal.

- Historical Price Action: Reviewing past XRP price movements around the $2 level shows how it has acted as a support or resistance in the past. This historical data provides valuable insights into its potential strength.

- Volume Analysis: Examining the trading volume at the $2 support level is crucial. High volume accompanying a breakdown below $2 indicates strong selling pressure, while low volume suggests weak support and a potential for a quick recovery.

- Moving Averages & Technical Indicators: Utilizing indicators like the 20-day and 50-day moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can provide additional confirmation of the support level's strength and predict potential breakouts or breakdowns. A bullish crossover of the moving averages could signal a potential uptrend.

Analyzing Trading Volume and Momentum

The interplay between price and volume provides further insights into the strength of the $2 support.

- High Volume Break Below $2: A significant price drop below $2 accompanied by high trading volume indicates strong bearish momentum and a potentially prolonged downtrend.

- Low Volume Bounce from $2: A bounce from the $2 level with low trading volume suggests weak support and a possibility of a further price decline. This indicates that the buying pressure wasn't significant enough to sustain the price.

- Price-Volume Relationship: Analyzing the relationship between price movements and volume provides a more complete picture. For example, strong upward price movements accompanied by high volume confirm buying strength, while weak upward movements with low volume suggest a lack of conviction.

Market Sentiment and Investor Confidence

Assessing Social Media Sentiment

Social media platforms like Twitter and Reddit offer valuable insights into market sentiment. Analyzing the tone of discussions surrounding XRP can reveal shifts in investor confidence.

- Positive vs. Negative Sentiment: Gauging the proportion of positive and negative comments allows us to understand the overall sentiment towards XRP. A preponderance of negative comments often correlates with price declines.

- Sentiment Shifts: Tracking changes in social media sentiment can help anticipate shifts in price. A sudden surge in positive sentiment might precede a price increase.

- Influence of Key Figures: Monitoring comments from prominent crypto influencers and news outlets can significantly affect overall market sentiment and price.

Analyzing News and Events Impacting XRP

News and events significantly influence investor confidence and XRP's price.

- Ripple's Legal Battle: The ongoing SEC lawsuit against Ripple directly impacts XRP's price. A positive outcome could lead to a significant price surge, while a negative ruling could trigger a sharp decline.

- Regulatory Uncertainty: Regulatory clarity or uncertainty around cryptocurrencies plays a vital role. Favorable regulations could boost investor confidence, whereas uncertainty tends to depress prices.

- Partnerships and Collaborations: Announcements of new partnerships and collaborations can positively influence market sentiment and XRP's price.

Ripple's Legal Battle and its Influence on XRP Price Prediction

Potential Outcomes and their Impact on Price

The outcome of the SEC lawsuit against Ripple is a major uncertainty affecting XRP's price.

- Scenario 1: Favorable Ruling: A win for Ripple could lead to a significant price surge due to increased investor confidence and reduced regulatory uncertainty.

- Scenario 2: Unfavorable Ruling: A loss could cause a considerable price drop, potentially impacting XRP's long-term prospects.

- Scenario 3: Settlement: A settlement could lead to price stabilization, but the long-term effects would depend on the settlement terms.

The Long-Term Outlook for Ripple and XRP

Beyond the legal battle, Ripple's long-term prospects and XRP's adoption in cross-border payments will influence its price.

- XRP Adoption: Wider adoption of XRP for cross-border payments could increase demand and drive up the price.

- Technological Advancements: Ripple's ongoing technological advancements and partnerships could further enhance its position in the market.

- Competitive Landscape: The competitive landscape within the cryptocurrency space will influence XRP's market share and, consequently, its price.

Conclusion

The $2 support level for XRP is a critical indicator for future price movements. While technical analysis offers insights into potential price reversals, the SEC lawsuit significantly impacts investor sentiment and the overall XRP price prediction. Analyzing market sentiment, news events, and potential legal outcomes is essential for forming a well-informed prediction. By closely monitoring these factors and using technical indicators, investors can better navigate the volatility of the XRP market. Stay informed on the latest developments and continue to analyze the XRP price to make informed investment decisions. Remember to conduct your own thorough research before investing in XRP or any other cryptocurrency.

