XRP Price Prediction: Will XRP Hit $10? Ripple's Dubai License And Resistance Break

Table of Contents

Ripple's Dubai License: A Catalyst for Growth?

Ripple's acquisition of a license to operate in Dubai is a significant development with potential implications for XRP's price. This move provides increased regulatory clarity and legitimacy for Ripple within a major financial hub. The implications are far-reaching:

- Increased regulatory clarity and legitimacy for Ripple: Operating legally in a well-regulated jurisdiction like Dubai enhances Ripple's credibility and reduces regulatory uncertainty, a significant factor influencing investor confidence in XRP.

- Potential for increased adoption and usage of XRP in the Middle East: Dubai's strategic location and its role as a global financial center offer Ripple access to a vast network of financial institutions and businesses potentially interested in utilizing XRP for cross-border payments. This increased adoption could drive demand and push the XRP price higher.

- Access to a new, lucrative market with significant financial institutions: Dubai is home to numerous major banks and financial institutions. Ripple can now directly engage with these entities, promoting the use of XRP in their operations and expanding its market reach.

- Positive impact on investor sentiment and XRP price: Positive news surrounding regulatory approvals and market expansion often translates to increased investor confidence, leading to higher demand and a potential price surge for XRP.

However, it's crucial to acknowledge potential challenges. Competition from other payment solutions and the overall acceptance of cryptocurrencies within the region will play a significant role in determining the true impact of the Dubai license on XRP's price.

Technical Analysis: Breaking Resistance Levels

Technical analysis is a crucial tool for predicting price movements. Resistance levels represent price points where selling pressure historically outweighs buying pressure, preventing further price increases. Breaking these levels often signals a significant shift in market sentiment.

For XRP, several key resistance levels have been identified throughout its history. Analyzing past price action and volume around these levels provides insights into potential future behavior.

- Analyzing past price action and identifying support and resistance: Chart patterns and historical data reveal where XRP has previously faced strong resistance. Understanding these levels helps anticipate potential price reactions.

- Importance of volume confirmation when breaking resistance: A significant increase in trading volume accompanying a breakout often validates the price move and suggests a sustained upward trend. Low volume breakouts can be less reliable.

- Potential price targets after breaking key resistance levels: Successful breakouts can open the path to higher price targets. Technical indicators can help predict these targets based on various chart patterns and Fibonacci retracements.

- Use of charts and graphs to illustrate technical analysis: Visual representations of price action, volume, and indicators are vital for interpreting technical analysis effectively. Moving averages (e.g., 50-day, 200-day) and Relative Strength Index (RSI) can provide additional signals.

A sustained break above key resistance levels, coupled with strong volume, could significantly influence the XRP price prediction, increasing the likelihood of it reaching $10.

The Role of Market Sentiment and Adoption

Market sentiment plays a significant role in influencing XRP's price. Positive news, such as the Dubai license, boosts investor confidence and can lead to price appreciation. Conversely, negative news or regulatory uncertainty can trigger sell-offs.

Adoption is another crucial factor. XRP's use in cross-border payments is a key driver of its value. Increasing institutional interest and partnerships are also likely to boost demand.

- Impact of Bitcoin's price movements on altcoins like XRP: Bitcoin's price often affects the entire cryptocurrency market, including XRP. A Bitcoin bull run can positively influence XRP's price, while a bear market can have the opposite effect.

- Growing institutional interest in XRP and its implications: Increased adoption by financial institutions lends credibility and legitimacy to XRP, potentially attracting further investment.

- The role of media coverage and public perception: Positive media coverage and favorable public perception can fuel demand and contribute to price appreciation.

- Potential partnerships and collaborations driving adoption: Partnerships with payment processors, banks, and other companies can significantly expand XRP's reach and increase its utility, ultimately impacting its price.

Factors Affecting the XRP Price Prediction – Beyond $10?

While the possibility of XRP reaching $10 exists, several factors could hinder its progress. The ongoing legal battle with the SEC presents a significant risk, potentially impacting investor sentiment and price.

- Ongoing legal battle with the SEC: The outcome of the SEC lawsuit could significantly impact XRP's price, either positively or negatively depending on the ruling.

- Competition from other cryptocurrencies: The cryptocurrency market is highly competitive. New and established cryptocurrencies vying for market share could limit XRP's growth potential.

- Regulatory uncertainty in various jurisdictions: Varying regulatory frameworks across different countries create uncertainty, potentially affecting the adoption and price of XRP.

- Overall macroeconomic conditions: Global economic conditions can significantly impact the cryptocurrency market as a whole, influencing investor appetite for riskier assets like XRP.

Considering these potential hurdles, achieving a $10 price target for XRP might be a challenging prospect, although not impossible. Alternative price scenarios should be considered, along with a realistic assessment of probabilities.

Conclusion

This XRP price prediction highlights several factors influencing XRP's potential: Ripple's Dubai license offers significant growth potential, while overcoming key resistance levels is crucial for sustained price increases. Positive market sentiment, increased adoption, and strategic partnerships are also essential. However, the ongoing SEC lawsuit and broader market conditions pose significant risks. While reaching $10 is possible, it's important to acknowledge the inherent uncertainty in the cryptocurrency market. Before investing in any cryptocurrency, including XRP, thorough research and risk assessment are paramount. This is not financial advice.

Call to Action: Stay informed about the latest developments affecting the XRP price prediction by subscribing to our newsletter and following us on social media. Continue your research on XRP and make informed investment decisions based on your own risk tolerance. Remember, this is not financial advice; thorough due diligence is crucial before investing in any cryptocurrency, including XRP.

Featured Posts

-

Holland And Knight Llp Insights Into Current Nuclear Litigation

May 02, 2025

Holland And Knight Llp Insights Into Current Nuclear Litigation

May 02, 2025 -

Metas Future Under A Trump Presidency Zuckerbergs Challenges

May 02, 2025

Metas Future Under A Trump Presidency Zuckerbergs Challenges

May 02, 2025 -

Car Dealerships Push Back Against Mandatory Ev Sales

May 02, 2025

Car Dealerships Push Back Against Mandatory Ev Sales

May 02, 2025 -

Xrps Future Navigating Regulatory Uncertainty After Sec Actions

May 02, 2025

Xrps Future Navigating Regulatory Uncertainty After Sec Actions

May 02, 2025 -

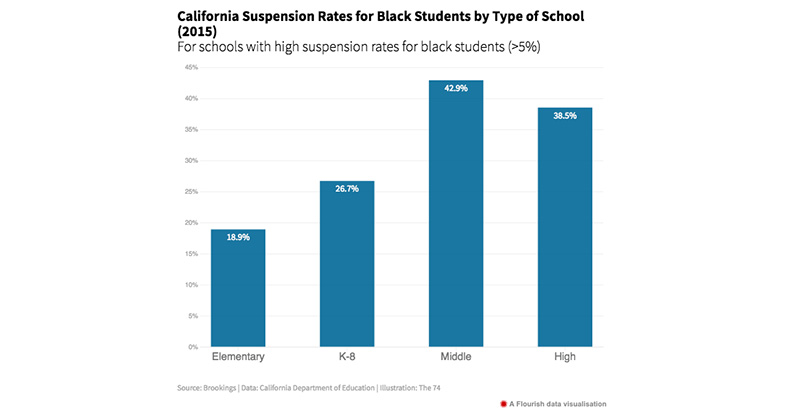

School Suspensions A Counterproductive Discipline Strategy

May 02, 2025

School Suspensions A Counterproductive Discipline Strategy

May 02, 2025