XRP (Ripple) Under $3: Is It Time To Buy Or Sell?

Table of Contents

Analyzing the SEC Lawsuit's Impact on XRP Price

The Ongoing Legal Battle

The SEC's lawsuit against Ripple Labs, alleging the unregistered sale of securities, casts a long shadow over XRP's price. The legal battle continues, with both sides presenting their arguments. Ripple maintains that XRP is not a security, while the SEC argues otherwise. The outcome will significantly impact XRP's future.

- Ripple's Argument: Focuses on XRP's decentralized nature and its use as a payment facilitator within the RippleNet ecosystem.

- SEC's Argument: Centers on the claim that Ripple's distribution and promotion of XRP constituted an unregistered securities offering.

- Potential Outcomes: A favorable ruling for Ripple could send XRP's price soaring. Conversely, an unfavorable ruling could lead to further price declines and potential delisting from exchanges. Expert legal opinions are currently divided, highlighting the uncertainty surrounding the case.

Market Sentiment and the Ripple Effect

The SEC lawsuit has undeniably impacted market sentiment. Fear, Uncertainty, and Doubt (FUD) surrounding XRP's future have led to significant price volatility. Negative news often triggers sell-offs, while positive developments can boost investor confidence and drive price increases.

- Negative News Influence: Negative press coverage and legal setbacks often result in immediate price drops and reduced trading volume.

- Social Media Sentiment: Monitoring social media platforms like Twitter and Reddit can provide insights into prevailing sentiment towards XRP. However, it's crucial to treat social media analysis with caution, as it can be easily manipulated.

- Correlation Analysis: Studies show a strong correlation between news events related to the SEC lawsuit and fluctuations in XRP's price. Tracking this correlation can help in understanding market reactions. [Link to relevant news article/analysis].

XRP's Technological Advancements and Future Potential

RippleNet Adoption and Growth

Despite the legal challenges, RippleNet continues to expand its reach. Its adoption by banks and financial institutions for cross-border payments demonstrates the technology's real-world utility.

- Successful Implementations: Numerous banks and payment providers worldwide utilize RippleNet for faster and cheaper international transactions. [Link to case studies showcasing RippleNet's success].

- Partnerships and Growth: Ripple continues to forge partnerships with financial institutions, further expanding RippleNet's global reach and demonstrating strong market demand for its services. [Link to news about partnerships].

- Planned Improvements: Ongoing developments and updates to RippleNet suggest a commitment to improving efficiency, security, and scalability, strengthening its long-term prospects.

XRP's Utility Beyond RippleNet

While RippleNet is a primary driver of XRP's utility, its potential extends beyond this ecosystem. The increasing interest in decentralized finance (DeFi) opens doors for XRP's integration into various DeFi applications.

- DeFi Integration: Exploration of XRP's integration into DeFi protocols could enhance its liquidity and provide additional use cases. [Link to relevant articles on XRP's DeFi potential].

- Cross-Chain Interoperability: The potential for XRP to facilitate cross-chain transactions between different blockchain networks could significantly boost its value and demand.

Technical Analysis of XRP's Price Chart

Identifying Support and Resistance Levels

Technical analysis of XRP's price chart can help identify potential support and resistance levels. These levels represent price points where the price is likely to find buying or selling pressure.

- Support Levels: These are price points where buyers are expected to step in, preventing further price declines.

- Resistance Levels: These are price points where sellers are expected to emerge, hindering further price increases.

- Technical Indicators: Moving averages, RSI, MACD, and other technical indicators can be used to assess the strength of trends and identify potential turning points. [Insert relevant chart/graph].

Predicting Future Price Movements (with caveats)

Based on technical analysis and current market conditions, we can speculate on potential price scenarios. However, it's crucial to remember that price prediction is inherently speculative.

- Bullish Scenario: A positive resolution to the SEC lawsuit and continued adoption of RippleNet could lead to a significant price surge.

- Bearish Scenario: An unfavorable legal outcome or a further downturn in the broader cryptocurrency market could result in continued price declines.

- Risk Management: Regardless of the prediction, risk management strategies such as stop-loss orders and diversification are crucial for protecting your investments.

Risk Assessment and Investment Strategies

Understanding the Volatility of XRP

XRP, like most cryptocurrencies, is highly volatile. Its price can fluctuate dramatically in short periods, presenting both significant opportunities and considerable risks.

- Market Fluctuations: External factors such as regulatory changes, macroeconomic conditions, and overall market sentiment can significantly impact XRP's price.

- Risk Mitigation: Dollar-cost averaging (DCA) and setting stop-loss orders can help mitigate the risks associated with XRP's volatility.

Diversification and Portfolio Management

Diversification is key to reducing overall investment risk. Don't put all your eggs in one basket.

- Diversified Portfolio: Spread your investments across different asset classes, including other cryptocurrencies, stocks, and bonds.

- Thorough Research: Always conduct thorough research and understand the risks involved before making any investment decisions.

Conclusion: Making Informed Decisions about XRP (Ripple) Under $3

The decision of whether to buy, sell, or hold XRP at its current price depends on a multitude of factors. The ongoing SEC lawsuit, RippleNet's growth, technical analysis indicators, and your own risk tolerance all play crucial roles. This article provides a framework for informed decision-making, but it's not financial advice.

