XRP (Ripple) Under $3: Investment Analysis And Outlook

Table of Contents

Current Market Conditions and Price Action

Analyzing XRP's price action requires examining its recent fluctuations against key support and resistance levels. While XRP has shown periods of significant growth, it's also experienced considerable volatility, mirroring the overall cryptocurrency market. The current market sentiment, often influenced by Bitcoin's price movements, plays a significant role. A bearish Bitcoin market typically negatively impacts altcoins like XRP, while bullish sentiment can lead to increased interest and price appreciation. Furthermore, macroeconomic factors such as inflation, interest rates, and geopolitical events can significantly influence the entire crypto market, impacting XRP's price indirectly.

- XRP price history and volatility: XRP's price has historically demonstrated substantial volatility, with sharp upward and downward movements.

- Correlation with Bitcoin and other major cryptocurrencies: XRP generally shows a positive correlation with Bitcoin, meaning their prices tend to move in the same direction. However, the strength of this correlation can vary.

- Impact of general market risk aversion on XRP: During periods of heightened risk aversion, investors often move towards safer assets, leading to a decline in cryptocurrency prices, including XRP.

- Technical analysis indicators (e.g., moving averages, RSI): Technical indicators provide insights into potential price trends, but should be used in conjunction with fundamental analysis for a more complete picture.

Regulatory Landscape and Legal Battles

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's price and future. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. A positive outcome for Ripple could significantly boost XRP's price, as it would remove a major regulatory uncertainty. Conversely, an unfavorable ruling could lead to further price declines and potentially even delisting from some exchanges. The regulatory environment for cryptocurrencies is constantly evolving, and the outcome of this case will set a precedent for other cryptocurrencies facing similar regulatory scrutiny. Different jurisdictions have varying regulatory approaches towards cryptocurrencies, adding another layer of complexity.

- Summary of the SEC lawsuit against Ripple: The SEC alleges Ripple sold unregistered securities through XRP sales.

- Potential implications of a favorable or unfavorable ruling: A favorable ruling could send XRP's price soaring; an unfavorable ruling could result in significant price drops and potential delisting.

- Regulatory clarity and its impact on investor confidence: Increased regulatory clarity would likely boost investor confidence and lead to greater institutional adoption.

- Comparative analysis of regulatory approaches in different jurisdictions: Some countries have embraced cryptocurrencies more readily than others, creating a patchwork of regulatory landscapes.

Ripple's Technology and Adoption

RippleNet, Ripple's payment network, is a key factor influencing XRP's value. Its adoption by financial institutions for cross-border payments is a significant indicator of its potential. RippleNet offers faster, cheaper, and more efficient transactions compared to traditional systems like SWIFT. However, XRP faces competition from other cryptocurrencies and payment networks vying for market share in the cross-border payments space. The scalability and speed of XRP transactions are crucial advantages, although ongoing technological advancements are necessary to maintain its competitive edge.

- Explanation of RippleNet and its functionalities: RippleNet facilitates faster and more cost-effective international money transfers.

- Number of financial institutions using RippleNet: A growing number of financial institutions are utilizing RippleNet, showcasing its increasing adoption.

- Comparison of XRP's transaction speed and fees with other payment networks: XRP boasts superior transaction speeds and lower fees compared to traditional alternatives.

- Potential future developments and upgrades to XRP's technology: Continued improvements to RippleNet and XRP's underlying technology are critical for maintaining its competitive position.

Competitive Analysis and Future Outlook

XRP faces competition from other cryptocurrencies offering similar functionalities, such as Stellar Lumens (XLM). While XRP aims to facilitate seamless cross-border payments, it must contend with established players and newer entrants in the fintech space. Assessing its competitive advantages and disadvantages in this crowded market is crucial for predicting its future trajectory. Short-term price predictions are inherently speculative, influenced by market sentiment and news events. However, its long-term success hinges on sustained adoption by financial institutions and further technological advancements.

- Comparison with competitors like Stellar Lumens (XLM) and SWIFT: XRP competes with XLM and other cryptocurrencies, as well as legacy payment systems like SWIFT.

- Potential market share gains or losses for XRP: XRP's market share will depend on its ability to innovate and adapt to the evolving landscape.

- Factors that could drive future price appreciation or depreciation: Regulatory clarity, technological advancements, and market adoption are key factors influencing XRP's price.

- Long-term potential for XRP as a payment solution: The long-term potential hinges on continued institutional adoption and successful navigation of regulatory challenges.

Conclusion

Determining whether XRP under $3 represents a buying opportunity is complex. While its current price might seem attractive, the ongoing SEC lawsuit, the competitive landscape, and the overall cryptocurrency market volatility all play significant roles. A thorough understanding of the regulatory landscape, Ripple's technological advancements, and its competitive position is paramount for making informed investment decisions. Remember, cryptocurrency investments are inherently risky, and you should always conduct your own thorough research before investing. Stay informed about the latest developments regarding XRP (Ripple) and continue your research to make informed investment decisions regarding XRP (Ripple) under $3. Weigh the risks and opportunities carefully before investing in this volatile asset.

