Yuan's Fall: PBOC Intervention Misses The Mark In 2024

Table of Contents

Factors Contributing to the Yuan's Decline

Several interconnected factors have contributed to the Yuan's decline in 2024. These can be broadly categorized into global economic headwinds and persistent domestic economic challenges.

Global Economic Headwinds

Global economic uncertainty significantly impacts the Yuan. The looming threat of a global recession has dampened investor confidence, leading to capital flight from emerging markets, including China. Rising US interest rates further exacerbate this issue, making dollar-denominated assets more attractive to international investors. This outflow of capital puts downward pressure on the Yuan's exchange rate.

- Weakening global demand for Chinese exports: Reduced global economic activity translates to lower demand for Chinese goods, impacting the country's trade balance and weakening the Yuan.

- Increased US-China trade tensions: Lingering trade disputes and geopolitical uncertainties create an atmosphere of instability, discouraging foreign investment and contributing to Yuan devaluation.

- Uncertainty surrounding geopolitical events: Global events, such as conflicts and political instability in various regions, introduce uncertainty into the global economic landscape, negatively affecting investor sentiment towards emerging market currencies like the Yuan.

Domestic Economic Challenges

Beyond global factors, China's domestic economic challenges play a crucial role in the Yuan's weakening. Slowing economic growth, a struggling real estate sector, and high levels of corporate debt create an environment of economic fragility.

- Slowdown in the manufacturing sector: A decline in manufacturing activity, a cornerstone of the Chinese economy, reflects weakening domestic demand and contributes to a less favorable outlook for the Yuan.

- High levels of corporate debt: The significant level of corporate debt within China poses a systemic risk, potentially leading to financial instability and further weakening the currency.

- Persistent property market instability: The ongoing crisis in China's real estate sector, with its ripple effects throughout the economy, continues to weigh heavily on investor confidence and contributes to the Yuan's decline.

PBOC Interventions and Their Limited Success

The PBOC has employed various strategies to counter the Yuan's decline, but these interventions have had limited success in stemming the tide.

Types of Interventions Employed

The PBOC's toolkit includes several methods to manage the Yuan's exchange rate:

- Setting daily fixing rates: The PBOC sets a daily reference rate for the Yuan against the US dollar, influencing market expectations and providing a degree of control.

- Buying Yuan in the foreign exchange market: The PBOC can intervene directly in the foreign exchange market by buying Yuan, increasing demand and supporting its value.

- Open market operations to manage liquidity: The PBOC uses open market operations to adjust liquidity in the banking system, indirectly influencing the Yuan's exchange rate.

- Increased scrutiny of capital outflows: Stricter regulations on capital outflows aim to reduce the pressure on the Yuan caused by capital flight.

Reasons for Ineffectiveness

Despite these efforts, the PBOC's interventions have not effectively stabilized the Yuan. Several factors contribute to this:

- Speculative attacks on the Yuan: Speculators betting against the Yuan can exert significant pressure on the currency, overwhelming the PBOC's interventions.

- Limited control over global capital flows: In a globalized financial market, the PBOC has limited control over the movement of capital, making it difficult to counter significant capital outflows.

- Balancing domestic economic needs with currency stability: The PBOC faces the difficult task of balancing the need to maintain currency stability with the need to support domestic economic growth. Actions taken to stabilize the Yuan may negatively impact the domestic economy.

Potential Future Scenarios and Implications

Predicting the future of the Yuan is challenging, but analyzing potential scenarios and their implications is crucial.

Short-Term Outlook

In the short term, the Yuan's exchange rate is likely to remain volatile, influenced by global economic developments and the effectiveness of further PBOC interventions.

Long-Term Implications

A sustained weakening of the Yuan could have significant long-term implications:

- Increased import costs for Chinese businesses: A weaker Yuan makes imports more expensive, potentially impacting the profitability of Chinese businesses.

- Impact on Chinese consumers' purchasing power: The rising cost of imported goods could reduce Chinese consumers' purchasing power.

- Implications for global trade and economic growth: A significant devaluation of the Yuan could disrupt global trade patterns and have wider implications for global economic growth.

Conclusion: Navigating the Uncertain Future of the Yuan

The Yuan's significant decline in 2024 and the limited success of PBOC interventions highlight the complex interplay of global and domestic factors affecting the Chinese currency. The weakening Yuan is a consequence of global economic headwinds and persistent domestic economic challenges. The future trajectory of the Yuan remains uncertain, influenced by unpredictable global events and the ongoing effectiveness of PBOC's strategies. Staying informed about developments concerning Yuan devaluation, PBOC intervention strategies, and the overall Chinese currency situation is crucial. Continue researching and monitoring the RMB exchange rate to better understand and navigate this evolving economic landscape.

