31% Reduction In BP's Chief Executive's Pay

Table of Contents

The Magnitude of the Pay Cut and its Context

The 31% reduction in Bernard Looney's compensation represents a substantial decrease in executive pay within the energy industry. While the exact figures require careful examination of BP's financial reports, it's crucial to understand the context of this reduction. Let's delve into the specifics:

- Exact figures: Before the reduction, Looney's total compensation package likely included a base salary, bonuses tied to performance metrics, and stock options. Once the exact numbers are publicly released in BP's financial statements, we can calculate the precise monetary value of the pay cut. We'll update this section with the concrete figures once available.

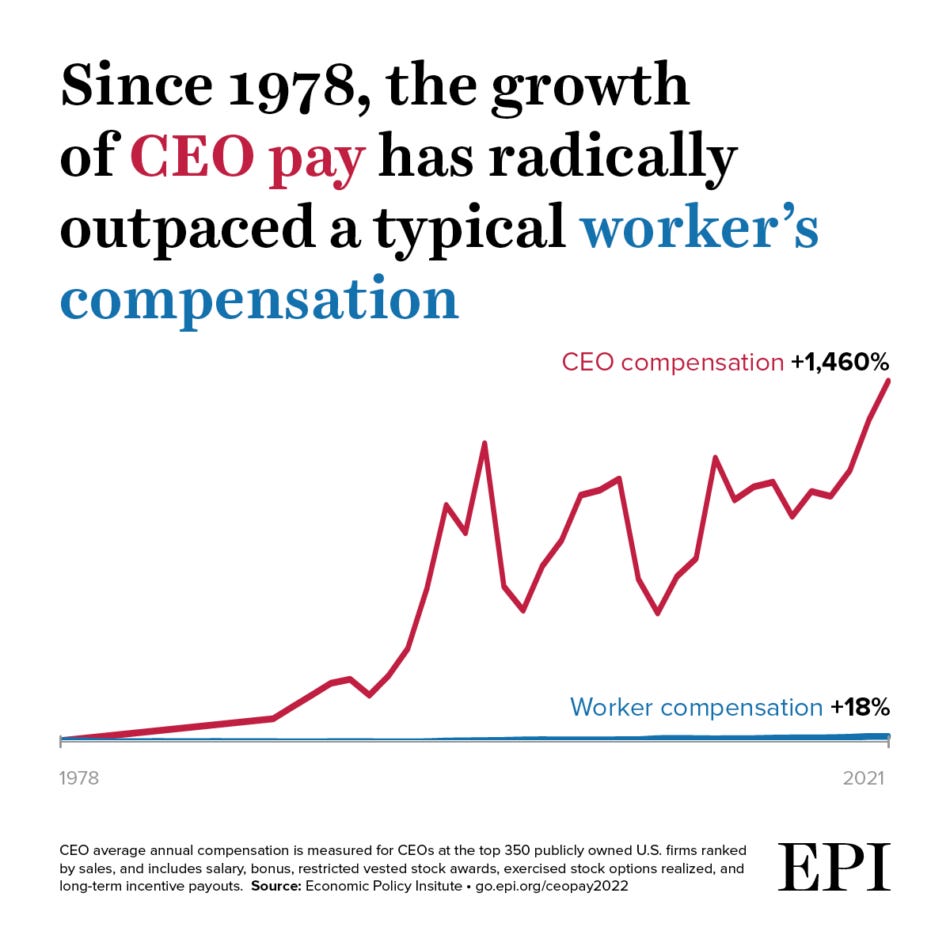

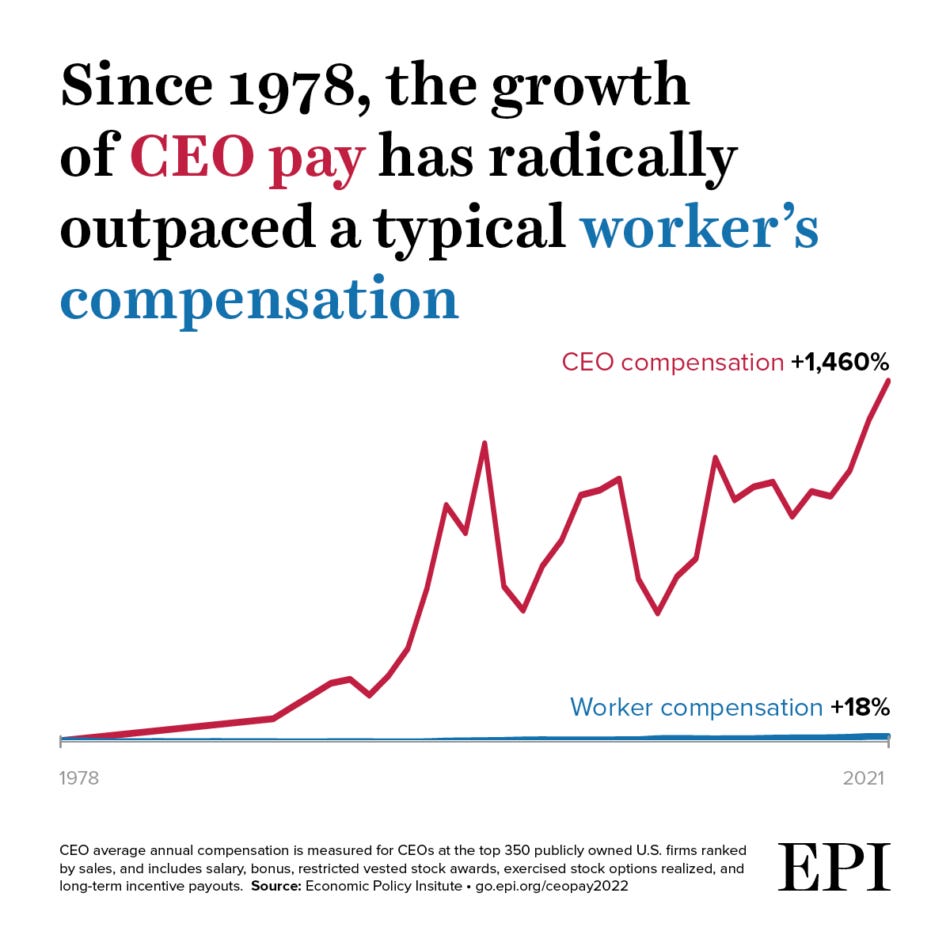

- Comparison with Competitors: To understand the significance of the BP CEO pay cut, we need to compare it with changes in CEO compensation at other major energy companies like Shell and ExxonMobil. A detailed analysis of their recent executive pay packages will illuminate whether this reduction is an anomaly or part of a broader trend in the sector. Preliminary research suggests varying approaches to executive compensation across these companies.

- Previous Changes: It’s important to note any previous significant changes in BP CEO compensation to establish a historical perspective. Analyzing past trends will help determine if this 31% reduction is a one-off event or part of a larger shift in BP's approach to executive remuneration.

Reasons Behind the BP CEO Pay Reduction

BP's official explanation for the pay cut, which will be detailed in their official statements and press releases, is crucial for understanding the motivations. However, several underlying factors likely contributed to this decision:

-

Company Performance: BP's recent financial performance, including profitability, stock price, and overall market standing, is likely a key factor. A period of lower profits or shareholder dissatisfaction with performance could influence a decision to reduce executive compensation.

-

Shareholder Pressure and Activism: Shareholder activism plays a considerable role in executive pay decisions. Pressure from investors concerned about executive compensation levels, particularly in light of environmental concerns, may have influenced BP's decision. Shareholder resolutions targeting excessive pay are increasingly common.

-

Public Scrutiny and ESG Concerns: The energy sector faces increasing public scrutiny regarding its environmental, social, and governance (ESG) performance. High executive pay during periods of environmental challenges or social controversies can attract negative public attention. BP's move might be a response to such concerns.

-

Specific Statements: We will analyze BP's official communications surrounding the pay cut once they're made publicly available to discern their exact reasoning.

