XRP Price Prediction: Could XRP Hit $10? Ripple's Dubai License And Resistance Break

Table of Contents

Ripple's Dubai License: A Catalyst for XRP Growth?

The recent acquisition of a virtual asset license in Dubai by Ripple Labs is a significant event that could act as a catalyst for XRP growth. This move signifies a major step towards broader regulatory acceptance and legitimization of Ripple and its associated cryptocurrency, XRP.

Increased Adoption and Market Penetration

The Dubai license signals Ripple's growing global acceptance and legitimization. This could lead to increased institutional adoption and broader market penetration, potentially driving up demand for XRP.

- Increased accessibility to institutional investors: The license provides a clearer regulatory framework, encouraging institutional investors, previously hesitant due to regulatory uncertainty, to enter the XRP market.

- Expansion into new markets with regulatory clarity: Dubai serves as a gateway to other markets in the Middle East and beyond, offering Ripple a strategic foothold in regions with growing interest in blockchain technology.

- Potential for strategic partnerships within the Middle East and beyond: The Dubai license opens doors for collaborations with financial institutions and businesses operating in the region, further boosting XRP adoption.

- Enhanced credibility and trust in the Ripple ecosystem: Regulatory approval from a major financial hub like Dubai lends credibility to Ripple and its technology, fostering greater trust among investors.

Impact on Trading Volume and Liquidity

Increased adoption translates to higher trading volumes and improved liquidity for XRP. This enhanced liquidity makes XRP more attractive to both institutional and retail investors, contributing to price stability and potential upward movement.

- More exchanges listing XRP: Regulatory clarity can encourage more cryptocurrency exchanges to list XRP, increasing its accessibility to a wider range of traders.

- Increased trading activity: Higher liquidity attracts more traders, leading to increased trading volume and potentially higher prices.

- Reduced price volatility (potentially): Improved liquidity can help mitigate extreme price swings, making XRP a less risky investment for some.