Is it time to buy or sell XRP under $3? Only you can decide after careful consideration of these factors. Do your own research and invest wisely.

Featured Posts

-

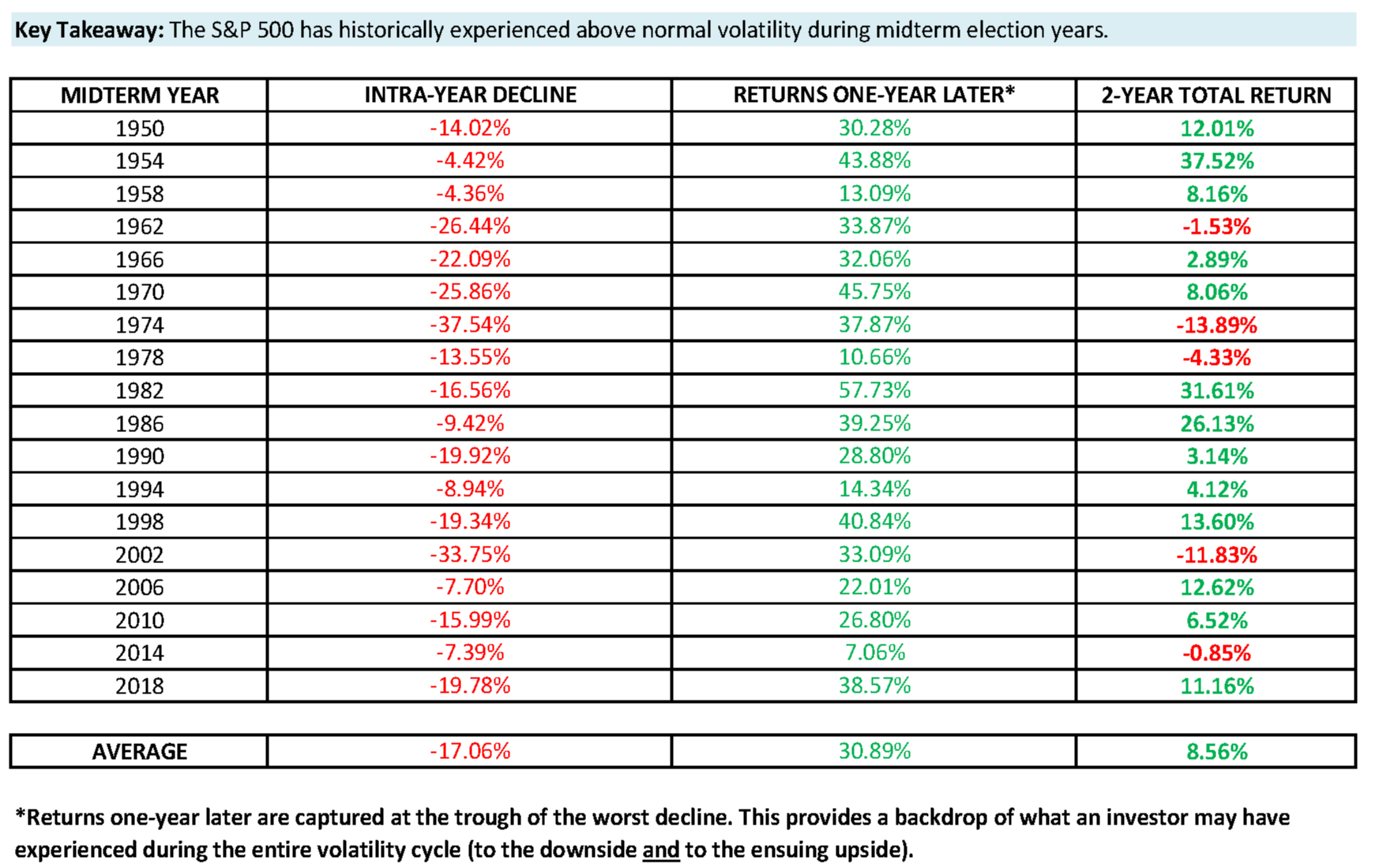

S And P 500 Volatility Is Downside Insurance Worth It

May 01, 2025

S And P 500 Volatility Is Downside Insurance Worth It

May 01, 2025 -

Early Death Risk Doctor Identifies Food Worse Than Smoking

May 01, 2025

Early Death Risk Doctor Identifies Food Worse Than Smoking

May 01, 2025 -

Sheens Million Pound Giveaway Christopher Stevens Channel 4 Review

May 01, 2025

Sheens Million Pound Giveaway Christopher Stevens Channel 4 Review

May 01, 2025 -

Prince William Witnesses Launch Of New Partnership For Royal Initiative

May 01, 2025

Prince William Witnesses Launch Of New Partnership For Royal Initiative

May 01, 2025 -

Canadian Domestic Travel A 20 Increase In Airbnb Searches

May 01, 2025

Canadian Domestic Travel A 20 Increase In Airbnb Searches

May 01, 2025