Implications for BP and the Energy Sector

The implications of this 31% BP CEO pay cut are far-reaching:

-

Employee Morale and Retention: The reduction in CEO pay could signal a commitment to fair compensation across the company, potentially boosting employee morale. However, it could also negatively impact the ability to attract and retain top talent if perceived as unfair or signaling financial instability.

-

Attracting and Retaining Top Talent: A significant pay reduction for the CEO may affect BP's ability to compete for top talent with other energy companies. It could potentially lead to difficulties in recruitment or higher employee turnover if compensation packages don't remain competitive.

-

Impact on BP's Stock Price and Investor Confidence: Investor perception of the company's financial health and commitment to responsible governance will likely play a role. The market’s reaction to the announcement is critical in evaluating the impact of this decision on BP's overall valuation.

-

Broader Industry Trends: This decision by BP might inspire other energy companies to reconsider their executive compensation strategies in response to increasing pressure from stakeholders demanding more responsible and sustainable corporate practices.

Shareholder and Public Reaction

Understanding the shareholder response is critical in assessing the effectiveness and long-term impact of the pay cut. We will need to monitor shareholder statements, voting outcomes (if any), and subsequent press releases to gain an understanding of the reaction. Additionally, analyzing the public discourse – news articles, social media sentiment, and public comments – will provide a comprehensive view of the overall reaction to the BP CEO's pay reduction.

Conclusion

The 31% reduction in BP's CEO pay signifies a significant shift in the energy sector's approach to executive compensation. Driven by a complex interplay of company performance, shareholder pressure, and public scrutiny of ESG concerns, this decision carries significant implications for BP's internal dynamics and its standing within the industry. The long-term effects remain to be seen, but it underscores the growing importance of responsible corporate governance and the evolving landscape of executive pay in the energy sector. To gain a deeper understanding, stay informed on the evolving landscape of executive compensation in the energy sector and the impact of ESG factors. Further research into BP's financial performance and corporate governance practices will offer a more complete understanding of the implications of this significant BP CEO pay cut. Continue to follow developments related to BP CEO pay and executive compensation in the energy industry.

Featured Posts

-

The Goldbergs The Best Episodes And Why They Resonate

May 21, 2025

The Goldbergs The Best Episodes And Why They Resonate

May 21, 2025 -

New Dexter Resurrection Villain Garners Significant Fan Support

May 21, 2025

New Dexter Resurrection Villain Garners Significant Fan Support

May 21, 2025 -

Clisson Le Festival Le Bouillon Et Ses Spectacles Sociaux

May 21, 2025

Clisson Le Festival Le Bouillon Et Ses Spectacles Sociaux

May 21, 2025 -

Analiz Dokhodiv Providnikh Finkompaniy Ukrayini Za Rezultatami 2024 Roku

May 21, 2025

Analiz Dokhodiv Providnikh Finkompaniy Ukrayini Za Rezultatami 2024 Roku

May 21, 2025 -

Watch Looney Tunes And Cartoon Network Stars In A Brand New Animated Short 2025

May 21, 2025

Watch Looney Tunes And Cartoon Network Stars In A Brand New Animated Short 2025

May 21, 2025

Latest Posts

-

Huizenprijzen Nederland Abn Amro Vs Geen Stijl Een Analyse

May 21, 2025

Huizenprijzen Nederland Abn Amro Vs Geen Stijl Een Analyse

May 21, 2025 -

Abn Amro Facing Investigation Dutch Central Bank Scrutinizes Bonus Payments

May 21, 2025

Abn Amro Facing Investigation Dutch Central Bank Scrutinizes Bonus Payments

May 21, 2025 -

Abn Amro Potential Fine From Dutch Central Bank Over Bonuses

May 21, 2025

Abn Amro Potential Fine From Dutch Central Bank Over Bonuses

May 21, 2025 -

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Reactie Geen Stijl

May 21, 2025

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Reactie Geen Stijl

May 21, 2025 -

Pivdenniy Mist Prozorist Ta Efektivnist Remontu Analiz Pidryadnikiv Ta Byudzhetu

May 21, 2025

Pivdenniy Mist Prozorist Ta Efektivnist Remontu Analiz Pidryadnikiv Ta Byudzhetu

May 21, 2025