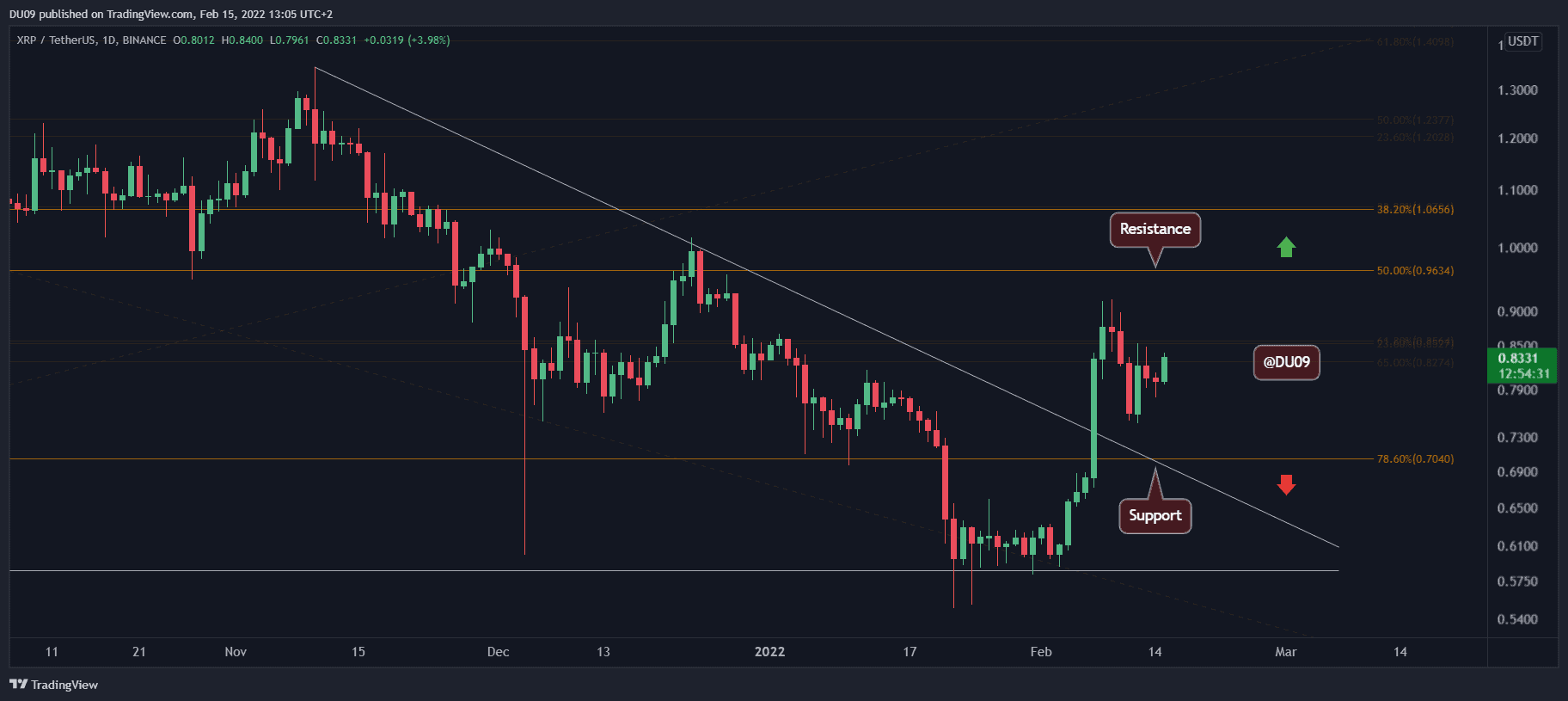

Breaking Key Resistance Levels: Technical Analysis Perspective

Technical analysis provides valuable insights into potential price movements by identifying key resistance levels that need to be overcome for a substantial price increase. Analyzing XRP's price charts helps to understand its past performance and predict future trends.

Identifying Crucial Price Points

Technical analysis of XRP's price charts reveals crucial resistance levels. Overcoming these levels is often a prerequisite for significant price appreciation.

- Discussion of historical price highs and support/resistance levels: Analyzing past price highs and lows helps identify key support and resistance zones. Breaking through these levels often signals a potential shift in market sentiment.

- Analysis of moving averages and other technical indicators: Technical indicators like moving averages, RSI, and MACD can provide further insights into the strength of price trends and potential reversals.

- Mention of potential breakout scenarios and their implications: Identifying potential breakout scenarios, where XRP decisively breaks above a key resistance level, allows for anticipation of significant price increases.

Market Sentiment and Investor Confidence

Positive news, like regulatory breakthroughs and successful partnerships, significantly impact investor confidence and drive the price upwards, especially if it leads to a sustained break above resistance levels.

- Impact of positive media coverage: Positive news coverage in reputable financial publications can generate significant buying pressure.

- Influence of social media sentiment on price: Social media sentiment analysis can provide insights into the overall market mood toward XRP.

- Role of whale activity and large-scale buying: Large-scale buying by institutional investors ("whales") can push the price significantly higher.

Factors that Could Hinder XRP's Ascent to $10

While positive developments are promising, several factors could hinder XRP's ascent to $10. Understanding these challenges is crucial for realistic XRP price prediction.

Regulatory Uncertainty

Despite the Dubai license, regulatory uncertainty in other jurisdictions, particularly the ongoing legal battle in the US, remains a significant challenge for XRP. Negative regulatory developments could dampen investor enthusiasm and impact price.

- Ongoing legal battles in the US: The ongoing SEC lawsuit against Ripple creates uncertainty, potentially affecting investor confidence and price.

- Varying regulatory approaches globally: Different regulatory frameworks across countries can create inconsistencies and complexities for XRP adoption.

- Potential for future regulatory hurdles: Future regulatory changes, even in favorable jurisdictions, could present unforeseen challenges.

Market Volatility and Crypto Winter

The cryptocurrency market is inherently volatile. Unexpected market downturns ("crypto winters") could significantly impact XRP's price regardless of positive developments.

- Impact of macroeconomic factors on crypto prices: Broader economic factors, such as inflation and interest rate hikes, can heavily influence the cryptocurrency market.

- Risks associated with investing in volatile assets: Investing in cryptocurrencies carries significant risk due to their inherent volatility.

- Need for diversification in investment portfolios: Diversification is crucial to mitigate risk in any investment portfolio, including cryptocurrency investments.

Conclusion

The possibility of XRP reaching $10 depends on a confluence of factors, including continued regulatory success, increased adoption, overcoming key resistance levels, and sustained positive market sentiment. While Ripple's Dubai license is a significant positive development, it's crucial to acknowledge the inherent risks associated with cryptocurrency investments. The XRP price prediction remains speculative, but by carefully analyzing the factors discussed, investors can make more informed decisions. Conduct thorough research and consider your risk tolerance before investing in XRP or any other cryptocurrency. Remember to always stay updated on the latest XRP price prediction news and analysis.

Featured Posts

-

Tragedy Strikes After School Camp Car Crash Claims Four Lives

May 01, 2025

Tragedy Strikes After School Camp Car Crash Claims Four Lives

May 01, 2025 -

Bartlett Texas Fire Two Total Losses Amid High Fire Risk

May 01, 2025

Bartlett Texas Fire Two Total Losses Amid High Fire Risk

May 01, 2025 -

Is Age Just A Number Redefining Aging And Its Impact

May 01, 2025

Is Age Just A Number Redefining Aging And Its Impact

May 01, 2025 -

Nrc Vandaag Krijgt Een Nieuwe Presentator Bram Endedijk

May 01, 2025

Nrc Vandaag Krijgt Een Nieuwe Presentator Bram Endedijk

May 01, 2025 -

Should You Buy Xrp Ripple Now Price Analysis Under 3

May 01, 2025

Should You Buy Xrp Ripple Now Price Analysis Under 3

May 01, 2025