8% Stock Market Rally On Euronext Amsterdam: Impact Of Trump's Tariff Pause

Table of Contents

Understanding the Tariff Pause and its Immediate Impact on Euronext Amsterdam

President Trump's decision to temporarily pause the implementation of new tariffs on Chinese goods, announced [insert date], provided a much-needed respite in the ongoing trade war. This move, while initially unexpected, was largely welcomed by global markets as a sign of potential de-escalation. The context was crucial: prolonged tariff battles had created significant uncertainty, impacting business investment and consumer confidence worldwide. This pause immediately injected a dose of optimism into the Euronext Amsterdam market, leading to a rapid surge in stock prices.

Specific sectors on Euronext Amsterdam benefited disproportionately. Technology companies, heavily reliant on global supply chains, saw particularly strong gains, as did automotive manufacturers, whose production and sales are directly impacted by trade policies. For example, [insert example of a tech company listed on Euronext and its percentage increase] saw a significant jump in its share price, while [insert example of an automotive company and its percentage increase] also experienced substantial growth.

- Increased investor confidence led to significantly higher trading volumes on Euronext Amsterdam.

- Many companies listed on Euronext experienced substantial short-term gains.

- Market sentiment indicators, such as the volatility index, showed a marked decrease, reflecting improved investor confidence.

- Compared to other major European exchanges, Euronext Amsterdam exhibited a stronger-than-average reaction to the tariff pause, suggesting a higher degree of sensitivity to US trade policy.

Analyzing the Long-Term Implications for Euronext Amsterdam and European Markets

While the immediate impact of the tariff pause was undeniably positive, the long-term implications for Euronext Amsterdam and broader European markets remain uncertain. The rally could represent a sustained period of growth, or it may simply be a temporary boost, quickly reversed by renewed trade tensions. Geopolitical risks remain significant. The ongoing trade negotiations between the US and China could easily reignite, potentially reversing the positive market sentiment. Furthermore, Brexit continues to cast a shadow over European markets, adding another layer of uncertainty.

- Uncertainty surrounding future trade negotiations between the US and China remains a key risk factor.

- The potential for renewed tariff tensions could significantly impact the long-term growth trajectory of Euronext Amsterdam.

- Investor behavior post-rally will be crucial in determining the sustainability of the market upswing. Are investors buying into long-term growth, or are they taking short-term profits?

- Comparing the long-term outlook for Euronext Amsterdam to global market forecasts reveals that while global growth is projected, the specific performance of Euronext remains highly dependent on the resolution (or lack thereof) of trade disputes.

Key Sectors Showing Significant Growth Following the Tariff Pause

The technology and automotive sectors experienced the most substantial gains on Euronext Amsterdam following the tariff pause. However, other sectors also benefited from the improved market sentiment. For example, [mention other sectors and examples of companies]. The strong performance of these sectors can be attributed to several factors, including reduced uncertainty about supply chains and increased consumer confidence in these sectors.

- [Specific company examples and their stock performance percentages] illustrate the sector-specific impact of the tariff pause.

- Analysis of individual company earnings reports (where available) provides further insight into the drivers of growth.

- Industry-specific analyses, such as those focusing on the automotive industry's dependence on global supply chains, highlight the direct link between trade policy and market performance.

- The correlation between sector performance and tariff sensitivity underscores the importance of understanding the global implications of trade policy for individual investments.

Expert Opinions and Market Analyses on the Future of Euronext Amsterdam

Financial analysts offer diverse perspectives on the future of Euronext Amsterdam. [Insert quote from a reputable financial analyst, referencing their expertise and organization]. Other market experts suggest [summarize another expert opinion]. The consensus view seems to be one of cautious optimism. While the tariff pause offers a temporary reprieve, long-term sustainability of the rally depends heavily on broader geopolitical developments and the progress (or lack thereof) in resolving international trade disputes.

- Quotes from reputable financial analysts, such as [mention names and affiliations], offer diverse but insightful perspectives.

- A summary of market predictions and forecasts reflects a wide range of potential outcomes, highlighting the uncertainty inherent in the current market environment.

- Analysis of various market sentiment indicators, such as the VIX index, offers quantitative measures of investor confidence.

- The overall risk level in the Euronext Amsterdam market remains relatively high, given the persistent geopolitical uncertainties.

Conclusion

The 8% stock market rally on Euronext Amsterdam, largely triggered by Trump's tariff pause, showcases the significant impact of trade policy on global markets, particularly on exchanges like Euronext Amsterdam with high exposure to international trade. While the immediate effect has been positive, long-term implications remain uncertain due to ongoing geopolitical factors, including potential renewed trade tensions and the ongoing impact of Brexit. Investors need to carefully monitor developments and diversify their portfolios accordingly.

Call to Action: Stay informed about the evolving situation on Euronext Amsterdam and the impact of future trade policies to make informed investment decisions. Understanding the nuances of the Euronext Amsterdam stock market and its sensitivity to global events is crucial for navigating this dynamic landscape. Learn more about navigating the Euronext Amsterdam market and managing risk during periods of trade uncertainty. Successful investing requires awareness of the interplay between global events and market performance.

Featured Posts

-

Porsche 911 F1 Motorral A Legendas Hajtomu Koezuti Verzioja

May 24, 2025

Porsche 911 F1 Motorral A Legendas Hajtomu Koezuti Verzioja

May 24, 2025 -

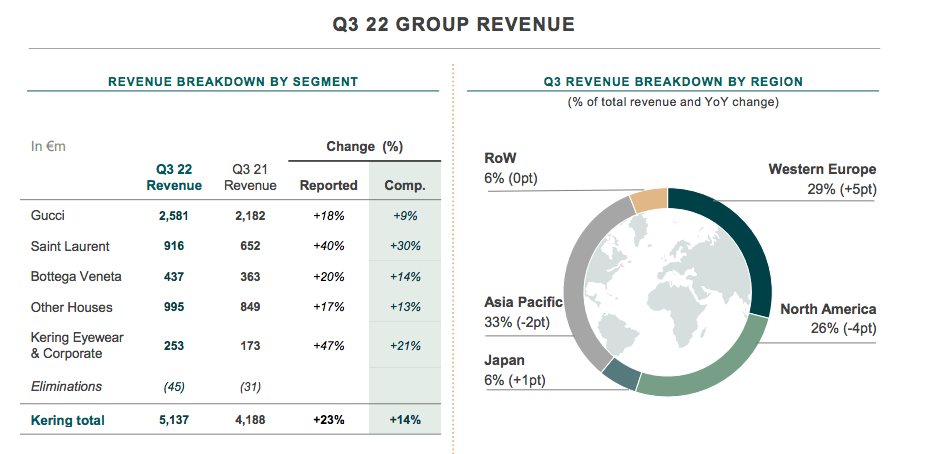

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025 -

Porsche 956 Tavan Asili Sergi Yoenteminin Teknik Ve Estetik Aciklamalari

May 24, 2025

Porsche 956 Tavan Asili Sergi Yoenteminin Teknik Ve Estetik Aciklamalari

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Key Considerations

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Key Considerations

May 24, 2025 -

The M62 Relief Road Why Burys Bypass Never Happened

May 24, 2025

The M62 Relief Road Why Burys Bypass Never Happened

May 24, 2025

Latest Posts

-

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025