6% Share Slump For Kering After Weak First Quarter Performance

Table of Contents

Declining Sales Figures Across Key Brands

The Kering share slump can be largely attributed to disappointing sales figures across several of its key brands. Let's examine the performance of some of its flagship labels.

Gucci's Performance Lags Behind Expectations

Gucci, Kering's flagship brand, experienced a particularly steep decline in sales during Q1. Reports indicate a [insert specific percentage]% drop in sales compared to the same period last year. This underperformance can be attributed to several factors:

- Shifting Consumer Preferences: The luxury market is dynamic, and Gucci's previous collections may have failed to resonate with evolving consumer tastes. A need for fresh, innovative designs is crucial to maintain market share.

- Increased Competition: Intense competition from other luxury brands vying for the same consumer segment has put pressure on Gucci's market position. Marketing strategies and product differentiation become paramount.

- Specific Product Category Weakness: [Mention specific product categories within Gucci experiencing significant sales drops, e.g., handbags, ready-to-wear]. This highlights the need for a re-evaluation of product lines and target demographics.

- Impact on Kering's Financials: Gucci's underperformance significantly impacted Kering's overall financial health, contributing heavily to the observed Kering share slump.

Yves Saint Laurent (YSL) Sales Growth Slowdown

While YSL hasn't experienced the same dramatic decline as Gucci, its sales growth has significantly slowed compared to previous quarters. [Insert specific percentage or quantifiable data on the slowdown]. This deceleration might be due to:

- Market Saturation: The luxury market segment in which YSL competes is becoming increasingly saturated, making it harder to achieve significant growth.

- Brand Repositioning Challenges: Any recent brand repositioning efforts may be facing hurdles in achieving their intended results, leading to temporary sales slowdown.

- Competitive Landscape: YSL faces stiff competition from other established luxury brands and emerging players.

Other Brands Contributing to the Overall Decline

Other Kering brands, while not all experiencing dramatic declines, also contributed to the overall negative trend. [Briefly discuss the performance of Bottega Veneta, Balenciaga, or other relevant brands, highlighting positive or negative contributions]. A holistic brand portfolio analysis is crucial to understanding the overall Kering share slump.

Impact of Global Economic Slowdown and Geopolitical Factors

The Kering share slump isn't solely due to internal factors; external economic and geopolitical forces played a significant role.

Weakening Consumer Spending

Global inflation and economic uncertainty have led to a noticeable decline in consumer spending, particularly within the luxury goods sector.

- Inflationary Pressures: Increased prices are impacting consumer purchasing power, affecting demand for luxury items.

- Regional Economic Differences: Kering's performance varies across different geographic markets, reflecting the diverse economic climates worldwide. Certain regions are more resilient to economic downturns than others.

- Economic Forecasts: [Mention relevant economic forecasts and their potential impact on future luxury spending]. These forecasts indicate the potential for continued challenges or a possible recovery.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical factors also significantly impact Kering's performance.

- Geopolitical Events: The ongoing war in Ukraine and lingering effects of China's zero-Covid policy created disruptions to global supply chains and consumer confidence.

- Supply Chain Disruptions: These disruptions led to delays in production, distribution, and increased costs, impacting profitability.

- Mitigation Strategies: Kering's response to these challenges, including their resilience and mitigation strategies, will influence future performance and recovery.

Kering's Response and Future Outlook

Kering is actively responding to the challenges that contributed to the Kering share slump.

Management's Comments and Strategic Initiatives

Kering's management has addressed the weak Q1 performance [summarize official statements and announced actions]. New strategic initiatives might include [mention any new strategies or plans]. The effectiveness of these strategies will determine the trajectory of the Kering share price.

Analyst Reactions and Stock Price Predictions

Financial analysts offer varying perspectives on Kering's future. [Present a range of predictions and their rationale]. Monitoring these predictions offers valuable insights into potential future scenarios for Kering’s share price.