Featured Posts

-

Analysis Of Trumps Oil Price Views A Goldman Sachs Perspective

May 15, 2025

Analysis Of Trumps Oil Price Views A Goldman Sachs Perspective

May 15, 2025 -

Kktc Isguecue Piyasasi Icin Dijital Veri Tabani Rehberi Sunumu

May 15, 2025

Kktc Isguecue Piyasasi Icin Dijital Veri Tabani Rehberi Sunumu

May 15, 2025 -

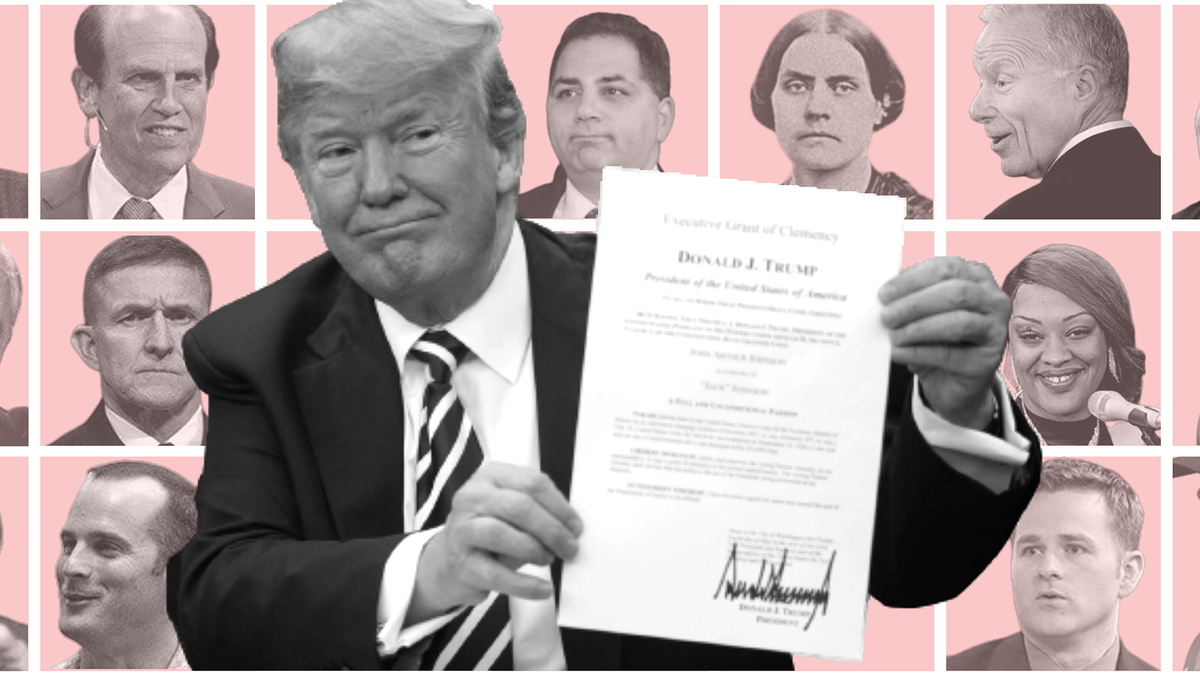

Trumps Second Term Unprecedented Presidential Pardons

May 15, 2025

Trumps Second Term Unprecedented Presidential Pardons

May 15, 2025 -

Trump Officials Push Back Against Rfk Jr S Pesticide Claims

May 15, 2025

Trump Officials Push Back Against Rfk Jr S Pesticide Claims

May 15, 2025 -

Leeflang Aangelegenheid Bruins Moet Met Npo Toezichthouder In Overleg

May 15, 2025

Leeflang Aangelegenheid Bruins Moet Met Npo Toezichthouder In Overleg

May 15, 2025

Latest Posts

-

Dodgers Minor League Standouts Kim Hope Phillips And Miller

May 15, 2025

Dodgers Minor League Standouts Kim Hope Phillips And Miller

May 15, 2025 -

Late Game Heroics Freeman And Kims Home Runs Secure Dodgers Win Against Giants

May 15, 2025

Late Game Heroics Freeman And Kims Home Runs Secure Dodgers Win Against Giants

May 15, 2025 -

Dodgers Defeat Giants Freeman Kim Hit Key Home Runs

May 15, 2025

Dodgers Defeat Giants Freeman Kim Hit Key Home Runs

May 15, 2025 -

Offseason Review Email Newsletter Los Angeles Dodgers

May 15, 2025

Offseason Review Email Newsletter Los Angeles Dodgers

May 15, 2025 -

Los Angeles Dodgers A Post Offseason Email Report

May 15, 2025

Los Angeles Dodgers A Post Offseason Email Report

May 15, 2025