Amsterdam AEX Index: Sharpest Decline In Over A Year

Table of Contents

Underlying Causes of the AEX Decline

The precipitous fall in the Amsterdam AEX Index can be attributed to a confluence of factors, both global and domestic.

Global Economic Factors

Global economic headwinds played a significant role in the AEX decline. The persistent threat of global inflation, coupled with aggressive interest rate hikes by central banks worldwide, fueled concerns about a potential global recession. This "global uncertainty" created a risk-off sentiment among investors, leading to widespread selling across various asset classes, including the AEX.

- Inflationary Pressures: Persistently high inflation rates erode purchasing power and stifle economic growth, impacting corporate profits and investor confidence.

- Interest Rate Hikes: Central banks' efforts to curb inflation through interest rate hikes increase borrowing costs for businesses, impacting investment and potentially slowing economic activity.

- Geopolitical Tensions: Ongoing geopolitical instability, such as [mention specific geopolitical event, e.g., the war in Ukraine], adds to global uncertainty and negatively impacts market sentiment.

- Energy Crisis: The ongoing energy crisis in Europe, characterized by high energy prices and supply chain disruptions, significantly impacts businesses and contributes to inflationary pressures.

Sector-Specific Performance

The AEX decline wasn't uniform across all sectors. Certain sectors were disproportionately impacted, reflecting specific vulnerabilities.

- Financials: The financial sector, sensitive to interest rate changes, experienced considerable weakness, with [mention specific examples of underperforming financial stocks]. Rising interest rates reduce profitability for banks and increase the risk of loan defaults.

- Technology: The technology sector, often vulnerable to shifts in investor sentiment, also saw significant declines, reflecting concerns about future growth and profitability in the face of economic slowdown. [Mention specific examples of underperforming tech stocks].

- Energy: While energy prices remained high, the energy sector's performance was mixed, reflecting concerns about future demand and regulatory changes. [Mention specific examples and explain their performance]. The overall sectoral weakness contributed to the AEX's overall decline. The impact on market capitalization across these sectors is significant, illustrating the widespread nature of the downturn.

Investor Sentiment and Market Psychology

The sharp drop in the AEX reflects a significant shift in investor sentiment and market psychology. News headlines and expert opinions pointed to a prevailing "investor fear" and "risk-off sentiment," causing a rapid sell-off.

- Fear of Recession: Growing fears of a looming recession led many investors to move their assets to safer havens, contributing to the decline in the AEX.

- Negative News Cycle: A negative news cycle, highlighting economic challenges and geopolitical tensions, further exacerbated investor anxiety and contributed to the market's negative reaction.

- Profit-Taking: Some investors might have engaged in profit-taking, selling off assets to secure gains before a potential further market correction.

Impact and Consequences of the AEX Decline

The sharp decline in the AEX has far-reaching consequences for various stakeholders in the Dutch economy.

Effect on Dutch Businesses

The AEX decline poses significant challenges for Dutch businesses listed on the exchange.

- Reduced Investment: Lower stock prices might make it more difficult for Dutch companies to raise capital through equity financing.

- Decreased Profitability: Reduced consumer spending and increased input costs, due to inflation and energy prices, could affect corporate earnings.

- Lower Business Confidence: The market downturn can negatively impact business confidence, potentially leading to reduced investment and hiring.

Implications for Investors

The AEX's decline significantly impacts investor portfolios and necessitates a reassessment of investment strategies.

- Portfolio Losses: Investors holding AEX-listed stocks experienced losses, impacting their overall portfolio performance.

- Impact on Retirement Savings: For investors relying on retirement savings invested in the AEX, the decline represents a setback in their long-term financial plans.

- Need for Diversification and Risk Management: The AEX decline underscores the importance of portfolio diversification and robust risk management strategies to mitigate potential losses.

Government Response and Policy Implications

The Dutch government is likely to closely monitor the situation and consider potential policy interventions.

- Fiscal Measures: The government might consider fiscal measures to stimulate economic growth and support businesses impacted by the market downturn.