Featured Posts

-

Enhancing Education The Power Of Shared Access With Project Muse

May 02, 2025

Enhancing Education The Power Of Shared Access With Project Muse

May 02, 2025 -

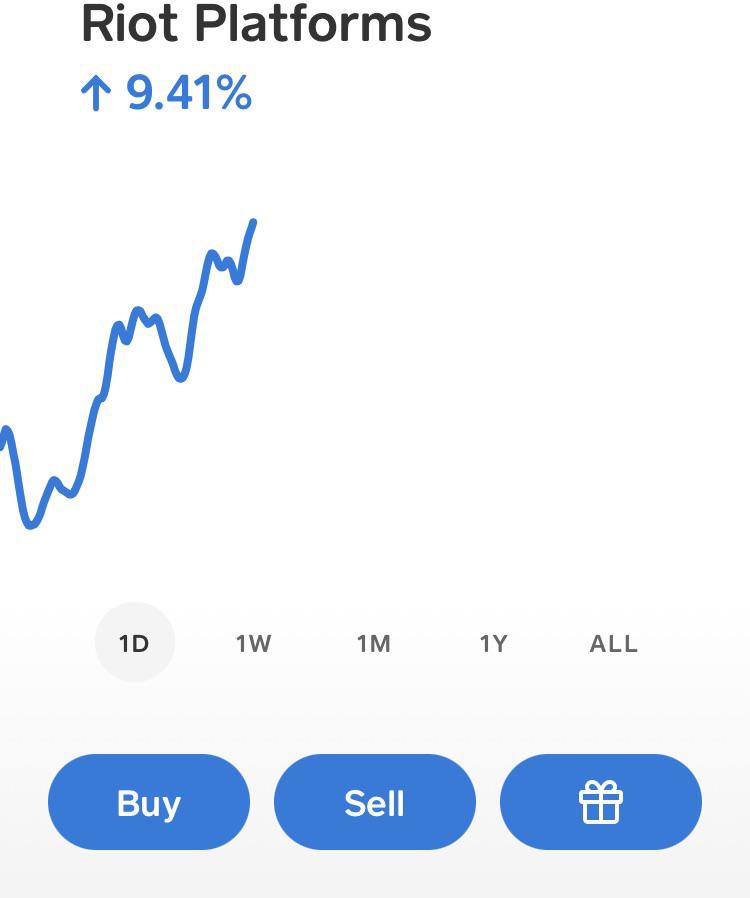

Analyzing Riot Platforms Riot Stock Performance Against Market Trends

May 02, 2025

Analyzing Riot Platforms Riot Stock Performance Against Market Trends

May 02, 2025 -

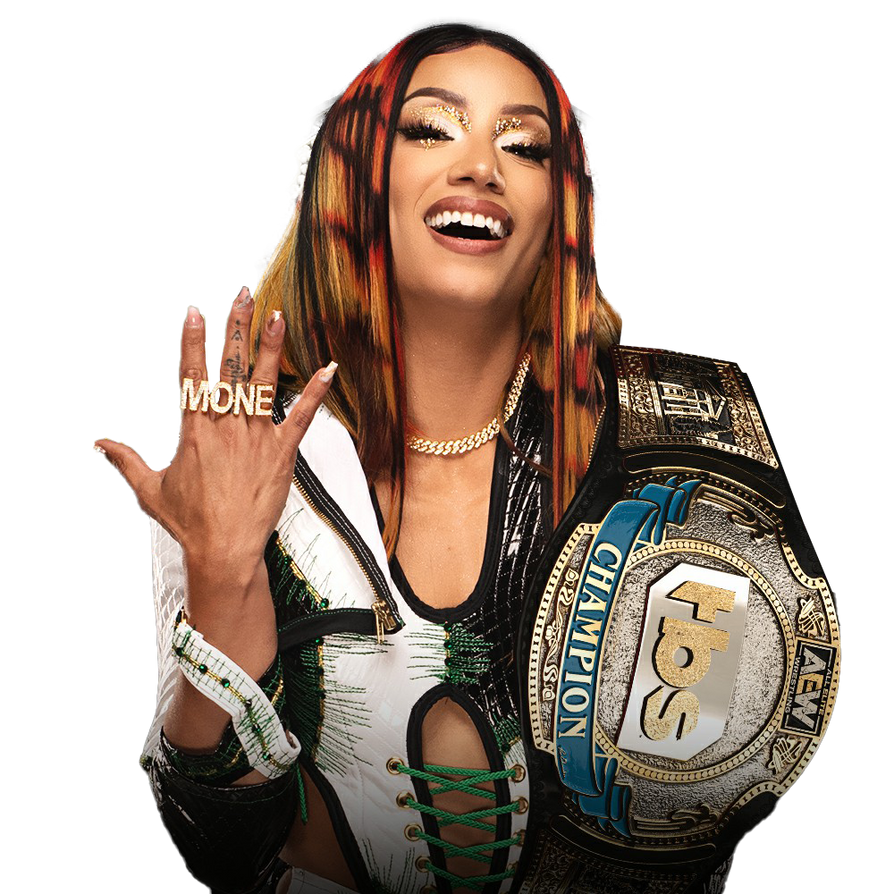

Watanabe Holds Mercedes Mones Tbs Championship A Plea For Return

May 02, 2025

Watanabe Holds Mercedes Mones Tbs Championship A Plea For Return

May 02, 2025 -

Check April 12 2025 Lotto Results Here

May 02, 2025

Check April 12 2025 Lotto Results Here

May 02, 2025 -

Perfekta Kycklingnuggets Friterade I Majsflingor Och Serverade Med Kalsallad

May 02, 2025

Perfekta Kycklingnuggets Friterade I Majsflingor Och Serverade Med Kalsallad

May 02, 2025