Featured Posts

-

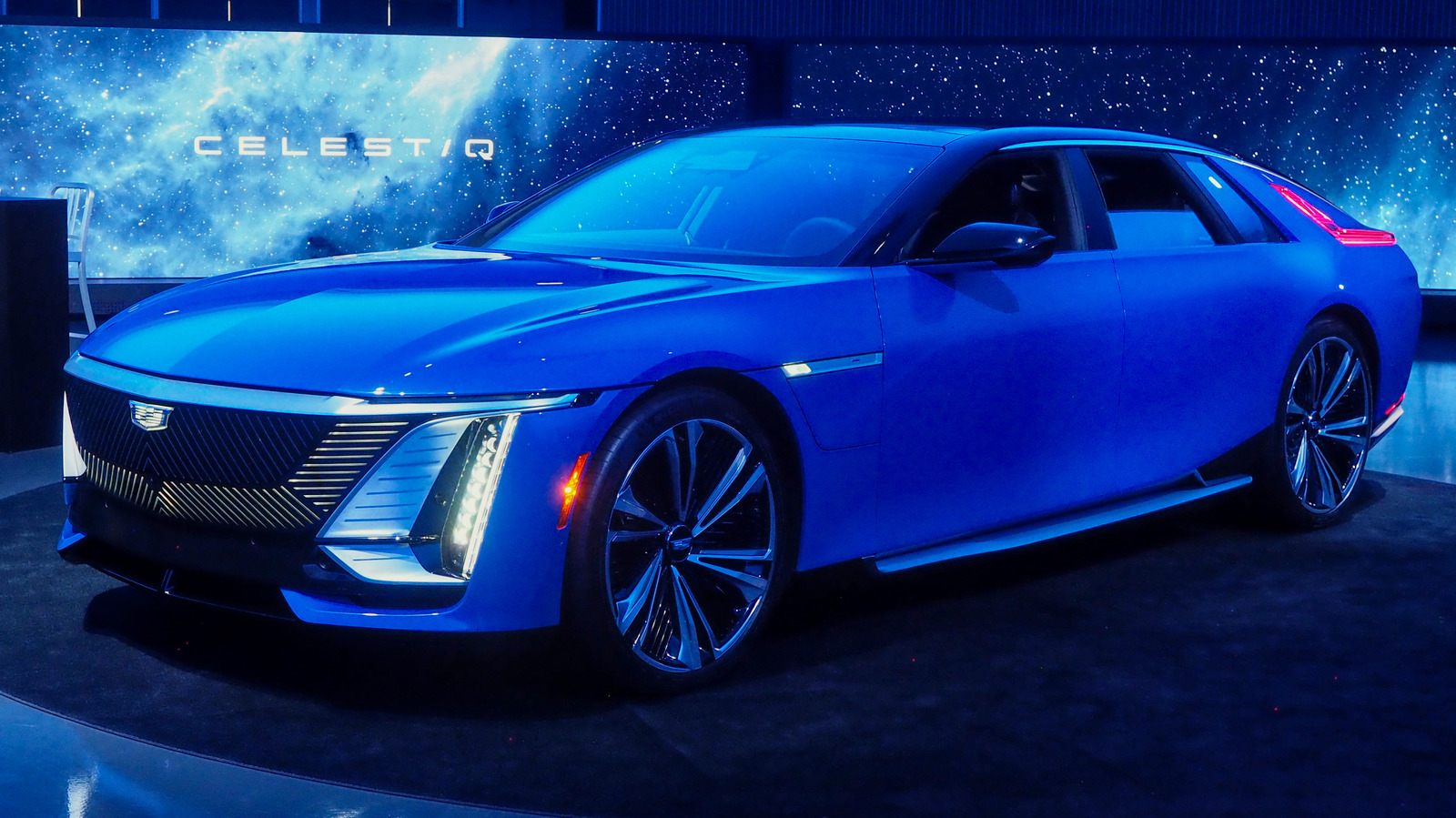

First Drive Cadillac Celestiq Luxury Technology And A 360 000 Price Tag

May 08, 2025

First Drive Cadillac Celestiq Luxury Technology And A 360 000 Price Tag

May 08, 2025 -

Billionaires Favorite Etf Predicted 110 Soar In 2025

May 08, 2025

Billionaires Favorite Etf Predicted 110 Soar In 2025

May 08, 2025 -

Improving Crime Control Through Swift And Decisive Directives

May 08, 2025

Improving Crime Control Through Swift And Decisive Directives

May 08, 2025 -

9 4000 2

May 08, 2025

9 4000 2

May 08, 2025 -

Unforgettable Tales Exploring The Best Krypto Stories

May 08, 2025

Unforgettable Tales Exploring The Best Krypto Stories

May 08, 2025