Apple Stock Price: How Tariffs Affected Buffett's Investment

Table of Contents

The Impact of Tariffs on Apple's Manufacturing and Supply Chain

Tariffs imposed during the trade wars significantly impacted Apple's manufacturing and supply chain, primarily due to its reliance on Chinese manufacturing for many of its products, most notably the iPhone. These tariffs increased the production costs of Apple products, triggering a ripple effect throughout the company's operations and ultimately influencing the Apple stock price.

-

Increased manufacturing costs leading to higher product prices: The added tariff costs were not easily absorbed by Apple, leading to higher prices for consumers. This increase in prices directly impacted consumer demand, potentially slowing sales growth.

-

Potential impact on consumer demand due to higher prices: Higher prices for iPhones and other Apple products resulted in reduced consumer demand in some markets, affecting Apple's overall revenue and profitability. This decreased demand further contributed to the volatility of the Apple stock price.

-

Apple's efforts to diversify its manufacturing base beyond China: In response to tariff uncertainties and geopolitical risks, Apple began exploring and investing in manufacturing diversification, shifting some production to other countries like India and Vietnam. This diversification strategy aimed to mitigate future tariff impacts and improve supply chain resilience, which positively impacted long-term investor confidence in the Apple stock price.

-

Analysis of the long-term effects on Apple's profitability: While the short-term impact of tariffs was negative, Apple's long-term profitability was less severely affected due to its strong brand loyalty and its ability to adapt its supply chain. The ongoing diversification efforts helped to reduce the vulnerability of the Apple stock price to future tariff increases.

Apple Stock Price Fluctuations in Response to Tariff Announcements

The announcement and implementation of tariffs created significant volatility in Apple's stock price. Investor sentiment directly mirrored the news cycle surrounding trade negotiations. Analyzing this correlation reveals a clear impact on the Apple stock performance.

-

Correlation between tariff news and Apple stock price movements: A strong negative correlation existed between negative tariff-related news and Apple's stock price. Conversely, positive news or de-escalation of trade tensions often led to a rise in the Apple stock price.

-

Stock market reactions to positive and negative tariff-related news: The stock market reacted swiftly to any news concerning tariffs. Positive news often boosted investor confidence, while negative developments led to selling pressure and decreased investor confidence in the Apple stock price.

-

Analysis of short-term vs. long-term effects on Apple's stock price: The short-term effects were dramatic, with significant daily fluctuations often directly linked to tariff-related headlines. The long-term effects, however, were less pronounced as Apple demonstrated its resilience and adaptability.

-

Graphs charting Apple stock price alongside tariff-related events: (Note: This section would ideally include charts visually demonstrating the correlation between tariff announcements and Apple's stock price movements. This would significantly enhance the article's impact and SEO value.)