- Monetary Policy Coordination: Coordination with the European Central Bank (ECB) on monetary policy could be crucial in addressing the economic challenges.

- Support for Businesses: Targeted support programs for businesses facing difficulties due to the market decline might be implemented.

Conclusion: Navigating the Volatility of the Amsterdam AEX Index

The sharp decline in the Amsterdam AEX Index is a result of a complex interplay of global economic factors, sector-specific weaknesses, and negative investor sentiment. This downturn has significant consequences for Dutch businesses and investors, underscoring the importance of understanding AEX fluctuations and managing your AEX investments wisely. While the situation presents challenges, it also offers opportunities for long-term investors to potentially acquire undervalued assets. To effectively navigate this volatile market, it's crucial to monitor the AEX closely, stay informed about economic developments, and consult with financial professionals for personalized investment advice. Understanding the intricacies of the AEX and its underlying drivers is paramount for making informed investment decisions and mitigating risk in the dynamic Dutch stock market.

Featured Posts

-

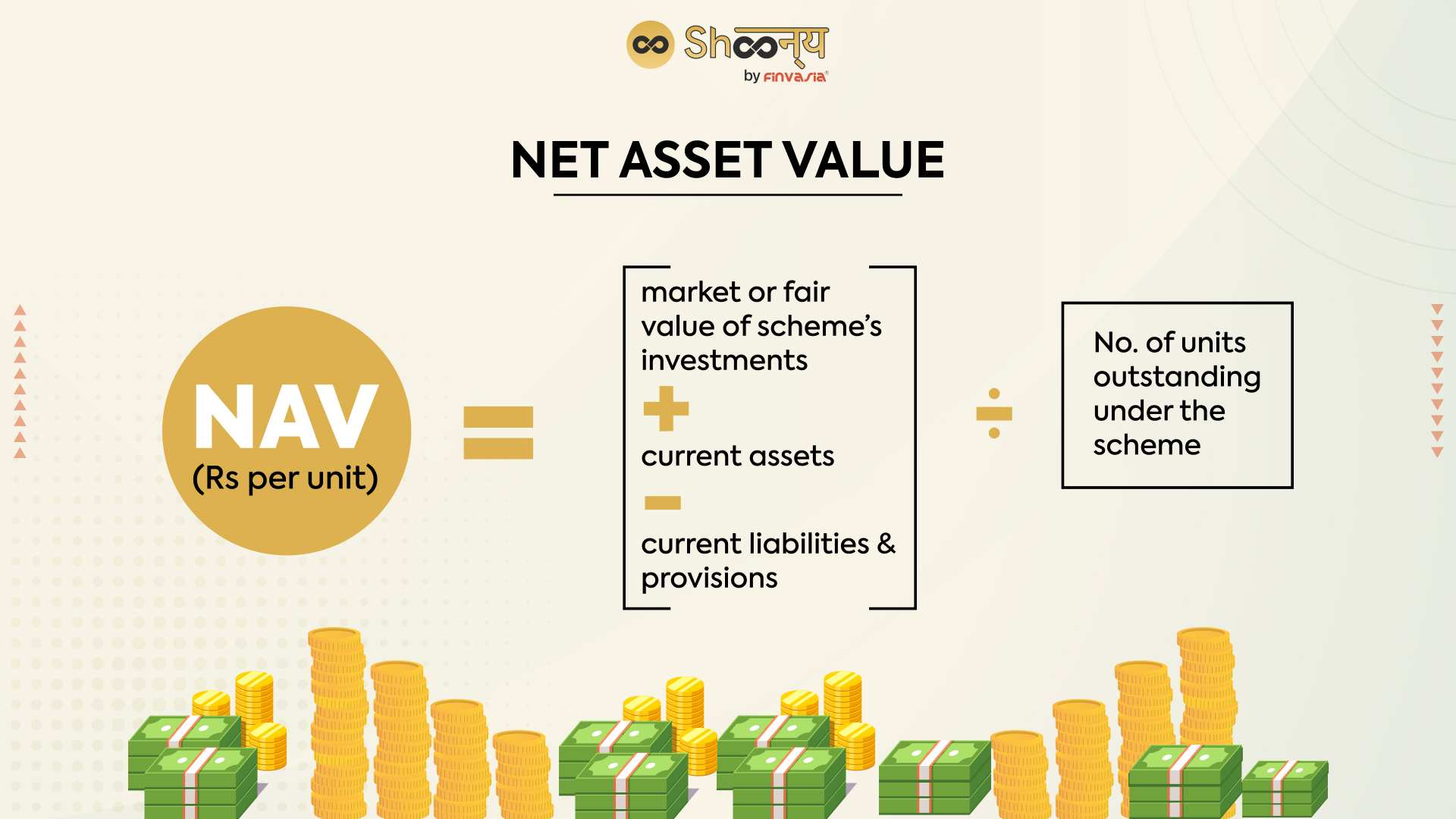

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist An In Depth Analysis

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist An In Depth Analysis