Conclusion: Navigating the Kering Share Slump – What's Next?

The Kering share slump following the disappointing Q1 results is a result of a confluence of factors: declining sales across key brands like Gucci, a weakening global economy impacting consumer spending, and persistent geopolitical instability. The 6% drop is significant and warrants close monitoring of Kering's strategic responses. The company's ability to adapt to evolving consumer preferences, navigate global economic headwinds, and mitigate supply chain disruptions will determine its future success. Stay updated on the evolving situation surrounding the Kering share slump by regularly checking back for updates and analysis of their future performance. Keep an eye on future Kering Q1 performance reports to gauge the recovery efforts and their overall performance.

Featured Posts

-

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Royal Philips Announces 2025 Annual General Meeting Agenda

May 24, 2025

Royal Philips Announces 2025 Annual General Meeting Agenda

May 24, 2025 -

Urban Nature And Mental Health A Womans Pandemic Experience In Seattle

May 24, 2025

Urban Nature And Mental Health A Womans Pandemic Experience In Seattle

May 24, 2025 -

Your Escape To The Country Making The Move A Success

May 24, 2025

Your Escape To The Country Making The Move A Success

May 24, 2025 -

Choosing The Right Porsche Macan A Comprehensive Buyers Guide

May 24, 2025

Choosing The Right Porsche Macan A Comprehensive Buyers Guide

May 24, 2025

Latest Posts

-

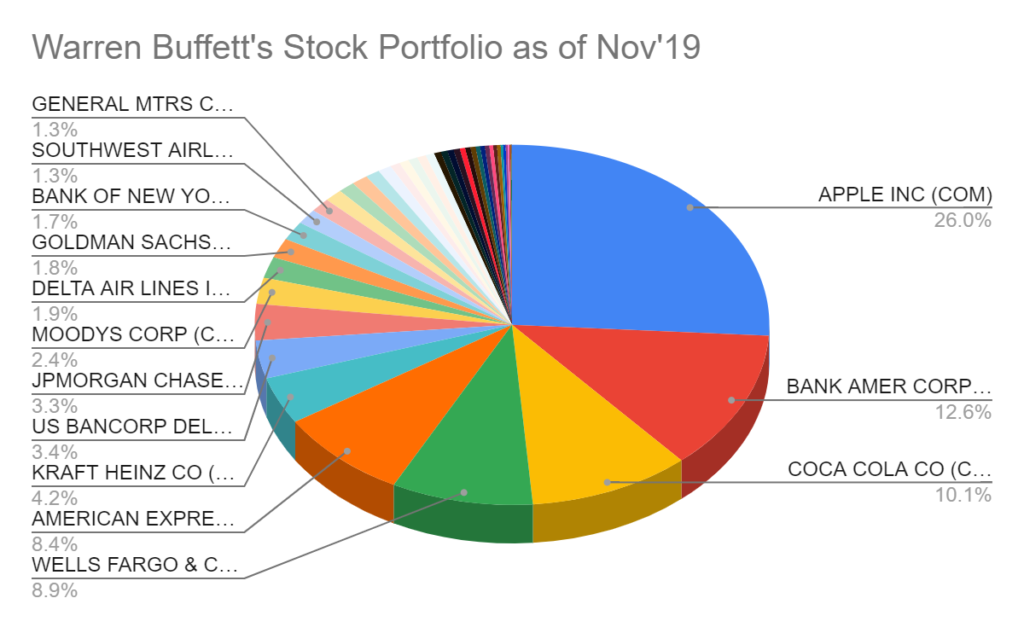

Apple Stock Price How Tariffs Affected Buffetts Investment

May 24, 2025

Apple Stock Price How Tariffs Affected Buffetts Investment

May 24, 2025 -

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025 -

Apples Resilience Withstanding The Impact Of Tariffs

May 24, 2025

Apples Resilience Withstanding The Impact Of Tariffs

May 24, 2025 -

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025 -

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025