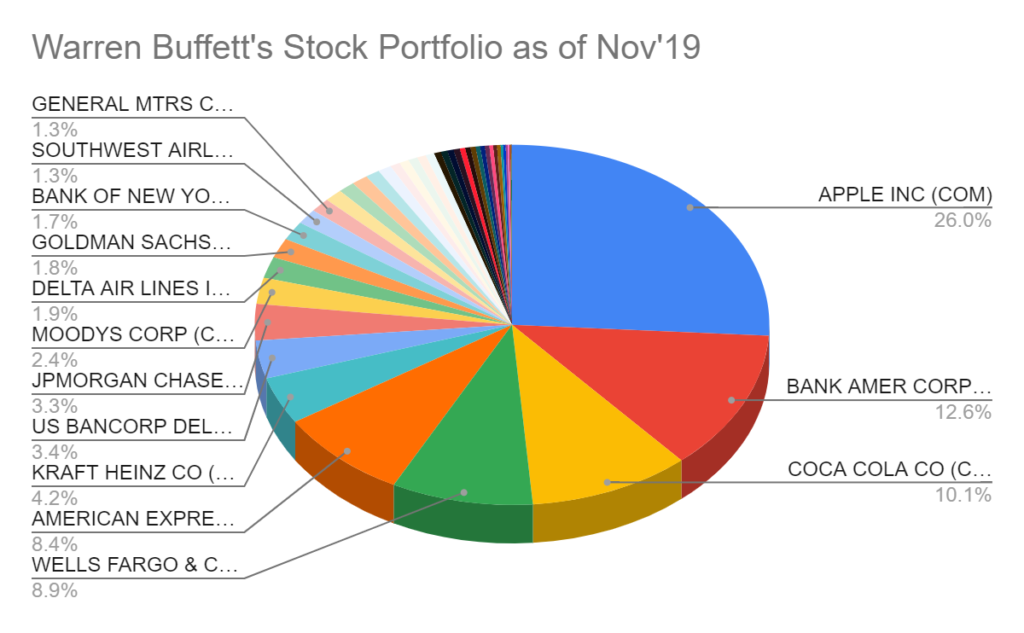

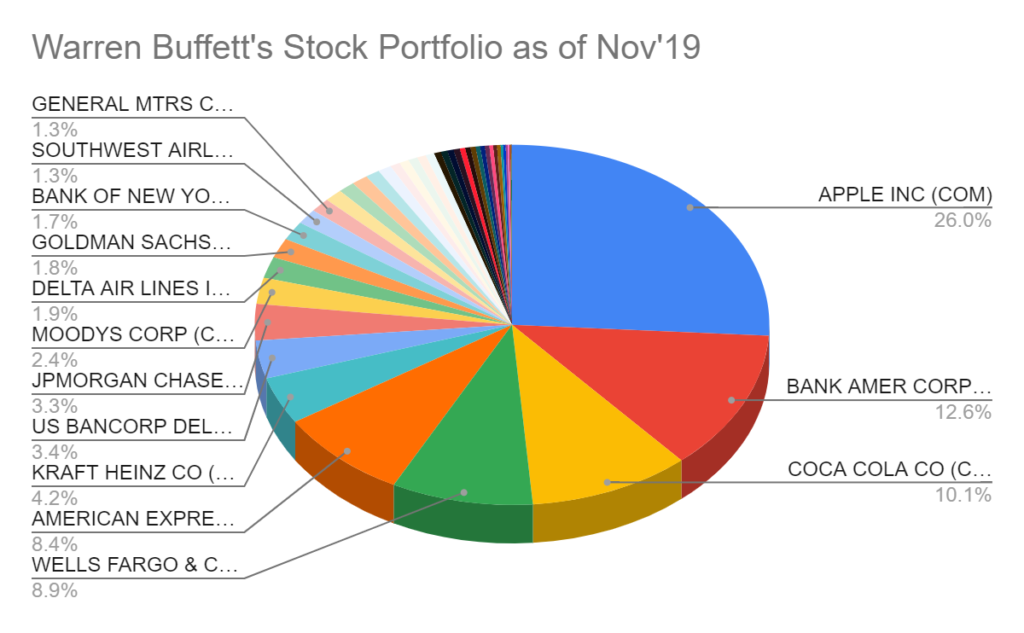

Buffett's Investment Strategy and the Tariff-Related Risks

Warren Buffett's investment strategy, characterized by long-term value investing and a focus on fundamentally strong companies, likely influenced Berkshire Hathaway's approach to the tariff-related risks affecting Apple.

-

Buffett's general investment philosophy and its application to Apple: Buffett's focus on long-term value suggests that he likely viewed the tariff-related volatility as a temporary setback for a fundamentally sound company like Apple.

-

Assessment of the potential impact of tariffs on Apple's long-term growth: Berkshire Hathaway likely conducted a thorough assessment of the potential long-term impact of tariffs on Apple's growth prospects. Their continued investment suggests a belief in Apple's ability to overcome these challenges.

-

Discussion on whether Berkshire Hathaway adjusted its investment strategy in light of the tariffs: While it's unlikely that Berkshire Hathaway drastically altered its overall investment strategy due to the tariffs, they may have made minor adjustments to their portfolio based on the short-term market reactions and other economic factors.

-

Analysis of Buffett’s past responses to similar economic challenges: Examining Buffett's responses to previous economic downturns and challenges can offer insights into his likely approach to the tariff-related situation. His history of holding onto investments during periods of uncertainty speaks volumes about his patience and long-term outlook.

Berkshire Hathaway's Holdings and Subsequent Actions

Berkshire Hathaway holds a significant stake in Apple, making it one of their largest investments. While the exact details of their actions during the tariff period are not publicly available in granular detail, their continued holding likely reflects their long-term confidence in Apple's potential. Any adjustments made likely fell under the umbrella of their broader portfolio management strategies and were not solely driven by the tariff situation. This highlights their diversification approach and reduced overall portfolio risk.

Conclusion

Tariffs imposed during trade wars undeniably impacted Apple's stock price, creating significant short-term volatility. Increased manufacturing costs, higher product prices, and fluctuating consumer demand all contributed to this. However, Warren Buffett's long-term investment strategy, as exemplified by Berkshire Hathaway's continued investment in Apple, suggests a belief in the company's fundamental strength and its capacity to overcome these challenges. Apple's efforts to diversify its manufacturing base further mitigate future risks.

Stay updated on the latest developments regarding the Apple stock price and the effects of global trade policies on your investment portfolio. Understanding the interplay between global trade, company performance, and investment strategies is crucial for informed decision-making in today's dynamic market.

Featured Posts

-

Guccis New Designer Kering Announces Sales Decrease

May 24, 2025

Guccis New Designer Kering Announces Sales Decrease

May 24, 2025 -

Joy Crookes I Know You D Kill A Deep Dive Into The New Song

May 24, 2025

Joy Crookes I Know You D Kill A Deep Dive Into The New Song

May 24, 2025 -

Jordan Bardella Leading The French National Rally Into The Next Election

May 24, 2025

Jordan Bardella Leading The French National Rally Into The Next Election

May 24, 2025 -

Berkshire Hathaway And Apple Will Buffetts Departure Impact Apple Stock

May 24, 2025

Berkshire Hathaway And Apple Will Buffetts Departure Impact Apple Stock

May 24, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Entertainment

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Entertainment

May 24, 2025

Latest Posts

-

Exclusive Inside Sam Altman And Jony Ives Top Secret Device Development

May 24, 2025

Exclusive Inside Sam Altman And Jony Ives Top Secret Device Development

May 24, 2025 -

Stock Market News Tax Bill Passed Bond Market Reaction Bitcoin Surge

May 24, 2025

Stock Market News Tax Bill Passed Bond Market Reaction Bitcoin Surge

May 24, 2025 -

House Passes Tax Bill Impact On Stock Market Bonds And Bitcoin

May 24, 2025

House Passes Tax Bill Impact On Stock Market Bonds And Bitcoin

May 24, 2025 -

Alix Earle And The Dancing With The Stars Effect A Gen Z Influencers Journey

May 24, 2025

Alix Earle And The Dancing With The Stars Effect A Gen Z Influencers Journey

May 24, 2025 -

Shooting Outside Jewish Museum Israeli Embassy Employees Killed

May 24, 2025

Shooting Outside Jewish Museum Israeli Embassy Employees Killed

May 24, 2025