May 25, 2025 -

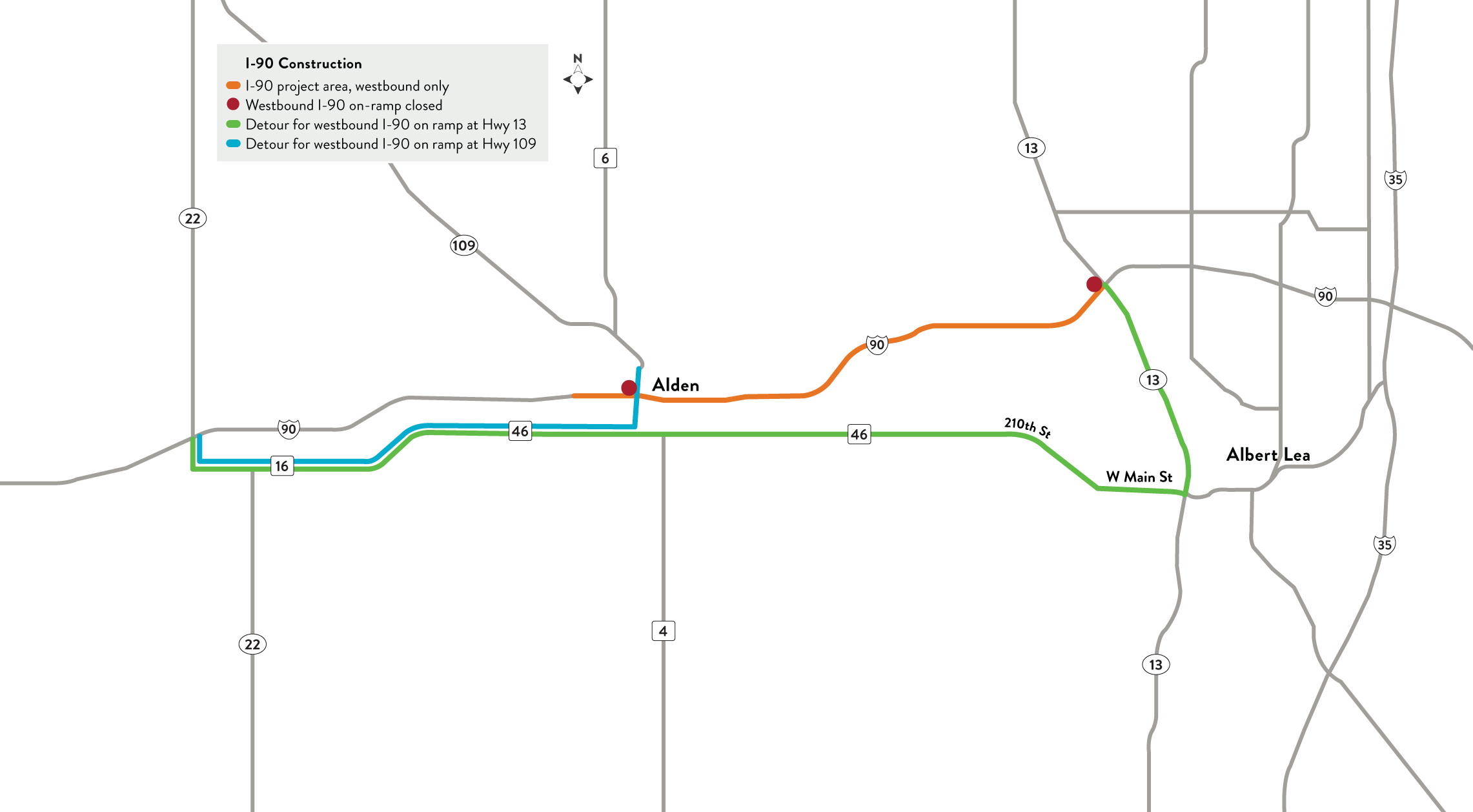

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025 -

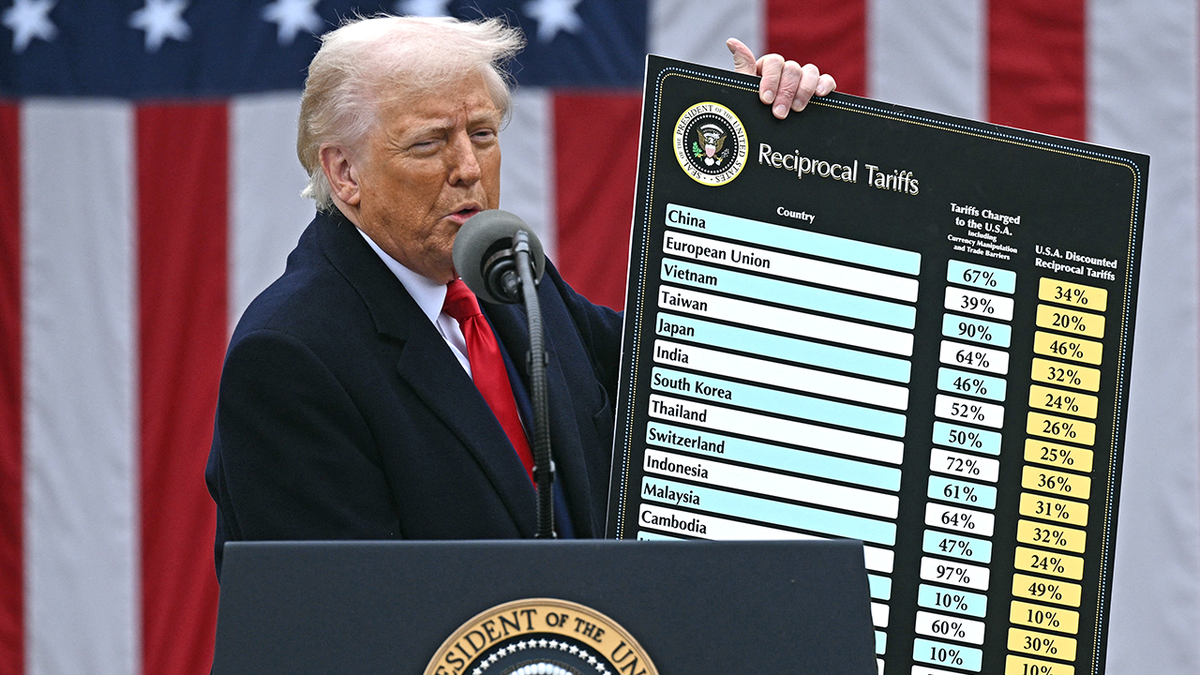

Amsterdam Stock Exchange Drops 2 Trumps Tariffs Take Their Toll

May 25, 2025

Amsterdam Stock Exchange Drops 2 Trumps Tariffs Take Their Toll

May 25, 2025 -

Apple Stock Below Key Support Ahead Of Q2

May 25, 2025

Apple Stock Below Key Support Ahead Of Q2

May 25, 2025 -

Nicki Chapmans Smart Property Investment A 700 000 Return On Her Escape To The Country Home

May 25, 2025

Nicki Chapmans Smart Property Investment A 700 000 Return On Her Escape To The Country Home

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025